Energy Fuels: Positioned to Lead the American Uranium Renaissance

The current uranium market has, in my opinion, all the makings of the perfect contrarian investment.

- The uranium price hit a 12-year low of $17.75 USD per lbs in these past weeks, which is close to 90% off the 2007 high – the cure for low prices is low prices.

- The world’s electricity output has grown steadily at an average rate of 3.4% CAGR, from 2009 to 2014, in the face of turmoil following the world economic crisis that struck in the fall of 2008. (Rate calculated using data from International Energy Agency (IEA))

- The clean air trend has greater momentum every year, with the Paris Climate Accord, or the 450 Scenario (International Energy Agency), leading the charge to reduce carbon emissions.

- Nuclear power generation is cheap, safe and reliable.

The uranium market is not without it detractors, but to me, it’s not if but when will the uranium market turn. The further the uranium price falls, the further uranium companies’ share prices drop and, thus, the less risk associated with buying them.

In the famous words of Howard Marks,

“Upshot is simple: to achieve superior investment results, you have to hold non-consensus views regarding value, and they have to be accurate. That’s not easy.”

~Marks, The Most Important Thing Illuminated, pg.7

For me, waiting for the uranium market to turn from bear to bull can be done successfully by choosing companies that are able to weather the storm. What do I mean by this? Well, some uranium producers have protected themselves by hedging all or part of their sales books for the next year or so to ensure they can still operate.

Those with great properties, scalability in their production, locations in the right jurisdictions, the sales contract books to at least partially protect downside uranium price risk, and that are run by experienced and proven management will be the companies that survive and are the first to lead the bull market.

The uranium market may not change tomorrow or next week, but I do believe there is a bright future for this clean energy producing commodity.

It’s Gonna Be HUGE!

Let us take a look at one country in particular, a country which I believe will turn to more domestic production of uranium in the future, and to nuclear power for its clean energy production.

An American Ressainance in Uranium

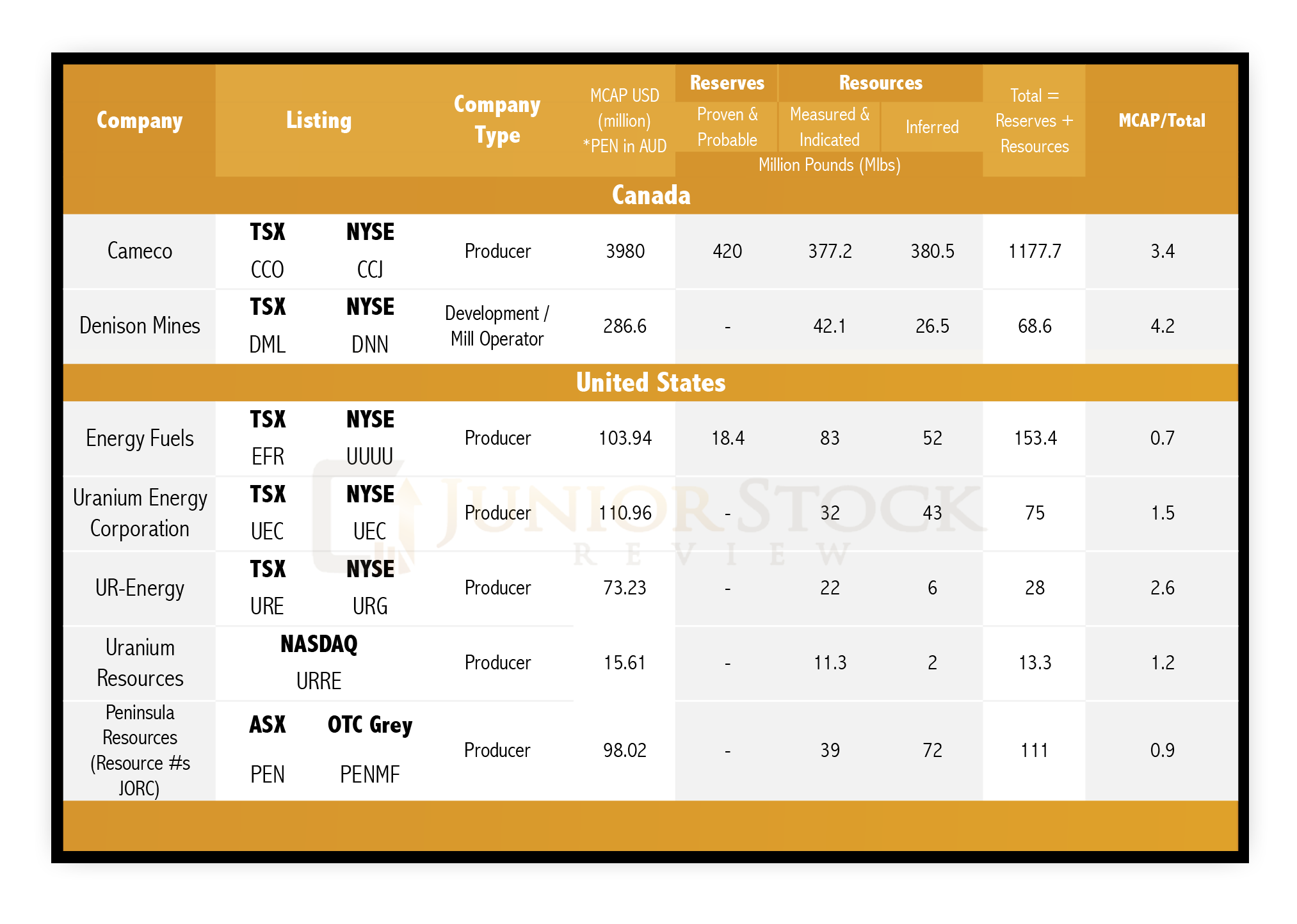

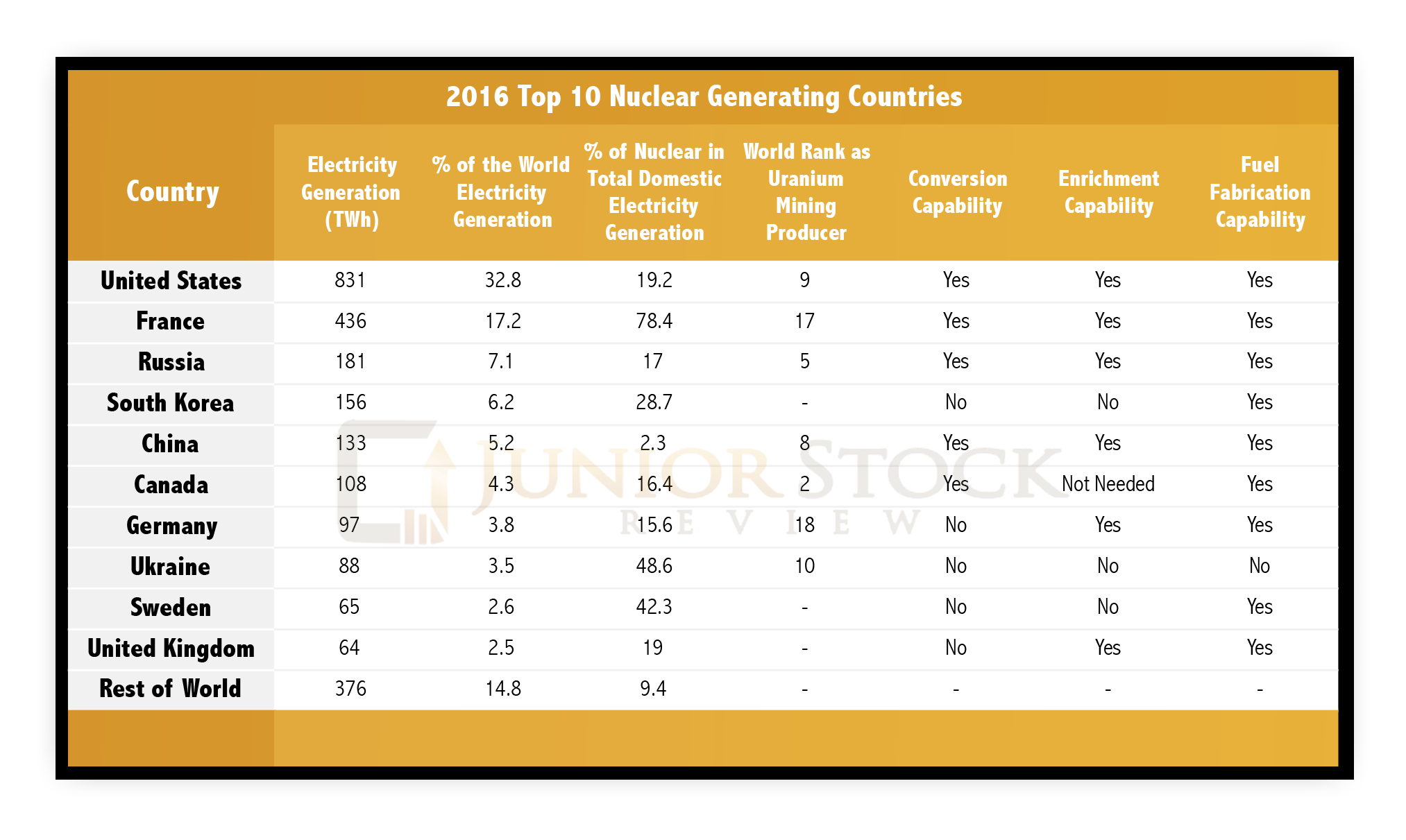

If you’ve haven’t already guessed, the country I’m referring to is the United States, and as you can see from the table below, they are the world’s largest generator of nuclear power. Interestingly enough, however, they are only the world’s 9th largest uranium producer.

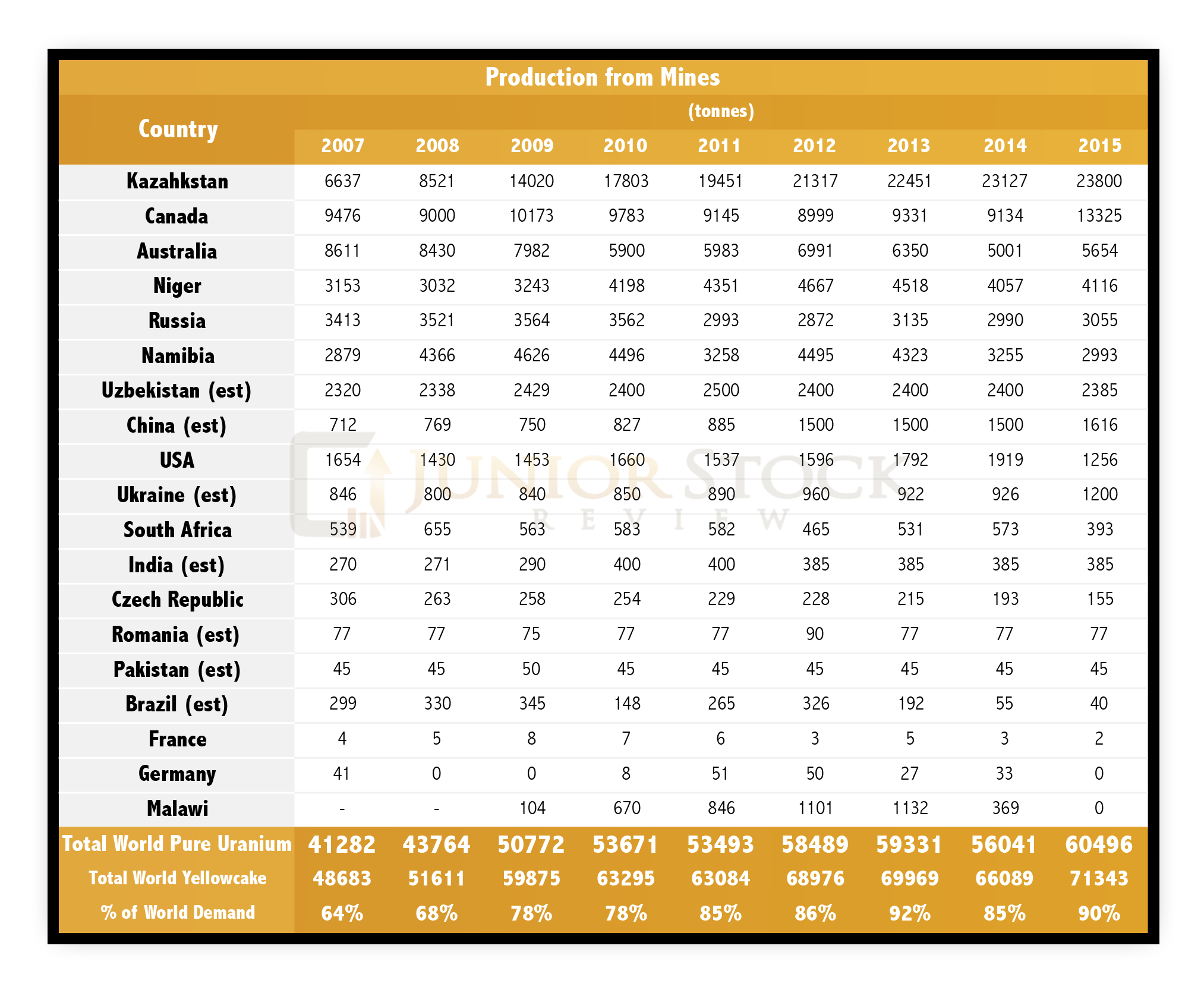

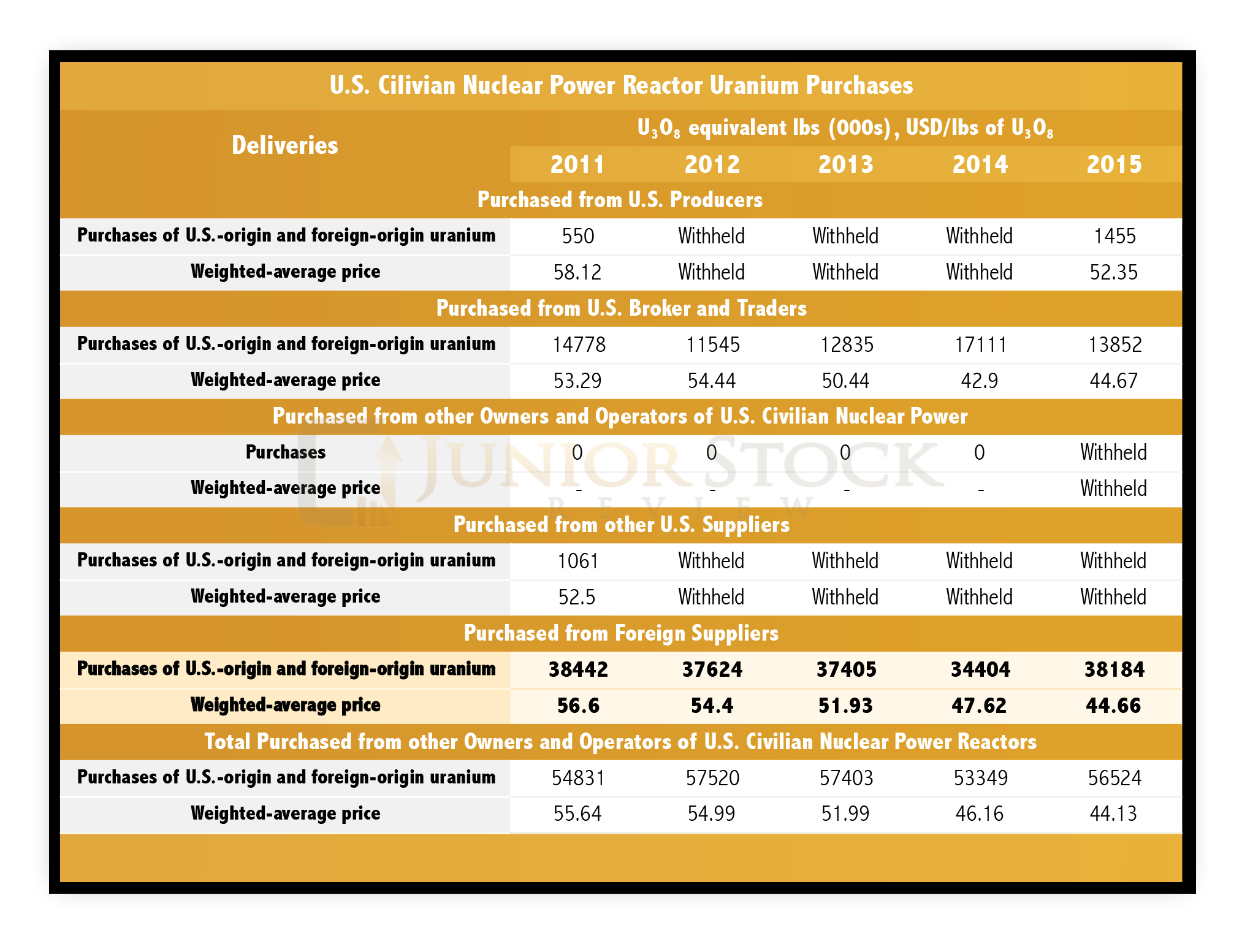

What does this mean? The United States is required to import the vast majority of their uranium needs, as can be seen in the table from the USA Energy Information Agency’s breakdown of the purchased uranium in years 2011 to 2015. Specifically, refer to the data in ‘purchased from foreign suppliers’ and you will see that the U.S. purchased the vast majority of their uranium from foreign entities in 2015.

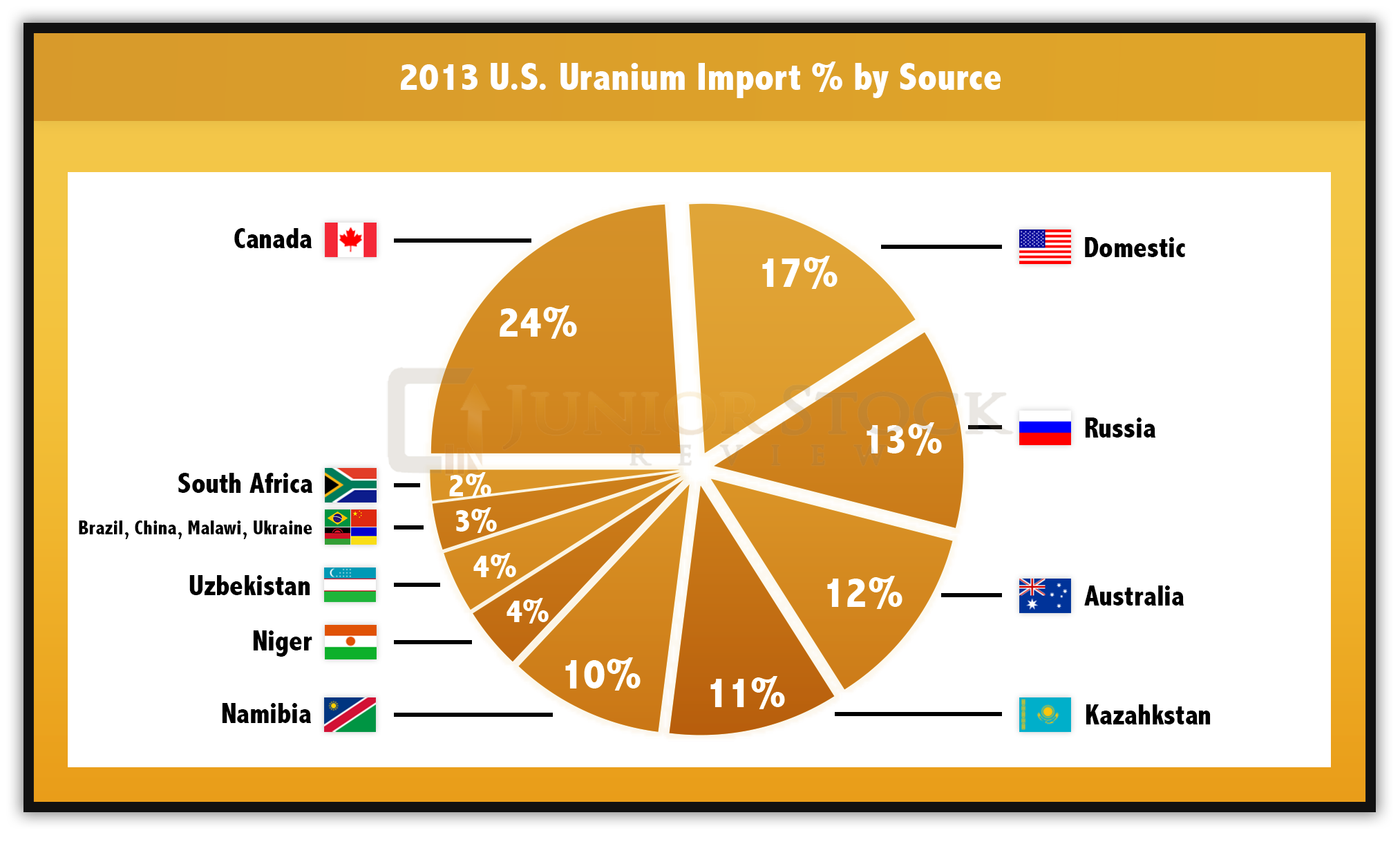

Who did the United States import their uranium from? Take a look at the pie chart below:

Source: U.S. Energy Information Administration

The effect that president elect Donald Trump will have on the American economy has yet to reveal itself. From the statements he made during his campaign, however, we know of a few things that could happen:

- Re-negotiate North American Free Trade Agreement (NAFTA)

- Canada is the U.S.’ #1 trading partner and its #1 supplier of uranium. If the re-negotiation adds a tariff to imported Canadian uranium, U.S. utilities will be looking internally for a cheaper source.

- Relations with Russia

- It’s hard to say where this will go, but if tensions were to increase with Russia, it’s my contention that their supply of uranium to the U.S. may end. The same could be said for the former Soviet States, Kazakhstan and Uzbekistan.

- Made in America

- Trump’s platform was “to make America great again,” and my guess is that this will include producing more of their goods within their borders. In particular, I believe there will be a push to produce more uranium within the country, creating more jobs and more security of supply.

Energy Fuels, America’s Next Leader in Domestic Uranium Production

The push for further domestic production will start with one of North America’s largest domestic uranium companies Energy Fuels. Energy Fuels is a uranium producer headquartered in Lakewood, Colorado, and with its producing assets in the western part of the United States. Its primary operations are as follows:

- White Mesa Mill (Utah) – Only licensed and operating conventional mill in the USA.

- Nichols Ranch Processing Facility (Wyoming) – In-Situ Recovery (ISR) of uranium

- Alta Mesa Project (Texas) – In-Situ Recovery (ISR) of uranium

Let’s take a look at the reasons I believe Energy Fuels is set to weather the bear market storm.

The Energy Fuels Team

The Energy Fuels team is led by President and Chief Executive Officer (CEO), Stephen P. Antony. Antony has led Energy Fuels since his appointment in 2010. He’s a graduate of the Colorado School of Mines, originally trained as an engineer. He also holds a Masters of Business Administration from the University of Denver.

Antony has been in the mining industry for 39 years, and his start in the uranium business was with the mining arm of Mobil Oil, where he developed the reclamation plan for Mobil’s El Mesquite ISR operation in Texas. His next years were spent in managerial roles with Energy Fuels Nuclear, where he held the position of Director of Technical Services and with Power Resources Inc., where he was Vice-President of Business Development. Antony then consulted for Cameco as they completed their due diligence on Power Resources before their take over. Finally, in 2005, Antony was back with Energy Fuels as Chief Operating Office (COO), in charge of all the day-to-day operations of the corporation, production and exploration.

Antony has a great mixture of technical and managerial experience, and with 39 years in the business, he is certainly in the right position at the helm of America’s largest domestic uranium company.

My personal work experience is in operations, so I’m probably a little biased in my belief that operations, next to the CEO, are the most important positions at a company. Energy Fuels has split their head operational position into 2 Executive Vice-President (VP) roles.

First, Harold R. Roberts is VP of Conventional Operations. Roberts is a trained engineer, having graduated from Montana State University in 1975. He has held many operational type roles throughout his career, from operations oversight to project development, as well as executive positions with Denison Mines, as Executive VP of U.S. Operations, and Energy Fuels Nuclear as President. Roberts’ work experience sets him up well for his operational role at Energy Fuels.

Secondly, W. Paul Goranson is VP of ISR Operations. Goranson is a trained engineer and possesses both an undergraduate and a Master’s degree from Texas A&M. Goranson has 28 years of experience in the uranium industry. Before joining Energy Fuels, he held executive roles with Uranez Energy Corporation, where he was COO and Director, Cameco Resources, where he was President, Mestena Uranium LLC, where he was VP, and finally, Rio Algom Mining and Uranium Resource Inc, where he held senior positions.

Energy Fuels is led by a seasoned group of uranium professionals, giving the company a solid footing during these hard days in the uranium business. Their business plans have thus far kept Energy Fuels profitable, and have set them up well for the upcoming bull.

Making America Great Again

It’s widely thought that North America is one of the best places for mining investment in the world. This is with good reason, as in our present moment in history, North America provides mining companies with a good legal system, relatively stable politics and a reliable workforce.

President Elect Trump is a wild card of sorts, and time will tell whether his proclamations will result in triumph or disaster, or maybe both, depending on your perspective. Only weeks after his win, it appears general consensus is that nuclear power will get a boost from Trump’s presidency.

Although the future is cloudy, I do believe that North America is your best bet from a jurisdictional perspective for uranium investment. The first part of this article describes the reasons I believe American uranium companies in particular will prosper in the years ahead.

Let us take a look at Energy Fuels’ presence in the United States and why they present the best bang for your investment buck for the American uranium companies.

Energy Fuels Properties

Located in Utah, White Mesa Mill is a conventional operation and the only licensed and operational mill in the United States. For those who aren’t familiar with the nuclear fuel cycle, let’s take a quick look.

A mill is integral to the cycle because yellowcake is produced through the milling process. Without it, uranium ore can‘t be converted into uranium hexafloride.

Conventional Uranium Mining

The White Mesa Mill has a licensed capacity of 8 million pounds (Mlbs) of uranium per annum and is centralized within the area where Energy Fuel’s high grade uranium mines are located. Also, it possesses separate circuits to process high-purity vanadium and an alternate feed circuit, which produces uranium from other uranium-bearing materials (don’t come from conventional ore). The alternate feed circuits are supplying Energy Fuels with profits during a dismal uranium market and represent a huge advantage to Energy Fuels when compared to its competitors.

Some food for thought, vanadium is extensively used within the steel industry as an alloying element, and is also a part of new battery technology, as it’s used with lithium to produce a powerful, safe and reliable battery solution.

PUSH: Some push going into 2017 is the income generated from Energy Fuel’s new alternate feed contract, which was announced on October 31, 2016.

Mine Sites

Energy Fuels has a wide range of properties throughout the western United States. Let’s look at the conventional properties, first. Conventional uranium mining means that they mine uranium ore in an open pit or underground. The White Mesa Mill is the centrepiece for these mines, as all of the ore is trucked to the mill for processing.

Canyon Mine

- Conventional development property located in Arizona

- Inferred resource of 1.6 Mlbs

- Extensive high grade copper mineralization (averaging 8.75%) was found (News Release). The plan is to expand the scope of the evaluation of the Canyon deposit, as this new discovery has the potential to make the economics of the project even better. The further exploration of this target comes at a cost, as seen in the Q3 results, but it’s well worth it in my opinion, as a high grade copper by-product from this uranium mine could add a ton of value.

- Production could start as early as 2017, with the ore being shipped to White Mesa for processing

Sheep Mountain

- Conventional development property located in Wyoming – Currently, permitting for surface and underground mining

- Probable reserves of 18.4 Mlbs U3O8, Indicated resource of 30.3 Mlbs U3O8

- With a proposed maximum output of 1.5 Mlbs per annum

Henry Mountains Complex

- Conventional property located in Utah, with close proximity to the White Mesa Mill. The Tony M mine is on standby, but fully permitted, while the Bullfrog portion of the project is still in permitting

- Indicated resource of 12.8 Mlbs U3O8 and an Inferred resource of 8.1 Mlbs U3O8

La Sal Complex

- The La Sal Complex is made up of a series of uranium/vanadium mines in Utah. These include: Beaver, Pandora, La Sal, Energy Queen and Red Clock projects

- Beaver and Pandora are fully permitted and developed

- Currently on standby

- Measured and Indicated resource of 4.1 Mlbs U3O8 and 21.5 Mlbs of vanadium, and an Inferred resource of 0.4 Mlbs U3O8 and 1.9 Mlbs of vanadium

Whirlwind

- Uranium/vanadium mine located on the Colorado/Utah border.

- Fully permitted and developed

- Currently on standby

- Indicated resource of 1.0 Mlbs U3O8 and 3.3 Mlbs vanadium, and an Inferred resource of 2.0 Mlbs U3O8 and 6.8 Mlbs vanadium

Daneros

- A uranium mine located in Utah, close to White Mesa Mill

- Fully permitted and developed

- Currently on standby

- Inferred resource of 0.7 Mlbs U3O8

Roca Honda

- Conventional property located in New Mexico, but within trucking distance to the White Mesa Mill. The project is still in permitting

- Measured and Indicated resource of 14.8 Mlbs U3O8 and an Inferred resource of 11.2 Mlbs U3O8

- PEA describes 2.6 Mlbs of production per year

Wate

- Conventional property located in Arizona, but is within trucking distance to the White Mesa Mill. The project is in permitting

- Inferred resource of 1.1 Mlbs U3O8

Energy Fuels also has a couple of other conventional development properties that are on a smaller scale: Sage Plain and EZ Complex. Check out their details here

In-Situ Recovery (ISR) Operations

Energy Fuels operates and owns ISR operations in the western United States, giving the company a portion of their U3O8 at a very low cost of production.

Nichols Ranch ISR Mine and Plant

- Located in the Powder River Basin, Wyoming

- Hank, Jane Dough properties are a part of Nichols Ranch

- Fully licensed

- 2 Mlbs of U3O8 per annum capacity

- Measured and Indicated resource of 2.8 Mlbs U3O8

- Resource expansion possibilities

Alta Mesa ISR Mine and Plant

- Located in Texas

- Purchased earlier this year (Mestena acquisition)

- Fully licensed

- 1.5 Mlbs of U3O8 per annum capacity

- Currently on standby

- Measured and Indicated resource of 3.6 Mlbs and an Inferred resource of 16.8 Mlbs

Energy Fuel’s owns a few ISR development properties, which are: Reno Creek, West North Butte, North Rolling Pin, and Arkose Mining Venture. For more information on these properties, check this out.

In total, Energy Fuels covers all of the bases with their ISR and conventional mining properties. The ISR projects provide the company with a low cost source of U3O8, which is particularly important in today’s price environment.

Not only is Energy Fuels one of America’s largest domestic uranium companies, but it has the potential to get even larger with there being a possibility for an expandable resource at a number of their properties. Available multiple million pounds in the ground and the ability to produce U3O8 up to 11.5 Mlbs per year, Energy Fuels has the horse power to respond to the growing domestic demand for uranium in the years ahead.

Author’s Note

As I mentioned earlier, my work experience was in the steel manufacturing business, and after the economic calamity of 2008, production at the plant where I worked was cut by 50% and stayed that way up until last year. With an increasing gap between the Canadian and U.S. dollars, more production tons were shifted to our plant in Canada.

To some, adding 25% more production should be easy, just flick the switch. But, what’s overlooked is the plant’s labour force, which was laid off during the downturn, leaving the plant with a senior workforce (unionized, senior members weren’t laid off). The issue with this scenario is that when it came time to add an additional crew, we had to train new workers in record time and fill in for the slew of retirements that removed experienced workers from a workforce that was largely baby boomers.

My point is this, it’s fantastic that there’s room to grow as the market turns, however, it isn’t always as easy as flicking a switch, because laid off employees don’t always return, and training new employees can be complex, depending on the process.

Financials

On November 3rd, Energy Fuels announced its 3rd quarter results.

Antony stated in the news release:

“In light of today’s uncertain uranium market, Energy Fuels is intently focused on preserving, and in the case of Canyon, enhancing the value of the Company’s uranium assets. We feel that the Company is well placed in the global uranium sector with multiple, 100%-owned production opportunities, which collectively have the potential to produce a large quantity of low-cost uranium in diverse ways in an improved market. Moreover, the Company is working diligently to strike the correct balance between growing our production capabilities, maintaining visibility in global uranium markets, advancing high-priority development and permitting activities, and sustaining the financial health of the Company. We believe our new Business Plan will upgrade and improve the quality of our portfolio of, producing, and permitted assets, while also maintaining and improving Energy Fuels’ sustainability, so our shareholders are in a position to benefit from the expected uranium market recovery.”

Here’s a summary of the news release highlights:

- Gross profit of $3.0 million USD from mining and milling operations (34% gross profit margin)

- Energy Fuels has a sales contract book that runs until 2020. Starting next year, in 2017, and working towards 2020, they have fewer tons contractually sold each year. This strategy leaves them open to upside in the uranium price, while protecting against downside.

- To note, Energy Fuels’ sales contracts are completed at fixed prices, therefore, allowing the company to predict future cash flows against current operating costs.

- Recovered 350,000 pounds of U3O8 during the quarter, 90,000 lbs from ISR and 260,000 lbs from conventional sources.

- Implementation of cost cutting measures such as: sale or abandonment of certain non-core properties, sale of excess mining equipment and the Board of Directors have decided to reduce their total compensation by 20%.

- Energy Fuels has re-jigged some of their contract deliveries, moving 300,000 lbs that were originally scheduled for 2017 to November 15, 2016.

- A net loss of $8.2 million USD, $1.4 million USD impairment of inventory, and $6.3 million USD of development (permitting and land holding costs)

- Development costs were for well-field construction at Nichols Ranch and continued shaft-sinking at the Canyon project (evaluation of high grade copper discovery)

- In a letter released September 22, 2016, CEO Stephen Antony discusses the current uranium market and why the company completed a 2nd financing ($15 million USD) this year. This letter is well worth the read, as Antony draws on his experience to explain current market dynamics and outlines where Energy Fuels is headed. Personally, I like the direction in which they’re headed; development and acquisition of properties is best done when the demand for your product isn’t there, just like being a contrarian investor and buying in a down market. When the market turns, Energy Fuels will be ready to rock, with their best properties ready to produce uranium ore.

Energy Fuels’ 3rd quarter financial results are reflective of a dismal market, one in which they produced profits from an operational perspective, but because the company has chosen to march ahead with the development of their other high potential properties, has incurred a net loss.

Even if the market doesn’t turn, Energy Fuels has efficient conventional and ISR projects that should give the company a healthy metal spread in the years ahead. Along with the additional income from their alternate feed circuits, Energy Fuels is poised to stick around for the boom.

Comparison to its Peers

NOTE: MCAP numbers may have changed since the writing of this article, please do your own due diligence and check. All other analytics are from the company websites.

To get an idea of how Energy Fuels stacks up against its peers, take a look at the table above. In a simple calculation of MCAP to total (reserves and resources) uranium, Energy Fuels is clearly undervalued. Other than Cameco, Energy Fuels has the most production upside capability, along with the largest total uranium resources, giving it the ability to capitalize to a greater extent on a change in market sentiment.

Cash Generation Calculation

Energy Fuels is licensed to produce 11.5 Mlbs of uranium per year. Current market conditions have forced the company to cut back production to around 1 Mlbs per year. Outside of their developments cost, Energy Fuels has the ability to generate cash through its operations.

- 1st quarter gross profit margin of 33%, 2nd quarter gross profit margin of 18% and a 3rd quarter profit margin of 34%. Average Profit margin for the year 28%.

- The White Mesa Mill has an annual capacity of 8 Mlbs, but for the sake of this calculation, let’s be conservative and say that full capacity during an up market is 5 Mlbs, or roughly 62.5% of capacity

- The ISR plants (Nichols and Alta Mesa) have a cumulative capacity of 3.5 Mlbs per year; let’s use the same conservative estimate and say that at full capacity the ISR plants will produce 2.2 Mlbs per year.

- Therefore, in total, Energy Fuels will produce 7.2 Mlbs in this hypothetical bull market scenario

- For the sake of this calculation, let’s use today’s approximate average sale price of $55 USD per pound

7.2 Mlbs x 55 $ USD /lbs = $396,000,000 USD

$396,000,000 x 0.28 = $110,880,000 USD in operational cash generation

Now, to put this in perspective, Energy Fuels’ current MCAP is roughly $111 million USD and this conservative example shows a cash generation of $110.8 million USD. If you consider that a portion of Energy Fuels’ sales will be at higher prices in the coming bull market, this number grows quite easily. Also, this example assumes a 62.5% capacity utilization, which may or may not be conservative, but there’s certainly room to grow to Energy Fuels’ licensed capacity of 11.5 Mlbs.

As with the 3rd quarter results, Energy Fuels will have development and permitting costs to pay over the next few years, but this money is well spent as it will bring on more capacity, fuelling American nuclear reactors for years to come.

Buying Value at a Discount

Looking to invest in the uranium space but are lukewarm about when the bear market will end? While Energy Fuels isn’t without risk because they are spending cash in the midst of a bear market to purchase great properties and to further explore, permit and develop high potential properties, Energy Fuels, in my mind, is well worth a look – they boast the following strengths:

- Experienced management team

- Undervalued, MCAP to Resources Ratio, compared to their North American peers

- They have a hedged sales contract book with orders confirmed to 2020. That said, not all of their production is contractually sold, giving them plenty of upside to a rising uranium price in the future.

- Largest American uranium company by resource size

- Production scalability – with a license to produce 11.5 Mlbs per year, there’s plenty of upside to fulfill demand. Many properties have the potential to expand their resource without the need for M&A.

- All operations are in the western United States

Energy Fuels is ready to fuel America’s uranium renaissance. Invest ahead of the crowd and be a contrarian!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: This is not an investment recommendation, it is an investment idea. I am not an investment professional and do not know your specific investment needs. Please do your own due diligence. I have not been compensated to write this article and do not own shares of Energy Fuels.