Month: September 2020

A Conversation with Martin Turenne, CEO of FPX Nickel Corp.

In the junior resource sector, people are everything.

Find the right people and, more often than not, you will have found a successful investment.

For me, I met FPX Nickel Corp.’s CEO Martin Turenne in the summer of 2018 and, right then and there, I knew I’d met someone worth investing in.

Turenne is as good as CEOs get in the junior mining sector – Intelligence, Integrity and Drive.

To date, FPX has generated an 800% return for myself and my subscribers, and I believe it has the potential to reach much higher levels in the future.

In our conversation, Turenne gives his opinion on the current nickel market, an overview of the recently released updated PEA on FPX’s Baptiste project and, finally, outlines FPX’s plan for the next 6 to 12 months.

Enjoy!

Brian: The Covid-19 pandemic has affected the mining industry, shutting down or drastically reducing production from a number of different mining operations worldwide.

In terms of supply, has the Covid-19 pandemic affected the worldwide nickel supply, and if so, how?

Martin: Earlier in the year, there was significant disruption to nickel mine supply in the Philippines and temporary shutdowns of certain nickel operations in Canada and Madagascar – at one point, approximately 20% of nickel mine supply was off-line. Even with the restart of most of those operations, BMO recently noted that, taking into account disruptions to both nickel supply and demand owing to the pandemic, it expects nickel demand to exceed nickel mine supply this year. However, BMO also expects that refined nickel supply (including refining of previously stockpiled nickel ore) will exceed demand in 2020.

Brian: Measuring the impact of the Covid-19 pandemic on the metal’s supply fundamentals is fairly straightforward. When it comes to demand, however, the answer is a little more ambiguous.

I will split this next question into 2 parts.

First, in your view, regarding present or near-term nickel demand, has the Covid-19 pandemic affected nickel demand, and if so, how?

Martin: The pandemic has resulted in an approximate 5-10% reduction in most nickel analysts’ 2020 demand projections versus what they had been forecasting before the pandemic – so this removes approximately 100-200 kt of demand from 2020. As the year goes on, and as Chinese demand continues to surprise to the upside, we expect that demand disruption to be closer to 5% than 10%.

Brian: Second, it seems to me that the long-term effect of the pandemic on nickel demand could be much different than the near term.

With many questions still surrounding near-term nickel demand, how do you view the long-term nickel demand thesis; are EVs at the core of a bullish future?

Martin: Yes and no. Stainless steel demand accounts for approximately two-thirds (or approximately 1.5 million tonnes per year) of total nickel demand, so this will continue to drive overall demand growth in the short-term. According to Shanghai Metal Market, stainless steel output is only down 1.7% year-to-date – this is more robust than most analysts predicted in light of the pandemic. Remember that stainless growth has averaged 5% CAGR over the last 5- and 15-year periods and has always surprised to the upside versus analyst expectations. If stainless grows by 5% per year, this adds about 75 kt per year of new demand to the market.

In terms of EVs, they represent about 5% of nickel demand, or approximately 100 kt per year. BMO figures this number will reach about 160 kt by 2023, or an incremental 20 kt or so per year. There will be a massive impact from EV demand on nickel, but it likely won’t reach that “hockey stick” growth phase until 2025 or so.

Brian: The nickel market has attracted a lot of attention over the last few months and, in my opinion, it is directly related to a few comments by Billionaire Tesla Founder, Elon Musk.

Musk made a reference to nickel during one of Tesla’s post-earnings conference calls saying,

“Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way.”

In your opinion, have Musk’s comments had an effect on the nickel market? If so, please explain.

Martin: Yes, they have. Among his many other qualities, Musk might be the best market promoter of all-time, so his call for “green” nickel has raised a huge amount of investor interest in nickel. In order to keep the cost of EV batteries (and therefore of EVs themselves) low, Tesla and other carmakers need a lot of nickel at the lowest possible price – because the price of nickel is a key driver of battery pack cost. His comments also highlight the fact that nickel is, in general, a highly carbon-emitting and polluting industry, so his call for “green” nickel really places a spotlight on the need for responsible practices in this sector – and that’s where we think Canadian projects like ours have a big advantage over nickel production in places like Russia, Indonesia and the Philippine.

For the first time in more than a decade, we are starting to see mainstream, generalist interest in nickel. For investors looking for nickel exposure, the landscape of nickel equities is very small, and generally constrained to smallcap companies like ours with market caps under $200 million. There’s potentially a lot of capital out there waiting to be deployed into a relatively small number of investable nickel companies.

Brian: The updated PEA results on FPX’s Baptiste project were just announced and I think they look great. In fact, better than I had guessed.

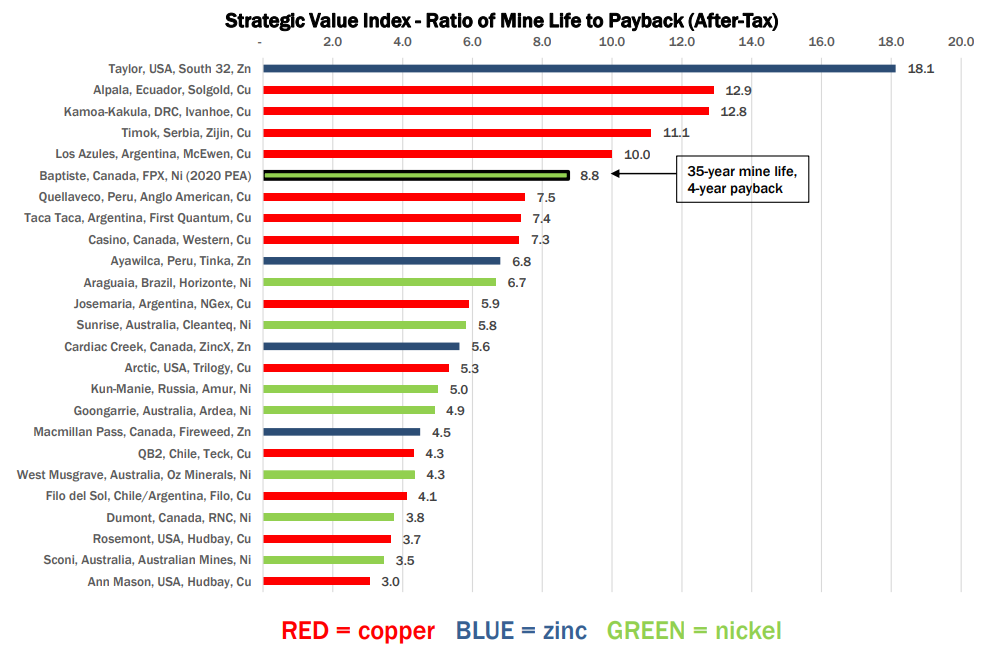

A few of the highlights – An after-tax NPV of US$1.7 billion, 35 year mine life, 1st quartile operating costs of US$2.74/lbs Ni and AISC of US$3.21/lbs Ni.

On the other side of the coin, some investors may be concerned with the upfront CAPEX cost of US$1.6 billion and, coincidently, the low after-tax IRR of 18.5%.

Martin, first, can you review the highlights as you see them from the updated PEA?

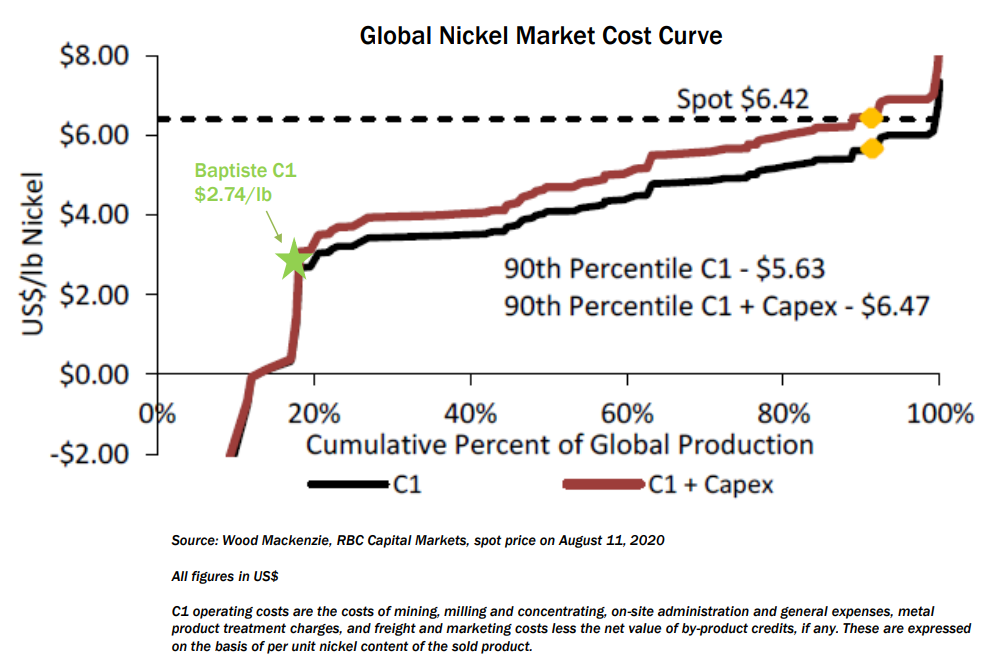

Martin: The PEA really highlights the huge strategic value of Baptiste. First, with annual output of 99 million pounds per annum, this could be one of the 10 largest nickel mines in the world. Second, the very long mine life (35 years) provides exposure to multiple up cycles in the nickel market, which as you know can be a volatile market with big swings between price highs and lows. With C1 operating costs at US$2.74/lb, Baptiste would sit in the bottom quartile of the industry cost curve, and thus provide margin protection even in periods of very low commodity prices. Finally, the fact that our testwork has demonstrated the potential to produce nickel for both the stainless market and the EV market – this really emphasizes the strategic long-term flexibility of the project for decades to come.

Brian: Following that, can you please address the concerns over the upfront CAPEX and IRR? I believe it needs further context.

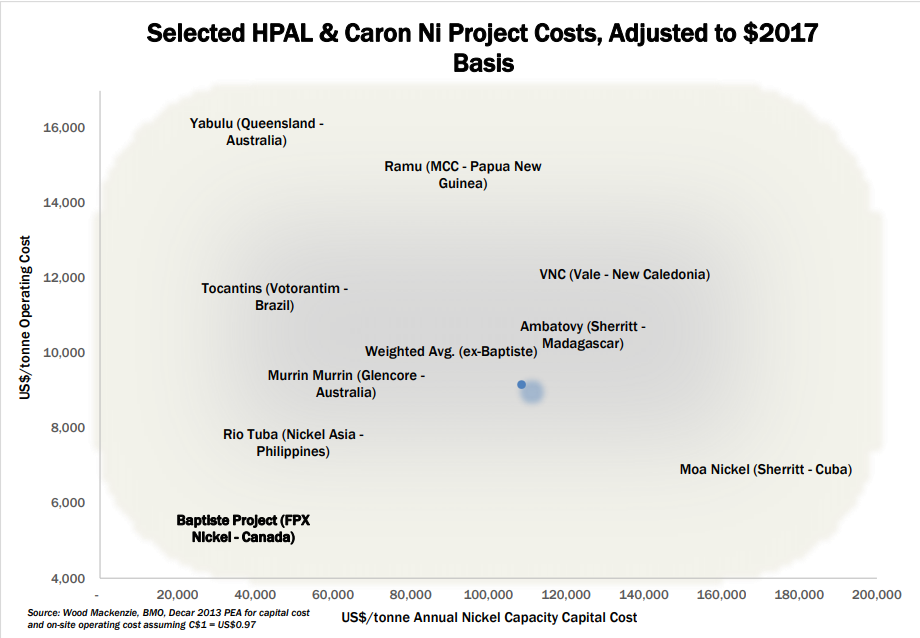

Martin: On CAPEX, building large nickel projects is very much like building large porphyry copper projects – these are inherently capital-intensive industries. During the last cycle of nickel mine construction from 2010 to 2013, major companies like BHP, Glencore and Vale built nickel mines at an average capital cost of US$4 billion. So while the CAPEX for Baptiste is by no means low, it is, actually relatively modest in the comparison to the CAPEX for other large nickel operations – either those build during the last cycle, or those projected for the next cycle.

In terms of IRR, it helps to understand the typical “hurdle rates” that major companies use to guide their mine construction decisions on large projects. An IRR over 10-12%, this is considered a strong rate of return for a large, multi-generational asset – so at over 18%, Baptiste is actually very robust given the scale of the project and duration of the project. Remember that IRR and NPV are discounting metrics – they apply a discount rate to future cash flows, so any free cash flow beyond the first 10 years of operations are heavily discounted and add very little to IRR and NPV calculations.

Brian: It isn’t a stretch to believe that the world is headed toward more stringent environmental controls. Musk’s comments are a great example of how culture shapes the direction of corporate culture.

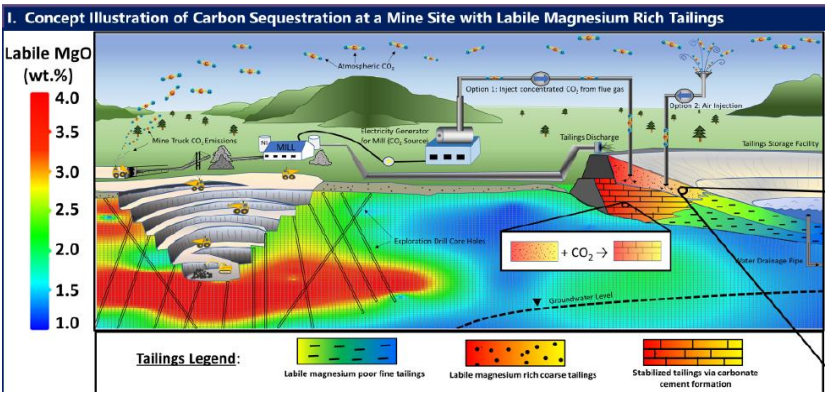

In terms of FPX, UBC and Trent University are currently completing a study on the Baptiste deposit waste rock, which they believe may have the capacity to sequester carbon.

Can you give us an update on the study and explain how carbon sequestering, if possible, could play a large role in a future mining operation?

Martin: A few nickel companies are starting to talk about the potential for developing zero-carbon operations, but we are really taking the lead in terms of testwork and publishing data to support these claims. Our Baptiste deposit is uniquely rich in a mineral called brucite; when brucite is exposed to air in the context of a tailings facility, the mineral will naturally absorb carbon dioxide from air and sequester the CO2 in mineral form forever. The researchers at UBC and Trent University believe that Baptiste has high potential to sequester enough CO2 to completely offset the carbon footprint of the mining operation, making this a carbon neutral operation. We will be publishing test data in the coming months to support the potential for this to become a reality.

When you consider Baptiste’s scale and strong economics, and then factor in its potential to be a low- or zero-carbon project, we believe this could be very important in attracting interest from investors working under an ESG mandate, and also major mining companies, most of whom have committed to making their operations carbon neutral in the coming decades.

Brian: With the updated PEA now behind you, what is the priority for FPX over the next 6 to 12 months?

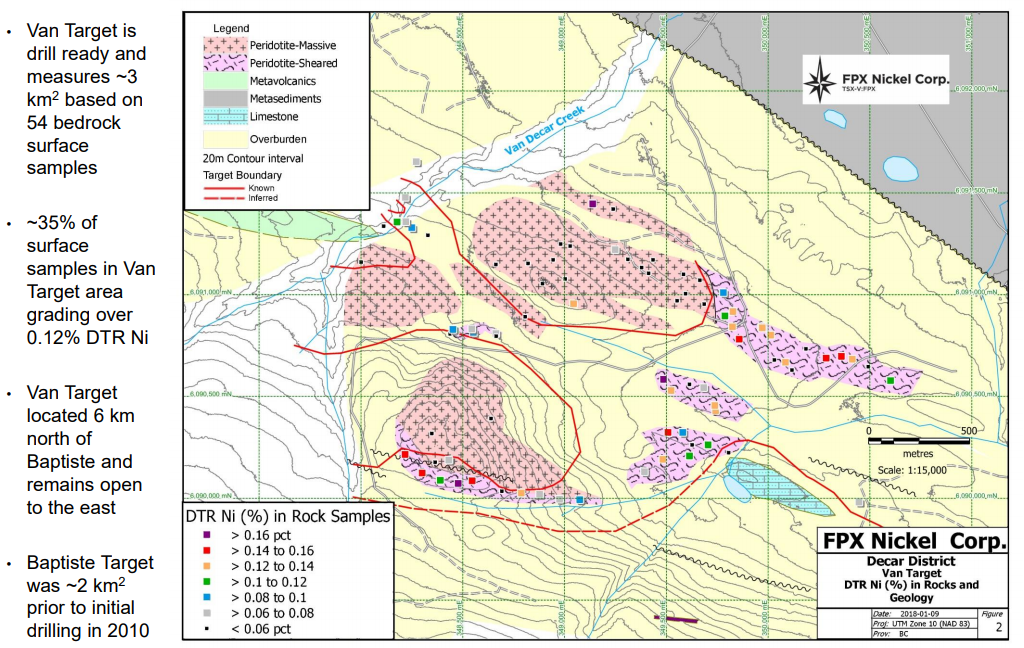

Martin: We have a dual-track strategy. First, we will advance Baptiste into the initial stages of a preliminary feasibility study, with a big focus on metallurgical test work and market testing of nickel products for both the stainless steel and EV battery markets. Second, we would like to undertake a drilling program at the Van target, which sits 6 km north of Baptiste within our 245-square km land package at Decar. Baptiste has a lateral footprint of 2.5 square km of mineralization; at Van, we have already delineated a 3 square km footprint of outcropping bedrock mineralization, with stronger grades at surface than those at Baptiste. The Van target has never been drilled, but we think there’s a strong possibility that it could prove larger and/or higher grade than Baptiste, and that we could delineate a second world-scale nickel orebody to truly make Decar a multi-generational nickel district with the scale and mine life potential that approaches the Sudbury complex. The PEA has already demonstrated that Baptiste is one of the most robust large-scale nickel deposits in the world – we’re really excited to see if Van can be even better than Baptiste in that regard.

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium

A Conversation with Martin Turenne, CEO of FPX Nickel Corp.

Market Update – September 17th

Nickel Market – Is a Boom or Bust Ahead of us?

Volatility in the gold market continues.

I’m not sure when it will end.

With the gold market moving mostly sideways, base metals have been on my mind as of late.

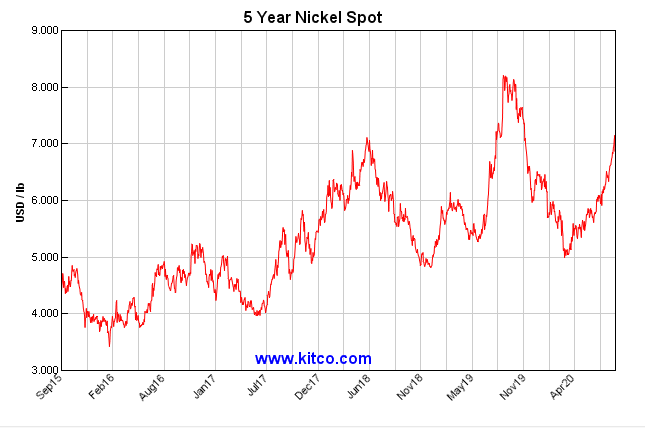

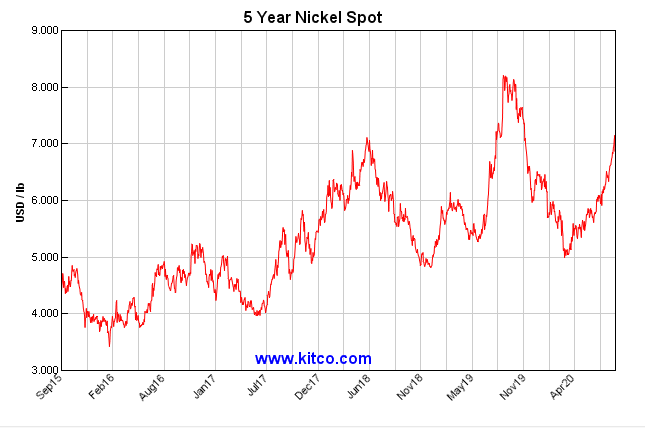

Copper, zinc and nickel are all seeing nice strength in their price.

Will it continue?

That’s a great question.

One of the biggest lessons I have learned over the last few years is that markets are complex and, therefore, impossible to predict with any consistency.

As such, I don’t let my view on the metal price dictate how I invest my money in the junior resource sector.

Remember, junior resource companies are speculations on management’s ability to pick the right projects, form action plans to add value and, of course, raise the money needed to execute on their action plan.

Without successful execution, it doesn’t matter how high the metal price goes, there is a high probability of losing money.

With that said, I do like to understand the metals markets as best I can and form a view of where the market is and where it is going.

Let’s take a closer look at the nickel market.

The Musk Effect

“In the short-term, the market is a voting machine and in the long-term, it’s a weighing machine.†~ Rick Rule

Sentiment or narrative can be a major driver of a market in the short term, however, in the long term, the fundamentals of a company or a metals market need to be solid for gains to be sustained and perpetuated.

The cream always rises to the top.

In my view, the current nickel market is driven more by sentiment than its underlying fundamentals and, therefore, I’m skeptical of whether the nickel price can continue on its trajectory upwards.

Nickel’s bullish sentiment, I believe, has been derived from the comments made by Elon Musk, Billionaire Founder of Tesla, earlier this year.

Musk made a reference to nickel during one of Tesla’s post-earnings conference calls saying,

“Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel. Okay. Wherever you are in the world, please mine more nickel and don’t wait for nickel to go back to some long — some high point that you experienced some five years ago, whatever. Go for efficiency, obviously environmentally friendly nickel mining at high volume. Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way. So hopefully this message goes out to all mining companies. Please get nickel.â€

In my view, these comments set off two narratives;

The first, and arguably the most potent, is Musk’s request for efficient and environmentally sensitive nickel mining.

The second is Musk’s general request for more nickel to be produced.

Environmentally Sensitive Nickel Mining

A big question for me is whether Musk really understands what he is asking for when he says,

“Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way.â€

Efficient and environmentally sensitive mining, I find that very vague.

Does it mean he is making a distinction between nickel sulphide and laterite mining?

Or, does it mean, nickel mining operations that derive their power from renewable sources?

Or, is it nickel mining operations that are carbon neutral?

If this narrative is driving the market, more questions need to be asked.

Class #1 Nickel – Sulphide Versus Laterite

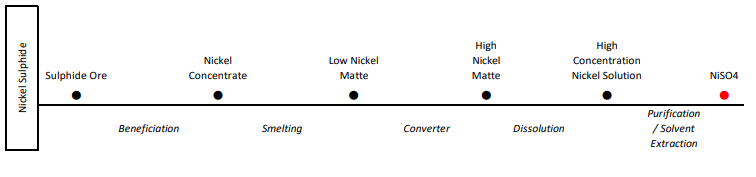

For those who don’t know, nickel sulphide mines produce nickel concentrates that are sold to smelters, which then convert the concentrate into the chemical nickel sulphate which is used by battery manufacturers.

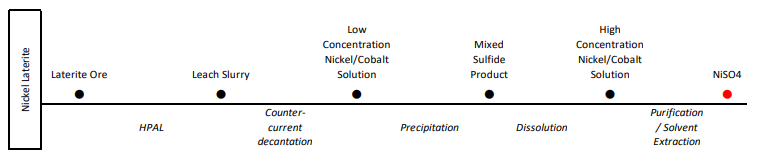

In the case of nickel laterite mines, the ore is mined and then processed through a high pressure acid leach (HPAL) circuit, which is then further processed to produce nickel sulphate.

To add, the HPAL process is more complex, requiring more steps to get to the end product and, generally speaking, has a higher carbon foot print due to emissions from the process.

It, therefore, could be the distinction that Musk is trying to make with his comments.

It’s hard to tell.

Renewable Energy Source

No matter how you slice it, most of the energy generated worldwide is still derived from fossil fuels.

Therefore, even if the mining operation is fully electrical, to be deemed environmentally sensitive, you must determine how the electricity was produced.

Was it via nuclear power or renewables?

In fact, you really have to go a step further and realize that the dams for the hydro power, the construction and materials used in nuclear power plants, the solar panels and the wind turbines were all made with metals and/or concrete, which were mined and by equipment that was most likely fueled by fossil fuels.

My point?

Stating a nickel mine has to produce its nickel in an environmentally sensitive way needs to be further defined before it’s a realistic narrative driving the nickel market.

With this said, at the moment, I’m only aware of one junior nickel company that can actually say that it has the potential to be carbon neutral.

That company is FPX Nickel Corp. (FPX:TSXV).

This isn’t meant to be an advertisement for FPX, but the reality is, it’s the only junior nickel company that I can see could even come close to fitting Musk’s criteria.

Remember from my update on FPX earlier this year, I mentioned that UBC and Trent University were collaborating on a research program which is investigating carbon capture and storage at mining sites.

FPX’s Decar Nickel District is at the centre of this research as the study looks to maximize the reaction between carbon dioxide and magnesium silicate mine tailings.

The Decar mine waste is high in Brucite, which makes it a prime candidate for carbon sequestration.

It’s, therefore, possible that a future mine at Decar could be carbon neutral.

Class #1 Nickel

On to the 2nd narrative – Class #1 nickel supply.

I’m bullish on nickel; my bullishness is supported by the overall fundamentals of the market and the potential for the increase in Class #1 nickel demand.

For those who don’t know, 2/3s of nickel demand is from stainless steel.

Therefore, undoubtedly, if you’re bullish on nickel, you’re bullish on stainless steel.

While stainless steel represents the backbone of the nickel market, however, it’s battery demand that holds the potential to really disrupt the nickel market in the future.

Currently, battery manufacturers make up less than 5% of the global 2 Mt nickel market.

Roughly half of the 2Mt market is derived from Class #1 nickel and this is where it gets really interesting.

In 2018, Glencore commissioned CRU to model the metal requirements of a 30% adoption rate of EVs in the global vehicle market.

The results revealed the following:

As you can see, a 30% adoption rate would result in roughly 1.1 Mt of Class #1 nickel demand.

This is interesting because, as I mentioned, the current Class #1 nickel demand worldwide is roughly 1 Mt.

Given the long duration and expense of exploration and development, which is at least 10 years from discovery to construction, it begs the question, where will the nickel come from?

This is a great question and really speaks to the amount of disruption that could occur.

The next most obvious question, therefore, is what are the odds of the EV adoption rate hitting 30% within the next 10 years?

For me, it will be determined by the following points:

- In the short term, what is the affect of a 2nd wave of Covid-19 in the last QTR of 2020?

There are a lot of unanswered questions regarding the last quarter of the year, especially when it comes to a 2nd wave of Covid-19. Further lockdowns would be devastating to the economy.

- What is the health of the global economy?

High unemployment and a stagnant economy could stall adoption of EVs for as long as the recession or depression lasts.

- Will governments around the world give further incentives to purchase EVs?

Especially in the case of poor global economics, I believe governments will have to continue, if not increase, subsidies for EV adoption. For example, we have seen in China, when the subsidy is removed, people stop buying them.

- EV infrastructure spending

Large scale EV adoption will require more EV infrastructure to be built, at home, at work and in the public realm – malls, restaurants, highways, etc.

If left to the free market, I would say we are still a ways away from adopting EVs into our everyday life.

But we don’t live in a free market.

Governments around the world are becoming larger and larger parts of the economy and, therefore, destroy any of the logic or economic factors that usually control markets.

I can’t say with any certainty what will or won’t happen, but what I can say is that if the government decides that the push is toward renewable energy and EV adoption, that is where the money will flow.

For instance, it’s rumoured that the Canadian government will soon unveil their version of “The Green New Deal.â€

If true, I would guess that it’s very likely we would see some incentive for EV adoption.

The Canadian market is small and, therefore, I don’t foresee it actually making a discernible difference to the EV market on a whole, but if this is indicative of a broader trend, things might actually fall in place.

Future Role of Nickel Laterites

As I outlined earlier, nickel laterites can be processed into Class #1 nickel with the help of the HPAL process.

Back in 2018, Tsinghan, a Chinese company, made the headlines within the nickel space as they toted the ability to construct a 50,000 tonne per year HPAL plant in Indonesia in just over a year, for $700ishM.

Tsinghan has a great reputation in the market for the pioneering of the NPI processing, which revolutionized the nickel market in the early 2000s.

This proclamation was, therefore, taken literally.

The nickel price sunk, as the market determined that the affect of an increase in demand to Class #1 market over time would be quelled if Tsinghan had this ability to construct a HPAL plant of this size, on the tight construction schedule and for under a billion dollars.

In the 2 years since, Tsinghan has experienced many of the historical delays associated with building a HPAL plant.

They have delayed construction and added upfront capital expenditures to continue to move forward with development.

With that said, in my view, I do believe that Tsinghan will be successful in constructing the plant.

Also, I think that as long as the Class #1 nickel market doesn’t require a certain environmental standard in the future, HPAL processing of nickel laterites will help quell some of the disruption caused by the potential surge in Class #1 nickel demand, albeit at a nickel price higher than US$10/lbs.

Nickel Market Fundamentals

Supply and demand fundamentals must be solid for any market to be strong over the long-term.

As I said, in my view, the current uptick in the nickel price is mainly driven by sentiment rather than underlying supply and demand fundamentals.

With that said, I think that there are many points to be bullish about.

Nickel Inventory

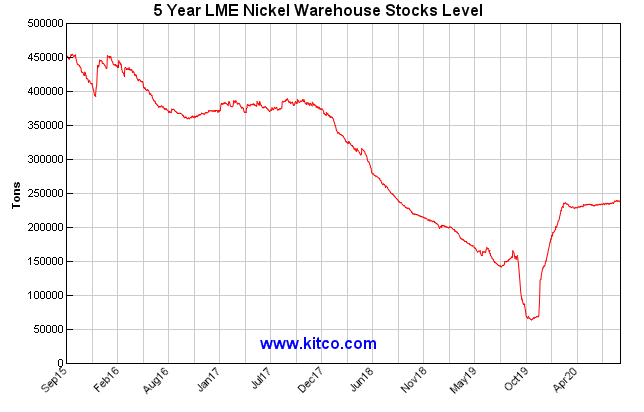

Over the last 5 years, the LME nickel inventories have been trending in the right direction.

As you can see from the graph, the inventory levels have steadily fallen since 2017, with a dramatic draw down in 2019.

The dramatic draw, however, was met with almost as dramatic a spike in the 10 months since, and now sits above the 200kt level.

The LME warehouses an inventory of Class #1 and is a key factor in gauging the health of the nickel market.

If we were to begin to see inventories drawn down once again, it would be very bullish for the nickel price, with the proviso that the reason for its depletion could be linked to a sustained source of demand or a permanent loss of supply.

As it stands right now, in a post pandemic world, nickel market analysts are calling for a surplus of supply to end 2020.

This is in sharp contrast to the pre-pandemic nickel market, where analysts were calling for a supply deficit.

NorNickel Corp Presentation – May 2020

Nickel Sulphide Supply

What I find most interesting about nickel sulphides is that not only are their production figures predicted to curtail over the coming years, but the amount of projects awaiting development is low.

Why is this?

In my mind, there are 2 reasons:

- First, a bear market in the nickel price, which pre-dates 2016, has stunted exploration.

- Second is the fact that exploring for these deep deposits is very costly. Drilling for a deposit at depths greater than 500m adds up quickly. Plus, if you add in the costs associated with tough terrain and weather, you have the perfect storm for short and costly drill seasons.

NOTE: A high percentage of nickel sulphide exploration is concentrated in cold climates – Russia, Finland, Greenland and Canada. Why? Most of the discoverable nickel sulphide deposits found around the equator or in hotter and wetter climates have mostly been converted, by nature, into nickel laterite deposits. Thus, nickel laterite deposits account for up to 70% of the known crustal nickel deposits on the earth.

Constrained nickel sulphide supply has the potential to be very bullish for the nickel price moving forward, however, it will have to be mixed with strong demand to be fully realized.

Nickel Demand

In my view, nickel demand is the key to understanding where the nickel price is headed in the future.

As I outlined earlier in the article, increased demand for Class #1 nickel from battery manufacturers and/or speciality steel makers has the potential to dramatically disrupt the nickel market.

Demand in the range of 500kt to 1Mt of Class #1 nickel per year by 2030 would very quickly reveal the short fall in supply from the nickel sulphide producers, and require much higher nickel prices to allow HPAL processing to economically participate in actively supplying the market.

Concluding Remarks

Generally speaking, I’m very bullish on the long-term potential for higher nickel prices.

With that said, I remain skeptical of the short-term longevity of the current run in the nickel price.

The global economy remains in disarray and, although governments have pledged unlimited amounts of QE to stimulate inflation, I’m still left with many questions about the remaining 3.5 months in 2020.

How will the U.S. election result affect both the U.S. and world economy?

Does a Trump re-election mean the broader stock market can continue upward?

Does a Biden win result in more socialist government policy? If so, what is the fall-out for the American economy?

Will there be a 2nd wave of Covid-19? If so, will governments revert back to complete lockdowns of their economies?

Is the U.S. headed to war with China? The world’s two largest economies remain at odds, with potential conflicts on a range of topics such as, the South China Sea, Covid-19, and human rights violations.

In my view, the next 3.5 months should provide us with a few of the answers to these questions, which will allow us to see more clearly into where things are headed in 2021.

In the end, the fact remains that markets are impossible to predict with any consistency.

Instead, I believe it’s pertinent to remain focused on the reasons why we are speculating in the junior companies.

Understand why a company is undervalued and how they will unlock that value through the execution of their action plans.

Time will tell where we are headed.

Get the e-book Junior Resource Sector Investing Success: The Risks, Rules & Strategies You Need to Know today, when you become a FREE Junior Stock Review VIP

Use the Coupon Code DILIGENT to get 25% off a subscription to and get my best investment ideas and commentary first.

Until next time,

Brian Leni P.Eng

Founder and Editor – Junior Stock Review Premium