“The desire for more, the fear of missing out, the tendency to compare against others, the influence of the crowd and the dream of the sure thing-these factors are near-universal. Thus they have a profound collective impact on most investors and most markets. The result is mistakes, and those mistakes are frequent, wide-spread and recurring. “ ~ The Most Important Thing Illuminated pg.97

Success in the junior resource sector is predicated on a few key things.

First and foremost, it’s vital to invest your money with the right people. The wrong people have the capability of destroying any semblance of value in a good project.

Second, you need to protect your downside risk as it pertains to a company’s share price versus its intrinsic value.

Finally, you need to be a deep thinker and see through the narrative of the herd. This point is as much about brains as it is about courage – it’s rare to have both.

Today, in mid-October, at the highest precious metals prices we have seen in 6 years, the junior resource sector is, for the most part, selling off.

It begs the question, why?

Is it profit-taking? Maybe for a few of the best names, but for the most part, I think many companies haven’t seen much of an uptick in their share price, even with the spike in metal prices over the last 3 months.

Is it premature tax-loss selling? I don’t think that’s totally out of the question.

Is it the narrative surrounding a large correction in precious metals prices, which has caused many to anticipate the fall in prices and sell?

Social media is a powerful tool, it wouldn’t surprise me if those calling for a correction are influencing a percentage of investors. There’s comfort in following the herd.

Or, is it a lack of confidence in high precious metals prices in the future? I think that makes a lot of sense.

Human behaviour suggests that most people project their immediate past into the future. I can, therefore, see a high percentage of investors expecting to see the gold price fall, which ultimately would lead to them incurring losses on the companies within their portfolio.

In the end, it’s probably the confluence of all of these points and many more which have caused there to be more sellers than buyers, at this point.

For me, I see it as an opportunity to add to my positions in companies already in my portfolio or buy tranches in new companies in which I have been waiting for weakness.

Today, I have some thoughts on a company that I believe has all of the right ingredients for success and, in my opinion, is selling at a discount to their intrinsic value.

The company is O3 Mining, the 3rd iteration from the Osisko mining group.

Let’s take a look!

O3 Mining (OIII:TSXV)

MCAP – $107.2 million (at the time of writing)

Shares – 46,174,125

Cash – $32.0 million (approximately)

Strategic Shareholders – Osisko Mining 54.1%, Insiders 3.7%

The Genesis of O3 Mining

Earlier this year, Osisko Mining entered into a definitive agreement with Chantrell Ventures Corp (CV-H:TSXV), which saw Osisko’s non-core assets transferred to Chantrell, resulting in the Reverse Take-Over (RTO) of Chantrell by Osisko Mining.

The company was renamed O3 Mining, its shares were consolidated 40:1, it raised $18.6 million at $3.88 per share with a full warrant at $4.46, and the 3rd iteration of the Osisko team was born.

NOTE: For those who don’t know, the founders of Osisko Mining consists of John Burzynski, Robert Wares, Sean Roosen. Jose Vizquerra Benavides became part of the leadership team in 2011.

O3 Mining is led by CEO, Jose Vizquerra-Benavides, who is a geologist by trade. Vizquerra-Benavides is a native of Peru and comes from a long line of miners, as his grandfather is the founder of Buenaventura, a major mining producer company in Peru listed on the NYSE.

Vizquerra-Benavides began his career in the sector with Buenaventura, but eventually moved to Canada where he worked as a production and exploration geologist at the Red Lake gold mine.

From here, Vizquerra-Benavides joined the Osisko team where he has held a number of different roles or positions, such as Executive Vice President of Strategic Development & Director at Osisko Mining, and President & CEO of Oban Mining Corp.

While he is arguably the least known of the Osisko leadership team, I think that will soon change because, in my opinion, it’s obvious to me that Vizquerra-Benavides has the right pedigree to be successful in his new role as CEO of O3 Mining.

Quebec and Ontario

I’m not going to go into any detail about the jurisdictions, because unless you have been living under a rock or are new to resource sector investing, you will know that Quebec and Ontario are two of the best jurisdictions for mining investment attractiveness in the world.

The Fraser Institute continually has both jurisdictions rated in their top 20 places to explore, develop and mine worldwide.

Acquisitions

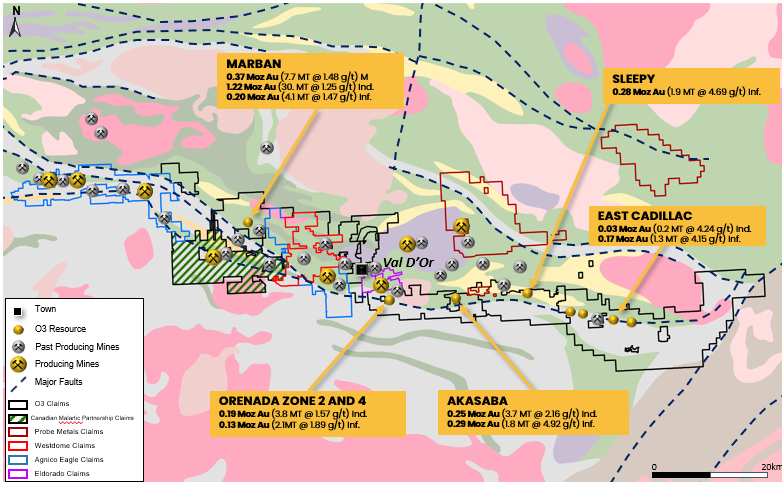

With the formation of the new company and Vizquerra-Benavides appointed as CEO, O3 didn’t waste any time adding to their already impressive land position within the Abitibi Greenstone Belt.

First was the acquisition of the Quebec subsidiary of Chalice Gold Mines Limited (details of the deal can be found here). A company with projects along the Cadillac Break.

NOTE: Chalice Gold Mines was acquired for $12.0 million in O3 stock.

Next, in another all shares deal, Alexandria Minerals was acquired (details of the deal can be found here). Clearly, given where O3 has focused their attention in their first drill program, Alexandria’s projects located in the Val d’Or region were particularly appealing.

NOTE: Alexandria Minerals had issued and outstanding 529,790,966 shares. O3 acquired Alexandria for $0.07 a share or 0.018041 for each O3 share, therefore, the purchase price was roughly $37.1 million.

Finally, in another all shares deal, O3 acquired Harricana River Mining Corporation, whose Harricana Mine Project is located in the Val d’Or area of the Cadillac Break (details of the deal can be found here).

NOTE: Harricana

was acquired for 773,196 shares in O3 with a stock price of $2.59 in the

announcement date – August 23, 2019. Therefore, the value of the transaction is

$2.0 million.

Figure 1: Val d’OR Consolidation – Post Acquisitions

Source: O3 Mining Inc.

Value of O3

In my opinion, protecting your downside risk is an integral part of consistently making profit from your investments within the junior resource sector.

Let’s do a quick calculation of O3’s underlying value:

- The total market value of O3’s acquisition is $51.1 million. Breakdown: Chalice Gold Mines – $12 million, Alexandria Minerals – $37.1 million, and Harricana River- $2 million.

- The RTO value of Osisko Mining’s non-core assets, which includes the advanced Marban project, was $99.9 million.

- O3 has raised a total of $37.78 million over the last 10 months: RTO financing – $10 million, Bought Deal financing (March 27th, 2019) – $17.7 million, Charitable Flow-Through financing (September 26th, 2019) – $10.08 million

Therefore, if you add up the value of O3’s acquisitions, Osisko’s non-core project portfolio and their cash (which will be lower than the total amount that they raised), the underlying value of O3 Mining is roughly $200 million or almost twice the current MCAP.

NOTE: No value is assigned to the exploration potential.

In my opinion, while the share price can undoubtedly move lower, I like the downside protection which O3 presents at its current price.

Drill Targets

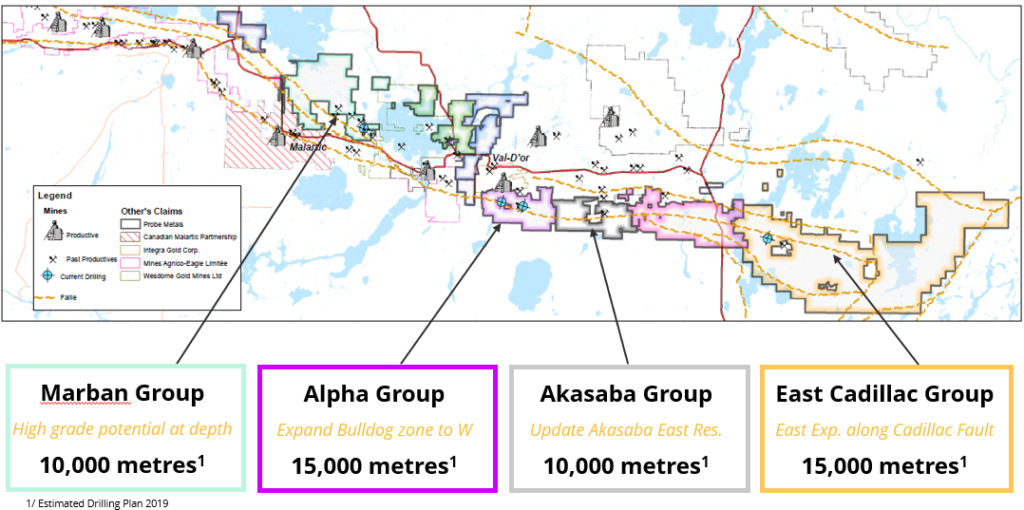

With the acquisitions in place, O3 is continuing to march forward with a 50,000m drill program on 4 main target areas within their Val d’Or region properties.

Figure 2: Aggressive Osisko Style Exploration

Source: O3 Mining Inc.

The drill program is being funded by a $10.08 million charitable flow-through private placement which closed on September 26th.

For those who don’t know about charitable flow-through shares, they’re typically issued at an even higher multiple above the market share price value than regular flow-through shares.

The ability to raise cash through charitable flow is a tremendous advantage compared to a regular hard dollar private placement, as it reduces the amount of dilution by the raise, while also giving the buyer an even higher tax reduction for participating.

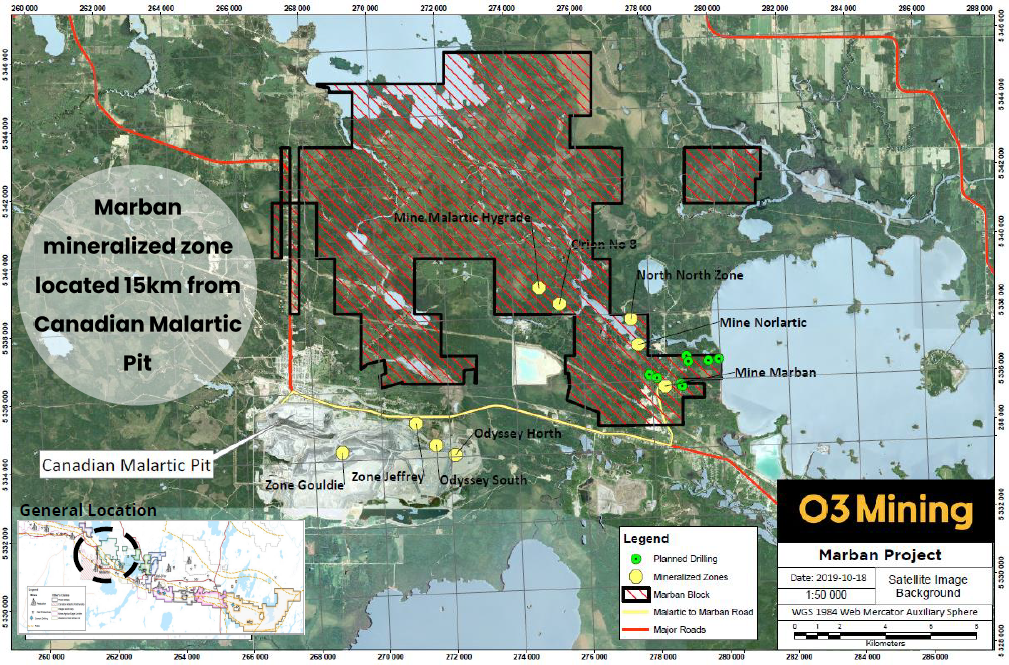

Marban Group

The Marban Group consists of the Marban and Harricana projects. The Marban project is located near the town of Malartic, Quebec, which sits roughly 30 km west of Val d’Or.

It’s one of the non-core assets which was spun out from Osisko Mining in the RTO with Chantrell Ventures. Marban was originally acquired by Osisko (Oban Mining at the time) from Niogold in 2016 when the 2 companies merged.

Marban has a 43-101 in-pit measured and indicated resource of 37 Mt at 1.24 g/t for 1.48 Moz of gold and an in-pit inferred resource of 3.6 Mt at 1.15 g/t for 0.13 Moz of gold.

In my conversation with Vizquerra-Benavides, O3 is planning to drill 8 holes there, which will be targeting high-grade gold below the existing resource – which means below 400m.

For those who aren’t familiar with Abitibi shear zone gold deposits, they can be deep, high grade and steeply dipping.

Therefore, exploration below 400m for high-grade gold mineralization is a legit prospect and one that I am very interested to see tested.

Figure 3: Marban Project

Source: O3 Mining Inc.

Additionally, as mentioned earlier, Marban is located in close proximity to the town of Malartic, which also means it’s in close proximity to the Canadian Malartic Open Pit Gold Mine owned by Agnico Eagle and Yamana Gold.

It is speculation, but I believe it’s valid to think that Marban becomes an attractive acquisition target for the Canadian Malartic Mine moving forward, as its reserves dwindle and precious metal prices remain strong.

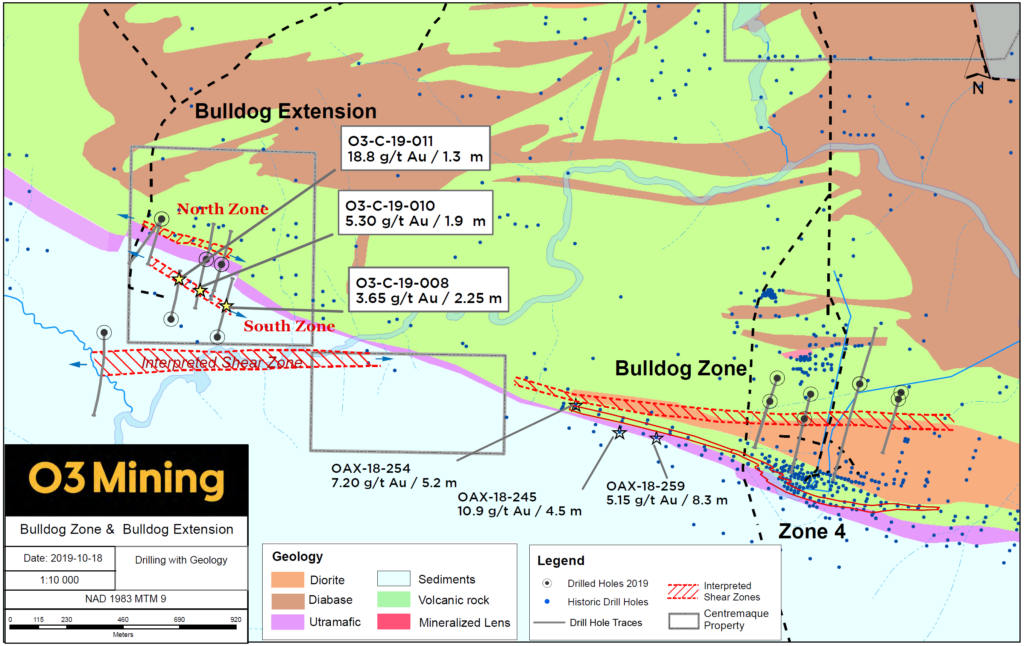

Alpha Group

The Bulldog zone was discovered by Alexandria Minerals in late 2018.

Reviewing the results in the December 11th, 2018 news release, the Bulldog zone is east-west trending and has been confirmed over 500m with a thickness ranging from 20 to 40 metres.

There were 8 initial holes drilled on the Bulldog target in 2018 and they returned some great results, which were highlighted by:

- Drill hole OAX-18-245 intersected 10.50 m @ 6.20 grams per tonne (g/t) Gold (Au) including 4.50 m @ 10.87 g/t Au.

- Drill hole OAX-18-254 intersected 10.50 m @ 4.25 g/t Au including 5.20 m @ 7.20 g/t Au.

- Drill hole OAX-18-259 intersected 8.30 m @ 5.15 g/t Au and 3.00 m @ 6.92 g/t Au.

With regards to drilling at Bulldog, Vizquerra-Benavides mentioned the phrase, “drill for structure, drift for gold”. Meaning, first and foremost, they want to establish or understand the structures that are controlling the gold mineralization.

Early this week, O3 announced results that confirm the extension of the Bulldog mineralized structure located 1,500 metres to the east and importantly, demonstrate the potential for gold-bearing structures in the Pontiac sediments.

The Bulldog gold-bearing mineralized structure discovered in December 2018, demonstrates good continuity in gold grades over several metres and is over 500 metres in strike length.

- Drill hole O3-C-19-011 intersected 18.8 g/t Au over 1.3 metres

- Drill hole O3-C-19-010 intersected 5.30 g/t Au over 1.9 metres

- Drill hole O3-C-19-008 intersected 3.65 g/t Au over 2.25 metres

Figure 4: Alpha Group – Bulldog Zone

Source: O3 Mining Inc.

O3 will continue with its 15,000m drill program in the Alpha Group, systematically drilling every 80 meters across the known zone, with the intent of establishing an inferred resource.

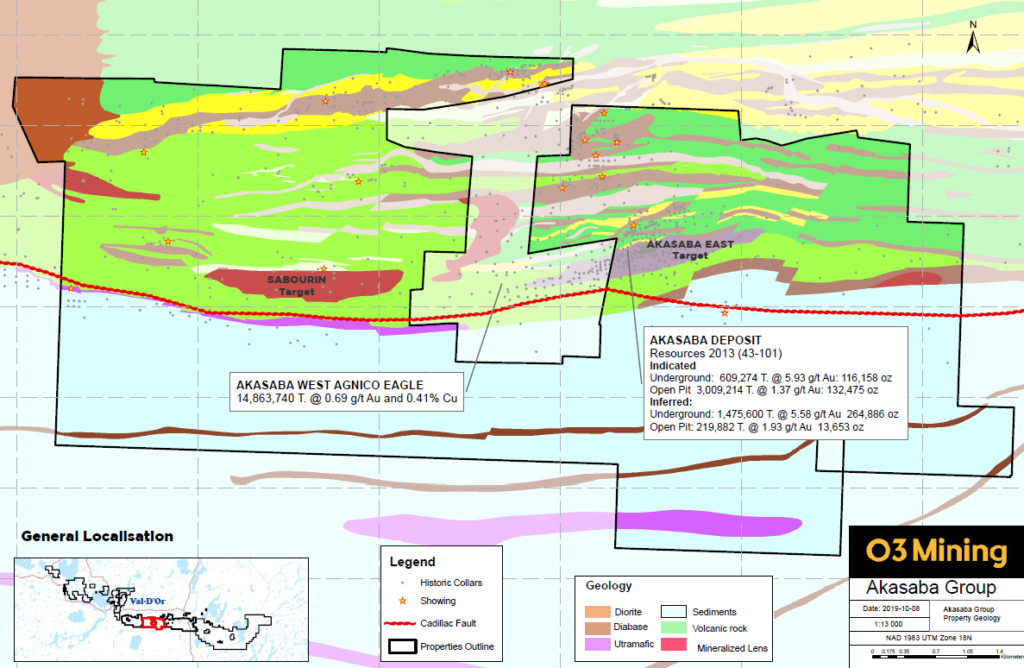

Akasaba Group

Akasaba sits east of the Bulldog Zone and, of course, on the east side of Akasaba West, which is an open-pit development project owned by Agnico Eagle. Akasaba West has an inferred resource of 14.8 Mt at 0.69 g/t for 332,074 oz of gold and 0.41% for 61.2 Mkg of copper.

O3 will perform a 10,000m drill program in the Akasaba Group

to confirm and expand resources in the Akasaba east target.

Figure 5: Akasaba Group

Source: O3 Mining Inc.

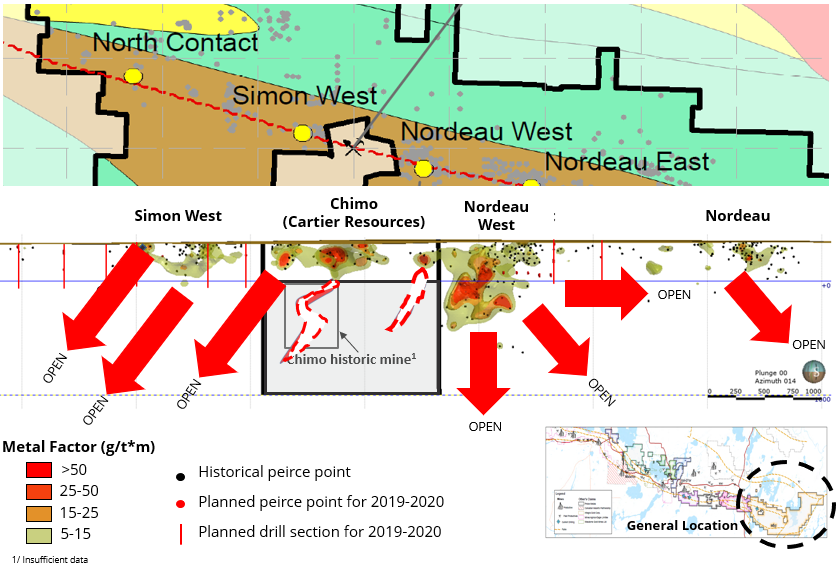

East Cadillac Group

The Nordeau West target in the O3’s East Cadillac Group, which was acquired in the acquisition of Quebec portion of Chalice Gold Mines, sits to the east of Val d’Or and of O3’s other 3 drill target areas.

Nordeau West has a JORC

indicated resource estimate of 225,000 tonnes at 4.17 g/t for 30,200oz of

gold and an inferred resource of 1.112 Mt at 4.09 g/t for 146,300 oz of gold.

Figure 6: East Cadillac Group

Source: O3 Mining Inc.

As you can see in the image above, O3 now controls essentially all of the land which surrounds the historic Chimo Mine, which is owned by another junior gold company – Cartier Resources (ECR:TSXV).

If you take the time to review the 3D resource model which is available on VRIFY’s website or in the video on Cartier’s website, you will get a good idea of the deposit and how it relates to the prospects on O3’s property.

Given the existing resource on the Nordeau West target and where O3 will be targeting their drilling, there’s a good chance that gold mineralization, possibly high grade, will be discovered.

Concluding Remarks

As I mentioned in the intro, success in the junior resource sector, I believe, is predicated on 3 main factors.

First, invest in the best people.

- O3 Mining is the 3rd iteration of the Osisko Mining Group and is led directly by its CEO, Jose Vizquerra-Benavides. The Osisko team has made it a habit of being successful in an industry that is fraught with failure.

- Not only have they done it at the peak of the market – bringing the Canadian Malartic Gold Mine into production in 2011, but they have also raised over $400 million dollars to develop the soon-to-be-feasibility-study-level Windfall project over the course of one of the worst bear markets in history.

Second, protect your downside risk.

- O3 is currently selling for roughly half of its intrinsic value, providing the investor with good downside risk.

And, finally, take a contrarian view of the market and/or the company.

- Most of the junior resource sector is selling off, including O3 Mining, which has seen its share price reach a low below $2.30 a share, over the last month or two.

- “Be fearful when others are greedy and greedy when others are fearful” ~ Warren Buffet

There is risk in any investment, especially when it comes to mineral exploration, but by sticking to the highest quality issuers, I believe, you give yourself the best opportunity for profit!

I own shares in O3 Mining and will continue to buy on weakness in the weeks ahead.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with any of the companies discussed in this article. I do own shares O3 Mining and Cartier Resources.