Anaconda Mining – Positive Preliminary Economic Assessment on its Goldboro Gold Project

As I have discussed numerous times, people are the most important part of a junior mining company. The reason for this, in my opinion, is because the vision and execution of that vision is what propels these junior mining companies forward. While great properties can be found accidentally, it does happen, most are sought out via a plan of action, which is specifically designed to identify the property or project with the highest potential, given the management teams criteria.

Today I have for you an example of how a bold vision, along with great execution is propelling a junior gold mining company into a mid tier gold producer on Canada’s east coast. This company is Anaconda Mining and the leader with the vision, is CEO Dustin Angelo.

In one of the first discussion I had with Angelo last summer, he explained that his goal for the company was to expand its production and eventually become a 100,000 of Au/year producer. He said Anaconda will achieve this by the developing its currently owned projects and will be looking to grow through the acquisition of gold projects on Canada’s east coast, which have an existing 43-101 resource estimate.

Angelo has an aggressive vision given the fact that their current production sits at roughly 15,000 oz of Au/year. However, fortune favours the bold, and given Anaconda’s pedigree for success it comes as no surprise to me, that they have taken a couple giant steps towards the goal in the first month of 2018.

First, their Argyle Gold Deposit, which is a part of the Point Rousse Project near Baie Verte, Newfoundland announced its maiden resource, including some fantastic high grade drill results. Second this month, and the big game changer announcement for Anaconda, is positive Preliminary Economic Assessment (PEA) for its Goldboro Gold Project.

Let’s take a look!

Goldboro Gold Project

Anaconda’s Goldboro Gold Project is located on the north east coast of Nova Scotia, roughly 250 km northeast of Halifax. Goldboro consists of 37 mineral claims on 600 hectares and is accessible year- round via Highway 316 on a 2.5 km gravel road, with the other more obscure parts of the property having access via logging roads.

Anaconda acquired the Goldboro Gold Project from Orex Exploration early last year (2017), in all shares deal. From many perspectives, this was a transformative acquisition for Anaconda, as it became their first property outside of Newfoundland and by far, their largest gold project, in terms of 43-101 resources.

The Goldboro Gold Project was acquired with a 43-101 complaint Measured and Indicated Resource of 2,556,000 tonnes at 5.48 g/t for 457,400 oz Au, and an Inferred Resource of 2,669,000 tonnes at 4.35 g/t for 372,000 oz Au.

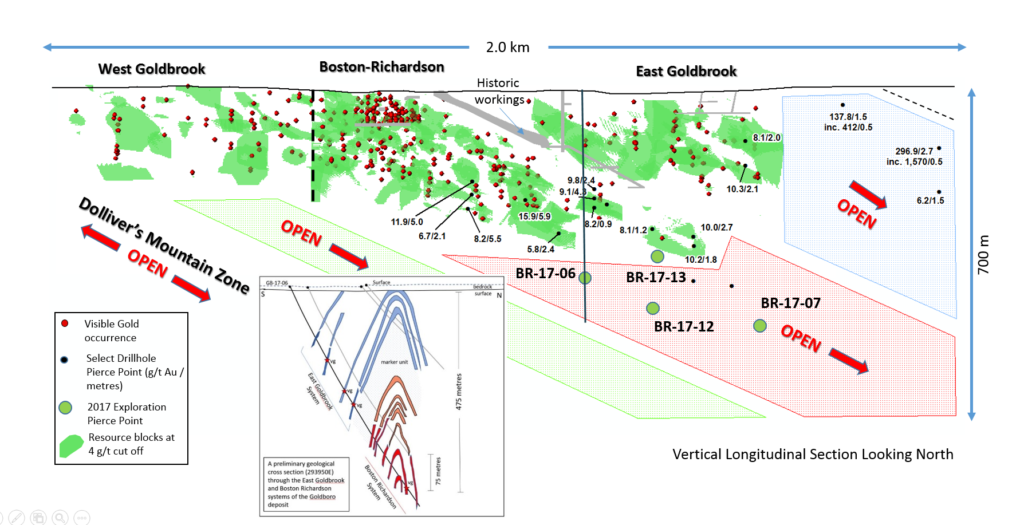

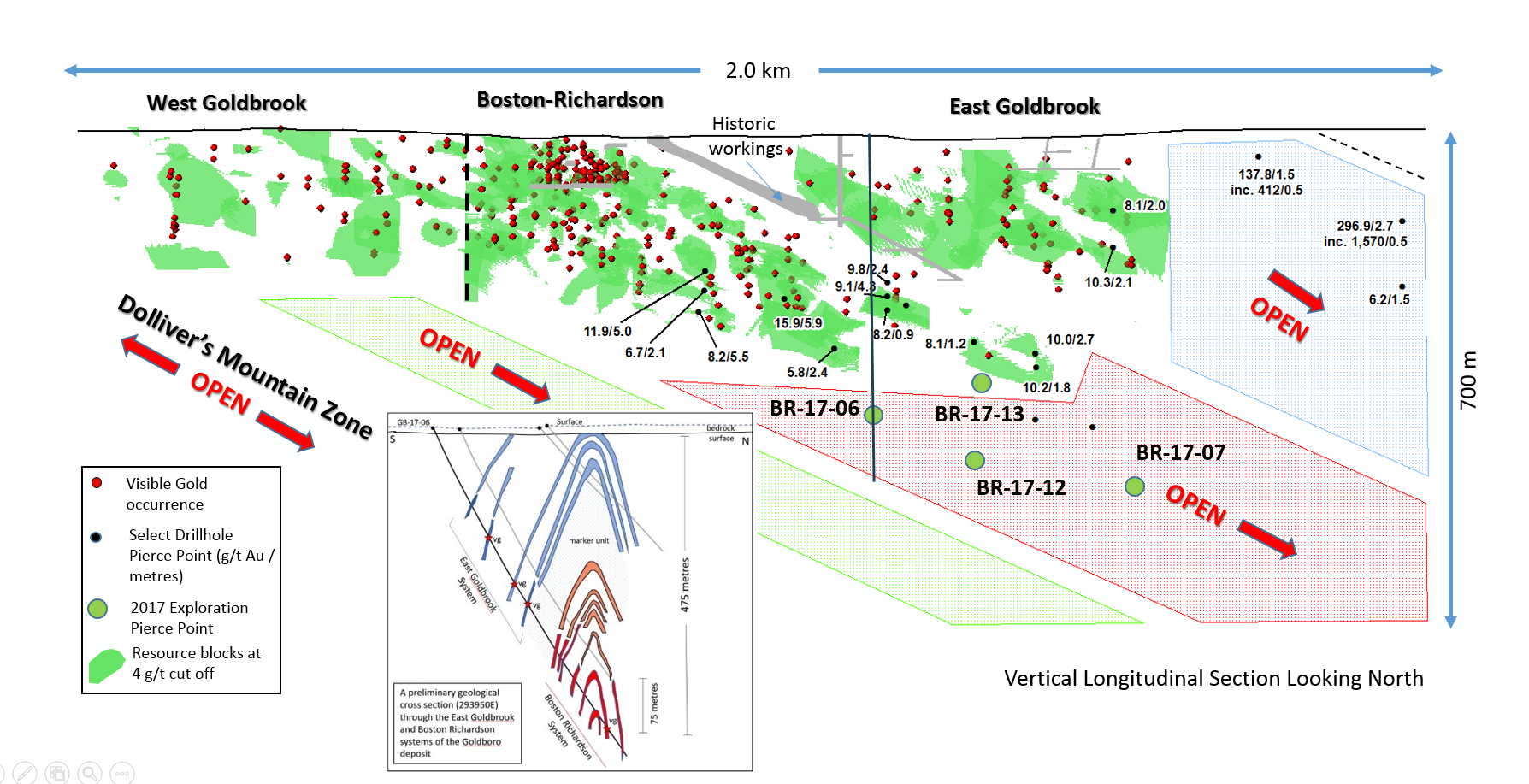

Goldboro is entirely underlain by sedimentary rocks of the Goldenville Group, which are made up of greywacke, arenite and slate. Gold mineralization is found in quartz veins and within disseminated sulphides in the wall rock. Currently, the deposit known strike length is 1.6 km and can broken down into three main areas, the Boston-Richardson gold system and the East and West Goldbrook gold systems.

Positive PEA Results

The Goldboro Gold Project PEA results are in and in my opinion, are very positive. The PEA base case scenario, sees Goldboro being mined by both an open pit and underground workings, with on-site concentration through gravity and flotation circuits. Further leaching of the concentrate and recovery of the gold will be done at Anaconda’s fully permitted and operational Pine Cove Mill in Newfoundland.

To note, Anaconda’s PEA on Goldboro, does not include any of the 6000 metre drill program which they are currently completing. This PEA is truly a base case scenario, which in my opinion, makes its results that much more impressive, as there is still a lot of upside potential given the high grade drill results which were released last summer.

Let’s take a look at the PEA base case scenario highlights:

Goldboro PEA Financial Figures

Long Term Gold Price Assumption for the PEA – $1550 CAD (roughly $1250 USD depending on the exchange rate)

After-Tax NPV @ 7% – $61 million CAD

IRR % – 26%

Pre-Production CAPEX Cost – $47 million CAD / additional $42 million CAD in years 1 and 2

Payback – 3.4 years

NOTE: Anaconda has provided Net Present Value (NPV) – gold price sensitivity tables within the news release for those that would like to take closer look at how the project’s NPV changes with different gold prices and varying discount rates. I am not going to cover every scenario listed, but will instead talk about the extreme highs and lows of the project NPV.

Goldboro PEA Operating Figures

LOM average operating cash cost – $654 CAD/oz or $525 USD/oz

LOM average all-in sustaining cost – $797 CAD/oz or $640 USD/oz

Mining Rate – 600 tpd at an average open pit grade of 2.99 g/t and underground grade of 6.83 g/t. Translating into an average annual gold production of 41,770 ounces with up to 62,000 ounces in year 5.

LOM – 8.8 years, with 2.4 million tonnes of potential mill feed at an average grade of 5.13 g/t and recovery of 93.6% resulting in gold production of 375,900 ounces.

The strength of Goldboro’s operating figures are expressed in the NPV calculation of the project, as the base case scenario of $1550 CAD/oz is well above the average all-in sustaining cost of $797 CAD/oz. Viewing Goldboro’s operating figures from the perspective of downside risk, I would say with respect to just the gold price, there is a lot of room for volatility. In reality, what would the world look like if gold were below $1000 CAD/oz? To be honest, I have no idea what that world looks, and believe it is unlikely we will see it.

Additionally, as I spoke about it in the introduction to the article, Angelo’s goal of reaching 100,000 oz of gold production per year is becoming more of a reality. Anaconda’s current production, plus Goldboro’s projected average of 41,770 oz, put the Anaconda team more than half way to their aggressive goal!

NPV – Gold Price Scenario Comparison

Low Case – $1450 CAD/oz Gold

The low case scenario covered in the tables considers a gold price of $1450 CAD/oz, which is roughly $1160 USD/oz. The low case price is around $200 USD less than the current gold price. I am very bullish on gold and think that while there is always a possibility for it to fall to this level, I think given the current political and economic environment it is unlikely.

Never the less, at $1450/oz CAD and a 7% discount rate, the after-tax NPV for Goldboro is $44 million CAD. At the time of writing, Anaconda’s MCAP is roughly $46 million CAD, therefore at $1450/oz CAD or $1160/oz USD, Goldboro alone is estimated to be worth what the entire company is currently being valued at.

In my opinion, the infrastructure (Pine Cove Mill, Tailings Facility, Port, Roads, etc) and in-situ gold ounces of the the Point Rousse are easily worth the current MCAP, making the Goldboro Gold Project, at this point, icing on the cake, which has yet to be fully recognized.

High Case – $1700 CAD/oz Gold

The high case scenario covered in the table considers a gold price of $1700 CAD/oz, which is currently around $1360 USD/oz. Consider that the high case is around what the current gold price is sitting at, I believe this a conservative high price scenario.

The after-tax NPV at $1450 CAD/oz at a 7% discount rate is $86 million CAD, and gives us a clear picture what Goldboro is currently worth. Given the fact that I see the gold price going much higher in the years ahead, I see tremendous value in the Goldboro Gold Project.

PUSH: Anaconda began a 6,000 metre drill program near the end of 2017. Watch for drill results in the coming weeks, as Anaconda completes both infill and step-out drilling on Goldboro, in an attempt to strength confidence in its inferred resource, and expand the overall size of the deposit.

The Point Rousse Project – Argyle Gold Deposit

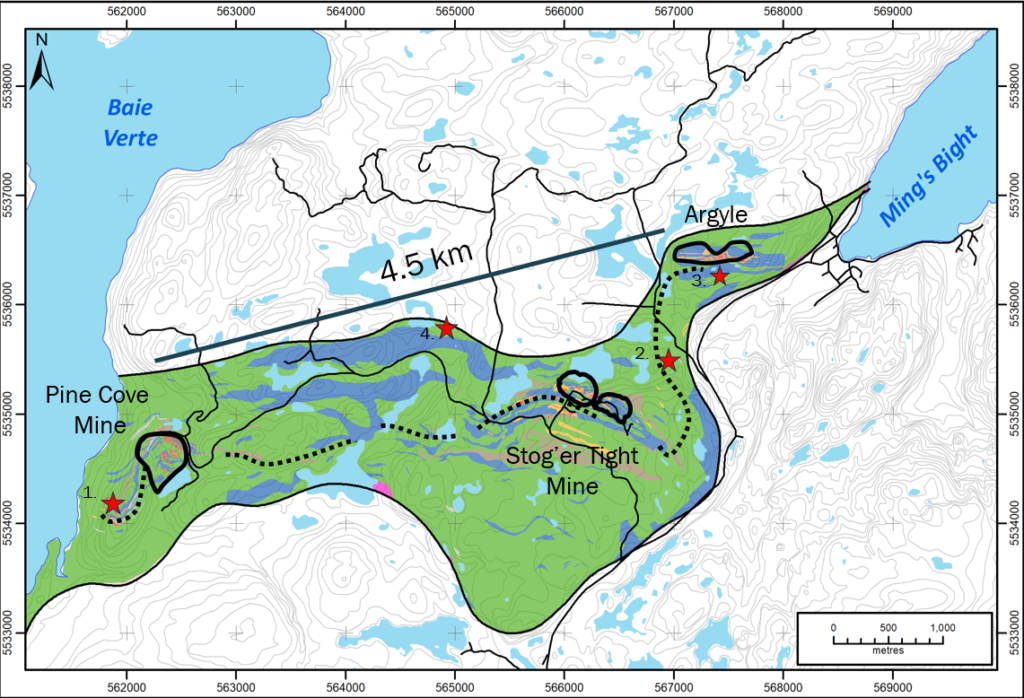

On January 8th, 2018 Anaconda announced its maiden resource estimate of its Argyle Gold Deposit, which is a part of the Point Rousse Project, near Baie Verte Newfoundland. Using the image below for reference, Argyle sits approximately 4.5 km from the Pine Cove Mill and 1.5 km from the Stog’er Tight Mine.

The Argyle Gold Deposit is defined over a strike length of 600 metres and to a down-dip depth of 225 metres and is open in all directions. Using a 0.5 g/t Au cut-off, Argyle’s maiden resource estimate is the following: Indicated Resource – 543,000 tonnes @ 2.19 g/t for 38,300 oz of gold, Inferred Resource – 517,000 tonnes @ 1.82 g/t for 30.300 oz of gold.

These are very encouraging results, given Argyle’s close proximity to the Pine Cove Mill and the fact that the Scrape Trend, the green area in the image above, has produced yet another gold deposit. Further, Anaconda has identified 4 other exploration targets within the Scrape Trend, which are identified in the image above.

Further economic discoveries in this area would be highly advantageous for Anaconda, as their proximity to existing infrastructure should prove to their development to be much easier than a Greenfield discovery.

Concluding Remarks

Anaconda has gotten off to a running start in 2018 with positive PEA results from the Goldboro Gold Project and the announcement of the Argyle Gold Deposit’s maiden resource estimate. The results of Goldboro’s PEA give us a glimpse at how transformative this project will be for Anaconda’s future as it represents an almost tripling of Anaconda’s annual gold production.

As is laid out in the Goldboro PEA news release, there are risks associated with any developmental mining project, such as environmental concerns, resource estimate reliability or reductions in metal prices. However, Anaconda’s team has proven themselves competent in the economic development of mining projects and I believe is well suited to navigate the potential pitfalls that may come with the development of Goldboro, Stog’er Tight or Argyle.

Drill results from the 6,000 metre drill program at Goldboro are upcoming and should provide some PUSH to the share price, as I believe we will see some high grade gold assays, as Anaconda further defines the existing mineralization and begins to step-out and expand the deposit.

In conclusion, I believe Anaconda is undervalued given their assets, the Point Rousse Project and Goldboro Gold Project. With the release of further drill results from Goldboro and Anaconda’s development of the Project, I believe Anaconda is due for a re-rating. Help in this regard should come from institutional level organizations which I believe will have interest in this burgeoning 100,000 oz/year gold producer, which is located one of the best jurisdictions in the world, Canada.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Brian Leni is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Brian Leni is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Junior Stock Review, especially if the investment involves a small, thinly-traded company that isn’t well known.

Brian Leni’s past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Brian Leni owns shares in the companies he features. For those reasons, please be aware that Brian Leni can be considered extremely biased in regards to the companies he writes about and features in his newsletters. You should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. Brian Leni may buy or sell at any time without notice to anyone, including readers of this newsletter.

Brian Leni shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Junior Stock Review does not undertake any obligation to publicly update or revise any statements made in this newsletter.

Brian Leni does own shares in Anaconda Mining. Anaconda Mining is a sponsor of Junior Stock Review.