Category: Data

Market Update – April 7th, 2023

Nickel Market – Is a Boom or Bust Ahead of us?

Volatility in the gold market continues.

I’m not sure when it will end.

With the gold market moving mostly sideways, base metals have been on my mind as of late.

Copper, zinc and nickel are all seeing nice strength in their price.

Will it continue?

That’s a great question.

One of the biggest lessons I have learned over the last few years is that markets are complex and, therefore, impossible to predict with any consistency.

As such, I don’t let my view on the metal price dictate how I invest my money in the junior resource sector.

Remember, junior resource companies are speculations on management’s ability to pick the right projects, form action plans to add value and, of course, raise the money needed to execute on their action plan.

Without successful execution, it doesn’t matter how high the metal price goes, there is a high probability of losing money.

With that said, I do like to understand the metals markets as best I can and form a view of where the market is and where it is going.

Let’s take a closer look at the nickel market.

The Musk Effect

“In the short-term, the market is a voting machine and in the long-term, it’s a weighing machine.†~ Rick Rule

Sentiment or narrative can be a major driver of a market in the short term, however, in the long term, the fundamentals of a company or a metals market need to be solid for gains to be sustained and perpetuated.

The cream always rises to the top.

In my view, the current nickel market is driven more by sentiment than its underlying fundamentals and, therefore, I’m skeptical of whether the nickel price can continue on its trajectory upwards.

Nickel’s bullish sentiment, I believe, has been derived from the comments made by Elon Musk, Billionaire Founder of Tesla, earlier this year.

Musk made a reference to nickel during one of Tesla’s post-earnings conference calls saying,

“Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel. Okay. Wherever you are in the world, please mine more nickel and don’t wait for nickel to go back to some long — some high point that you experienced some five years ago, whatever. Go for efficiency, obviously environmentally friendly nickel mining at high volume. Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way. So hopefully this message goes out to all mining companies. Please get nickel.â€

In my view, these comments set off two narratives;

The first, and arguably the most potent, is Musk’s request for efficient and environmentally sensitive nickel mining.

The second is Musk’s general request for more nickel to be produced.

Environmentally Sensitive Nickel Mining

A big question for me is whether Musk really understands what he is asking for when he says,

“Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way.â€

Efficient and environmentally sensitive mining, I find that very vague.

Does it mean he is making a distinction between nickel sulphide and laterite mining?

Or, does it mean, nickel mining operations that derive their power from renewable sources?

Or, is it nickel mining operations that are carbon neutral?

If this narrative is driving the market, more questions need to be asked.

Class #1 Nickel – Sulphide Versus Laterite

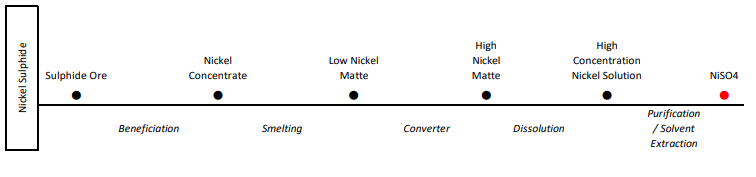

For those who don’t know, nickel sulphide mines produce nickel concentrates that are sold to smelters, which then convert the concentrate into the chemical nickel sulphate which is used by battery manufacturers.

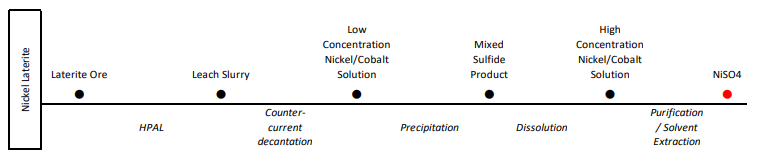

In the case of nickel laterite mines, the ore is mined and then processed through a high pressure acid leach (HPAL) circuit, which is then further processed to produce nickel sulphate.

To add, the HPAL process is more complex, requiring more steps to get to the end product and, generally speaking, has a higher carbon foot print due to emissions from the process.

It, therefore, could be the distinction that Musk is trying to make with his comments.

It’s hard to tell.

Renewable Energy Source

No matter how you slice it, most of the energy generated worldwide is still derived from fossil fuels.

Therefore, even if the mining operation is fully electrical, to be deemed environmentally sensitive, you must determine how the electricity was produced.

Was it via nuclear power or renewables?

In fact, you really have to go a step further and realize that the dams for the hydro power, the construction and materials used in nuclear power plants, the solar panels and the wind turbines were all made with metals and/or concrete, which were mined and by equipment that was most likely fueled by fossil fuels.

My point?

Stating a nickel mine has to produce its nickel in an environmentally sensitive way needs to be further defined before it’s a realistic narrative driving the nickel market.

With this said, at the moment, I’m only aware of one junior nickel company that can actually say that it has the potential to be carbon neutral.

That company is FPX Nickel Corp. (FPX:TSXV).

This isn’t meant to be an advertisement for FPX, but the reality is, it’s the only junior nickel company that I can see could even come close to fitting Musk’s criteria.

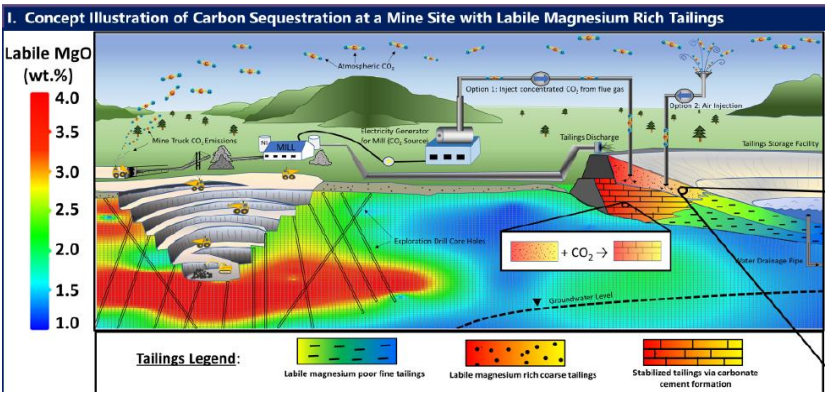

Remember from my update on FPX earlier this year, I mentioned that UBC and Trent University were collaborating on a research program which is investigating carbon capture and storage at mining sites.

FPX’s Decar Nickel District is at the centre of this research as the study looks to maximize the reaction between carbon dioxide and magnesium silicate mine tailings.

The Decar mine waste is high in Brucite, which makes it a prime candidate for carbon sequestration.

It’s, therefore, possible that a future mine at Decar could be carbon neutral.

Class #1 Nickel

On to the 2nd narrative – Class #1 nickel supply.

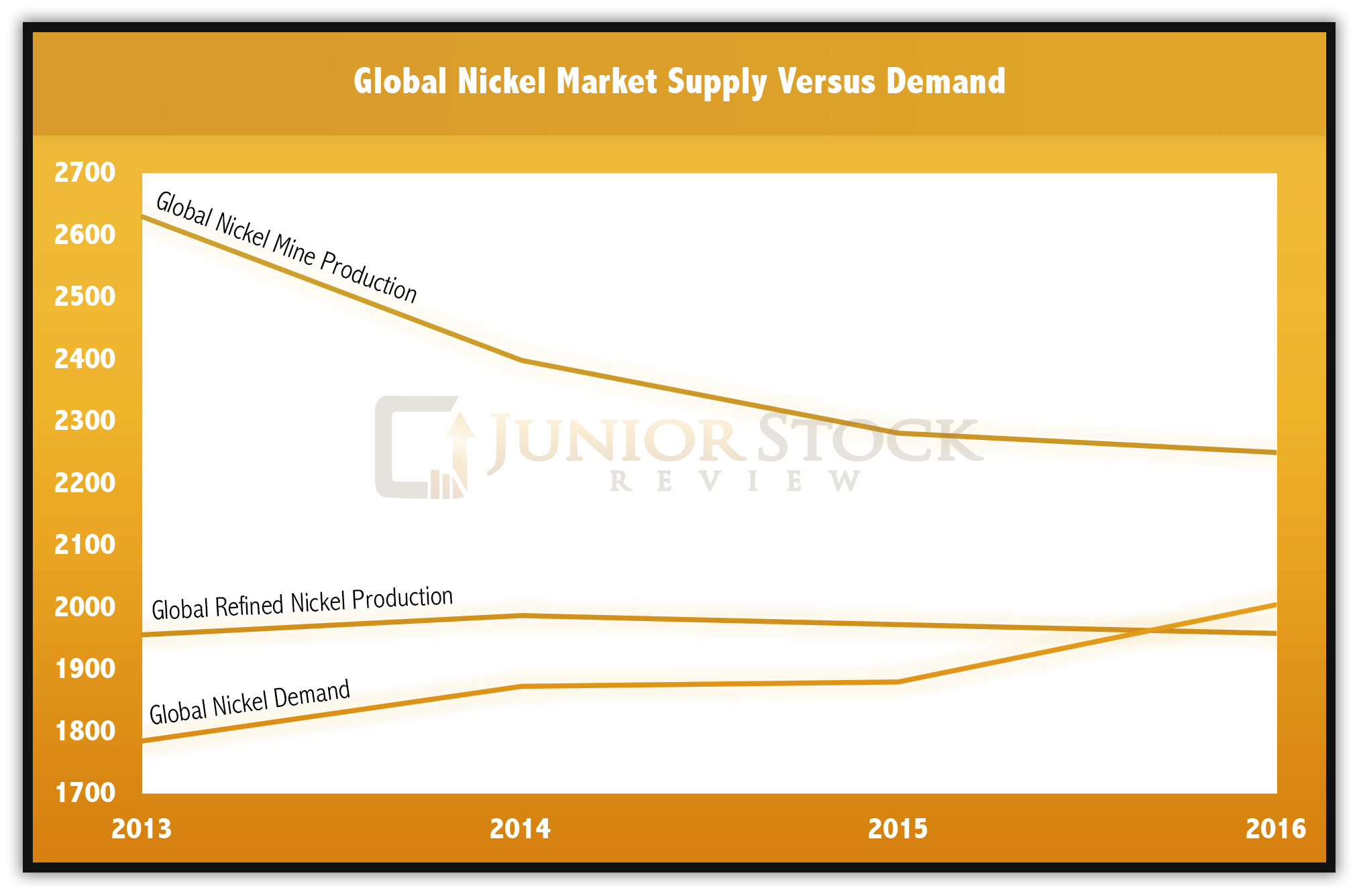

I’m bullish on nickel; my bullishness is supported by the overall fundamentals of the market and the potential for the increase in Class #1 nickel demand.

For those who don’t know, 2/3s of nickel demand is from stainless steel.

Therefore, undoubtedly, if you’re bullish on nickel, you’re bullish on stainless steel.

While stainless steel represents the backbone of the nickel market, however, it’s battery demand that holds the potential to really disrupt the nickel market in the future.

Currently, battery manufacturers make up less than 5% of the global 2 Mt nickel market.

Roughly half of the 2Mt market is derived from Class #1 nickel and this is where it gets really interesting.

In 2018, Glencore commissioned CRU to model the metal requirements of a 30% adoption rate of EVs in the global vehicle market.

The results revealed the following:

As you can see, a 30% adoption rate would result in roughly 1.1 Mt of Class #1 nickel demand.

This is interesting because, as I mentioned, the current Class #1 nickel demand worldwide is roughly 1 Mt.

Given the long duration and expense of exploration and development, which is at least 10 years from discovery to construction, it begs the question, where will the nickel come from?

This is a great question and really speaks to the amount of disruption that could occur.

The next most obvious question, therefore, is what are the odds of the EV adoption rate hitting 30% within the next 10 years?

For me, it will be determined by the following points:

- In the short term, what is the affect of a 2nd wave of Covid-19 in the last QTR of 2020?

There are a lot of unanswered questions regarding the last quarter of the year, especially when it comes to a 2nd wave of Covid-19. Further lockdowns would be devastating to the economy.

- What is the health of the global economy?

High unemployment and a stagnant economy could stall adoption of EVs for as long as the recession or depression lasts.

- Will governments around the world give further incentives to purchase EVs?

Especially in the case of poor global economics, I believe governments will have to continue, if not increase, subsidies for EV adoption. For example, we have seen in China, when the subsidy is removed, people stop buying them.

- EV infrastructure spending

Large scale EV adoption will require more EV infrastructure to be built, at home, at work and in the public realm – malls, restaurants, highways, etc.

If left to the free market, I would say we are still a ways away from adopting EVs into our everyday life.

But we don’t live in a free market.

Governments around the world are becoming larger and larger parts of the economy and, therefore, destroy any of the logic or economic factors that usually control markets.

I can’t say with any certainty what will or won’t happen, but what I can say is that if the government decides that the push is toward renewable energy and EV adoption, that is where the money will flow.

For instance, it’s rumoured that the Canadian government will soon unveil their version of “The Green New Deal.â€

If true, I would guess that it’s very likely we would see some incentive for EV adoption.

The Canadian market is small and, therefore, I don’t foresee it actually making a discernible difference to the EV market on a whole, but if this is indicative of a broader trend, things might actually fall in place.

Future Role of Nickel Laterites

As I outlined earlier, nickel laterites can be processed into Class #1 nickel with the help of the HPAL process.

Back in 2018, Tsinghan, a Chinese company, made the headlines within the nickel space as they toted the ability to construct a 50,000 tonne per year HPAL plant in Indonesia in just over a year, for $700ishM.

Tsinghan has a great reputation in the market for the pioneering of the NPI processing, which revolutionized the nickel market in the early 2000s.

This proclamation was, therefore, taken literally.

The nickel price sunk, as the market determined that the affect of an increase in demand to Class #1 market over time would be quelled if Tsinghan had this ability to construct a HPAL plant of this size, on the tight construction schedule and for under a billion dollars.

In the 2 years since, Tsinghan has experienced many of the historical delays associated with building a HPAL plant.

They have delayed construction and added upfront capital expenditures to continue to move forward with development.

With that said, in my view, I do believe that Tsinghan will be successful in constructing the plant.

Also, I think that as long as the Class #1 nickel market doesn’t require a certain environmental standard in the future, HPAL processing of nickel laterites will help quell some of the disruption caused by the potential surge in Class #1 nickel demand, albeit at a nickel price higher than US$10/lbs.

Nickel Market Fundamentals

Supply and demand fundamentals must be solid for any market to be strong over the long-term.

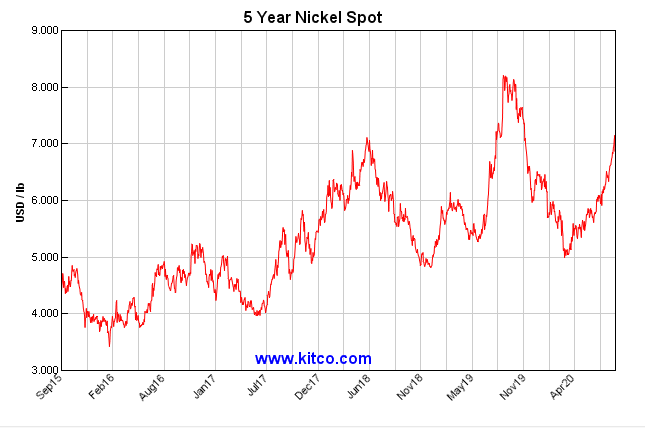

As I said, in my view, the current uptick in the nickel price is mainly driven by sentiment rather than underlying supply and demand fundamentals.

With that said, I think that there are many points to be bullish about.

Nickel Inventory

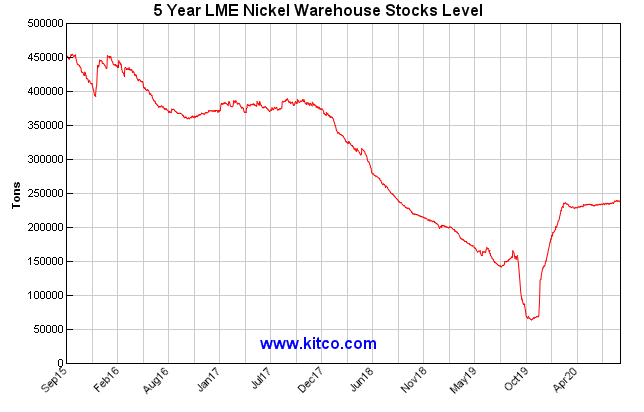

Over the last 5 years, the LME nickel inventories have been trending in the right direction.

As you can see from the graph, the inventory levels have steadily fallen since 2017, with a dramatic draw down in 2019.

The dramatic draw, however, was met with almost as dramatic a spike in the 10 months since, and now sits above the 200kt level.

The LME warehouses an inventory of Class #1 and is a key factor in gauging the health of the nickel market.

If we were to begin to see inventories drawn down once again, it would be very bullish for the nickel price, with the proviso that the reason for its depletion could be linked to a sustained source of demand or a permanent loss of supply.

As it stands right now, in a post pandemic world, nickel market analysts are calling for a surplus of supply to end 2020.

This is in sharp contrast to the pre-pandemic nickel market, where analysts were calling for a supply deficit.

NorNickel Corp Presentation – May 2020

Nickel Sulphide Supply

What I find most interesting about nickel sulphides is that not only are their production figures predicted to curtail over the coming years, but the amount of projects awaiting development is low.

Why is this?

In my mind, there are 2 reasons:

- First, a bear market in the nickel price, which pre-dates 2016, has stunted exploration.

- Second is the fact that exploring for these deep deposits is very costly. Drilling for a deposit at depths greater than 500m adds up quickly. Plus, if you add in the costs associated with tough terrain and weather, you have the perfect storm for short and costly drill seasons.

NOTE: A high percentage of nickel sulphide exploration is concentrated in cold climates – Russia, Finland, Greenland and Canada. Why? Most of the discoverable nickel sulphide deposits found around the equator or in hotter and wetter climates have mostly been converted, by nature, into nickel laterite deposits. Thus, nickel laterite deposits account for up to 70% of the known crustal nickel deposits on the earth.

Constrained nickel sulphide supply has the potential to be very bullish for the nickel price moving forward, however, it will have to be mixed with strong demand to be fully realized.

Nickel Demand

In my view, nickel demand is the key to understanding where the nickel price is headed in the future.

As I outlined earlier in the article, increased demand for Class #1 nickel from battery manufacturers and/or speciality steel makers has the potential to dramatically disrupt the nickel market.

Demand in the range of 500kt to 1Mt of Class #1 nickel per year by 2030 would very quickly reveal the short fall in supply from the nickel sulphide producers, and require much higher nickel prices to allow HPAL processing to economically participate in actively supplying the market.

Concluding Remarks

Generally speaking, I’m very bullish on the long-term potential for higher nickel prices.

With that said, I remain skeptical of the short-term longevity of the current run in the nickel price.

The global economy remains in disarray and, although governments have pledged unlimited amounts of QE to stimulate inflation, I’m still left with many questions about the remaining 3.5 months in 2020.

How will the U.S. election result affect both the U.S. and world economy?

Does a Trump re-election mean the broader stock market can continue upward?

Does a Biden win result in more socialist government policy? If so, what is the fall-out for the American economy?

Will there be a 2nd wave of Covid-19? If so, will governments revert back to complete lockdowns of their economies?

Is the U.S. headed to war with China? The world’s two largest economies remain at odds, with potential conflicts on a range of topics such as, the South China Sea, Covid-19, and human rights violations.

In my view, the next 3.5 months should provide us with a few of the answers to these questions, which will allow us to see more clearly into where things are headed in 2021.

In the end, the fact remains that markets are impossible to predict with any consistency.

Instead, I believe it’s pertinent to remain focused on the reasons why we are speculating in the junior companies.

Understand why a company is undervalued and how they will unlock that value through the execution of their action plans.

Time will tell where we are headed.

Get the e-book Junior Resource Sector Investing Success: The Risks, Rules & Strategies You Need to Know today, when you become a FREE Junior Stock Review VIP

Use the Coupon Code DILIGENT to get 25% off a subscription to and get my best investment ideas and commentary first.

Until next time,

Brian Leni P.Eng

Founder and Editor – Junior Stock Review Premium

The Nickel Market: Investing Ahead of the Crowd – Part 1

First and foremost, the way to make money on a consistent basis in the junior mining sector is to buy quality. Chasing what is hot in the market typically means you are too late to the story. However, in my opinion, it’s still necessary to have a good idea of where the commodity is within the cycle, as buying near the bottom of the cycle will tilt the odds of success in your favour.

Today, we’re going to look at a base metal market which has been beat up over the last few years, but may be on its way up. This metal is nickel, one of the most important metals of our industrial world.

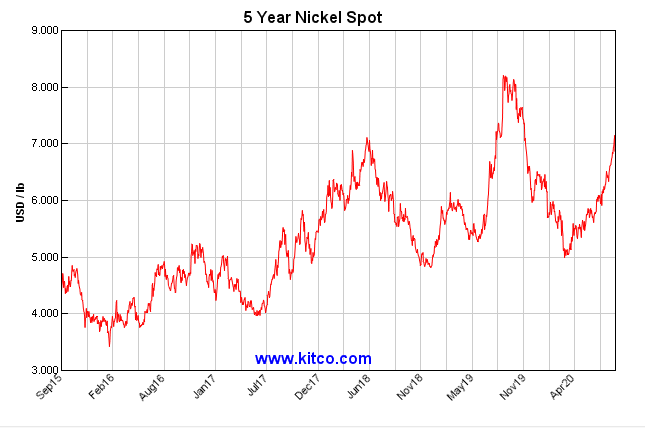

For the most part, nickel has been somewhat off the radar in the resource investment world; in the 4 years preceding 2016, the nickel market was over-supplied with nickel ore, sending the nickel price to 5 year lows under $4 USD/lbs.

2016 may have marked the bounce back in nickel prices for a number of reasons that we will get into later on in this report. Before we get into the supply and demand fundamentals, let’s take a look at some basic geological background information on the metal.

Nickel Ore

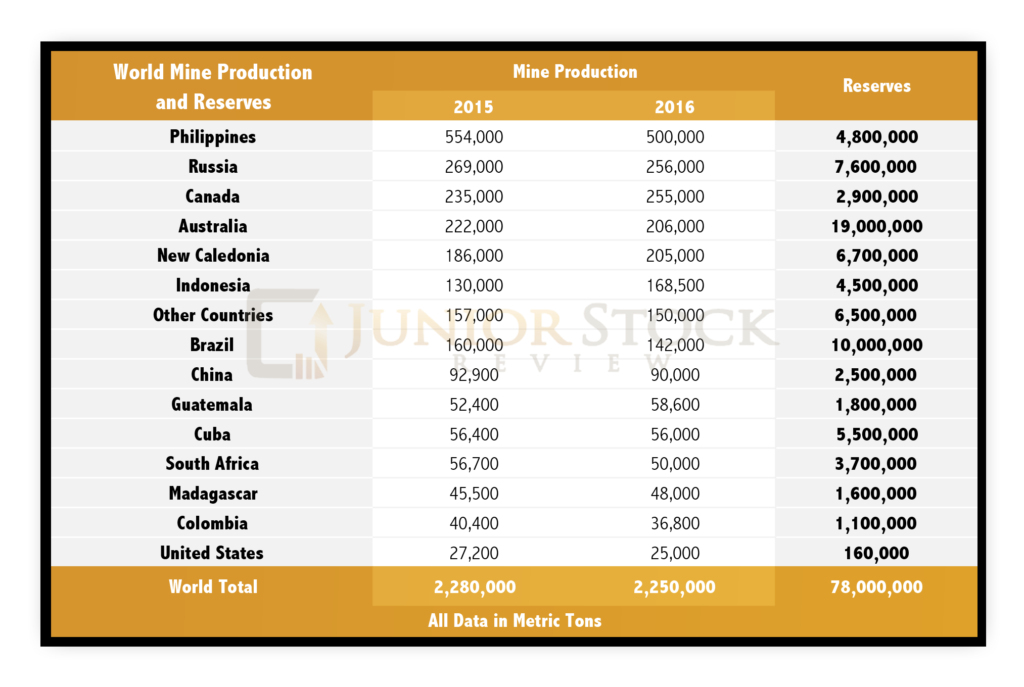

In the U.S. Geological Survey’s(USGS) 2017 review, it states that the world has 78 million metric tons of nickel reserves and produced roughly 2.25 million metric tons of nickel ore in 2016.

Source: US Geological Survey

Nickel is most often found in two types of ores, sulfides or laterites. While nickel laterite ores are more commonly found in the world, they are mined less than nickel sulfide ores, which make up the vast majority of current and historical production.

Laterites are formed near surface, typically in tropical regions, where high rainfall and higher temperatures have released the nickel from ultramafic rocks, forming highly leached soils. Laterite deposits are commonly found around the equator, for example the Philippines, Indonesia, Western Australia and southern Africa.

Nickel laterite ores are mined less often than sulfide ores because they require more extensive and more complicated processing to extract the nickel. Higher cost of production means these deposits typically sit and wait for higher nickel prices to make them economic.

Nickel sulfide ores are associated with ultramafic rocks, which sit near the surface. It’s theorized that during formation, ultramafic flows picked up sulphur droplets from adjacent rock. As the sulphur droplets moved through the ultramafic flow, they collected nickel, copper and other platinum group metals. Thus, we’re left today with nickel sulphide deposits that commonly have these other metal types.

A Conversation with Martin Turenne

I had the chance to ask FPX Nickel CEO, Martin Turenne, a series of questions pertaining to the global nickel market. Highlights from our interview will be shared throughout the report.

FPX Nickel Corp. (FPX:TSXV)

MCAP – $13.4 million CAD (at the time of writing)

CEO – Martin Turenne

FPX Nickel is developing its flagship Decar nickel project, located in central British Columbia, Canada. The Decar project is a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite.

Nickel Supply Analysis

Nickel ore is mined all across the world, however, the majority of current production is concentrated in a few keys areas: the Philippines, Russia, Canada, Australia, New Caledonia and Indonesia.

As a country, the Philippines represents roughly 20% of the world’s nickel production. Rewinding back to 2013, global nickel production looked much different, as Indonesia was the largest producer in the world, representing an overwhelming 34% of the market. However, this changed very quickly in 2014.

Indonesia’s Nickel Ban

Why did Indonesia’s production fall in 2014? In a nutshell, the Indonesian government instituted a ban on nickel ore exports in an effort to encourage investment in downstream nickel ore smelting operations. Prior to 2014, China, the largest importer of Indonesian nickel ore, would ship the raw nickel ore back to its smelters, where it would be processed into nickel pig iron (NPI).

NPI is a ferronickel product, the creation of which is credited to China, and it can be used in the making of stainless steel. Stainless steel producers have a choice between using NPI or pure nickel in their process, however, NPI is typically a cheaper alternative.

NPI is created using low grade, laterite nickel ores which are mixed with coking coal and a mixture of fluxes. The process culminates in a blast furnace, which renders the unwanted impurities into slag and allows the molten mixture to be cast into molds, forming nickel pig iron.

While the Chinese provided Indonesia’s nickel mines with steady demand for the ore, the Indonesian government wanted more from the industry and, thus, in 2014 issued a ban on the exporting of nickel ore.

To date, it would appear that this ban hasn’t worked out as well as the Indonesian government would have hoped, as earlier this year they relaxed their stance on nickel ore exports, saying that some approved, low grade (less than 1.7% Ni content) nickel ores could be released into the market, provided the buyer expresses a commitment to build a smelting operation in Indonesia within five years.

Considering this, I asked Martin the following:

Question 1:

In your opinion, will the Indonesian government further relax or lift their nickel ore export ban and how will that affect the global nickel market?

Martin: If the Indonesian government wants to encourage greater investment in domestic smelting capacity, it will not further relax or lift the export ban. When the export ban was relaxed earlier this year, the nickel price dropped; the Indonesian Smelter Association has since reported the closure of 13 out of 25 Indonesian nickel pig iron (“NPI”) smelters due to low nickel prices. So relaxing the ban has defeated the purpose of its initial implementation, which was to encourage investment in new smelter capacity. The relaxation of the export ban has actually had a relatively neutral impact on global nickel supply this year; to the extent the ban is further relaxed, any increase in Chinese NPI production is largely offset by lower Indonesian NPI production, and this limits the potential for further development of Indonesian NPI smelters going forward.

The Environment and its Effect on the Nickel Market

I don’t think it should come as a surprise to anyone that the environment and how we live in it is becoming a larger political issue around the world with each passing day. A large segment of the population is demanding both industry and individuals reduce their impact on the environment, mainly via reducing carbon emissions.

The Paris Accord and the 450 Scenario are two examples of organized attempts to bring countries together in addressing our impact to the environment. While many countries have embraced these hefty goals for carbon emissions, there are still countries that choose not to conform to the trend, as well as others who are walking to the beat of their own drum by setting their own goals and plans to achieve them.

China has long been associated with poor air quality in its cities, an unfortunate trade-off for the country’s massive manufacturing industry. This trade-off has long been accepted, but this sentiment is quickly changing, as the Chinese government has begun to target industries that contribute significantly to air pollution, forcing them to shut down or improve their process.

Earlier this year, I wrote about the effect this has had on China’s zinc smelting operations and how that loss of smelting capacity has further contributed to the supply crunch in the zinc market. Nickel is no different, as, most notably, the Philippines are shutting or suspending nickel operations in an effort to reduce the industry’s affect on the environment.

The Philippines is particularly interesting in the nickel space, because they are by far the largest producer of nickel ore in the world. Anglo America states,

“The Philippines has ordered many nickel mines to shutdown, or to suspend operations, accounting for [roughly] 50% of the country’s annual output, [roughly] 10% of world mine supply” ~ April 2017 Nickel Perspectives Presentation – Slide 7

Further, the Philippines Department of Environmental and Natural Resources’ (DENR) Environmental Secretary, Gina Lopez, said in reference to the mine closures and their environmental impacts,

“My issue here is not about mining. My issue here is social justice. If there are businesses and foreigners that go and utilize the resources of that area for their benefit and the people of the island suffer, that’s social injustice.” ~ DENR

Philippine Ban on Nickel Ore Exports?

In recent developments, as reported by Channel NewsAsia on August 25, 2017,

“Philippine lawmakers have filed a bill seeking to ban mining in watershed areas and exports of unprocessed ores and will require miners to get legislative approval before operating, in line with President Rodrigo Duterte’s pledge to overhaul the sector.”

This would have major implications on the nickel market if it becomes official policy. As stated earlier, the Philippine government had already started to suspend and shut down mining operations due to their affect on the environment. Taking it a massive step forward is incorporating a ban on the export of unprocessed ore.

We need to keep a close eye on this, because in my mind, this makes the nickel narrative very bullish.

Question 2:

Brian: In what appears to be a growing trend, the Philippines have ordered the suspension or closure of roughly 50% of their nickel producing mines due to environmental concerns.

In your opinion, will the environment continue to play a role in the global nickel market moving forward, or are the actions by the Philippine government an isolated situation? If this is just the tip of the iceberg, how do you foresee it affecting future nickel supply?

Martin: The environmental factor could be significant going forward, because mining practices in the Philippines can be pretty gruesome for the local ecosystem, and the move to suspend operations has very vocal support from Filipino President Duterte and local populations. Beyond that, we have recently started to see some curtailing of NPI smelting operations in China, which are very dirty operations. Given China’s current crackdowns on polluting industries, and given that the country has capacity to produce up to 20-25% of global refined nickel supply, smelter shutdowns there are significant for the market.

Nickel Producers by Company

Source: Statista

Two companies stand above the rest when it comes to world nickel production, Vale and Norilsk Nickel. Combined, they control more than a quarter of the nickel produced in the world, let’s take a look at these two companies.

Vale (VALE:NYSE)

Share Price – $10.17 USD (at the time of writing)

MCAP – $52.4 Billion USD

Vale is a major resource company with a variety of different areas of business: mining, logistics, energy and steelmaking. While they have multiple cash flow sources, they are primarily a mining company. As a mining company, they have operations that mine iron ore, nickel, coal, copper, fertilizers and manganese/ ferro-alloys.

Currently, Vale is the largest producer of nickel ore, with 14% of the global market. Vale’s nickel operations are in Brazil, Canada, Indonesia and New Caledonia. Also, Vale is a refiner with both fully owned and joint venture operations in China, South Korea, Japan, the United Kingdom and Taiwan.

One of Vale’s largest footprints is in Canada with offices or mining operations in the following cities: Toronto, Sudbury, Port Colborne, Thompson, St. John’s, Voisey’s Bay and Long Harbour.

- Vale’s Sudbury location employs roughly 4000 people and is one of their largest properties with six mines, a mill, a smelter, and a refinery. Along with nickel, the mines also produce copper, cobalt, platinum group metals, gold and silver.

Norilsk Nickel (MNOD:LSE)

Share Price – $15.35 USD (at the time of writing)

MCAP – $24.14 Billion USD

Norilsk is a Russian company and the 2nd largest nickel producer in the world. As their name would suggest, nickel is their primary focus, however, they do produce a number of other metals, including: palladium, platinum, copper, cobalt, rhodium, silver, gold, iridium, ruthenium, selenium, tellurium and sulphur.

Norilsk’s main mining operations are as follows:

- Polar Division – Located in Russia, north of Arctic Circle. The Polar Division has 4 mines which produce sulfide copper-nickel ores.

- Kola MMC – Located in Russia, near the border with Norway and Finland. Kola has sulfide disseminated ores mainly containing nickel and copper. The ore is then processed into a collective copper-nickel concentrate. Kola’s refining facilities can then create electrolyte nickel and copper, carbonyl nickel, cobalt concentrate and precious metals concentrates.

- Norilsk Nickel Finland – Located in Finland, it is the only refining plant in the country. The refinery processes nickel concentrates from Norilsk’s other operations.

- Norilsk Nickel Australia – Operations are currently suspended.

- Norilsk Nickel Africa – 85% ownership of Tati Nickel Mining Company in Botswana and 50% ownership in Nkomati in South Africa.

Question #3

Brian: The major mining companies are typically a great gauge for the supply and demand fundamentals in their given sector.

In your opinion, from the information they are disseminating, where is the nickel market currently and where is it headed?

Martin: In terms of market fundamentals, all the analysts and the major companies are aligned in predicting supply deficits for the next several years and rising nickel prices. You just have to look at the deficit forecasts recently disclosed by Norilsk and Sumitomo Metal Mining, to name just two. We are also seeing companies like Glencore and BHP very publicly highlighting the growth in nickel demand from electric vehicle batteries, and the hugely bullish implications of that for the nickel price. Finally, we are starting to see majors starting to look for growth opportunities for their nickel businesses; that’s a common theme we hear when speaking to those companies and to investment bankers in the industry. As the nickel price continues to strengthen, that urgency to acquire new projects will pick up considerably.

Question#4

Brian: Mines are depleting assets and, therefore, regardless of where we are in the bull or bear cycle, the major mining companies, when push comes to shove, have to replenish their coffers with more pounds or ounces of metal on a continuous basis.

Roughly, 60% of the world’s nickel production is from major mining companies, which, in my mind, means that good nickel deposits are typically bought up in the market by the majors versus being developed by the junior that discovers them.

How close and what do you believe will be the catalyst for the next merger and acquisition rush in the nickel sector? Please explain.

Martin: Just one year ago at this time, mid-tier and major companies in base and diversified metals were still focused on repairing their balance sheets and in divesting non-core assets; growth wasn’t on their radar at all. With the subsequent run in the prices of base metals and bulks, those same companies are now generally very profitable again, and given that their pipeline of new projects is relatively empty, they are actively seeking growth opportunities and looking to add new development projects to their portfolio. We’ve started to see a few mid-tiers and majors investing into copper and zinc projects, and I would expect you will see them looking to add nickel assets into their portfolio next. The fact that there’s been so little investment in base metal projects in the past few years bodes extremely well for companies like FPX Nickel – companies with large, low-cost development-stage assets located in attractive jurisdictions.

Nickel Mine Production Changes

Existing and newly approved nickel mining operations are projected to show an average yearly increase of roughly 440,000 tonnes of production leading up to 2020. Let’s take a look at a few of the largest contributors by country.

- Indonesia is set to have the largest yearly increase in production with an average of roughly 258,000 tonnes of laterite ore over the next 4 years. Indonesia’s expected production increase is directly related to the low-grade ore which will exported.

- Guatemala’s Fenix Mine is projected to show an average yearly increase of 27,000 tonnes of laterite ore over the next 4 years. The Fenix Mine was reopened in 2014 after 30 years of closure due to disputes over land ownership.

- Finland’s Talvivaara (Sotkamo) and Kevitsa Mines are set to increase yearly production on average by 25,800 tonnes of sulphide ore over the next 4 years. The Talvivaara Mine will show the bulk of the increase in production. It is located in Sotkamo, and is mined by Talvivaara Mining Company, a company which has had its share of issues, including bankruptcy in 2014 and a tailings spill. The company has since signed a 10 year deal with Norilsk Nickel, which will buy all of its nickel and cobalt production over the contract period.

- Australia’s Nova-Bollinger Mine is projected to increase its average yearly production by 20,400 tonnes of sulphide ore over the next 4 years. The Nova-Bollinger Mine is owned and operated by Independence Group, which is an ASX listed diversified mining, development and exploration company.

A decline in the yearly production of currently producing nickel mines is projected to average 270,000 tonnes leading up to 2020. Here’s a look at some of the larger reductions in nickel production from around the world.

- Australia’s Long and Savannah Mines are expected to decrease their yearly production by a combined average of roughly 10,000 tonnes until 2019 and 2020 where that will double to 20,000 tonnes. The Long mine is owned and operated by Independence Group, which purchased the project in 2002 from BHP. The Savannah Nickel & Cobalt Mine is owned and operated by Panoramic Resources. All of the mineral concentrate produced by the Savannah mine is contractually sold to Jinchuan Group, one of the world’s largest nickel companies.

- Brazil’s Mirabela and Niquel Tocantins Mines’ yearly production is expected to decrease by a combined 46,000 tonnes per year leading up to 2020.

- Guatemala’s Montufar – Garnierite Mine is expected to decrease its average yearly production by 20,000 tonnes over the next 4 years.

Subtracting the projected decreases to increases in production, by 2020, the yearly available supply should roughly increase by 174,000 tonnes. However, a major wild card in this estimate is the actions by the Filipino and Indonesian governments. They hold a lot of influence on the future supply numbers, positive or negative.

Global Reported Nickel Inventories

When examining the supply numbers for any of the industrial metals, it’s important to check the inventory levels held by the London Metal Exchange (LME), Shanghai Futures Exchange (SHFE) and bonded warehouses.

London Metal Exchange

For those who aren’t aware, the LME is a major world centre for the trading of futures contracts in industrial metals. Established in 1877, the LME has a long history in the metals industry and, thus, has a great network of warehouses around the world.

Shanghai Futures Exchange

The SHFE is Asia’s answer to the LME, as it allows for futures contracts trading of a number of different commodities, which include: gold, silver, copper, aluminum, nickel, steel rebar, zinc, etc. While not being as old as the LME, the SHFE has become a major part of the global market, one that needs to be considered when researching any commodity.

Total Nickel Inventory Levels

Examining the total global nickel inventory, you see that they are down 15% from the April 2016 peak, and down 10% year-to-date in 2017. Currently, total global inventories sit just below 500,000 tons. (Source: ScotiaBank and RBC Capital Markets) Contrasting this against 2016 production levels, which were 2.25 million tons, the current total global inventory represents roughly 22% or 3 months of annual production.

To note, the LME nickel supply makes up roughly 80% of the total global nickel inventory. For those interested, the LME inventory data is readily available on their site or on the Kitco site. The LME’s nickel 5 year stock level chart shows that since 2012, nickel inventories have grown from just over 100,000 tons to a high in 2015 of roughly 450,000 tons. However, since 2015, these stock levels have fallen down below 400,000 tons.

Question #5

Brian: LME nickel inventory levels have trended downwards after hitting a 5 year high in 2015. Current LME nickel inventory is sitting just below 400,000 tons, which is roughly 18% of 2016 world nickel production.

How much influence does the LME inventory supply have on the nickel price? Secondly, is there a key inventory level which can be looked at as critical to its influence on the nickel market?

Martin: Global reported inventories do have a big influence, and we are a ways off from reaching a critical level in terms of perceived tightness in nickel inventories. I think the important takeaway is that global reported inventory levels are down 15% from the peak in April 2016, which reflects the supply deficit in 2016 and 2017; so we have some very positive momentum in inventory draw downs and spot price escalation. More importantly, the analyst consensus is for more severe supply deficits over the next several years, which is the fundamental driver for an increase in prices going forward. Among the major metals, nickel has by far the most upside from the current spot price; the long-term consensus forecast price is around $7.50/lb, which means the price has to go up 45% to reach a stable long-term equilibrium, whereas the current spot price for copper and zinc is already at or above the long-term consensus forecast level. If you’re looking for the base metal with the most upside, nickel is the choice.

Nickel Supply Concluding Remarks

Like all commodities markets, the supply fundamentals of any particular metal are complicated, not only from a quantitative perspective, but also because these markets are so large and widespread. Their size and geography leave them very susceptible to the jurisdictional risk that we all stress about when investing in individual mining companies.

There were a number of topics discussed in the article, let’s recap some of the key nickel supply numbers and the factors affecting its current and future supply:

- 2016 marked the first year in the last 5 where the nickel supply was out-stripped by demand.

- Major nickel producers believe that we will see continued supply deficits and a rising nickel price over the next few years.

- The Indonesian partial ban on nickel exports should continue as the country looks to develop its smelting industry.

- The Philippines have suspended or closed roughly 50% of its annual nickel production due to environmental concerns. In 2016, the Philippines were the world’s largest nickel producer, given the current direction of government policy, this may not be the case in 2017.

- Subtracting the projected decreases to increases in nickel production, by 2020, the yearly available supply should roughly increase by 174,000 tonnes. The Philippines and Indonesia are wild cards in this projection.

- Total global nickel inventories are trending downwards, falling 15% to below 500,000 tonnes, since hitting a high in April of 2016.

The Philippines and Indonesian will have a major impact on the direction of the nickel price. If things remain status quo, it would appear that the nickel supply should continue to get out-stripped by demand.

However, we have only covered only one component of the equation; we need to look at nickel demand. What does the nickel demand look like, currently? From there, we can make some conclusions about where we think the market is headed. Stay tuned!

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company(s) and sector that is best suited for your personal investment criteria. Junior Stock Review does not guarantee the accuracy of any of the analytics used in this report. I do own FPX Nickel Corp. shares. I have NOT been compensated to write this article.

Drug Lord Book Review – Drugs, Sex and Speculation

Drug Lord is the 2nd book of 7 in the High Ground Novel Series, written collaboratively by Doug Casey and John Hunt. Drawing on Casey’s experience as an international speculator and Hunt’s career as a medical doctor, Drug Lord tells a riveting tale about Charles Knight as he transitions into one of society’s unjustly besmirched and most politically incorrect occupations, a drug lord.

For those who haven’t read the first book in the High Ground Novel Series, Speculator, here’s a quick snapshot of how the main character, Charles Knight, developed into the man that we meet in Drug Lord.

Speculator tells the story of Charles Knight as he finds himself in the fictional West African country of Gondwana, where he’s performing his due diligence and investigating a junior gold mining company in which he has a major position.

What Knight finds will forever change him, because he’s given a crash course in some of the evils that lurk in our world. Knight is a curious young man of high moral character and, thus, won’t allow the fraud that he has uncovered to go without repercussion. Read my review of Speculator here.

Drug Lord

Drug Lord takes place seven years after Knight uncovers B-F Exploration’s fraud, and he’s making his way back to the United States, where he’s planning to use the culmination of what he’s learned, thus far, in his young life to disrupt the hypocritically governed pharmaceutical industry.

Knight’s plans are two-fold; distribute cheap generic brands of a few immensely popular drugs, including Viagra, and take a large speculative position in a small drug development company, Visioryme. This two pronged plan forces Knight to use his intuition and street smarts to navigate both the Federal Drug and Administration (FDA) hurdles and establish himself on the streets as a drug lord.

Knight is opposed by agents of the FDA, DEA, the newly formed Sybillene Eradication Task Force (SETF) and the return of Sabina Heidel, the sociopathic vixen from Speculator. The opposition is fierce and will stand at nothing to stop Knight, not even the killing of innocents.

Morality

In my opinion, the major theme found throughout the book is morality, and more specifically, living a moral life is not only a personal pursuit, but something that you should look for in other people, as well. Knight holds himself and the people he calls friends to a high moral standard. In a conversation between Knight and his business associate, Epsilon, where Epsilon asks why Knight let ‘the Fat Man,’ a drug cartel leader, live, Knight replies;

“I don’t know if it was wise, Epsilon…But the Fat Man didn’t attack us. So, for better or worse, I think we had no choice. Epsilon replies, ‘Let’s hope it works out for the best, Paladin.’ Charles frowned. In the dictionary, hope falls between hell and hysteria.†~Drug Lord – pg.226

This is a very important conversation for two reasons: Firstly, Knight’s decision to not kill ‘the Fat Man’ was based on his morals; if the person hasn’t done wrong to me, I can’t do wrong to them. This ideology is the basis for how Knight acts and reacts to the world around him.

Secondly, from a speculation perspective, whenever you’re hoping for an outcome instead of having a calculated reason to believe in an outcome, you and your speculation are most likely doomed.

Anti-Depressant to Naked Emperor

A pivotal point in the story, Knight finds himself in the Capital Building before a committee of government officials. Knight has been called before this committee because Visioryme’s drug, Sybillene, a newly FDA-approved anti-depressant medication, is revealed to be a ‘truth serum,’ so to speak. When 10 times the recommended dosage is taken, it allows people to see through the smoke and mirrors of everything that’s a fraud in our society.

This off-label use is a threat not only to institutions like the FDA, but up to the highest cog on the chain, the United States government. While the committee believes Knight will back down from their evil and immoral pursuit of shutting down the distribution of Sybillene, Knight has other ideas.

Knight says,

“There are essentially four ways to deal with evil. You can bow to it, and let it rule you. You can pretend it doesn’t exist. You can try to run, and hope it won’t find you. Or you can confront it, and attack it. Only the last alternative has a chance of success of more than a moment.†~Drug Lord – pg.244

These courageous words speak a lot of truth; in the face of evil or adversity, what will you do? In my opinion, most of society pretends evil doesn’t exist, shutting off their ability to critically think through the trials and tribulations that are and will affect us as a society in the future.

Instead, the ‘thinking’ is left to government officials, primarily sociopaths, that seek to control and proliferate an agenda which doesn’t have the population’s best interests at heart. On a personal level, the older I get, the more I think that people are really only capable of effectively governing themselves, because although this comes with the stigma of being selfish, living our lives by a set of morals and the intention of our own success allows everyone in the society to prosper.

Concluding Thoughts

Today, in 2017, we stand on the precipice of major change because the world financial system is broken and will inevitably need to change. How and by whom it is changed will speak volumes about where society is from a cognitive perspective.

Sybillene or Naked Emperor, as it became more popularly known in the book, could be a metaphor for future events, however, it will come down to a choice; more of the status quo or can we make a dramatic change in the direction of liberty? Time will tell if we are true to ourselves.

To conclude, Drug Lord is a fantastic follow up in the High Ground Novel Series, one that will keep you glued to your seat as you follow Knight in his journey. Â There are many lessons to be gleaned from this story, but at the very least, it’s highly entertaining! You won’t be disappointed.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Newfoundland & Labrador – A New Frontier for Gold Exploration

Canada is well known for its gold mineralization; the Abitibi Greenstone Belt in Northern Ontario and Quebec, the Golden Triangle in Northern British Columbia and the White Gold District in the Yukon.

Source: Anaconda Mining – Viking Project

Lesser known, but quickly emerging as the next frontier in Canadian gold mining exploration and development, is Newfoundland & Labrador (NL). Over the last year, NL has seen a staking rush and looks to be added to the list of world-class destinations for mineral exploration.

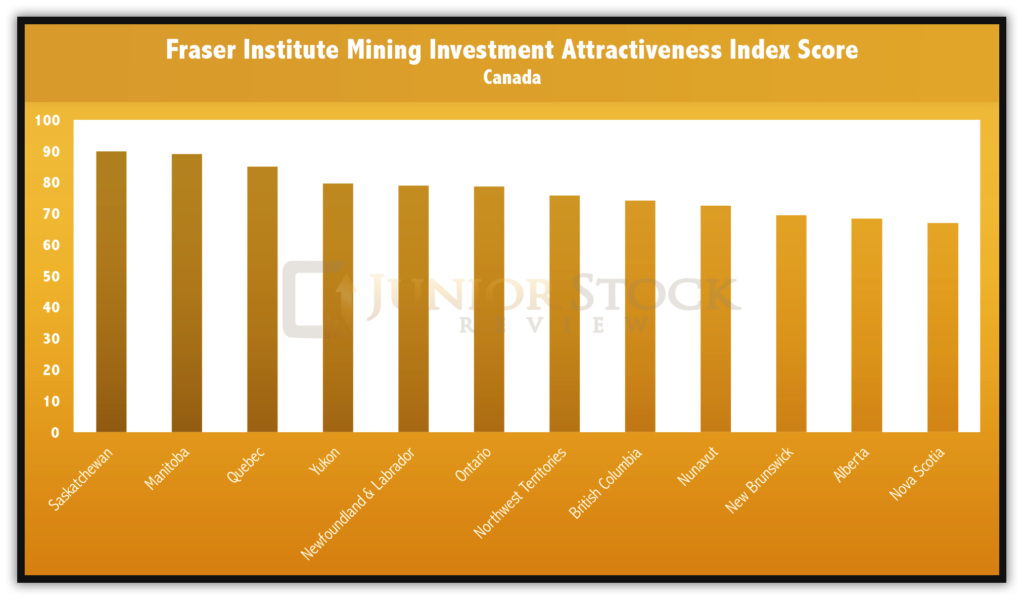

Source: Fraser Institute

This opinion is shared by the Fraser Institute, as it Ranks NL 5th in Canada and among the top in the world when it comes to mining investment attractiveness. The mining investment attractiveness score is a combination of the politics and, most importantly, the geological appeal of the region.

Examining the rankings, you can see that NL ranks ahead of a couple of the more well known Canadian provinces, Ontario and British Columbia.

Let’s take a look at why NL scores so well in politics and geologic attractiveness.

Newfoundland & Labrador’s Geology

NL’s Ministry of Natural Resources’ website has a tremendous library of resources available to anyone looking to learn what the island has to offer from a mineralization perspective.

The island can be broken down into 4 geological zones: (NL Ministry of Natural Resources)

- Starting on the western most portion of the island, we have the Humber Zone, which hosts Mid-Paleozoic extensional cover basins, Siluro-Devonian plutonic & volcanic rocks and Early Paleozoic rift, slope, shelf and foreland basin-facies carbonate and siliciclastic rocks.

- The Dunnage Zone sits on the Humber Zone’s eastern border and hosts Silurian marine to terrestrial volcano-sedimentary basins, Cambro-Ordovician marine volcanic and sedimentary rocks of arc and back-arc origin, including ophiolite.

- The Gander Zone is found in two spots on the island, amongst or in the middle of the Dunnage zone and on the Dunnage Zone’s eastern border. The Gander Zone is considered by many to be the most prospective for gold exploration in the province. The Gander Zone is host to Silurian synkinematic granitoids and high-level Devonian plutons, Silurian metamorphosed Early Paleozoic quartz-rich terrigenous siliciclastics; Ordovician magmatic rocks.

- Finally, the Avalon Zone makes up the eastern most portion of NL. It hosts Devonian terrestrial basins, Cambrian shallow-marine, shaley platformal cover, latest Neproterozoic (post-560 Ma) pull-apart basins and related peralkaline magmatic rocks and Neproterozoic (760-565 Ma) volcano-plutonic arc complexes and siliciclastic sedimentary basins overlain by shaley deltaic rocks.

The age, type and structure of the rock, especially in the Dunnage and Gander Zones, make them especially interesting for precious metals exploration. For me, I will be focusing on gold exploration and development companies in these regions, as I believe they have the highest probability of making and developing an economic discovery.

To note, most of the island of NL is covered with a glacial till or cover of some sort (most notably bogs), making the outcropping of mineralization much more rare than other provinces in Canada, where it is quite common.

This aspect of NL makes it that much more important to have a strong geological background in your exploration team, as they will be highly dependent upon their ability to interrupt much subtler geological information. NOTE: Pay close attention to the exploration teams for the companies you research, as they should (preferably) have a background in exploring in this type of terrain.

I had the chance to ask the CEO of Anaconda Mining, Dustin Angelo, and the CEO of Torq Resources, Michael Kosowan, a series of questions pertaining to the exploration and development of properties in NL. Who better to give us an idea of what it’s like to conduct mining business within the province than these two leaders?

Anaconda Mining (ANX:TSXV)

Gold Producer, Developer and Explorer

CEO – Dustin Angelo

Anaconda Mining is a gold producer, explorer and property developer in Newfoundland & Labrador and Nova Scotia. Their main producing property, Point Rousse, produces roughly 16,000 oz of gold per year and is located on the Ming’s Bight Peninsula located in the Baie Verte Mining District. Anaconda’s other projects include Goldboro and Viking, which bring Anaconda’s total gold resource to over a million ounces and counting.

Torq Resources (TORQ:TSXV)

Gold Explorer

CEO – Michael Kosowan

Torq Resources is a mineral exploration company with a goal to establish a tier-one mineral portfolio. Currently, Torq owns 120,000 hectares of prospective gold property in Newfoundland & Labrador. Torq is led by CEO, Michael Kosowan, and board members, Ivan Bebek and Shawn Wallace, who are serially successful entrepreneurs within the mining sector.

Brian: From a geological perspective, why explore for mineralization in Newfoundland & Labrador?

Anaconda Mining Inc. – CEO: Dustin Angelo

“The long geological history with diverse geological terranes that have seen multiple mountain building events and deep crustal scale fault zones lend themselves to strong potential for gold mineralization. The Appalachians as a whole is a mountain belt that has not seen a lot of exploration for orogenic gold deposits despite similar age rocks throughout the globe (e.g. Lachlan fold belt in Eastern Australia) being a significant host for gold mineralization. Recent discoveries and development projects (e.g. Valentine Lake, NL; Moose River Mines, NS) are starting to show the potential for the Appalachians to host large gold deposits. Newfoundland is becoming a recognized place to look.”

Torq Resources – CEO: Michael Kosowan

“Newfoundland presents a significant underexplored opportunity for Torq and its shareholders. Early indications demonstrate the potential for orogenic and epithermal styles of gold mineralization. High grade gold intersections have been reported throughout central Newfoundland, as demonstrated by the recent success of Marathon Gold at Valentine Lake and Antler Gold at Wilding Lake. There are a number of structural scale suture zones and thrusts (large faults) which represent large scale fluid pathways which potentially have focused fluid flux along them and, if these fluids carried metals, there can be significant mineralization.”

Newfoundland & Labrador’s Base Metal Production

From a mining perspective, NL is most known for its base metals discoveries and production, with the Voisey’s Bay Discovery being the most famous, in my opinion. NL’s Ministry of Natural Resources released a report on the province’s mines in February of this year.

The report mainly covers the producing mines within the province, giving the reader an overview of the mine activities and some production statistics.

NL is currently home to 9 producing mines:

- Vale Newfoundland and Labrador Limited, Voisey’s Bay

- Iron Ore Company of Canada, Labrador City

- Tata Steel Minerals Canada Ltd., Menihek Area

- Atlantic Minerals Limited, Lower Cove

- Anaconda Mining Inc., Pine Cove – Open Pit Gold Mine

- Rambler Metals and Mining Canada Limited, Baie Verte Peninsula

- Barite Mud Services Inc., Buchans

- Hi-Point Industries Ltd., Bishop’s Falls

- Trinity Resources Ltd., Manueals

One of the graphs provided gives an overview of the gross value of mineral shipments over the last 8 years by metal type. The graph shows that, overwhelmingly, iron ore is the number one mineral export in the province, followed by nickel and copper. This heavy dependency on base metals makes the province even more susceptible to the global economy and its ebbs and flows.

However, the current push towards making NL a world-class destination for precious metals exploration will help bring some much needed jobs to the province and further diversify its metal exports.

I asked the NL Ministry of Natural Resources,

“Currently, the majority of the mine production comes from base metals such as iron ore and nickel. Do you see progress in any other metal(s)? Possibly gold?”

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“There are a number of advanced exploration projects for potential investment, including opportunities for gold, base metals, rare earths and other commodities. High gold prices as well as new gold discoveries and new analyses of public geo-scientific data are fueling gold exploration.

Marathon is continuing to advance exploration and increase reported resource for its Valentine Lake Gold Property located in Newfoundland. They have currently reported measured and indicated resources totaling 1,388,200 oz. of gold at 1.91 g/t and inferred resources totaling 766,500 oz. of gold at 2.24 g/t. Drilling in 2017 is continuing to focus on expanding the Marathon Deposit at surface and to depth.

Anaconda Mining is continuing to actively explore to expand its resources and extend the life of its existing mining operations. Rambler Metals and Mining is producing copper-gold concentrate at their Nugget Pond mill from the Ming Mine on the Baie Verte Peninsula.”

Brian: Will there be an attempt to grow the mining industry within the province? If so, how will it be done?

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“To increase exploration and development activity we are working on sharing mineral information globally – similar to sharing seismic data with oil and gas companies around the globe. We believe this will help attract mineral exploration activity that has the potential to generate significant new industrial activity in the coming years. We are committed to working closely with the mining industry and the communities in which they operate to attract investment and develop the economy of Newfoundland and Labrador.”

Ultimately, I believe the future is bright for base metals, and today’s lows may be great buying opportunities. Gold discoveries and further promotion of NL’s prospective gold properties should help to spur further investment into the province and help diversify NL’s base metal mining dependency, as there is no better way to spur investment in a region than to have a major discovery!

Newfoundland & Labrador Infrastructure

A jurisdiction’s geology is of the utmost importance when it comes evaluating the value of a prospective property. However, while a nice high grade gold discovery is fantastic, if there’s no power or road access to the property, the sexy high grade gold can soon become just an average or uneconomic discovery.

While the island portion of NL is, comparatively to the rest of Canada, just starting a major push towards precious metals exploration, it has long been a logging province. For many of the current companies that own prospective properties within the province’s interior zones, these logging roads provide much needed access to some of the more remote land claims.

I posed the question regarding infrastructure to Angelo and Kosowan;

“Is Newfoundland & Labrador’s infrastructure conducive to exploring and developing mining properties? Please explain.”

Anaconda Mining Inc. – CEO: Dustin Angelo

“Newfoundland has excellent infrastructure to support exploration work. Much of the province is transected by provincial highways that access historic fishing communities along the coast. The island has traditionally been logged for pulpwood and the island has an extensive network of logging roads that allow access to remote areas. Small hydroelectric projects occur throughout much of the island and in tandem with numerous coastal communities means that electricity is generally fairly close to most exploration areas.

There is a strong geo-scientific community on the island and historical exploration data and drill core are available through the government. Skilled workforce trained in mining and exploration.”

Torq Resources – CEO: Michael Kosowan

“There is great infrastructure throughout the majority of Newfoundland. That said, parts of Newfoundland, particularly the Central region, are very remote. Ninety five percent of Torq’s properties are accessible from the ground via forestry roads. There is also an analytical laboratory located in nearby Springdale for processing samples. Gander, the closest major town, is adjacent to and provides excellent infrastructure to our Gander suite of claims.”

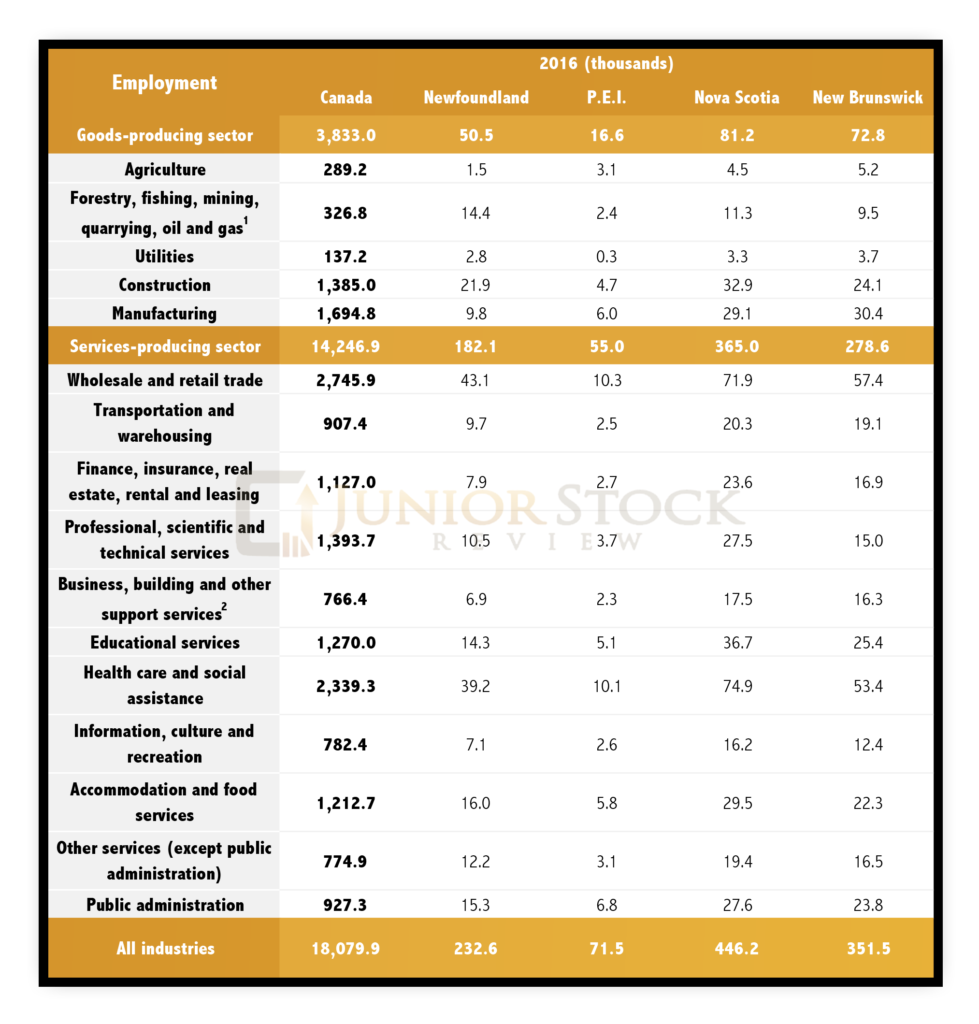

Mining as an Employer in Newfoundland & Labrador

Where does mining stand in NL’s employment rankings? Examining the table below, courtesy of Statistics Canada, mining represents 8.5% of the goods producing sector employment. For me, this is surprising as I would have thought that it would have represented a larger portion of the employment in the province already.

Source: Statistics Canada

I asked Kosowan and Angelo,

“Does Newfoundland & Labrador have the available workforce to fill the needs of the growing mining sector?”

Anaconda Mining Inc. – CEO: Dustin Angelo

“Yes, there are a great number of local experienced workers plus an equal number that are working a rotation (Fort McMurray, diamond mines, Ontario mines while waiting for employment at home). With the downturn in Alberta and Labrador, Anaconda has seen a significant influx of skilled workers looking for jobs.”

Torq Resources – CEO: Michael Kosowan

“ Yes, it does indeed − both in numbers and in experience. Torq attended the CIM conference in St. John’s last November (called Stratton Resources, at the time) and we were very impressed with the number of experienced prospectors and exploration services companies. Torq recently completed a regional scale sampling program with 90% of the crew residing in Newfoundland.”

While mining isn’t currently the largest employer in the province, mining jobs are typically well paid and, therefore, usually a priority for any provincial government. In the next section of this report, I will cover NL politics and how the provincial government is looking to increase the number of mining related jobs through improving its mining investment attractiveness.

Newfoundland & Labrador Politics

To many, the biggest risk associated with speculating in junior mining companies is the risk associated with the jurisdiction in which the company is exploring, developing or producing. Interestingly, not only do you have to look at a country’s overall politics, but it’s an absolute must to review the state or provincial politics to gain a sense of the amount of risk you are taking on.

Provincially, NL is governed by the Liberals, who have been in power since 2015. The Conservatives and Liberals have flip flopped control of the province since NL became a part of Canada in 1949.

How do the NL Liberals approach mining? I did a little digging and found their platform from the beginning of their term, called their Five Point Plan. On page 15 of that document, there are two paragraphs on the promotion of growth in mining. The Liberals say,

“Despite challenges associated with fluctuating commodity markets, the mining industry remains a valuable contributor to the provincial economy with strong potential for recovery and growth in the coming years. Liberals believe in continued development through industry partnerships and innovation, while also ensuring that benefits are maximized for local economic regions where mining operations take place.” ~ Five Point Plan

On page 15 of the Liberal government’s Five Point Plan, they outline a few points regarding the mining industry and what they wish to address during their term. How is that plan progressing?

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“As a province, we support growth in the mineral industry through prospector training and mentoring, the mineral incentive program, which supports grassroots prospectors and junior mining companies, public geo-science, the core storage program, promotions, and efficient and transparent regulation.

In 2016, 21,000 claims were staked in the province, just over three times the amount staked in 2015, and the most in the last five years. We want to ensure that everyone, every growing company, has the opportunity to learn, grow and advance their operations. To support development and to streamline processes, government has created industry facilitators.

Assigned among existing staff, these facilitators will liaise with companies in early stages of exploration and development to guide them through the provincial policy and regulatory frameworks, helping facilitate their progress.

The industry facilitators also connect with our colleagues in other departments to ensure the companies they work with get timely support from departments across government.

Having this kind of support available to mining companies will help them navigate the various supports and regulatory functions so they can operate successfully in the province, now and well into the future.

By creating an attractive environment for exploration, we are strengthening the industry, and growing private sector jobs and the economy throughout our province.”

Further, I asked Kosowan and Angelo,

“Is Newfoundland & Labrador’s provincial government focused on improving its investment attractiveness for mining? If so, how?”

Anaconda Mining Inc. – CEO: Dustin Angelo

“Yes, since the Liberal Government came in during late 2015, it has made a concerted effort to diversify away from the oil and gas sector. Anaconda has had several conversations with the relevant ministers and the Premier about focusing on mining. The government is working on mining centres of excellence in conjunction with its college campus system. From a financing standpoint, the government provides loans through the Department of Business, Trade, Culture and Rural Development to help companies, including mining companies, fund innovation initiatives. Anaconda has been the recipient of such loans. In addition, the Department of Natural Resources has embarked on a restructuring to better serve mining companies who are permitting for various activities.

Lastly, the Provincial Government funds the “Junior Exploration Assistance Program” (JEA), which aims to grow the mineral inventory of the Province through the discovery of new mineral districts, occurrences, prospects and deposits. Anaconda has benefitted from JEA as well as the provincial Research & Development Council (RDC), and federally from Atlantic Canada Opportunities Agency (ACOA) and the Industrial Research Assistance Council (IRAP). Recent financial support was received to develop technology for narrow vein mining.”

Torq Resources – CEO: Michael Kosowan

“Yes. They have a very well set up mineral incentive program through the Department of Natural Resources. This program provides rebates through the Junior Exploration Assistance Program (JEA). Grants top out at $150K in Newfoundland and $225K in Labrador. The 2017 budget is $1.3M and there were 39 JEA applicants this year. Additionally, the Newfoundland Geoscience Atlas website is a phenomenal source for minerals data including, but not limited to, downloadable claims, mineral occurrences, historic drilling, geology, available geophysical surveys and geology. The online staking system is also quite handy. The online staking and Geoscience Atlas make exploring in Newfoundland that much easier.

True story: in 2016, Torq’s prospectors filed more claims than the government’s online intake system could handle, and inadvertently crashed it. News spread, and Newfoundland is now considered, by some, to be the next hotbed of mineral exploration.

There is also the Matty Mitchell Prospectors Resource Room which is designed to help local prospectors connect with juniors through major companies. The majority of the historic drill core is available for viewing and sampling at core facilities throughout Newfoundland. Lastly, the Geologic Survey Division is well set up and open to meeting with industry and disseminating their knowledge. They are well staffed with some fantastic geologists who have a wide range of expertise.”

Newfoundland & Labrador First Nations

Not just in Canada, but around the world, First Nations’ involvement in mining are met with trepidation by investors. This isn’t without cause, as in the past and I’m sure in the future, disputes over the development of First Nations’ lands into producing mines will be disputed. However, there are many First Nations which welcome mining into their communities, along with the cash flow and improvements that typically follow with the development of an operating mine.

In my research, I found that the Mi’kmaq First Nations occupy some areas in Newfoundland, with their main reserve in Conne River. Excluding Labrador, do the Mi’kmaq First Nations or any other First Nations control any lands that are being mined or have the potential to be explored and developed in the future?

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“First Nations on the island of Newfoundland are encouraged to participate in any public regulatory review process in which they are interested, and we often work bilaterally with each of the First Nations to address concerns related to areas of local or cultural significance to the First Nations, regardless of Aboriginal rights to the lands in question (The Mi’kmaq First Nations do not have Section 35 rights of the Constitution Act on the island of Newfoundland).”

Past is typically prologue, so looking at a First Nations’ track record in negotiating land development is key, in my opinion, to understanding the risks associated with investing in a company which is exploring or developing a property in a First Nations’ controlled area.

Newfoundland and Labrador have 3 groups of First Nations peoples: the Inuit, the Innu, and the Mi’kmaq. Let’s take a closer look.

Inuit

The Inuit communities are found along the north coast of Labrador. The people of these communities are descendants of the prehistoric Thule, a marine oriented group of hunters, which were drawn to the north coast of Labrador due its abundance of both marine and land wildlife. The Thule are originally from Alaska and moved across to the Arctic and further east to Greenland and the Labrador coast around 1250 AD.

The Nunatsivut First Nations are a self governing community in Labrador of Inuit descent. The Nunatsivut have 55,000 square miles of land which they are willing to develop if the opportunity presents itself, as they describe in this quote,

“We have a lot to offer including 55,000 square miles of land that is rich in natural resources; a recognized and responsible self-government; a willing and innovative workforce; and a challenging but rewarding climate for new ideas and businesses. Our goal is to create long-term benefits for our people.” ~ Nunatsiavu

Mi’kmaq

The Mi’kmaq First Nations are located on the island of Newfoundland. While they were recognized by the Government of Canada in 2011 as an indigenous Band, the Mi’kmaq do not have Section 35 rights of the Constitution Act on the island of Newfoundland. What does that mean? Section 35 provides Aboriginals with constitutional protection on fishing, logging, hunting and the right to land.

The Miawpukek First Nations (Conne River) community, the largest of the Mi’kmaq, is located in an area known as the “Coast of Bays Region,” which is on the south coast of Newfoundland. The community is approximately 224 km south of Gander and has approximately 787 on-reserve members and 1779 off-reserve members.

Qalipu is a Mi’kmaq First Nation located in Newfoundland which has no reserve land. The Qalipu community is made up of 66 traditional Mi’kmaq communities, spread out across 9 different electoral wards. Offical Qalipu offices are held by community reps in Corner Brook, Glenwood, Grand Falls-Windsor and St. George’s, giving the widespread Qalipu community representation.

Innu

The Innu First Nations (Naskapi-Montagnais) are located in central Labrador and are made up of two main communities, Sheshatshiu and Natuashish. The roughly 2200 members of the Innu community elect a Band counsel which represents the community’s need and concerns.

In 2001, they established the Innu Business Development Centre (IBDC) to formally deal with companies that want to conduct business with their community. An example of a successful negotiation with a mining company is with Inco, now Vale, on a mining royalty for the Voisey’s Bay Project.

Two Final Questions Regarding Newfoundland & Labrador

Finally, before making my concluding remarks, here are two final questions which I posed to my three interviewees:

What differentiates Newfoundland & Labrador as a destination for mining versus the rest of Canada?

Anaconda Mining Inc. – CEO: Dustin Angelo

“Newfoundland and Labrador has a young mineral tenure system.Modern claim staking began in the late 1970’s. Prior to that, the only exploration undertaken was on Charter Land. The advent of the mineral tenure system in the late 1970s led to a boom in gold and base metal discoveries in 1980s to present. As such, gold exploration in Newfoundland is still relatively shallow compared to the Timmins area, for example (over 1.5km deep).

There are 722 gold showings on the island. The Baie Verte Peninsula went from ~ 35 to 150+ during the exploration boom in the mid 80’s with 4 gold deposits discovered on this peninsula alone. Several new discoveries in recent years illustrate the potential (ie: Argyle, Wilding Lake, Frank Zone, Hope Brook).”

Torq Resources – CEO: Michael Kosowan

“Newfoundland is differentiated by the lack of exploration history by juniors. The island has really only been open for exploration for about 25 years. The vast majority of Newfoundland was tied up in leases or grants to the big forestry companies until recently.”

*Answer provided on behalf of the Newfoundland & Labrador Ministry of Natural Resources:

“Mining is one of the oldest and leading industries in Newfoundland and Labrador and is a major contributor to our economy. Today, more than 5000 people are employed in the industry, particularly in rural communities, and almost $3 billion in mineral shipments are forecast. Globally, Newfoundland and Labrador is currently ranked 16th on the Fraser Institute’s 2016 International Mining Survey as one of the most attractive jurisdictions worldwide for investment attractiveness.

Our diversified minerals industry provides a wide variety of commodities to the world market. Eleven mineral commodities are produced or mined in the province. Five metal mines currently produce: iron ore, nickel, copper, cobalt, silver, and gold. In Newfoundland and Labrador, we have armed ourselves with public geo-science, clear regulations and support for prospectors and junior mining companies through the Mineral Incentive Program, all in order to create the greatest opportunity for exploration and development.

We are also doing more work online and providing services and information through a digital format. One of the services we provide is our online mineral staking system or MIRIAD – which was the first of its kind in Canada. Development of MIRIAD began in 2002 with the system going live on February 28, 2005. This is a great resource that gives companies or individuals the ability to obtain the mineral rights of an area by staking a claim online from anywhere in the world. We also make geo-science data publicly available for free through the Geological Survey’s Geo-science Online (Geo-science Atlas). Online geo-science data has been available to the public for the past 20 years.

And, we are moving to establish online services to help increase exploration and development activity. The Department of Natural Resources plans to share core sample information with more companies worldwide through digitization and web access.

We believe this will help attract mineral exploration activity that has the potential to generate significant new industrial activity in the coming years.”

What are the greatest challenges for exploring and developing mineral properties in Newfoundland?

“The greatest challenges for exploration on the island is the generally extensive glacial till cover and presence of extensive bogs, lakes and ponds across much of the island. These obscure the geochemical and geophysical signature of low lying areas (valleys that are host to faults, eroded alteration zones) that potentially host mineralization.

In some areas that have some of the best potential there is a lack of systematic geo-scientific and exploration data that requires companies to start from scratch.”

Anaconda Mining Inc. – CEO: Dustin Angelo

“We’ve had very few challenges. We see opportunity and significant potential in Newfoundland. The remoteness is one of the attractions, as it has led to the Island being underexplored historically. As frontiersmen, this excites us.

Torq searches the globe for high-quality precious metals assets. We’re looking for the next big discovery. Our team is visionary and not bound by convention. We have the confidence and budget to conduct grassroots exploration. We also have the experience and tenacity to manage the risks for which the majors have little appetite. Exploring Newfoundland and unlocking its value is our first step in building a world-class portfolio.”

Torq Resources – CEO: Michael Kosowan

Concluding Thoughts

Summarizing my thoughts on Newfoundland & Labrador, I believe it’s a province which is set to play a much larger role in Canada’s mining industry in the years ahead. Newfoundland checks all the boxes when it comes to being a desirable jurisdiction for investment:

- Newfoundland & Labrador’s geology has long been associated with base metals such as iron ore and nickel, however, I think this is quickly changing as a number of precious metals companies look to explore and develop some highly prospective properties. Comparatively to the rest of Canada, NL is under explored, especially for precious metals, such as gold.

- Newfoundland & Labrador encourages mineral exploration within its borders with the Junior Exploration Assistance Program (JEA). While the available funds in the program are small, it is a step in the right direction towards encouraging mining investment in Newfoundland & Labrador.