Month: July 2020

Market Update – July 30th, 2020

Module #3 – Mineral Processing and Metallurgy

Module #2 – Exploration

Module #4 – Balance Sheets

PREMIUM ISSUE #6 – July 2020

Monarch Gold – Compelling Value in the Abitibi

NOTE: This article was originally published for Junior Stock Review Premium readers on July 3rd, 2020. Subsequently, Monarch’s share price has appreciated 20%. Get my best investment ideas first by becoming a member today.

Finding companies that are trading for less than their value is integral for success in the junior resource sector.

With that said, investors have to be cognizant of why the company is trading at a discount to its value.

Value traps do exist and can either put your investment dollars into neutral or worse – lose you money.

You must, therefore, spend the time to understand the reasons for the discount and decide if it’s realistic, given the company’s action plan, to change the market’s perception.

In my research to identify the top M&A candidates in the sector, I have found that the companies that fall in this category are well known in the market and, in some cases, trade at a premium to their value.

The company I have for you today is not only trading at a steep discount to its value, but it also has, in my opinion, all the makings of a premier M&A candidate.

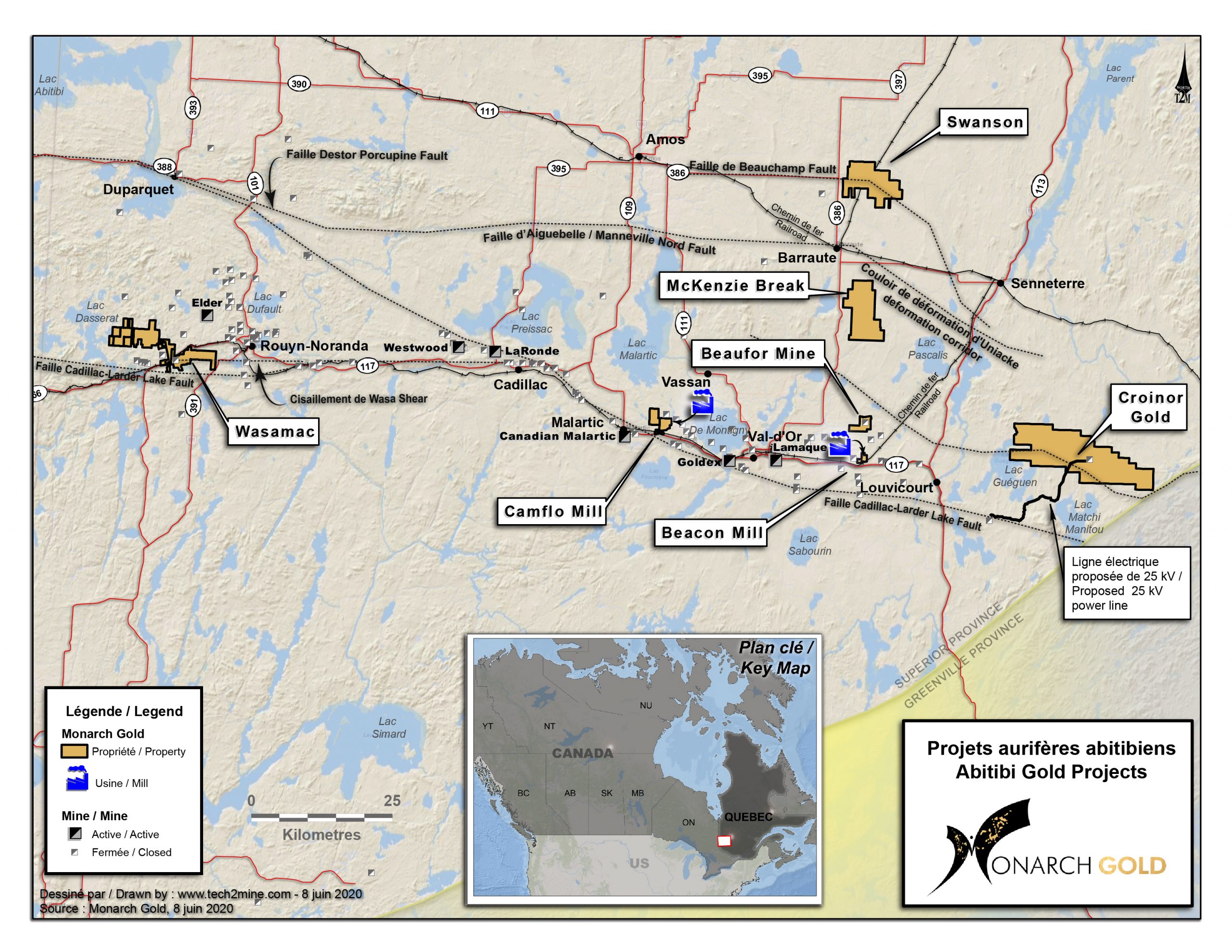

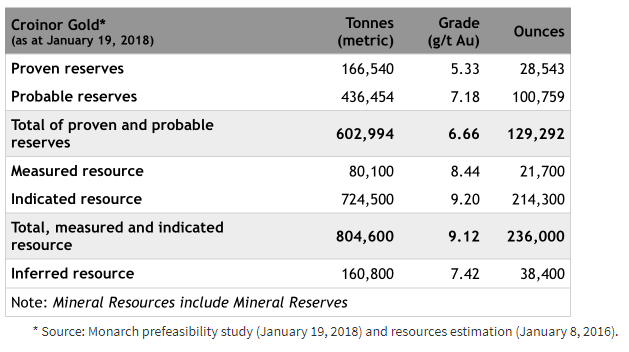

The company is Monarch Gold and they are developing their flagship Wasamac project in the heart of the world-famous Abitibi Greenstone Belt.

Let’s take a closer look.

Monarch Gold (MQR:TSX)

MCAP – $141.6M (at the time of writing)

Shares – 294.1M

FD – 333.7M

Cash – roughly $25M

Strategic Investors – Alamos Gold (16%), Yamana Gold (6%), Hecla (4%), Agnico Eagle (3%)

Total Equity Holdings –$3.2M As of March 31st, 2020 (O3 Shares, Probe Metals, etc.)

Debt – $3.8M of which $2.4M is due this year.

The People

Monarch Gold is led by CEO Jean-Marc Lacoste. Lacoste has a financial background and, in my opinion, a clear understanding of how to add value to a junior resource company.

Over his close to 8 years as CEO of Monarch, Lacoste has demonstrated that he and his team are able to execute the company’s vision of acquisition and development.

The ability to buy projects cheaply, add value through exploration and development, and then have the wherewithal to make a deal and sell the project to unlock the value for shareholders isn’t done successfully, all that easily, in the junior resource market.

Lacoste and supporting cast are clearly capable of executing this process and, given the current market, should be able to reap the benefits of multiple years of practice.

Lacoste is supported by CFO Alain Levesque, VP Corp Development Mathieu Seguin and VP Operations Marc-Andre Lavergne, together with a committed board of directors which has a strong track record of mine discovery and development.

I’m confident that the Monarch Gold team has the experience and focus to unlock the value at Wasamac and the rest of their secondary projects.

Wasamac

As I mentioned in my intro, I believe Monarch is trading at a discount to their value.

As investors, we must try and understand why.

In Monarch’s case, at least a portion of the issue, I think, is directly related to the upfront capital cost and low after-tax internal rate of return (IRR) reported in Wasamac’s 2018 FS.

Wasamac 2018 FS Highlights:

At US$1300/oz gold

- After-tax NPV@5% – $311M

- After-tax IRR – 18.5%

- Upfront CAPEX – $464M

- P&P Reserves – 1.767Moz

- Average Production – 142Koz/year

- Mine Life – 11 years

- AISC – US$630/oz

When you examine the numbers, you can see that the upfront CAPEX and the IRR stand out like a sore thumb.

Let’s start with the upfront CAPEX, which is estimated at $464M, and includes roughly $230M for the mill and tailings facility.

This is a good chunk of cash, especially when put into context with other gold projects of similar size – it is much higher.

A big reason for this, at the moment, is that most of Wasamac’s comparisons are open-pit mines, which do typically have lower upfront capital costs – but not always.

Second is the poor after-tax IRR of 18.75% at US$1300/oz gold.

For those who are not aware, IRR is a measure of profitability, comparing the upfront capital cost to the estimated cash flow.

For further perspective, the best gold projects typically have after-tax IRRs over 25%.

Now, at today’s gold prices, Wasamac’s after-tax NPV and IRR increase and, most importantly, bring the IRR above the 30% mark – which is great.

Wasamac’s comparables, however, also respond well to rising gold prices and, therefore, are still better.

In my view, the stigma of these metrics has resulted in the discount to value, thus far.

The obvious question is, then, how does Monarch improve the upfront CAPEX cost and IRR metrics?

On May 14th, Monarch announced a MOU with Glencore regarding the potential use of the Kidd concentrator in Timmins, Ontario for the treatment of ore to be mined from Wasamac.

The MOU consists of 4 stages: Phase 1 – Upgrading Study (to be completed before Dec.31, 2020), Phase 2 – Negotiation and Signing of a Toll Milling Agreement (to be completed before March 30, 2021), Phase 3 – Concentrator Upgrading Work (to be completed before July 31st, 2021) and, finally, Phase 4 – Performance of the Toll Milling Services (First delivery to take place by Dec.31, 2023).

Further, on June 22nd, Monarch awarded the Phase 1 Upgrading Study on the Kidd Concentrator to Ausenco Engineering Canada.

These steps, if executed and with acceptable results, have the ability to address the 2 issues which I think have been impacting Monarch’s valuation, and could result in a substantially higher IRR.

To add, I believe the addition of Yamana (YRI:TSX) to the list of Monarch’s strategic investors is a bigger deal than the market has given it credit.

Yamana not only participated in the latest financing, but also wanted a Board of Directors seat, which I think is very telling with regards to future possibilities.

Clearly, to me, this move suggests that Yamana sees the potential in Wasamac.

With the Canadian Malartic mine, their 50% owned operation, sitting just east of Wasamac, it’s possible that Monarch will have another option outside of Glencore’s Kidd Concentrator when it comes time to negotiate terms of a toll mining scenario.

Plus, it’s entirely possible that a deal with Glencore, and Monarch’s valuation at the moment, could push Yamana to acquire Monarch.

That is entirely speculation, but something that, I think, has weight.

Either way, Wasamac’s resource size, production profile, sensitivity to higher gold prices and location put it at or near the top of my list of M&A targets.

Monarch’s Other Projects

There is far more to the Monarch Gold story than just Wasamac, with 4 other advanced stage projects in the Beaufor Mine, Croinor Gold, McKenzie Break and Swanson projects.

Additionally, Monarch has 2 fully permitted mills in Camflo and Beacon.

Clearly, project development in the Val d’Or region of the Abitibi is a major part of Monarch’s growth strategy.

Further, scanning their news releases, you will find a history of acquisitions and sales.

A great example of this comes from earlier this year with the sale of Monarch’s Fayolle project to IAMGOLD (IMG:TSX) for $11.5M.

A willingness to monetize secondary projects for cash and/or shares is a great way for Monarch to advance their flagship Wasamac project without further dilution to existing shareholders.

As Lacoste mentioned to me in conversation, the focus is Wasamac and Monarch becoming a +100Koz/year producer.

The proceeds and the reason for the investment and development of these secondary assets is to, therefore, progress Wasamac with as little dilution to shareholders.

Let’s take a closer look at their current project inventory and the potential value that it could unlock for the company moving forward.

Let’s begin with the 2 mills – Camflo and Beacon.

Camflo Mill

- Fully permitted

- 1600 tpd

- Available tailings capacity

- Capable of crushing, grinding, cyanidation and precipitation via zinc powder

- Camflo Mine produced 1.6M ounces over its history (The original Barrick asset)

- Monarch announced that they will be re-evaluating the exploration potential of this project using modern technology this year

Beacon Mill

- Fully permitted

- 750 tpd

- Available tailings capacity

- 500m shaft

- Additional buildings

So what are they worth?

That’s a great question and one that is hard to answer.

For perspective, along with at least a 5-year development and permitting timeline, the upfront capital needed to construct a new mill could be in the order of $40M to $50M.

With that said, we do have a recent deal on a mill in the Val d’Or area which I think we can use as a conservative estimate for the value of Beacon and Camflo.

In May, O3 Mining (OIII:TSXV) acquired QMX’s (QMX:TSXV) Aubrel Mill for $5M.

With that set as our precedent, we will assume Camflo and Beacon are worth $5M each.

Beaufor Mine

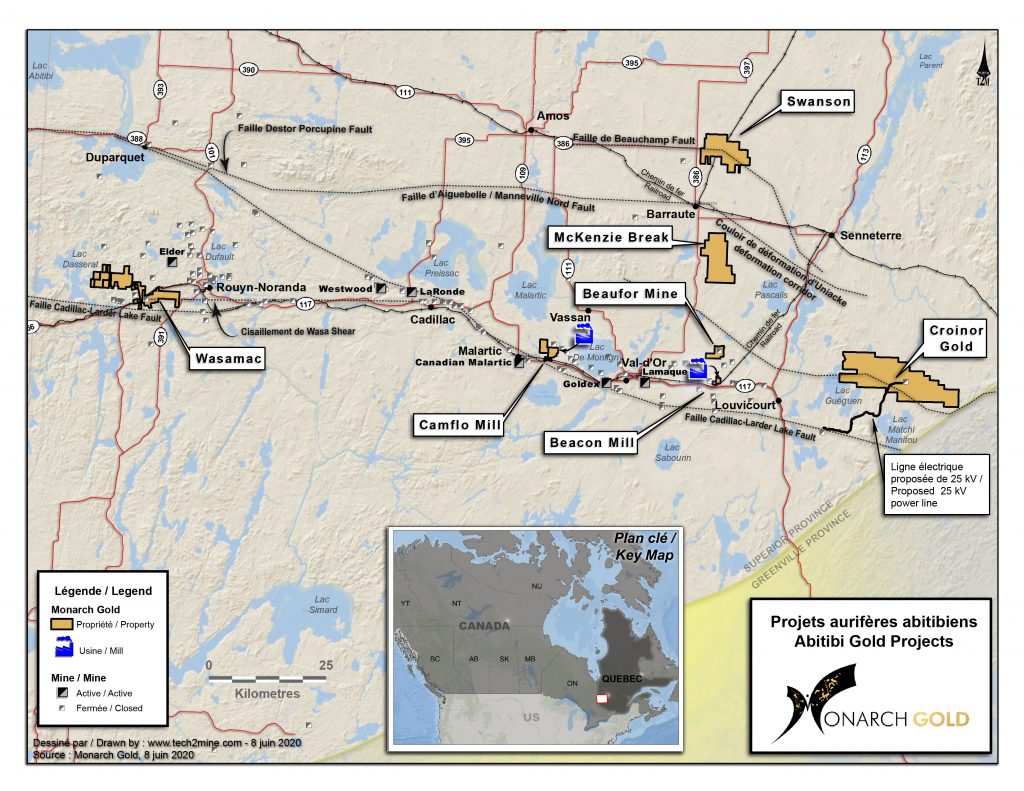

Next to Wasamac, the Beaufor Mine is arguably Monarch’s 2nd most important asset, as it was a producing mine up until last summer when it was put on care and maintenance.

Beaufor was formerly owned by Richmont Mines, who sold it to Monarch along with the rest of its Quebec assets before being acquired by Alamos Gold in 2017.

Beaufor presents an interesting dynamic to Monarch’s valuation, because it both proves the management team’s ability to operate a mine and gives the added potential for cash flow moving forward.

On May 7th, Monarch announced that they had sold a 3% NSR on the Beaufor Mine to Caisse de depot et placement du Quebec (CDPQ) for $5M (with the option to redeem up to 2%).

This cash will be put to work right away with a 42,500m drill program, which currently has 95 high grade gold targets, many of which are below 800m.

Monarch has retained the services of Goldspot Discoveries (SPOT:TSXV), which uses their expertise in geosciences and advanced artificial intelligence algorithms to aid in the efficiency and success rate of exploration.

The company hopes to delineate enough resources for 3 to 4 years of production and are targeting a re-start of the operation by Q1 2021.

So, economically speaking, what can we expect from Beaufor upon re-start?

That’s a very important question.

As I mentioned, last summer, Beaufor was put on care and maintenance because it was losing money at roughly US$1350/oz gold.

We can conservatively say, therefore, that the operating cost moving forward is probably around US$1400/oz gold.

At gold’s current price, therefore, we are looking at a profit margin in the order of $300/oz, which is great.

Monarch operated Beaufor for 18 months prior to shutdown and was producing at a rate of roughly 20,000 oz per year.

Now, assuming that this is the rate which they will produce at in the future, we can make a rough estimate that Beaufor could cash flow $6M a year.

Honestly, though, considering that the company is targeting grades much higher than the 4.5g/t gold, which they were mining prior to the shutdown, the cash flow generation could be much higher.

For the sake of this valuation, let’s assume that Beaufor on a discounted basis is worth $20M.

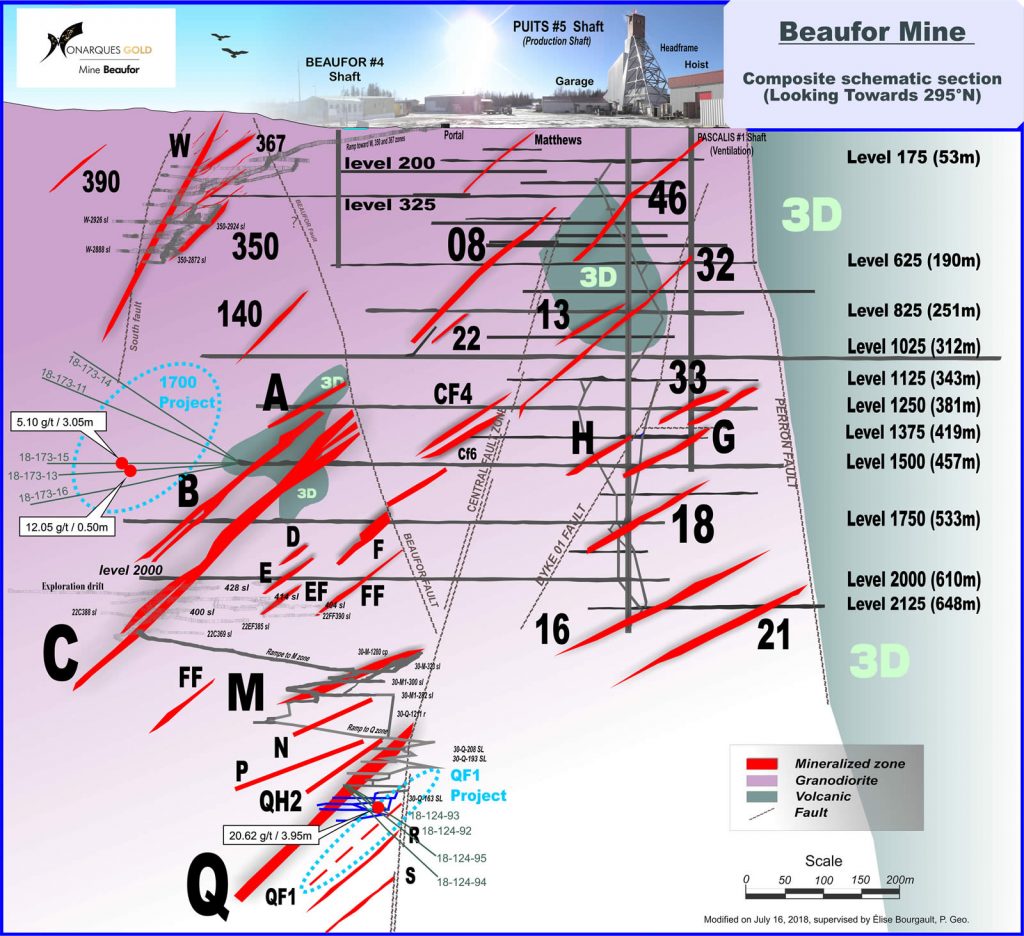

Croinor Gold

The Croinor Gold project sits just 55km east of Val d’Or and encompasses over 151 square kilometres.

Croinor is well developed with a 2018 PFS on the project.

Croinor Gold Project 2018 PFS Highlights:

At US$1280/oz gold

- After-tax NPV@5% – $18.3M

- After-tax IRR – 30%

- Mine Life – 2.6 years

- Upfront CAPEX – $32.8M ($17.2M sustaining CAPEX over LOM)

Using the PFS sensitivity table, you can see that at roughly today’s gold price, US$1664/oz, the after-tax NPV of the project increases to $50.64M.

Now, these aren’t earth-shattering numbers, but I can clearly see how Croinor has the potential to be a great spin out or acquisition target for a new junior gold company – especially given the current market dynamics.

For the sake of our valuation, let’s assign a value of $15M, which is roughly 30% of the project value given the current gold price.

McKenzie Break & Swanson Projects

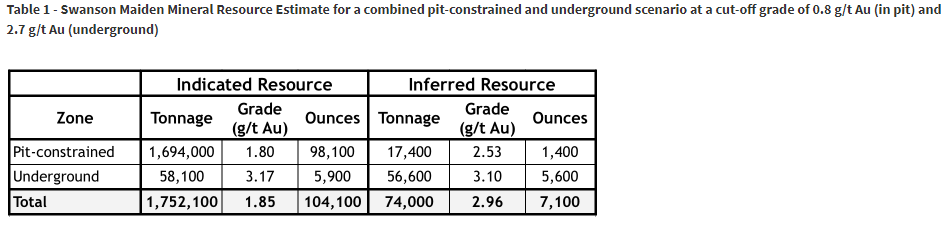

Last but not least, we have the McKenzie Break and Swanson projects.

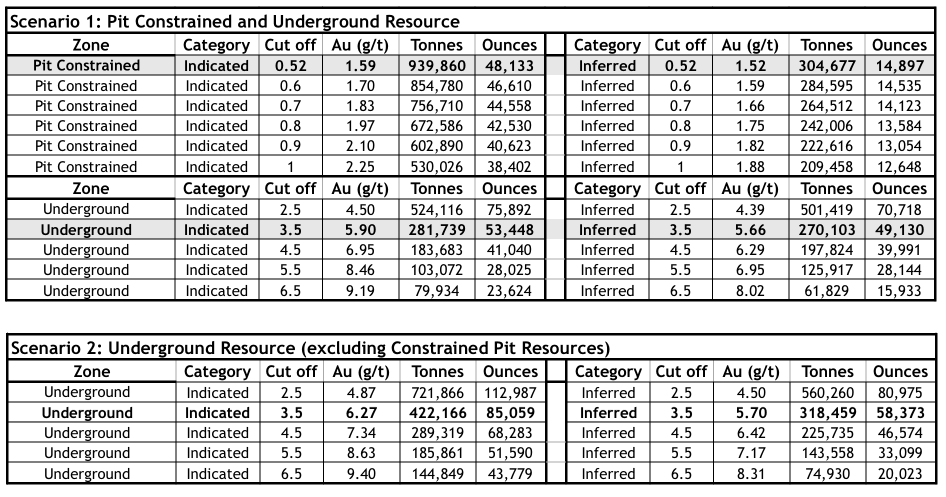

Both projects have 43-101 resources, but no economic studies completed on them.

Most notably, exploration drilling below the current resource at McKenzie Break returned some fantastic intervals in February which were highlighted by:

- MK-18-205ext – 32.30 g/t gold over 7.1m, including 142.80 g/t gold over 1.2m, 26.97 g/t gold over 1.3m and 24.60 g/t gold over 0.7m

- MK-19-249 – 5.28 g/t gold over 13.7m, including 58.17 g/t gold over 0.6m and 21.04 g/t gold over 0.8m

- MK-19-250 – 10.50 g/t gold over 11.0m, including 156.00 g/t gold over 0.6m and 13.15 g/t gold over 1.0m

- MK-19-251 – 7.04 g/t gold over 6.0m, including 25.92 g/t over 1.0m

Monarch plans to follow up and continue to explore the McKenzie Break property. It recently completed a 1,600-metre drilling program, with results pending.

Building on these results will further increase the value of the project and make it another prime candidate for Monarch to sell into this high gold price environment.

To round out the valuation of Monarch’s secondary projects, let’s assume that collectively the McKenzie Break and Swanson projects are worth $5M.

Risks to Investment

Gold Price – The gold price remains, in my opinion, the biggest risk to Monarch Gold’s share price. As I have noted before, however, this risk is ubiquitous across the sector. In my view, the gold thesis has never looked better and, thus, I’m inclined to think that there is a much better chance we will see higher gold prices ahead – time will tell.

Covid-19 – The Covid-19 pandemic continues to present a risk to the entire world. For companies such as Monarch, the risk is in the delayed development of their projects. A 2nd wave of lockdowns due to Covid-19 could put Monarch’s action plan on hold and, therefore, provide little return to investors as cash would only be going to G&A.

At this point, it’s still hard to say where we are headed this fall.

Wasamac – It’s entirely possible that the market will not recognize the value of Wasamac until there is more clarity on the reduction in upfront CAPEX costs. Ausenco is mandated to have their report completed by October of this year, so we should have a good idea of the cost of upgrading the Kidd concentrator by then.

In my estimation, I’m guessing we will see a number of around $50M. Therefore, the overall savings with the toll milling agreement should be around $180Mish.

Will this be good enough for the market?

Remember, the Wasamac gold project is one of only a handful of projects in Canada and the United States that has had an FS completed and has the production capacity of at least 100Koz/year.

With that in mind, I think it’s only a matter of time before the market recognizes Monarch’s true value.

Concluding Remarks

Putting it all together, Monarch has roughly $25M in cash, a total equity holding of $3.2M (this is most likely higher given the market dynamics), and, conservatively, has a collection of secondary projects that are collectively worth $50M.

The market is, therefore, currently valuing Wasamac, which is a FS level project with an after-tax NPV@5% of $750M at the current gold prices, at approximately $63.4M.

In comparison to its peers, no matter how you slice it, this is incredibly cheap.

With that said, Monarch does have some work to do to improve on upfront CAPEX costs for Wasamac.

They must make a good deal with Glencore or another suitor in the area to toll mill Wasamac’s future production.

The economics of the toll milling agreement will be officially shown in the updated FS, which is expected next year.

Along with this, they must continue to development and have an eye to monetize the secondary projects within their portfolio.

Given the current market dynamics and very strong case for high gold prices, Monarch is in an enviable position when it comes to negotiating for the best deals on their projects.

Monarch Gold is selling at a fraction of its value and, given management’s plan for the next 6 to 12 months, I believe it’s only a matter of time before their value is recognized.

I am a buyer of Monarch Gold (MQR:TSX).

Get the e-book Junior Resource Sector Investing Success: The Risks, Rules & Strategies You Need to Know today, when you become a FREE Junior Stock Review VIP

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with Monarch Gold Corp (MQR:TSX). I do own shares in Monarch Gold Corp.

Market Update – July 15th, 2020

Market Update – July 10th, 2020

Integra Resources – A Premier M&A Candidate in the Making

NOTE: This article was originally published on June 23rd, 2020 for subscribers. Subsequently, the share price has risen 40%.

As I mentioned in last week’s Market Update commentary, M&A is on my mind.

This new bull cycle in gold will bring fourth many new deals and with them a chance for investors to make a very good profit – if you choose right.

Picking the right company will be a reflection of the criteria you use.

Being picky and setting the bar high not only protects your downside risk, but also forces you to think like a major mining company, which is looking to add economic resources to their books.

Today, I have for you one company which I believe will be at the forefront of M&A activity in the not-so-distant future.

The company is Integra Resources (ITR:TSXV) and they are developing their flagship Delamar project in Idaho.

Let’s take a closer look.

Integra Resources (ITR:TSXV)

MCAP – $190.1M (at the time of writing)

Shares – 119.6M

FD – 130.7M

Cash – roughly $27M

People

Integra is led by CEO George Salamis, who has over 30 years experience in the resource sector and is a geologist by trade.

Salamis has a very good reputation in the sector and the resume to support it.

He has been involved in over $2B inM&A transactions over his career, with his most recent success coming from the acquisition of Integra Gold by Eldorado Gold Corporation for C$590M.

Salamis is supported by a strong team with CFO Andree St-Germain, VP Exploration Max Baker, and COO Tim Arnold.

Further, Integra has a great Board of Directors; Chairman Steve de Jong, David Awram (Co-Founder of Sandstorm Gold), Timo Jauristo (Former Executive VP with Goldcorp), Anna Ladd-Kruger, and C.L. “Butch†Otter.

Finally, and although not a Director, Strategic Advisor Randall Oliphant (Former CEO of Barrick Gold) brings 30 years of experience to the table.

Clearly, Salamis and his supporting cast have a history of developing projects into premier M&A candidates.

I fully expect to see the same story play out with Delamar, as the team works to improve Delamar’s economics and this gold bull market progresses.

Delamar Project

The Delamar project encompasses roughly 8,100 hectares in southwestern Idaho, about 80 km southwest of Boise.

Idaho is a premier mining jurisdiction and, while it may not have as deep a history and fanfare as its neighbour to the south, Nevada, it does rank very high in mining investment attractiveness.

In fact, the Fraser Institute agrees and ranks Idaho 8th in the world in mining investment attractiveness with a score of 82.78.

Delamar is a past producing mine and, prior to its acquisition by Integra in 2017, it was owned by Kinross.

The Delamar and Florida Mountain deposits have produced an estimated 1.3 million ounces of gold and 70 million ounces of silver over the course of their 100 year history.

Since its acquisition, Integra has converted 90% of its inferred resources to M&I between 2018 and2019, it has completed extensive metallurgical studies on both the oxide and sulfide portions of the deposits, and completed a PEA last fall.

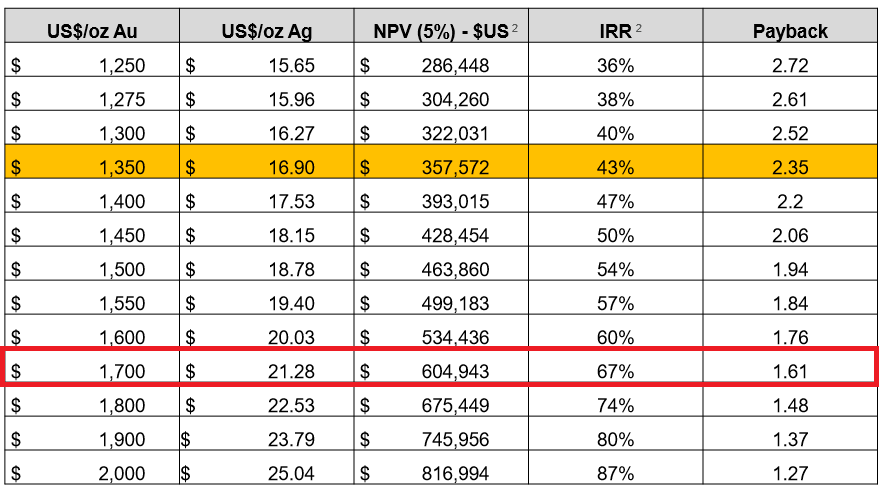

The PEA reveals robust economics at US$1350/oz gold and US$16.90 silver. Let’s take a look at some of the highlights.

2019 Delamar PEA Highlights:

After-tax NPV@5% – C$472M

After-tax IRR – 43%

Upfront CAPEX – US$161.0M

Sustaining CAPEX – US$93.4M

AISC – US$742/oz AuEq

Production Capacity – 124 Koz/year AuEq

Life of Mine – 10 years

M&I Resources – 1.8 Moz AuEq

These are great numbers, as the project has good size, comparatively low upfront capital costs, and the gold and silver price assumptions are well under today’s prices.

How does the project’s economics look at today’s metal prices?

Great question; while it’s imperative to understand our downside risk in-terms of the metal prices, we need to understand the value of the project today.

In Integra’s corporate presentation, there’s a great sensitivity table which reflects Delamar’s NPV and IRR and varying metal prices.

Highlighted in red is a snap shot of today’s metal prices. I will note that the silver price isn’t anywhere near US$21.28, yet, but silver’s impact on the project is much lower than gold’s given the metallurgical recoveries at this point.

The other thing to consider is that this sensitivity analysis only changes the metal price, it doesn’t account for the other positives that are derived from higher gold and silver prices.

Most notably in this base case scenario, is the increase in the pit shell and the possibility of mining underground, which is a very good possibility given the mineralization which Integra has encountered.

What was once waste in the low metal price environment is now ore.

In the US$1350/oz gold and $17.47/oz silver scenario, the Delamar pit would process 46,734,000 tonnes at 0.34 g/t gold and 19.14 g/t silver and have a strip ratio of 0.67.

Additionally, the Florida Mountain pit would process 53,142,000 tonnes at 0.47 g/t gold and 11.83 g/t silver and have a strip ratio of 1.25.

Conversely, if you consider today’s metal prices, US$1700/oz gold and $22.00/oz silver, the tonnage at the Delamar pit increases to 51,474,000 tonnes at 0.33 g/t gold and 19.76 g/t silver and have a strip ratio of 0.92.

Florida Mountain’s tonnage increases to 59,396,000 tonnes at 0.46 g/t gold and 11.69 g/t silver and have a strip ratio of 1.39.

NOTE: These figures can be found on pages 177 and 179 of the 2019 PEA.

In total, the higher metal prices, in terms of ounces, account for a further 35Koz of gold + 4Moz of silver from the Delamar pit, and 77Koz of gold + 2.1Moz of silver, bringing the grand total to 112Koz of gold and 6.1 Moz of silver.

Those aren’t earth-shattering numbers, but still contribute to the bottom line of the project.

Putting it altogether, I like the base case scenario for the project and, outside of exploration upside, which we have yet to discuss, I like how the project responds over a variety of metal prices.

Exploration Upside

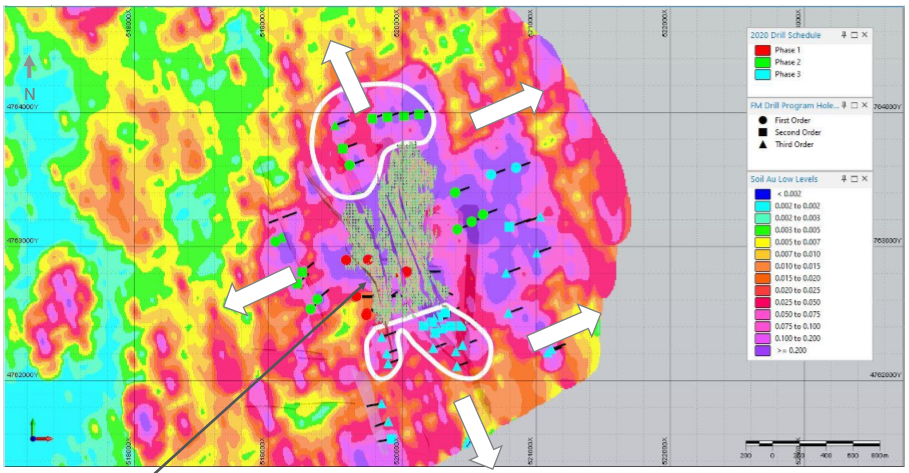

#1 – Expansion of the Florida Mountain Deposit

As I explained in my thoughts on M&A, size matters.

While comparatively, the Delamar project is already large, an expansion of the resource would be highly advantageous for its economics and appeal to major mining companies.

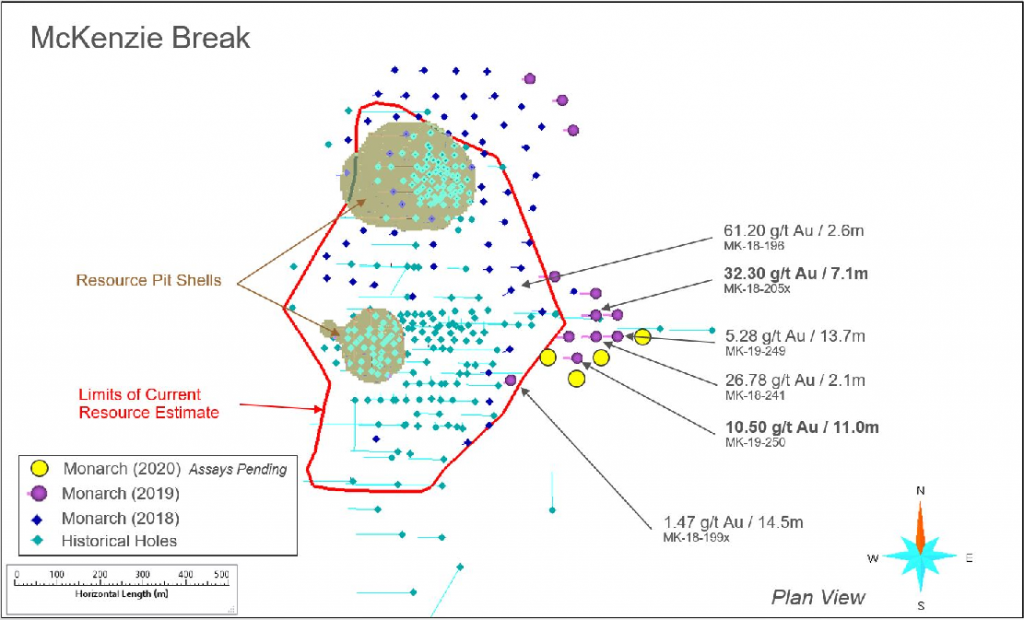

As you can see in the image below, there’s a large gold in soil geochemical anomaly which surrounds the existing deposit.

Integra will be targeting oxide/transitional mineralization in this area.

As investors, we should be looking for assay grades around that which we have seen on the existing deposit resource, so roughly 0.5 g/t.

While this isn’t the flashy high grade stuff Integra will be exploring for at other targets, remember that it’s oxide/transitional mineralization which is the backbone of the future operation.

The drilling of this anomaly will occur this year and, in my view, represents a tremendous opportunity to add value to the project.

#2 – Underground Resource

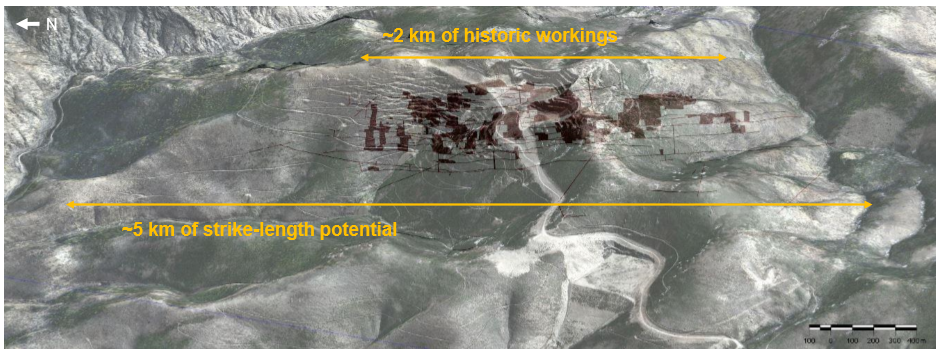

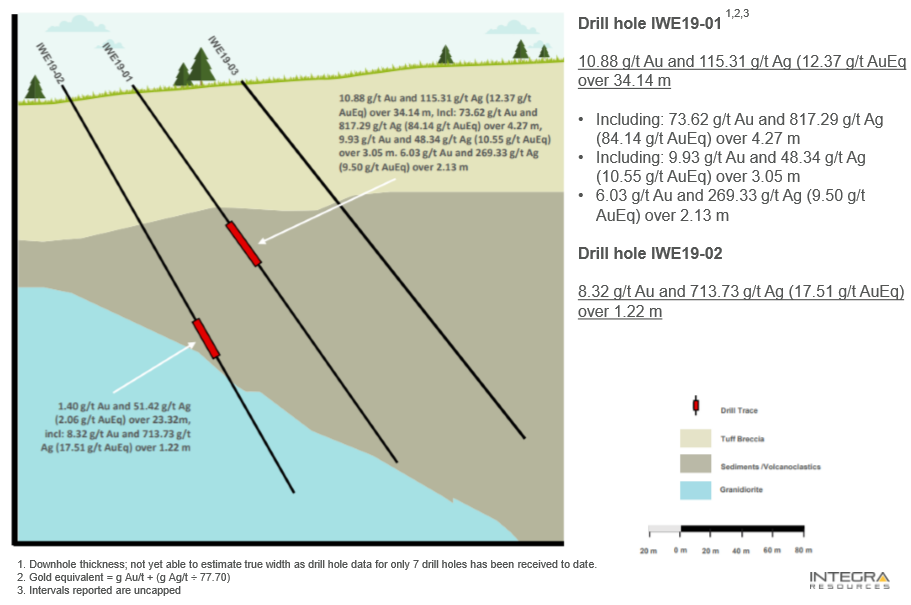

As I mentioned in the project introduction, the Delamar project was a past producing mine, both open pit and underground workings.

The underground workings at Florida Mountain are extensive, stretching over 2km, and will be the focus of high grade exploration this year.

In my discussion with management, these workings were encountered during the metallurgical drilling last year and returned some great intervals.

For example:

- IFM 19-054 – 9.70 g/t gold and 12.85 g/t silver over 1.52m

- IFM 19-062 – 2.12 g/t gold and 181.96 g/t silver over 37.95m, including 7.68 g/t gold and 623.86 g/t silver over 4.88m

- IFM 19-058 – 18.50 g/t gold and 850.70 g/t silver over 1.52m

Although this high grade mineralization is underground, it appears as though it’s easily accessible and, of course, is in close proximity to the future mill site.

Outlining a high grade underground resource at Florida Mountain, therefore, represents a tremendous opportunity to add value to Delamar’s NPV, especially if the high grade material can be mined early on in the production schedule.

#3 – War Eagle

In Q4 of 2019, Integra drilled their War Eagle target, which sits roughly 3km southeast of Florida Mountain.

As you can see in the image below, they hit some very nice high grade intervals.

Given its proximity to the main project, it’s reasonable to think that at some point, depending on a number of factors, War Eagle could become a high grade production source for the mill.

A feed of high grade ore from this potential satellite deposit would be gravy on top of what already looks like a profitable operation.

Drilling at War Eagle will commence within the next 2 to 3 weeks.

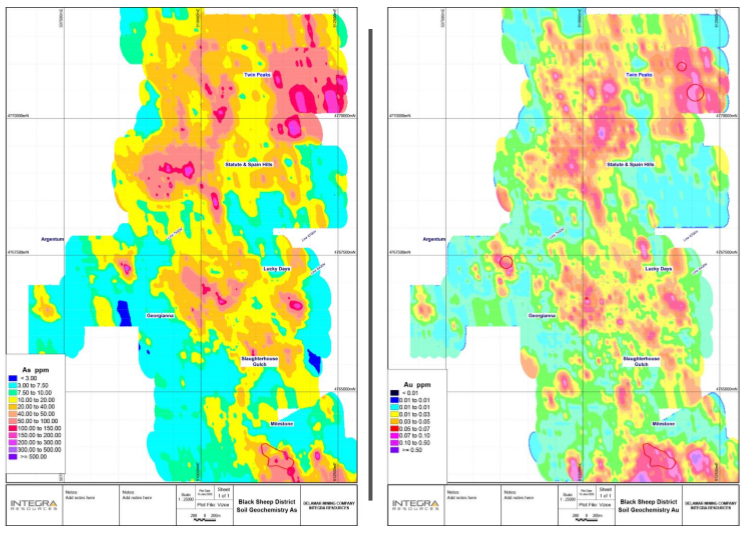

#4 – Black Sheep

Finally, there is the Black Sheep target area, which sits to the northwest of Florida Mountain.

At Black Sheep, Integra has a 25 square kilometre target area, with multiple geochemical and geophysical anomalies to follow up on.

Integra plans to drill 3,000m in this area later this year.

Risks to Investment

Exploration – The Delamar project has tremendous exploration potential across its 4 main target areas: the oxide/transitional geochem anomaly at Florida Mountain, the high grade underground target at Florida Mountain, War Eagle and, finally, Black Sheep.

With that said, with exploration comes risk.

If mineralization is intersected, what is the grade? At what depth was it discovered? Is there enough of it? All these questions need to be answered before any discovery can be deemed economic and, therefore, a positive addition to a future mine plan.

Covid-19 – The contagion of the Covid-19 virus remains a risk to every junior mining company. Any future lock down could put Integra’s action plan in neutral and, therefore, delay Delamar’s development. With a high burn rate, G&A + development/exploration costs, time not spent developing the project comes at a high cost to investors.

Gold Price – At this point, the gold price is arguably the biggest risk to company valuations, as a fall back to US$1350/oz, I believe, would result in a massive sell off and, thus, dramatic drops in company valuations.

Much like Covid-19, however, downside risk associated with the gold price is an ubiquitous risk across the sector.

With gold holding, more or less, at US$1700/oz for many weeks now, I believe it’s less and less likely that we see US$1350/oz gold any time soon.

Time will tell.

Concluding Remarks

Integra’s Delamar project is excellent, it has robust economics at US$1350/oz gold and, more importantly, its sensitivity to the metal prices allows it to respond very positively to the rising gold and silver price environments that we see today.

Protecting your downside risk is integral to success in the junior resource market.

With that said, in terms of company valuation, Integra is well known within the sector and, therefore, with reference to Delamar’s base case valuation, doesn’t present a huge discount to value, in my view.

However, when you consider the exploration potential and, if successful, the impact it will have on the economics of the project, I believe this is where the true upside potential lies.

In my opinion, Integra’s story is as much about exploration as it is about development.

To add, Integra is run by a stellar group of people, who have a history of success in developing companies into premier M&A candidates.

I’m very confident that Salamis and team will continue to make the right decisions as the Delamar project continues to grow and take shape in this very important exploration season.

A PFS is expected in the second half of 2021; the discovery of further high grade mineralization could further separate Integra from the other gold development companies in Tier #1 jurisdictions.

Get the e-book Junior Resource Sector Investing Success: The Risks, Rules & Strategies You Need to Know today, when you become a FREE Junior Stock Review VIP .

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with Integra Resources (ITR:TSXV). I do own shares in Integra Resources.