What has been the best performing metal in 2019 YTD? Nickel is up roughly 20% from the beginning of the year, which makes it one of the best performing metals, if not the best, thus far. I could write a whole report regarding the fundamentals of nickel and why I’m so bullish, but instead, I’ll direct your attention to my presentation at the Vancouver Resource Investment Conference (VRIC), where I covered the subject in detail.

With global nickel inventories falling rapidly and the nickel price responding positively, I thought it was a great opportunity to give an update on one of my favourite junior resource companies in the sector, FPX Nickel Corp.

My update is two-fold; first, I want to review the newly released metallurgical test work, and finally, I want to touch on one of my most asked questions regarding FPX, “what’s the deal with the debt?”

Let’s take a look.

Metallurgical Test Work

I’ve been eagerly awaiting FPX’s update on their metallurgical test work which began last summer. For many, the Baptiste deposit’s metallurgy was a big question mark because awaruite isn’t exactly the most common primary nickel mineral being mined these days.

For those who aren’t familiar with awaruite, it’s a dense and highly magnetic nickel-iron alloy, Ni₃Fe, which is commonly referred to as a ‘naturally occurring stainless steel.’

FPX appointed ALS Metallurgy, operating out of Kamloops, BC, with the goal of improving the previous metallurgical results from the 2013 PEA, which demonstrated nickel recoveries of 82%.

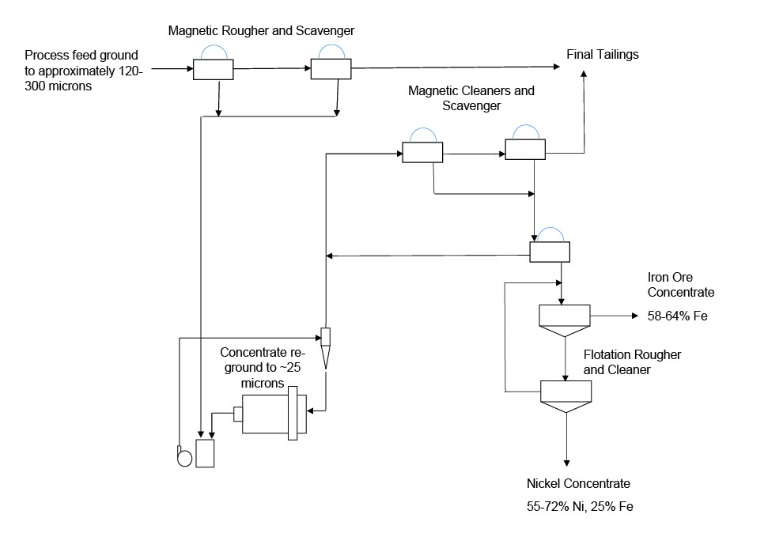

The recovery and concentrate grade assumptions in the 2013 PEA were based on a two-stage process, which consisted of a primary coarse grind to P80 600 microns, followed by a rougher magnetic separation, then a re-grind of that fraction to P80 70 microns, followed by Knelson gravity concentration to produce a concentrate grading 13.5% nickel, 45-50% iron and 1-2% chromium.

While this concentrate would have been a highly marketable product within the nickel market, improvement in recoverable nickel and the subsequent reduction in the amount of gangue present in the concentrate could be very advantageous to Decar’s NPV and, of course, increase the demand for the improved contents of the concentrate.

Testing

To complete the metallurgical test work, ALS was given 400 kg of core sample reject material from 4 drill holes completed in 2012 and 2017. The material was then used in a two-phase program, focused on 3 goals: (1) improving nickel recovery, (2) increasing nickel grade in the final product; and (3) producing a saleable iron ore concentrate by-product.

Phase 1 testing provided proof of the recovery of nickel and iron using magnetic separation and the upgrading of these minerals into a bulk Ni-Fe concentrate using re-grinding and magnetic cleaning.

Phase 2 focused on the flotation of the concentrate created in Phase 1, separating the awaruite from magnetite. This process was very successful, as the floatation separated the 2 minerals, recovering 80 to 90% of the nickel and allowed for the creation of a high grade nickel concentrate – 55 to 72% Ni, which compositionally is almost pure awaruite (75% Ni / 25% Fe).

For most nickel companies, the tailings of their final upgrading circuit is waste, or in many cases, where sulphides are present, often leaves them with a potential environmental liability in terms of its acid generating capability.

FPX is in an enviable position, as there are little to no sulphides present in the host rock and tailings and, most advantageous, the flotation tailings appear as though they will be saleable. In FPX’s case, the tailings are actually a magnetite iron ore concentrate, which has a grade range of 58 to 64%, and may be a good candidate for sale to steel mills in the western portion of Canada and the United States.

Saleability of the Magnetite Iron Ore Concentrate?

For those who aren’t familiar, I spent 10 years within the steel manufacturing business. While my work experience was within the rolling mill, as an engineer and manager, I do have an understanding of the steel making process within a mini-mill.

A mini-mill derives its in-feed primarily from recycled steel products, such as cars. As such, many mills have their own recycling facilities that purchase scrap steel from the public. The scrap is then shredded and brought to the scrap bay, where it is piled with many other types of scrap.

Other potential scrap can include (but is not limited to) busheling, heavy melt, turnings (lathe or mill) or pig iron.

Depending on the grade of steel to be produced and the cost of the various input scrap sources, an algorithm is used to optimize the scrap mixture so that the highest potential profit is achieved. From there, a crane with a huge grapple begins to fill a charge bucket with the correct amounts of the various scrap sources. Not only is the amount of scrap from each source important, but so is the order in which it is placed into the bucket.

Why? The mini-mill process uses an electric arc furnace (EAF) to melt the steel and, therefore, the density of the material which will be charged into the EAF is very important, as the more densely packed the scrap is, the more efficient the application of electrical energy to the steel to melt it.

The reason I’m explaining this is because I think it’s vitality important for judging the likelihood of FPX being able to sell their magnetite iron ore concentrate to a steel mill.

Personally, I think it’s very realistic that there will be a mill that is interested in the product, but it’s going to come down to price and possibly the consistency of the end product.

Firstly, the price question. Further metallurgical analysis should give FPX a better indication of the cost profile of this process and, subsequently, allow them to conduct market research on a possible buyer of both the high-grade nickel concentrate and the magnetite iron ore concentrate.

Secondly, the steel manufacturer may require the powder like magnetite iron ore concentrate to be agglomerated before they can use it. I’m not sure which would be preferred, but it’s something that I intend to do my own research on with the contacts I still have within the steel business.

FPX’s Debt

Beside the questions I have received regarding the Baptiste deposit metallurgy, questions regarding FPX’s debt is the next most popular. So, what’s the deal with the debt and should I be concerned?

This is a great question and one that certainly deserves contemplation before investing. If you examine FPX’s most current financial statement, you will see under the line item, Loan payable (note 10), there’s an amount for $7,296,794 CAD.

This isn’t a small amount of cash, especially given current market dynamics; however, I think the back story on this loan needs to be discussed.

In 2015, FPX was given the opportunity, by their former joint venture partner Cliffs Natural Resources (NYSE: CLF), to purchase their 60% stake in the Decar nickel project for US$4.75 million. The purchase would give FPX 100% ownership of the property at a cost which, I believe, is a STEAL, especially considering the amount of money (US$22 million) which Cliffs spent developing the property.

It was here that FPX and a large individual shareholder of the company came to an arm’s-length agreement on a loan (details can be found here), which would be used to make the purchase from Cliffs. The term of the loan was 5 years, which makes it due in fall of 2020.

I recently posed the question regarding the debt to FPX’s CEO, Martin Turenne, and here’s what he had to say,

“The debt was initially provided to us on very favourable terms, with a low interest rate, by one of our major shareholders in order to fund the re-acquisition of a 60% interest in Decar from Cliffs. Since advancing this loan to us in 2015, this shareholder has significantly increased their equity position in the company. The shareholder continues to be very supportive of our efforts, and we are working on a plan to deal with the impending maturity of the debt in a way that will be beneficial to all shareholders.”

Situations such as this require some trust as the identity of the large shareholder isn’t known to me and, therefore, I have no way of verifying what Turenne says. However, I do know Turenne and, without a doubt in my mind, believe that what he’s saying is true and, therefore, am not personally concerned with the debt at this point.

Concluding Remarks

As I’ve mentioned many times before, a bullish outlook on a metal is not a good reason to invest in a junior resource company. Junior resource companies are businesses whose value is primarily driven by the people who run them. Therefore, in my opinion, it’s of the utmost importance that you understand who you’re giving your money to, what their plan is to move the company forward, and if their interests are aligned with the shareholders (i.e. cost of capital in the company).

In terms of nickel, as I mentioned, I’m very bullish and it just so happens that FPX Nickel Corp. fits the bill in terms of price-to-value proposition. The company has a greatt management team that has ticked all the boxes in terms of keeping its promises to shareholders as they progress the company forward, into what looks to be a tremendous nickel bull market on the horizon.

In summary, FPX’s metallurgical test work results are great and should validate any of the concerns from those who were skeptical about the refinement of the Baptiste deposit ore. While the results from the met work are great, in my mind, it does create a few new questions, such as the saleability of the magnetite iron ore concentrate or what is the cost profile for the new process. These, however, are great progressive questions to have, and I personally believe FPX is headed in the right direction.

Finally, for the questions regarding the debt, it’s a valid concern, however, given the background of the debt holder and my trust in Turenne, I’m inclined not to be concerned with it at this point.

I continue to hold FPX and look to increase my position with any weakness in the share price.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own FPX Nickel Corp. stock. I have NO business relationship with FPX Nickel Corp.