A Clean Energy Giant In the Making

Disclaimer: The following is not an investment recommendation, it is an investment idea. I have not been compensated to write this review, nor do I own shares in this company. Please perform your own due diligence to decide whether it is a company that’s best suited for your personal investment criteria. All GoviEx Uranium analytics were taken from their website and press releases.

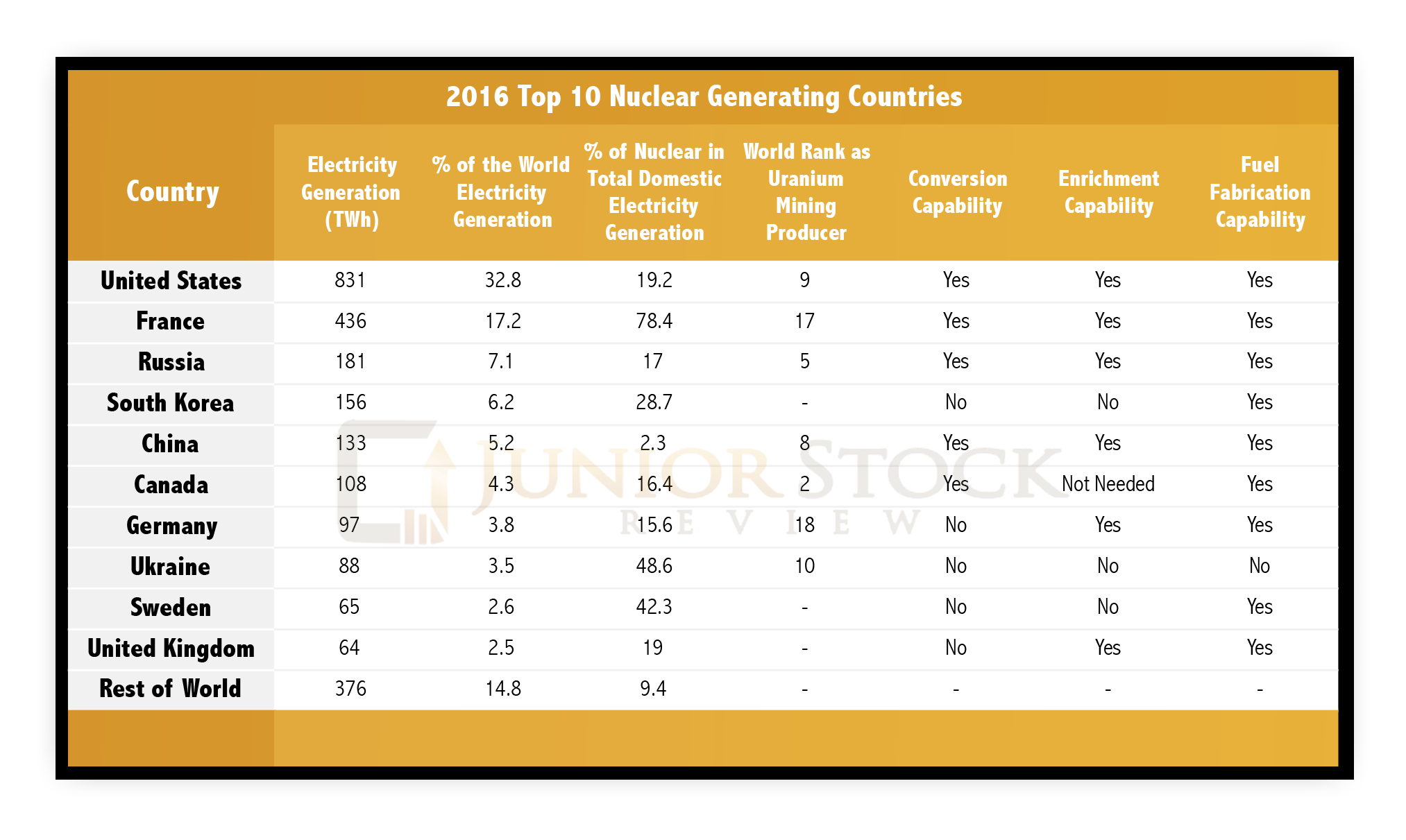

There’s an abundance of naturally occurring uranium (the nuclear fuel) in the world, but producing mines of consequential size and profitability are scarce. This is especially clear looking at the top 10 nuclear power generating nations. Canada is the only country with surplus uranium production; most of the rest are importing close to 50% or more of the uranium they consume.

France, in particular, stands out like a sore thumb because it’s not only the 2nd largest nuclear power generator, at 436 TWh, but nuclear power accounts for 78% of France’s domestic electricity generation. This is further compounded by France’s dismal uranium producing capability, with a mere 2 tonnes being produced in 2015. Low production forces France to import the vast majority of its U3O8 needs. Using the WISE Uranium Project’s Nuclear Fuel Material Balance Calculator, 436 TWh requires roughly 12,1576.74 tonnes of U3O8. So where do the French get their supply?

Areva is the 3rd largest uranium producing company in the world, with 9,368 tonnes of uranium produced in 2015. Areva, however, isn’t just a miner, it’s involved in all aspects of the nuclear fuel cycle. In addition major shareholder in Areva NP, Electricite De France (EDF), operates the majority of the nuclear power generation plants in France. From a global perspective, France makes up 39% of total company revenues, and 68% of total company employment. More than 85% of Areva’s shares are in French state hands, making it absolutely sensitive to French power generation needs.

Areva’s uranium production comes primarily from Niger, with its world class COMINAK and SOMAIR mines. The COMINAK mine is smaller than SOMAIR, but is the 15th largest uranium producing mine in the world, of which Areva owns 34%.

The SOMAIR Project, on the other hand, is the 5th largest current producing mine in the world, and Areva owns 63.6%. Both mines are located in the northwest region of Niger, near the town of Arlit. The mine was established in 1968, and by the end of 2015, had produced around 63,240 tonnes of uranium. With the mine lives nearing 50 years, SOMAIR and COMINAK could are approaching the end of their production, based on the quoted reserves.

Along with France, China and South Korea are the other standouts for me, from the world’s top 10 nuclear power generating countries, as their uranium needs far outweigh their uranium production figures. With future nuclear plant construction being dominated by these Asian power houses, the current U3O8 surplus will quickly be shifted to these nations.

In my opinion, a portion of this future uranium demand could be satisfied by GoviEx Uranium.

The GoviEx Uranium Story

The GoviEx Uranium story is bigger than its flagship Madaouela Project, in Niger. In their June 13, 2016 news release, GoviEx Uranium and Lukas Lundin’s Denison Mines announced that they had completed the transaction to combine their respective African uranium interests. GoviEx Uranium’s deposit portfolio now consists of not only its flagship Madaouela Project, but also the Mutanga Project in Zambia, the Falea Project in Mali, and finally, the Dome Project in Namibia. For this, Denison received 56,050,450 shares and 22,420,180 common share purchase warrants in GoviEx (further details can be found in the press release). This deal makes Denison Mines GoviEx’s largest shareholder, with a 25% stake in the company, and results in GoviEx holding approximately 200Mlb U3O8 in total mineral reseources, and two permitted mines.

Investing with Some of the Best

The insider support for GoviEx extends beyond the Lundin Group. Nuclear industry giants, Cameco and Toshiba, own 7% and 11% respectively. Mining legend, Robert Friedland’s Ivanhoe Industries owns 7%. Friedland’s geologist son, Govind, is the founder of GoviEx and holds 12% of shares. In total, roughly 60% of GoviEx is owned by influential corporate and strategic shareholders.

Jurisdiction

It’s no secret that Africa has seen its fair share of political unrest and overall unpredictability. At first glance, this may seem like a negative for the company, but a portion of the African nations depend almost entirely on their resource exports for the cash their economies so desperately need. In particular, Niger stands out as a mining friendly jurisdiction, with a democratically elected government. In my conversation with GoviEx CEO, Daniel Major, he highlighted this fact when he referred to Niger, where uranium production makes up about 70% of the national exports. For Niger, uranium mining is a business that brings social stability through job creation.

Further summarizing my conversation with Major, most West and Central African nations use OHADA business law, making navigation for companies in multiple jurisdictions much easier. In particular, GoviEx benefits by spreading risk across 4 countries that share similar legal systems and histories of mining. As described earlier, the SOMAIR mine has been in operation since 1968, meaning that the Nigerien people have multi-generational experience with this business. As Major points out, the Madaouela Project’s onsite work force, at least currently, is totally Nigerien.

The need for uranium production exports, and meeting the high international standards on its studies, has allowed GoviEx to acquire mining permits in 6 months, which is unbelievably fast compared to its peers. Mines such as Cigar Lake in Canada’s Athabasca Basin, for instance, have taken several years to acquire the appropriate permitting.

Any concerns about terrorist activity in Africa can be at least partially alleviated by the fact that there’s military presence, most notably the French, US and German in neighbouring Niger and neighbouring Mali. Also, drawing on one of the points I made earlier, because GoviEx has a 100% local work force, its projects may be considered less of a terrorist target.

GoviEx Resources

Beginning with the flagship asset, the Madaouela Project is made up of 5 deposits: Marianne, Marilyn, Miriam, MSNE and Maryvonne. As outlined in the development plan (where you will find further details), the Madaouela Project has approximately 61 million lbs U3O8 of Probable Mineral Reserves. The after-tax NPV, with an 8% discount, is USD $339 million with an IRR of 23.5%, and a long-term uranium price of USD $70 /lbs U3O8. The life of the mine (LoM) is expected to be 21 years, with an annual average production of 2.69 Mlb U3O8. Now, I’m sure most are wondering, how much is this going to cost, and how do you finance a project with a falling uranium price, in Niger? These are the questions I asked Major during our conversation:

- How much is this going to cost?

As described in the development plan, initial capital costs are estimated at USD $359 million, with LoM capital cost being USD $676 million.

Short-Term PUSH:

A reliable indicator for identifying the presence of uranium in the ground is a radon gas survey. Radon gas is produced via the radioactive decay of radium-226, which is found in uranium ores. RadonEX of Saint-Lazare, Quebec in Canada will be conducting a radon gas survey at the Madaouela Project for GoviEx in the near future.

To summarize Major, the RadonEx program is targeted to expand resources at the Miriam open pit deposit portion of Madaouela. He said he believes that if this program is successful, it could improve the economics of the open pit portion of the project, reducing the capital cost associated with its construction. This reduction in cost not only reduces upfront capital, but also simplifies the project in the eyes of the financiers, who should be paid back before the second leg of the project, which is underground.

- How do you finance the mine construction, given the uranium price and the jurisdiction?

To summarize Major, the traditional financing measures used by a lot of companies throughout the world aren’t typically available to projects in countries such as Niger. GoviEx has appointed Medea Capital Partners Ltd. as a Project Debt Advisor. They will assist in the process of structuring the debt portion of the project financing that’s required for the development of the project in Niger.

Medea concluded that there should be market capacity for Export Credit Agency (ECA) covered debt project financing for the development of the mine. The ECA’s involvement is expected to play a key role in achieving full funding. ECAs can provide credit insurance, which significantly reduces the risk profile of project debt to the syndicate of mining finance banks, that ultimately finance the development of the project. ECAs are public agencies that provide sovereign-backed loans, guarantees and insurance to companies who seek to do business in developing countries.

This method takes a little longer than the traditional process, and as Major says, they hope for the financing structure to be in place by the end of next year.

GoviEx’s other 3 properties are highlighted by the other fully permitted mine, Mutanga, situated in Zambia and was part of the acquisition from Denison Mines. In total, the Mutanga Project (Resource Outline) has 2.0 Mlbs U3O8 Measured, 5.8 Mlbs Indicated and 41.4 Mlbs Inferred. Some short-term PUSH could come from a Preliminary Economic Assessment (PEA) on the Mutanga Project, which Major indicated they would be pursuing in the near future.

Each of GoviEx’s 4 projects present exploration upside, which may not be as important in the near-term, but present great options for the future expansion of the resource.

Most Valuable Commodity

In the junior resource sector, it’s widely accepted that people are the company’s most valuable commodity. In GoviEx’s case, Daniel Major was tasked with bringing this company to production, drawing upon his technical background in mining. During our conversation, he outlined his work history and it’s chock-full of mining industry experience, ranging from his humble beginnings with Rio Tinto, as a mining engineer and hands-on equipment operator, to his work as an analyst with HSBC and JP Morgan. This combination of skill set and experience leave me feeling confident that Major is the man to bring this deposit into production.

Money is Made on the Delta Between Price and Value

While there are unanswered questions and concerns about GoviEx Uranium, such as solidifying financing, the African jurisdictional risk, and a falling uranium price, in my opinion, the story is undervalued in comparison to its development peers. Also in the last uranium bull cycle two of the best performing shares were Paladin and Energy Fuels, because they built mines in the cycle. After all, in the junior sector, money is made on the delta between price and value.

You be the judge:

· Proximity to the world’s 5th and 15th largest uranium producing mines

· Two mining permits: One for the 61 Mlbs (Probable) U3O8 Madaouela Project in Niger, and one for the Mutanga Project in Zambia

· 60% insider ownership; Lukas Lundin’s Denison Mines, Govind Friedland, Robert Friedland’s Ivanhoe Industries, Cameco and Toshiba

· 4 Projects with a combined resource of 197 Mlbs (M&I + I) with exploration upside

Is its current CDN $30 million MCAP justified next to its presented value proposition and company peers?

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review