Anaconda Mining – An Undervalued Gold Producer on Canada’s East Coast

With turmoil ramping up around the world in recent weeks, from Hurricane Harvey wreaking havoc in Texas to the mounting discord between North Korea and the United States over missile testing, and a weakening U.S. dollar, the price of gold pushed up over $1300/oz USD.

A rising gold price and the end of the summer doldrums could spell the beginning of the next leg up in the gold bull market. For those looking to profit in this next wave, today I have a gold producing company which is set to be re-rated in the coming months.

This company is Anaconda Mining, a gold producer with its flagship property, The Point Rousse Project, on the Baie Verte Peninsula in Newfoundland & Labrador. Looking out to 2020, the company’s short term goal is to significantly increase their gold production up to 50,000 ounces per year. Through further project acquisitions in Atlantic Canada which have NI 43-101 resources, and the development of Anaconda’s existing projects, they hope to leverage their team’s mine building experience and existing Point Rousse Project infrastructure, Pine Cove Mill, port and in-pit tailings facility, to push them towards their long term goal of becoming a 100,000 ounce per year producer.

Here is an executive summary of my conclusions on Anaconda, which will be followed by my in-depth analysis of the company.

- Led by CEO, Dustin Angelo, Anaconda has a great team of professionals who are looking to take the company to the next level. The Goldboro Project acquisition and further acquisitions in the future will cement Anaconda’s reputation as a premier gold producing company.

- Anaconda Mining’s assets are located in Canada, more specifically, the provinces of Newfoundland & Labrador and Nova Scotia. These are premier destinations for mining as they present a stable political landscape and world-class geology.

- Anaconda achieved gold sales totalling 15,562 ounces in the fiscal year ended on May 31, 2017. The gold was produced from the cash flowing Point Rousse Project, which includes the Pine Cove Mill and Mine.

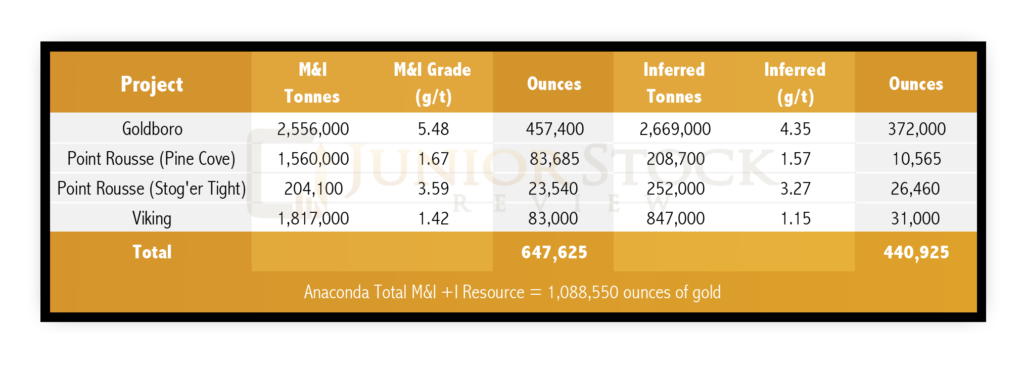

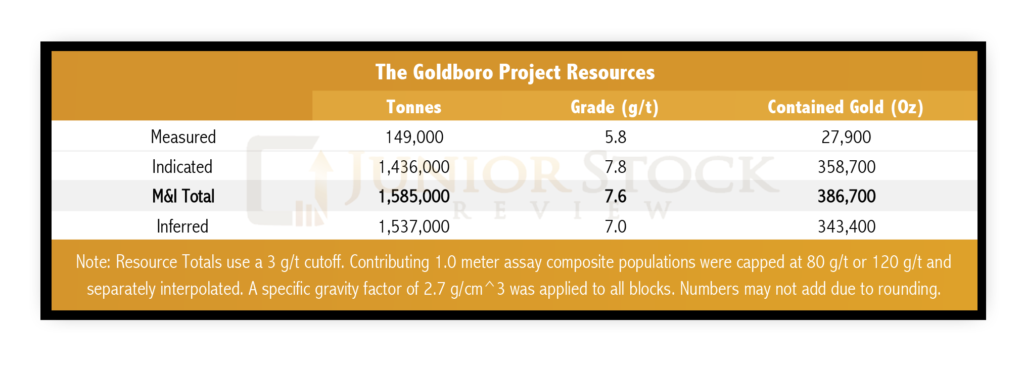

- Existing 43-101 Measured & Indicated + Inferred Resource Total of 1.1million ounces of gold

- Anaconda Mining’s EV/Oz is well below similar gold companies developing properties on Canada’s east coast.

- PUSH: Anaconda will be drilling Goldboro this fall, with the intent of both expanding the resource and shoring up the existing deposit. Watch for these drill results.

- PUSH: A PEA on the Goldboro Project will be completed by the end of this year, giving us a clear picture on the project’s potential profitability.

Anaconda Mining (ANX:TSX)

MCAP – roughly $28.6 million CAD (at the time of writing)

Cash – As reported in Anaconda’s news release dated August 2017, reflecting fiscal year end on May 31, 2017 – $2.5 million CAD

Shares – 382.0 million – NOTE: On May 8, 2017 Shareholders voted to give management the right to consolidate shares – 0.25 to 1. The Board of Directors has discretion to implement a consolidation within 12 months.

Stock Options – 33.0 million

Warrants – 34.0 million

Fully Diluted – 449.0 million

Officers & Directors’ Ownership – 7.8%

Anaconda’s People

Since taking the helm of Anaconda Mining in 2010, CEO, Dustin Angelo, has eliminated the company’s interest bearing debt and funnelled cash flow towards the development of its Point Rousse Project and further expansion of their land package, increasing it ten-fold over the last 6 years. The Goldboro Project, Anaconda’s most recent acquisition under Angelo, is the most aggressive to date, adding much needed gold resource ounces to Anaconda’s books.

Previously, Angelo held senior level management positions with Waller Capital Corporation, MHI Energy Partners and Elgin Mining Incorporated. These positions have given him a great base of knowledge and experience to draw on, as he leads Anaconda Mining into a major stage of growth, during what looks to be one of the biggest gold bull markets in history.

Also to note, Angelo is an accountant by trade, earning a BSBA in accounting and international business from Georgetown University and a MBA from the Columbia Business School.

Speaking from experience and a little bit bias, operations are the heart of any mining or manufacturing company. Let’s take a look at who is leading operations for Anaconda.

At the top of operations is COO, Gordana Slepcev. Slepcev, prior to her promotion, was VP of Technical Services, managing the mining and geology departments at the Point Rousse Project. Now in her new position, she is responsible for all operational aspects of the company, including permitting, mine development, strategic planning, project evaluation, and also delivering long/short-term planning and geological support to mining operations. Slepcev is a professional mining engineer and has prior working experience with Labrador Iron Mines Holdings, Agrium Inc., and Western Coal Corporation.

Next is Anthony Chislett, Operations Manager for the Point Rousse Project, managing all aspects of the milling and mining operations. The Pin Cove Mill will be counted on in the future to process ore from Anaconda’s other projects and still maintain a high level of efficiency in its recoveries. Chislett and those who operate the mill will be strong contributors in the near future as they get set to incorporate Goldboro’s ore. Chislett has a Certificate in Civil Engineering Technology and over 26 years of work experience over his career.

Additionally, Robert Dufour is the CFO, Allan Cramm is VP of Innovation & Development, Paul McNeill is VP of Exploration, and Lynn Hammond is VP of Public Relations.

Anaconda’s Board of Directors

Anaconda’s Board of Directors has a great balance of experience, with members who have strong resumes in both the geological and financial sides of the mining industry. Here is a quick look at the board members:

John Fitzgerald is the Chairman of the Anaconda Mining Board of Directors and former Chairman and CEO of Orex Explorations. Fitzgerald’s expertise in finance comes from 25 years in the investment banking industry. Also, he has been a member of or advised a number of different companies including Boston Poly Corporation, Epcylon Technologies, DayStar Technologies, Hesat Acquisition Corp., iSense Corporation and Trustwater PLC.

Michael Byron is a board member and also the CEO of Nighthawk Gold, a gold exploration company, exploring the Indin Lake Greenstone Belt in the Northwest Territories. Byron, a geoscientist, has been in the mining industry for over 30 years and brings with him plenty of geological technical expertise to the Anaconda Board.

Additionally, on the geological technical side, is Kevin Bullock, a registered Professional Mining Engineer with over 25 years of experience in the mining industry. Currently, Bullock is the CEO of Golden Reign Resources and has held senior positions at a number of other junior mining companies, including being a Director at B2Gold.

On the financial side of the Board are Maruf Raza, Jacques Levesque, and last but not least, Anaconda’s CEO, Dustin Angelo.

Newfoundland & Labrador and Nova Scotia

The bulk of Anaconda Mining’s assets, Point Rousse Project, Viking Project, Great Northern Project and Tilt Cove Property, are located on the island of Newfoundland in the province of Newfoundland & Labrador. The Goldboro Project, their most recent acquisition from Orex Exploration, is located in Nova Scotia.

Both Newfoundland & Labrador and Nova Scotia are provinces located on Canada’s east coast. Both provinces have a long history of mining but have recently seen a staking rush, particularly on the island of Newfoundland.

Newfoundland & Labrador

I recently wrote an article about Newfoundland & Labrador and why I think it is a premier destination for our mining investment dollars; for the full article follow this link. Otherwise, here is a list of my summarized thoughts regarding Newfoundland & Labrador:

- Newfoundland & Labrador’s geology has long been associated with base metals such as iron ore and nickel, however, I think this is quickly changing as a number of precious metals companies look to explore and develop some highly prospective properties. Compared to the rest of Canada, NL is under explored, especially for precious metals, such as gold.

- Newfoundland & Labrador encourages mineral exploration within its borders with the Junior Exploration Assistance Program (JEA). While the available funds in the program are small, it is a step in the right direction towards encouraging mining investment in Newfoundland & Labrador.

- Newfoundland & Labrador has a workforce which is accustomed to heavy industry. With low oil prices hurting the oil fields of Alberta, many native Newfoundlanders are finding their way back to the island and, with them, comes multiple years of heavy industrial experience. As properties develop, there is both a workforce to fill the needed positions and the infrastructure to produce and export their goods.

- The people of Newfoundland & Labrador have consistently voted for Conservative and Liberal governments since joining Canada in 1949. I expect this tradition to continue, which presents a stable political landscape for mining companies looking to explore and develop properties within its borders.

- From an investment standpoint, First Nations’ involvement in the mining sector can cause trepidation for the investor. In Newfoundland’s case, this isn’t an issue, as the First Nations do not control any large blocks of land that are prospective for mineralization. NOTE, it is a different story for Labrador.

Nova Scotia

- Since 2013, Nova Scotia has been led by Premier Stephen McNeil, a member of the Canadian Liberal Party. Historically, dating back to Confederation, the people of Nova Scotia have voted either Conservative or Liberal, however, it should be noted that they did vote NDP in 2009, by electing Darrell Dexter who is a member of the NDP Party. For those unaware, the NDP Party is typically cast as being bad for business, and given their history, this isn’t without cause. However, even though the past is typically prologue, we need to examine the policies of each incoming government no matter what their party affiliation, as they are all capable of introducing policy which is detrimental to mining. One thing to keep in mind, Nova Scotia’s unemployment rate is almost 9%, a government which would hinder job creation in the province’s current state wouldn’t last long.

- In total, there are 16,245 registered Indians in Nova Scotia. The Indian population is represented by 13 band councils and 2 tribal councils, the Confederacy of Mainland Mi’kmaq and the Union of Nova Scotia Indians. The Mi’kmaq are the predominant Aboriginal group in Nova Scotia, with 13 communities across the province.

- Nova Scotia has a long history of mining dating back 300 years. Gold, in particular, has played a big role in the Nova Scotia economy, with 3 separate gold rushes having produced over 1 million ounces gold since the 1860s.

- Geologically, Nova Scotia is broken up into two main geological terranes. The Avalone Zone, which forms the northern half of the province, and the Meguma Zone which forms the southern half. The two zones are separated by the Cobequid-Chedabucto Fault Zone, which runs east to west. This fault zone represents where the two zones collided over 400 million years ago. The geology specific to Anaconda’s Goldboro can be found later on in this article.

Anaconda’s Properties

Source: Anaconda Mining Corporate Presentation – August 2017

The Point Rousse Project

The Point Rousse Project is Anaconda’s Flagship 6,300 hectare property and is located on the Baie Verte Peninsula which is on the north west coast of the island of Newfoundland in the province of Newfoundland & Labrador.

Source: Anaconda Mining – Appendix Slide 1

The Point Rousse Project consists of the Pine Cove Mill and Mine, the Argyle Zone, the Stog’er Tight Deposit and Aggregates Project, all are located within 8 km of each other. The Project is underlain by Cambro-Ordocivian ophiolitic and cover-sequence rocks of the Point Rousse Complex, which is part of the Baie Verte Tract.

The Point Rousse Complex is host to both orogenic-style gold and volcanogenic sulphide mineralization. There are three identified mineralized trends within the Project: the Scrape Trend, the Goldenville Trend, and the Deer Cove Trend.

Pine Cove Mill and Mine

The Pine Cove Mill and Mine began producing in 2008, with commercial production achieved in September 2010. To date, Pine Cove has produced 76,379.34 ounces of gold. In a news release dated August 25, 2017 Anaconda announced it fiscal year ending production figures which were highlighted by:

- Pine Cove Mill increased throughput by 8% to 1,223 tonnes per day when compared to the 2016 fiscal year.

- Operating cash cost per ounce sold was $1,126 CAD or USD $$856/oz and an all-in sustaining cost (AISC) per ounce of $1,735 CAD. NOTE: Remember that AISC includes: CAPEX, Corp Admin and exploration expenses.

- Additionally, the Pine Cove pit, generated $0.9 million CAD from the sale of waste rock. Anaconda is working with Shore Line Aggregates and Phoenix Bulk Carriers to supply 3.5 million tonnes of construction aggregate using Anaconda’s waste rock from the Pine Cove Mine and Mill operation. The waste rock is transported via Anaconda’s Point Rousse Port Facility.

The Pine Cove Mine is an open pit design, which is designed to be 350 m wide by a maximum depth of 150 m by the end of mine life. The pit’s main access ramps are designed at a 10% gradient and are 15 m wide, facilitating two-way truck traffic. The pit rock is drilled and blasted and then loaded into haul trucks by excavators, which transport the ore to the crusher ROM Pad.

The future of Anaconda lays in the hands of the Pine Cove Mill, which operates as a grind/flotation circuit followed by leaching. The Mill will be counted on in future to process the ore generated by Goldboro and Anaconda’s other deposit on the island of Newfoundland.

Here is an excerpt from the 2015 Point Rousse Technical Report,

“The concentrator has a flotation circuit which produces a gold-pyrite concentrate that advances to the leach circuit. Comminution is via a two-stage crushing plant followed by a 10 ft by 14 ft primary ball mill. Cyclone overflow feeds the flotation circuit, with four unit cells for roughing and one cleaner cell. Mass recovery is typically 2-4 percent. Flotation concentrate is thickened in a 4.5 m diameter thickener and reground in a 5.5 ft diameter ball mill. Leaching is conducted in a series of four 70 cubic metre mechanically agitated leach tanks. Two drum filters and a Merrill-Crowe circuit are used for gold recovery from the pregnant solution. Cyanide destruction of leach tailings is achieved through the Inco SO2 process. The mill currently achieves 86-88 percent recovery.” ~ 2015 Point Rousse Technical Report – pg. 21

Anaconda has two tailings facilities and a polishing pond. The Tailings 1 storage facility had its final expansion in 2014, increasing its elevation up to 103 (msl). Additionally, in the last fiscal year, the Tailings 2 storage facility and new polishing pond were constructed on the property.

Stog’er Tight Deposit

The Stog’er Tight Deposit was originally discovered by Noranda Exploration Company in the late 1980s. Anaconda optioned the property from 1512513 Alberta Ltd. in 2012, with the intent of securing future supply for the Pine Cove Mill.

Anaconda has since worked on evaluating the deposit’s potential, by the verifying of historic drill data with the completion of nine twinned diamond-drill holes. Anaconda’s work indicates that other similar prospects lay adjacent to the Stog’er Tight Deposit and may represent an expansion of resource for the area.

Currently, the Stog’er Tight Deposit is estimated to contain Indicated Mineral Resources of 204,100 tonnes grading 3.59 g/t gold for a total of 23,540 ounces and an Inferred Resource of 252,100 tonnes gtrading 3.27 g/t gold for a total of 26,460 ounces, both using a cut-off grade of 0.8 g/t gold.

As mentioned in the August 25, 2017 news release, CEO, Dustin Angelo, states,

“Looking ahead to 2018, the Company is projecting to produce and sell approximately 15,500 ounces of gold. Production in the first three quarters will be from the Pine Cove Pit, and will transition to the Stog’er Tight pit early in the 2018 calendar year.”

Argyle Zone

The Argyle Zone is a highly prospective zone located immediately northwest of the community of Ming’s Bight. The Argyle Zone has seen a reconnaissance soil survey in 2012, with a total of 364 samples collected at 25m intervals. These samples returned some impressive assay values, highlighted by 112 samples assayed 25 ppb gold or greater to a maximum of 4.88 g/t and several pieces of mineralized float returned assay values of up to 9 g/t gold.

The property has since seen additional exploration work including an airborne magnetic survey, trenching and drilling. The trenching revealed strongly-altered, quartz-veined and pyritized gabbro. Highlights of the trenching include 3.75 g/t gold over 16 m and 1.49 g/t gold over 3.5 m. While a total of 5,000m of drilling has been completed on the zone, which is highlighted by 3.63 g/t gold over 12m, 5.52 g/t gold over 12m, and 9.31 g/t gold over 6m.

Argyle remains a highly prospective Zone within a stone’s throw of the Pine Cove Mill; it will need additional exploration to fully understand its potential.

The Goldboro Project

Anaconda’s Goldboro Project is located on the north east coast of Nova Scotia and consists of 37 mineral claims on 600 hectares. The main portion of the Goldboro property is accessible year- round via Highway 316 on a 2.5 km gravel road, with the other more obscure parts of the property having access via logging roads.

Highway 316 connects Goldboro to the nearest full service town of Antigonish, which sits approximately 75km to the north west. The capital of Nova Scotia and home to the province’s international airport, is Halifax, which sits 250 km to the south west.

Arguably the most important available access to the property comes from Isaac’s Harbour, a tide water port which is key for Anaconda’s plan to transport Goldboro’s ore back to their existing Pine Cove Mill in Baie Verte, Newfoundland & Labrador. Also, to note, a larger deep water port is located 60 km north east, in the Strait of Canso Superport.

Goldboro Infrastructure

The property has access to power and has existing buildings, a tailings pond, a settling pond and some advantageous underground workings.

Goldboro’s existing underground infrastructure includes a vertical shaft from surface down to the old 400 ft level and an inclined shaft from the bottom of the vertical shaft, running down plunge of the anticline fold axis of the main Boston-Richardson Belt down to the old 700 ft level. Also, there are several drifts which could possibly be used for future exploration, along with some minor workings in the East and West Goldbrook zones.

Goldboro’s History

The Goldboro property has a long history, dating back to 1862 when mineralization was first found, and then 1893 when mining began. In the 17 years that it was mined, it produced roughly 55,000 ounces of gold at an average grade of 4.5 g/t.

Modern exploration began on the property with Patino Mines Ltd in 1981. Further work was completed on the overlying claims by Onitap, who completed diamond drilling, airborne VLF-EM and magnetic surveys and ground based IP surveys.

In 1988, Orex Exploration purchased the property from Onitap. Over the course of the next 26 years, Orex developed the property with further drilling and the refurbishment of its existing underground infrastructure, but also optioned the property to Placer Dome.

In 1995, Placer Dome optioned Goldboro with the objective of determining whether the property could be mined as an open pit operation. To determine this, they would focus on exploring for low-grade gold mineralization in the Boston-Richardson arenite or hanging wall sequence in the range of 0.5 g/t to 1.0 g/t.

Placer Dome was unsuccessful in their pursuit as they let their option on the property expire. They are quoted as saying,

” the property did not meet corporate requirements with respect to large open pit mining opportunities” ~ 2014 Goldboro PEA – pg.63

In 2010, Orex and Osisko formed a joint venture partnership for the exploration of Goldboro. Together, they drilled 59 NQ-sized drill holes with a combined length of close to 13,000m. The data from the drill program provided in-fill data to the property drillhole database.

Goldboro Gold Mineralization

Goldboro is entirely underlain by sedimentary rocks of the Goldenville Group, which are made up of greywacke, arenite and slate. Gold mineralization is found in quartz veins and within disseminated sulphides in the wall rock.

From the 2014 Goldboro PEA,

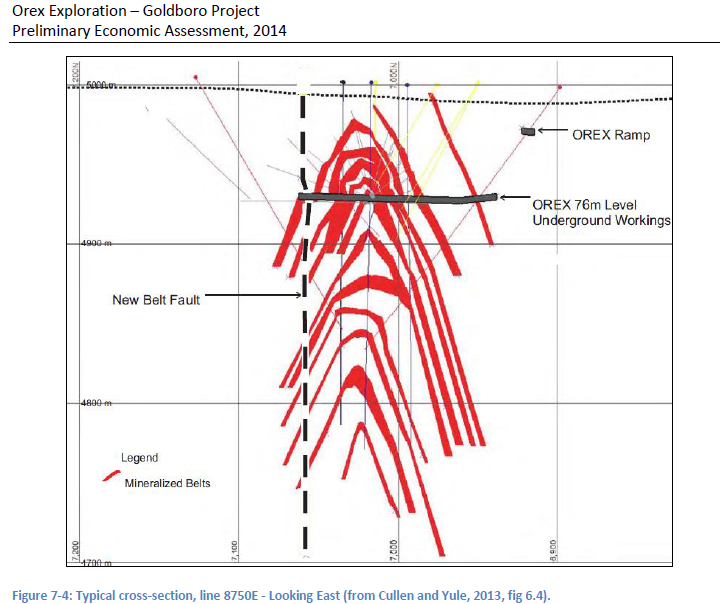

” Gold mineralization at Goldboro occurs in quartz veins and wall rocks adjacent to the veins. At the deposit scale, the veins form a swarm and are clearly located in the flexure zone (hinge and adjacent limbs) of the Upper Seal Harbour anticline. The gold-bearing veins are found in a 140- to 160-m wide envelope centred on the axial surface. The veins occur mostly on the limbs of the fold, but also in the hinge, and all are hosted by turbiditic metasedimentary rocks consisting of metagreywacke, arenite and slate.” ~2014 Goldboro PEA – pg.51

Source: 2014 Goldboro PEA – pg.48

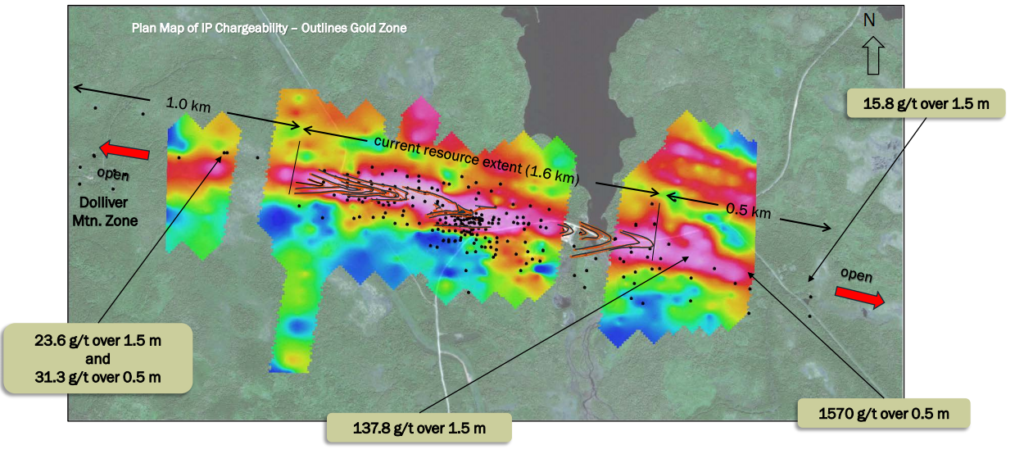

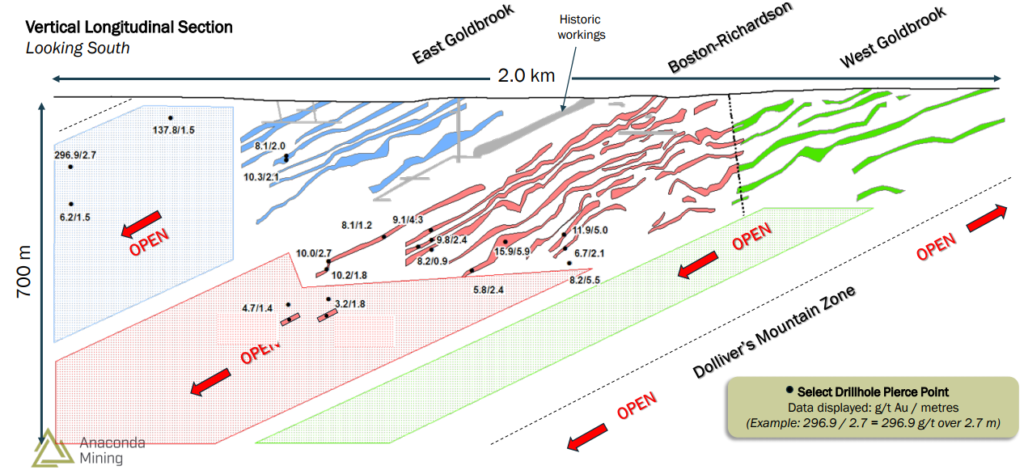

Goldboro’s deposit is broken down into three main areas, the Boston-Richardson gold system and the East and West Goldbrook gold systems. Currently, the deposit’s known strike length is 1.6 km and is associated with a geophysical anomaly. This anomaly extends east and west beyond the current known strike length of the deposit.

Source: Anaconda Mining – Slide 14

The IP anomaly and the fact that historical drill results from those prospective areas east and west of the known strike length, led Anaconda geologists to believe that there is potential to expand the Goldboro Deposit east and west along strike.

Source: Anaconda Mining – Slide 13

PUSH: Anaconda plans to drill Goldboro this fall, with the intent of both expanding the resource and shoring up the existing deposit.

Source: 2014 Goldboro PEA – pg.13

Boston-Richardson Gold System

As described earlier in the article, the Boston-Richardson (BR) gold system was the first mineralization discovered and mined on the property, along with being the host of the existing underground infrastructure.

The BR Belt is host to 15 tightly-stacked, high-grade, gold bearing vein zones. The zones are characterized by thick gold bearing quartz veins and thin veins arrays within the highly altered argillite, separated from the neighbouring vein zones by un-mineralized greywacke.

The BR Belt has been modelled to a depth of 350 metres and plunges eastward beneath East Goldbrook. Anaconda believes that the deposit continues at depth, as some historical drill results have retuned results with high grade and widths at depth in the eastern portion of the deposit.

East Goldbrook Gold System

East Goldbrook is host to 7 stacked vein zones, but has not seen the amount of drilling that the BR gold system has and, therefore, is home to the majority of the deposit’s inferred resource. Drill holes are broadly spaced at intervals of roughly 100 metres. Like the BR system, Anaconda believes that given historical drill results, a portion of the veins in East Goldbrook, extend farther west, beyond what is currently modelled.

The Nugget Effect

Interestingly, the Goldboro gold mineralization is subject to what they call the Nugget Effect, where the gold is present in large nuggets, fine disseminations within the wall rock and fine gold grains associated with carbonaceous material.

The nugget effect can both inflate and deflate the sampling results. However, a lot of work on Goldboro has focused on better understanding this effect, including undergoing multiple instances of twinning drill holes in an attempt to validate results, drilling samples with a larger HQ-sized diamond drill core, plus the use of field duplicates, certified reference standards and field blanks were used during their 2008 program.

A.S. Horvath Consulting remarks,

“At Goldboro, historic conventional sampling, processing and analytical gold determination protocols consistently under-estimate the grade due to the extreme nugget effect.” ~ 2014 Goldboro PEA – pg.83

Anaconda’s Plans for Goldboro

Anaconda has a tremendous advantage when it comes to developing the Goldboro Project, as they’re the owner and operator of the Pine Cove Mill. Theoretically, the ore mined at Goldboro can be shipped via the tide water port, in Isaac’s Harbour, to Anaconda’s Pine Cove Mill on the Baie Verte Peninsula in Newfoundland & Labrador for processing.

A bulk sample of Goldboro ore is planned for completion in early 2018 and will test the Pine Cove Mill’s ability to recovey the gold from the ore. The successful completion of the bulk sample will be a major accomplishment by the Anaconda team and one that we, as investors, should pay close attention to.

The 2014 PEA on Goldboro estimated the total CAPEX cost for development, expansion and the sustaining of the Goldboro Project to be $46.4 million USD. Considering this cost, the estimated Net Present Value (NPV) at a 7.5% discount is $80 million USD, with an Internal Rate of Return (IRR) of 52% at $1200 USD/oz gold.

Within the PEA, one of the projected CAPEX costs is for processing equipment and the tailings management facility, which accounted for $16.1 million USD or 35% of the total cost. Therefore, although this is a crude estimate, the CAPEX costs in the newly proposed scenario of shipping the ore to the Pine Cove Mill may come closer to $30 million USD, which gives the project a lot of breathing room, as far as profitability is concerned.

PUSH: With the future mine production processing moving to the Pine Cove Mill and the additional drilling completed by Anaconda this fall, and a new PEA on the project by December of 2017, should provide us with a view of the potential profitability of this new arrangement.

Additionally, Anaconda has a few other goals to complete for the Goldboro Project this fall and winter, including: Complete an archeology study report, Mik’maq ecological studies, and environmental baseline studies for the property.

Summarizing the important points on The Goldboro Project:

- The Goldboro deposit is open along strike, in both directions and at depth. Anaconda will be drilling the property this fall in an attempt to increase the resource size and infill drill the areas of the deposit where further information is needed.

- The metallurgical drill program is completed and testing is underway. A bulk sample of the Goldboro ore is planned to be completed by early 2018 and will be a great indication of gold recoveries for the project.

- A PEA of Anaconda’s Goldboro Project will be completed by December of this year. Given the savings provided by Anaconda’s existing Pine Cove Mill, it will be interesting to see how it translates into the project’s potential profits.

The Viking Project

The Viking Project is set on 6,225 hectares of property located roughly 180 km by road from the Pine Cove Mill and 10 km southwest of Pollards Point and Sop’s Arm in White Bay, on the island of Newfoundland. The Project is underlain by rocks of variable age that are separated along the large-scale Doucers Valley Fault System.

The Viking Project has two main properties within it, The Kramer property and The Viking property. The mineralization and alteration on the Kramer property are developed in the Main River Plutonic rocks and adjacent Cambro-Ordovician quartzites. The Viking property’s mineralization and alteration are developed in potassium-fieldspar megacrystic to augen granodiorite of the Main River Pluton.

Kramer Property

Historic exploration on the Kramer property was conducted by BP Resources in 1987 and Spruce Ridge Resources from 2009 to 2013. The property has seen soil sampling, geological mapping, airborne magentics, VLF-EM, trenching and diamond drilling. Currently, gold mineralization is defined over a strike length of 1.3 km and remains open to the northeast and southwest. Some of the drilling highlights include 3.78 g/t gold over 5.15 m and 25.41 g/t gold over 0.5 m.

Viking Property

Historic exploration on the Viking property was conducted by BP Resources in 1987, Noranda from 1988 to 1990, Altius Minerals in 2006, and Northern Abitibi from 2007 to 2011. Like the Kramer property, Viking has seen soil sampling, geological mapping, airborne magentics, VLF-EM, trenching and diamond drilling, but to a much higher degree, with 62 trenches and 131 holes totalling almost 19,000 m.

Mineralization has been found along the Thor and Viking Trends. The Thor Deposit has a historical 43-101 resource estimate of 63,000 ounces of gold at 2.09 g/t in the Indicated category and 20,000 ounces of gold at 1.79 g/t in the Inferred category, however, Anaconda does not consider this to be a current mineral resource as an Anaconda Qualified Person has not completed sufficient work to classify it as a current mineral resource. See SEDAR for the technical report entitled, “MINERAL RESOURCE ESTIMATE UPDATE FOR THE THOR TREND GOLD DEPOSIT, NORTHERN ABITIBI MINING CORP”.

Additional Projects

Additionally, Anaconda has the Great Northern Project and Tilt Cove property which are very early stage projects. These will not be covered in this report, please see their respective web pages for further information.

Anaconda Mining Financials

Anaconda’s fiscal year report was released on August 25, 2017 and covered the company’s financial and operating results for the fiscal year ended on May 31, 2017. Here is a look at some of the important high level figures (Note: figures have been rounded and are in CAD unless otherwise stated)

- Production – 15,562 ounces of gold at an average sale price $1,651/oz or USD $1,248/oz

- Point Rousse Project EBITDA – $8.0 million

- Consolidated EBITDA – $6.3 million

- Revenue Generation – $25.7 million

- Total cost of operations – $24.8 million at an operating cash cost per ounce of $1,126/oz or USD $856/oz

- All-in Sustaining Cost (AISC) – $1,735/oz or USD $1,318/oz

- AISC includes corporate administration, capital expenditures (CAPEX) and exploration costs

- CAPEX included tailings and polishing pond construction of $1.9 million, mill equipment upgrades of $0.7 million, production stripping asset additions of $1.1 million and dock facility permitting/legal costs of $0.1 million

- Exploration and evaluation costs were high, with purchase of Orex Exploration, as the company conducted its due diligence. Additionally, exploration of all Anaconda properties totalled $3.3 million for the fiscal year, as drilling, trenching, mapping and mineral resource estimates were completed.

- Mine Operating Income – $900K

- Expenses and other Income – $2 million

- Loss before Income Tax – ($1.1 million)

- Net Loss and Comprehensive Loss for the Period – ($3.6 million) or $0.02 Net Loss per share

- Net Loss for the fiscal year is attributed to higher non-cash charges including depletion and depreciation expense and deferred tax expense.

- Weighted average number of shares – 210,921,901

Anaconda Mining is a company in a major growth stage of its development, and their financials reflect it in their net loss for the fiscal year. However, this loss comes with the development of their projects: Point Rousse and Viking, and includes the transformative purchase of the Goldboro Project, which should pay back in a big way once in production. The upcoming PEA should provide us with a relatively clear guideline of how lucrative Goldboro will be.

Bottom line is that the Point Rousse Project creates a cash flow which the company can deploy into its other assets for development. This is a situation which many other companies try and foreshadow, but Anaconda is actually doing it.

Anaconda Comparables

Who are Anaconda’s comparables? This is a great question, one that is hard to answer for a number of reasons. One thing that I try and keep constant when comparing companies is jurisdiction, as this is a huge wildcard and arguably has the largest speculative affect on the value of a company.

Therefore, I will be comparing Anaconda to two companies, one in Newfoundland & Labrador and the other in Nova Scotia. While the two companies aren’t currently producing gold, I feel they are as close to comparables as you can get for Anaconda on Canada’s east coast.

NOTE: These calculations are approximations and shouldn’t be counted on as being exact or reflecting the enterprise values at the time of reading this report.

Anaconda’s Enterprise Value per Ounce of Gold

Before getting to the comparisons, let us take a look at Anaconda’s Enterprise Value in relation to their 43-101 Resource.

MCAP at the time of writing – roughly $28.6 million CAD

Cash – As reported in Anaconda Corporate Presentation dated August 2017 , reflecting fiscal year end on May 31, 2017- $2.5 million CAD

Debt – As reported in Anaconda Corporate Presentation dated August 2017 , reflecting fiscal year end on May 31, 2017- $1.0 million CAD

Therefore, Anaconda’s Enterprise Value (EV) = 28.6 + 1.0 – 2.5 = $27.1 million CAD

43-101 Total M&I + I Resource = 1.1 million ounces of gold

Therefore, EV / Resource = 27.1 / 1.1 = 24.6

Marathon Gold (MOZ:TSX)

The first company is Marathon Gold, which owns the Valentine Lake Gold (VLG) property in Newfoundland. The VLG property, is being developed as an open pit mine, which may be later converted to an underground operation. VLG has a 43-101 Measured and Indicated Resource of roughly 1.4 Moz of gold and an Inferred Resource of 0.8 Moz of gold, giving VLG a total of 2.2 Moz of gold.

MCAP at the time of writing – roughly $145 million CAD

Cash – As reported in Marathon’s Financials dated June 30, 2017 – $21.1 million CAD

Debt – As reported in Marathon’s Financials dated June 30, 2017 – $0 million CAD

Therefore, Marathon’s Enterprise Value (EV) = 145 – 21.1 = $123.9 million CAD

43-101 Total M&I + I Resource = 2.2 million ounces of gold

Therefore, EV / Resource = 123.9 / 2.2 = 56.3

Atlantic Gold (AGB:TSXV)

The second company is Atlantic Gold, which owns 4 gold development projects in Nova Scotia. Atlantic’s Touquor Project is its most advanced project, with open pit mining production slated for October 2017. Atlantic Gold has a 43-101 Measured and Indicated Resource of 1.7 Moz of gold and an Inferred Resource of 0.4 Moz of gold, for a total of 2.1 Moz of gold.

MCAP at the time of writing – roughly $277 million CAD

Cash – As reported in Atlantic’s Financials dated June 30, 2017 – $11.5 million CAD

Debt – As reported in Atlantic’s Financials dated June 30, 2017 – $128.3 million CAD

Therefore, Atlantic’s Enterprise Value (EV) = 277 + 142.2 – 11.5 = $407.7 million CAD

43-101 Total M&I + I Resource = 2.1 million ounces of gold

Therefore, EV / Resource = 407.7 / 2.1 = 194.1

While ounces in the ground are not created equal, using a comparison method such as EV/Oz is a great way to gauge the valuations of companies of similar ilk. In this case, I think it’s clear that Anaconda is undervalued in comparison to Marathon Gold and Atlantic Gold.

Anaconda’s production is small at approximately 16,000 ounces per year, but they are in full production and have acquired a project in Goldboro, which looks to bring them to the next level of gold producers. I expect Anaconda’s market capitalization to be re-rated in the near future, as its story becomes more widely known.

Concluding Remarks

In conclusion, Anaconda Mining is an under-valued gold producing company, which I believe is set for a MCAP re-rating in the months ahead. To refresh your memory, here’s a list of the contributing factors:

- Anaconda has a great team of professionals led by CEO, Dustin Angelo. The Goldboro Project acquisition and further acquisitions in the future will cement Anaconda’s reputation as a premier gold producing company

- Anaconda Mining’s assets are located in the provinces of Newfoundland & Labrador and Nova Scotia, Canada. These are premier destinations for mining with a stable political landscape and world-class geology

- Anaconda achieved gold sales totalling 15,562 ounces in the fiscal year ended on May 31, 2017. The gold was produced at the Point Rousse Project, which includes Pine Cove Mill and Mine

- An existing 43-101 Measured & Indicated + Inferred Resource Total of 1.1million ounces of gold

- Their EV/Oz is well below similar gold companies developing properties on the east coast of Canada

- PUSH: Anaconda plans to drill Goldboro this fall and intends to expand the resource and shore up the existing deposit.

- PUSH: A PEA on the Goldboro Project will take place by the end of 2017, giving us an idea of the potential profitability.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company(s) and sector that is best suited for your personal investment criteria. Junior Stock Review does not guarantee the accuracy of any of the analytics used in this report. I do own Anaconda Mining Inc. and Marathon Gold Corp. shares. Anaconda Mining Inc. is a Sponsor of Junior Stock Review.