Ready to take your due diligence skills to the next level? Conferences are a great way to do just that. Junior companies are built upon the strength of their people, and meeting these people in person is the best way to judge just who it is that you’re speculating in.

I attended the Vancouver Resource Investment Conference (VRIC), sponsored by Katusa Research and Cambridge House, the weekend of January 22 and 23. The VRIC was an opportunity to learn from some of the best in the business, as they broke down the current trends in the market and explained where it is that they feel we’re headed in the weeks and months ahead.

The conference was held at the Vancouver Convention Centre, where there were 4 workshop stages and 1 main stage for company presentations and speeches from the likes of Doug Casey, Marin Katusa, Brent Cook, Tommy Humphreys, and James Kwantes, just to name a few. There were some insightful discussions among the panel members, and some interesting company stories.

Having never attended a Cambridge event before, I can’t compare the attendance to previous years, however, some repeat conference goers did tell me that this appeared to be the best attendance in years. I take this as a great sign that we are early into a bull market, with a ton of upside potential as the junior resource sector starts to becomes sexy again.

Here are a few highlights from the event:

Words of Wisdom from Casey

Doug Casey, Founder of Casey Research and legendary speculator, was inducted into the Cambridge House Hall of Fame at this year’s event. The ceremony consisted of a classic Casey acceptance speech and a Casey roast, performed by Marin Katusa, Frank Guistra and Frank Holmes.

Here are some of the highlights from the 4 speeches Casey gave at this year’s conference:

- Buy the best – Now, this may seem like an obvious statement, but what I think he means is take your time and do your due diligence – know what you’re buying.

- Be patient – The junior market is highly volatile; don’t be sucked into emotional buying and chase a stock price that is rising quickly. You can’t, so to speak, kiss all of the girls; there will either be other opportunities or you will have a chance to buy the stock at a reduced price in the future.

- We are exiting the eye of the storm, things are going to get rocky. Casey believes that we are headed toward further turmoil, the intensity of which, he predicts, will be worse than 2008.

- Internationalization for yourself and your assets – this entails acquiring additional passports through residency (Argentina is his favourite). Buy international real estate, it can’t be repatriated

- Hold your savings in gold – the smaller the physical size of the coin or bar the better, because they blend in with other coinage quite easily.

- China, not Russia, could be the country that the United States has issues with in the future – Casey believes that President Trump will be able to find common ground with Putin, while China could prove to be much harder to deal with.

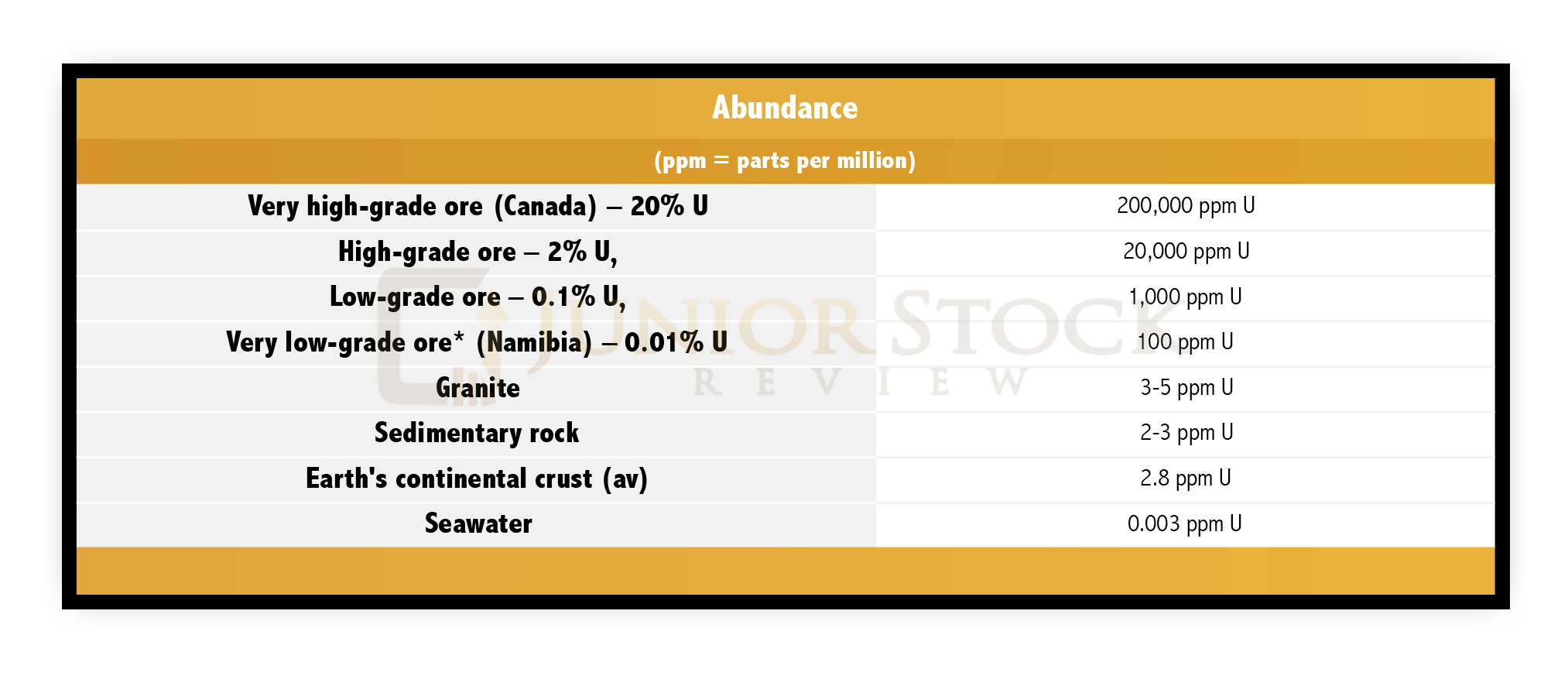

- Doug’s Picks: Northern Dynasty (NDM – TSX) and Uranium Energy Corporation (UEC – NYSE). Marin offered a third pick: Blackbird Energy (BBI – TSXV)

- Buy in tranches – the junior sector is volatile, buying in tranches allows you to dollar cost average your position

- Keep a store of cash ready for a rainy day – the volatility in the sector provides buying opportunities, you need cash to deploy when opportunity knocks

- Recommended Brent Cook’s newsletter, Exploration Insights. I second that recommendation!

Newsletter Writer Panel

An interesting panel that was held on the last day of the conference was the Newsletter writer panel, which included Louis James (Casey Research), Brent Cook (Exploration Insights), Frank Curzio (Curzio Research), Benj Gallander (Contra Herd Investment Letter),and was moderated by Marin Katusa (Katusa Research).

Katusa asked the panel a number of questions, including: Top pick, advice for subscribers, and what sets them apart from other newsletter writers. Here is a summary of the notes I took from what Brent and Louis had to say; this isn’t verbatim and only reflects my understanding of what was said:

Brent Cook

- Top Pick – Mirasol Resources (MRZ:TSXV)

- When a company story changes and your thesis now relies on hope, you are in trouble and need to sell

- Limit portfolio size to no more than 20. It isn’t possible to follow more than 20 companies and still perform the proper due diligence

- Cook is an economic geologist; this is what sets him apart

- His passion is discovery and exploration companies are his speciality

- He’s partnered with Joe Mazumdar who is an economic geologist and analyst. Previously, Mazumdar has worked at Haywood Securities and Canaccord Genuity as a senior analyst.

Louis James

- Top Pick – Pretium Resources (PVG:TSX)

- Do more due diligence, put boots on the ground and visit the company properties

- Don’t rush into buying a stock, the junior market is volatile and will most likely come back to you

- Find the fatal flaw of the company, there is always one (this echoes Exploration Insights’ Fatal Flaw Article that’s available on their website – a must read!)

- If you read a news release and you don’t know how it will affect the company, it’s a sign you probably have too many companies in your portfolio

- Louis’ boots on the ground approach sets him apart from the crowd

- Louis is very passionate about his work and takes his responsibility to his subscribers to heart, feeling each win and loss

Quants

Frank Holmes, CEO and Chief Investment Officer of U.S. Global Investors, opened the VRIC speeches early on Sunday morning to a packed crowd. His presentation was on the changing world of market investment. U.S. Global is an investment manager, who specializes in precious metals, natural resources and emerging markets. Holmes remarked that they have seen a drop in the amount of money flowing through their funds, yet the stocks their funds follow are still rising. Through his research to determine how money was alternatively flowing into these investments, he found Quants.

Quants uses artificial intelligence or algorithms to examine markets and companies. This data mining is then used to adjust cash flows into the companies that fit the specific criteria. The algorithm criteria can be companies with low General and Administrative costs to Profits, or the algorithm will buy and sell related to sentiment, scanning news for specific words and phrases.

The use of artificial intelligence certainly isn’t new to the financial markets, as high frequency traders use similar algorithms to control their trading, going in and out of stocks in fractions of a second. Interestingly, remembering back to May 6, 2010, the NYSE was hit with a flash crash, which was traced back to the HFT algorithms that all decided to sell at the same time. Here is a useful link to the SEC report.

The fact is, these algorithms are designed by some very smart people, who are graduates of a handful of universities. This commonality in teaching no doubt leads to similar thinking patterns and, therefore, similarities in algorithm design, which means they come to the same conclusions relatively quickly.

In the end, I’m not entirely sure about Holmes’ conclusion, but I would hazard a guess that he’s pointing out the complexity and ever-changing nature of the financial markets.

An Investment Conference in Your Pocket – CEO.ca

Tommy Humphreys, founder of CEO.ca, gave a great speech on day 1 of the conference. Among other things, he outlined how you can access an investment conference, like the VRIC, every day through your phone.

For those not familiar, he’s talking about his website, or App, which is an online community, bringing together a whole host of people from investing newbies to experts, to discuss and share ideas for investment and speculation in the highly volatile, junior sector of the stock market.

For those interested in attending a conference in person, check out the FREE Subscriber Investment Summit (SIS) in Toronto on March 4th. The SIS is hosted by Humphreys, Eric Coffin (Hard Rock Analyst) and Keith Schaefer (Oil and Gas Investment Bulletin). I attended this conference last year and it’s time well spent.

Conferences are a great way to expand your knowledge of the sector and to speak to the people who are running the companies in which you’re speculating. Learn who these people are – you’re trusting them with your money. Turn your BS detector on and expand your due diligence process!

I look forward to seeing you at the SIS and PDAC conferences in March!

Until next time,

Brian