2019 VRIC and a Few Thoughts for 2019

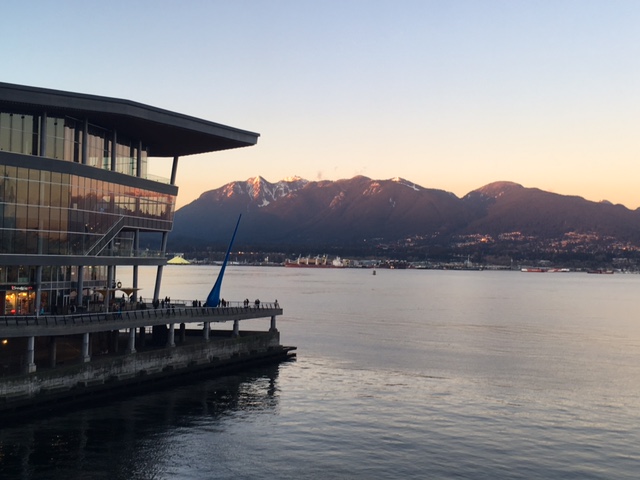

Vancouver Resource Investment Conference 2019

Those who read my work on a regular basis know that I’m bullish on nickel. I first began researching the sector in 2017 and have felt that there are many reasons to be bullish, ever since. In 2017, the nickel price followed my thesis with very strong price performance. 2018, however, was very different, as we saw the nickel price take a step back.

Although there are a few hurdles that must be overcome in the short term, I’m more bullish than ever on nickel.

Find out why at the upcoming Vancouver Resource Investment Conference (VRIC) on January 20th and 21st., where I will be giving a presentation – Nickel: A Short and Long-Term Outlook.

In addition to my overview of the nickel market, I will be providing the audience with a few of my best picks for 2019. Hope to see you there!

Presentation – Nickel: A Short and Long-Term Outlook – 2:20pm in Workshop #4

Panel – Nickel Panel: Moderator – Brian Leni, Companies: FPX Nickel, Giga Metals and RNC Minerals – 11:40pm in Workshop #4

2018 Tax Loss Season

As expected, tax loss season saw many junior resource company share prices fall. Tax loss season, however, went into overdrive after the Federal Reserve’s (Fed) announcement on December 19th, which brought news of a further rate hike.

This was exactly the opportunity I was looking for, as the announcement clearly did not sit well with the market. Not surprisingly, companies with heavy association with base metals took it on the chin the worst, and provided me with an opening tranche in Champion Iron Ore (CIA:TSX) and the opportunity to buy more of Labrador Iron Ore Royalty (LIF:TSX) and Altius Minerals (ALS:TSX).

In my opinion, each of these companies sits at the top of their respective sectors in terms of management and their overall business. Regardless of what the market thinks, I’m a buyer of the best of the best and have a long-term outlook for these well-run businesses.

On the other side of the coin, one company which I thought was going to have a tough tax loss season, FPX Nickel Corp. (FPX:TSXV), performed exceptionally well and actually gained ground in terms of the share price during what was a selling filled December.

FPX shares are clearly in capable hands, people who understand the underlying fundamentals of the company, and considering there’s impactful news to be released regarding metallurgical work in Q1, 2019 is shaping up to be a good year for FPX owners.

2019 – The Year Ahead

2018 was worse than I expected. So what’s in store for 2019?

My guess is that we are headed for some major volatility in the broader market as anticipation of a Fed rate hike in March nears. For the gold market, this is probably a good thing, because when doubt prevails in the broader market and investors are trying to mitigate risk, gold has been one of the pillars of safety.

How does the volatility affect the base metals? This is a great question, one which I have been asking myself. While I believe the volatility will be primarily driven by the interest rate decision, I believe the key to strength in base metals prices is probably more linked to the U.S. and China trade war.

A resolution to the trade war could be the catalyst which brings to light the global supply issues that many of the major base metals appear to have.

I must again reiterate that predicting the future is hard to do with any consistency, and for investment in the junior resource companies, it provides little value. Junior resource companies are speculations on management’s ability to execute on a plan, not because gold is going to $2,000 per ounce – although, it would certainly help!

Being picky at the bottom or near the bottom will help ease the emotional effects of a volatile market and, most importantly, put you in the best possible position for success in the future.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria.