Quebec Site Tour Visit Day 2 – Cartier Resources

Day 2 began at Cartier Resources’ offices in Val d’Or. Interestingly, Cartier’s office walls are filled with field work photos, Chimo mine blueprints, deposit layouts, historical Val d’Or mining statistics and a whole host of other interesting pictures.

Personally, I thought this was a nice touch for visitors as it gives a good perspective on what the company has and is doing to move the company forward – a picture is worth a thousand words.

Cartier Resources (ECR:TSXV)

MCAP – $30.1 million (at the time of writing)

Shares – 177.1 million

Cash – roughly $6 million

CEO – Phillippe Cloutier is a geologist by trade with over 25 years of experience in mining exploration and development.

Cartier’s Business Plan

Cartier made it clear that using funds efficiently is their top priority; they started their presentation by outlining how they go about their exploration work with an added focus on how they planned their drill programs on the past producing Chimo mine property.

The talk was led by VP Dr. Gaetan Lavalliere, who is a professional geologist with over 25 years of experience in the mining industry.

Cartier organizes their geological data to formulate a prioritized list of targets. By doing this, they are always focused on the targets that have the highest probability of returning good results for each dollar spent.

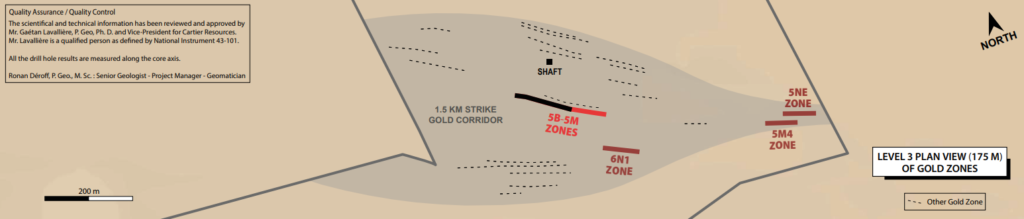

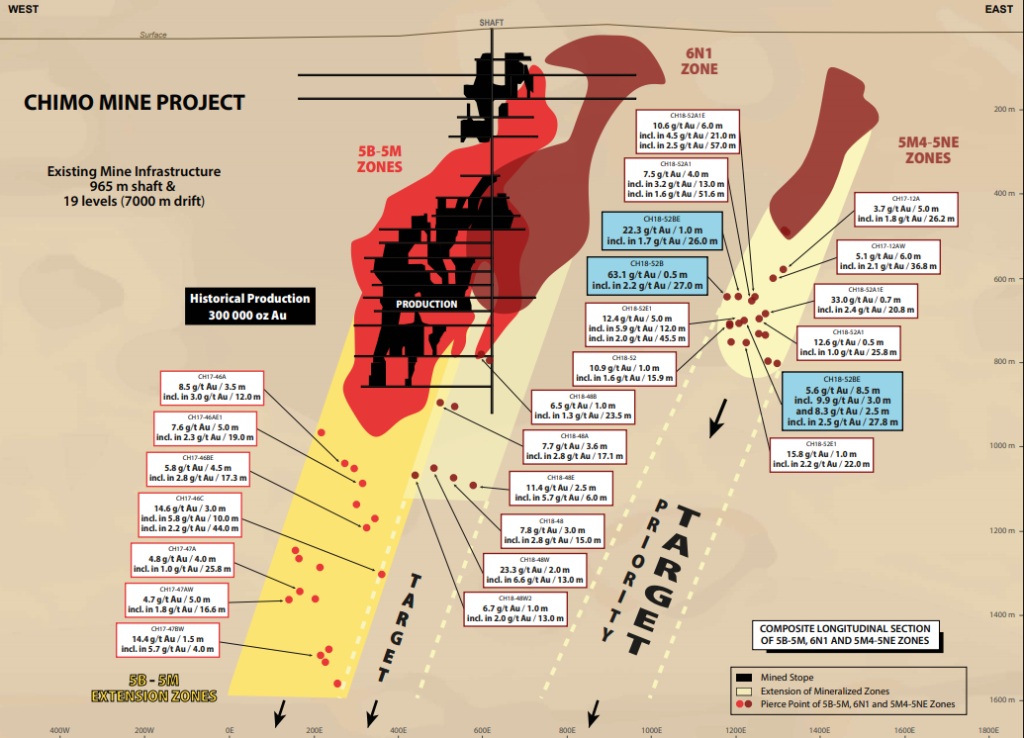

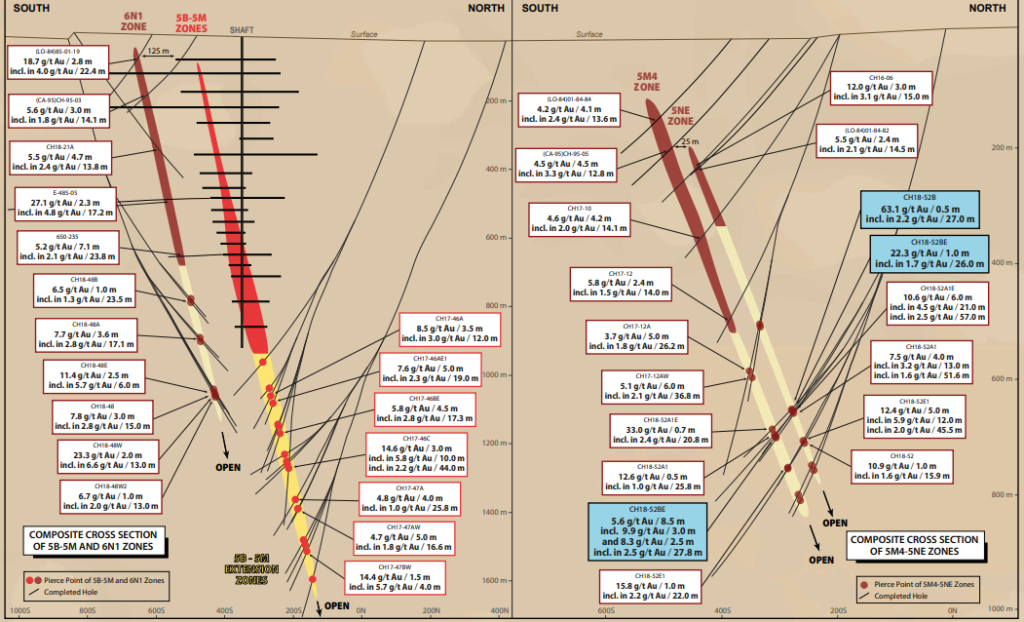

With regards to Chimo, the team was focused on 3 high priority targets from the deposit’s 24 zones.

It should come as no surprise that these zone extensions are mostly at depth, which fits the Abitibi shear zone related gold deposit model. Each of the companies that we visited on our trip were focused on targeting high grade gold mineralization at depth.

I believe Osisko’s ‘Discovery 1’ hole could prove to be a major catalyst for all the other companies with gold projects along the Abitibi, to follow suit and explore deeper…much deeper.

Cartier’s zone extension drilling, in my opinion, has been a success with some very good grades and widths. Reviewing the images above, which were provided by Cartier, you can clearly see how the drilling was systematically planned to delineate the gold mineralization.

If I were to have a criticism of Cartier, it would be that they don’t have any 43-101 technical reports supporting what they have done at Chimo. To explain that further, I fully subscribe to the fact that any senior company interested in Chimo will disregard any technical report Cartier possessed in favour of conducting their own due diligence.

Moreover, most sophisticated investors in the sector can review the drill results and historical mine data and construct an economic model for the revitalized mine and have an idea of its potential value.

The problem, at the moment, is the company says they are targeting the retail market, who, by and large, don’t have the necessary skills to calculate the value of Chimo. Instead, they are depending on someone else’s opinion to gauge its potential value.

NOTE: On a high level, to model Chimo effectively, you would need to have a grip on two important points; the resource size and grade and cost of dewatering the flooded shaft and underground workings. With realistic values for these 2 points, you could model the project using the costs and tax structures from other economic studies or mines in the general Val d’Or area.

In open discussion with CEO Cloutier, this point hasn’t been overlooked by the management team. They are now, however, in a position that requires them to conserve money and await a buyer for Chimo. The conservation of cash allows Cartier to weather any storm that may be headed their way when it comes to negotiation for Chimo.

Takeover Candidates

Who would be a likely candidate to purchase Chimo?

That’s a great question and one that’s key to Cartier’s investment proposition.

First and foremost, the obvious candidate is O3 Mining, which, over the last month or so, has bought up a ton of land around Chimo, through their purchases of Chalice Gold Mines and Alexandria Minerals.

O3 Mining is a new company formed by the Osisko Mining team, whose track record supports an aggressive approach to all aspects of mining company development.

In my opinion, if O3 were interested in Chimo, it wouldn’t be for the short-term production capability, it would be because they see the potential for a much larger system in the area, Chimo just being one of the key pieces.

Additionally, I have heard Agnico Eagle’s name come up as a potential suitor for the purchase of Chimo. I’m less inclined to believe they are a better candidate than O3 to make the purchase, because Chimo, at this point, is much smaller in both resource size and land position than would typically entice a major’s attention.

While O3 and Agnico are arguably the top takeover candidates, it could be a much smaller producer with underground experience that is willing to take on this small short-term production capability story, but they will have to be well financed to make it happen.

Time will tell.

Concluding Remarks

Personally, I do see the value in owning Cartier, even without having modelled Chimo. They are cashed up, have a good management team, and have a bunch of other high potential projects that are just waiting in the wings as far as exploration goes.

Without a doubt, there will be a buyer for Chimo, it’s just a matter of price and when it will happen.

A potential investor must realize that a deal may not be imminent and understand that Cartier will be in hibernation mode until a deal can be made. Depending on your investment outlook and level of patience, this could be a deal breaker.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with Cartier Resources, nor do I currently own any shares. However, all of my expenses for the site visit were paid for.