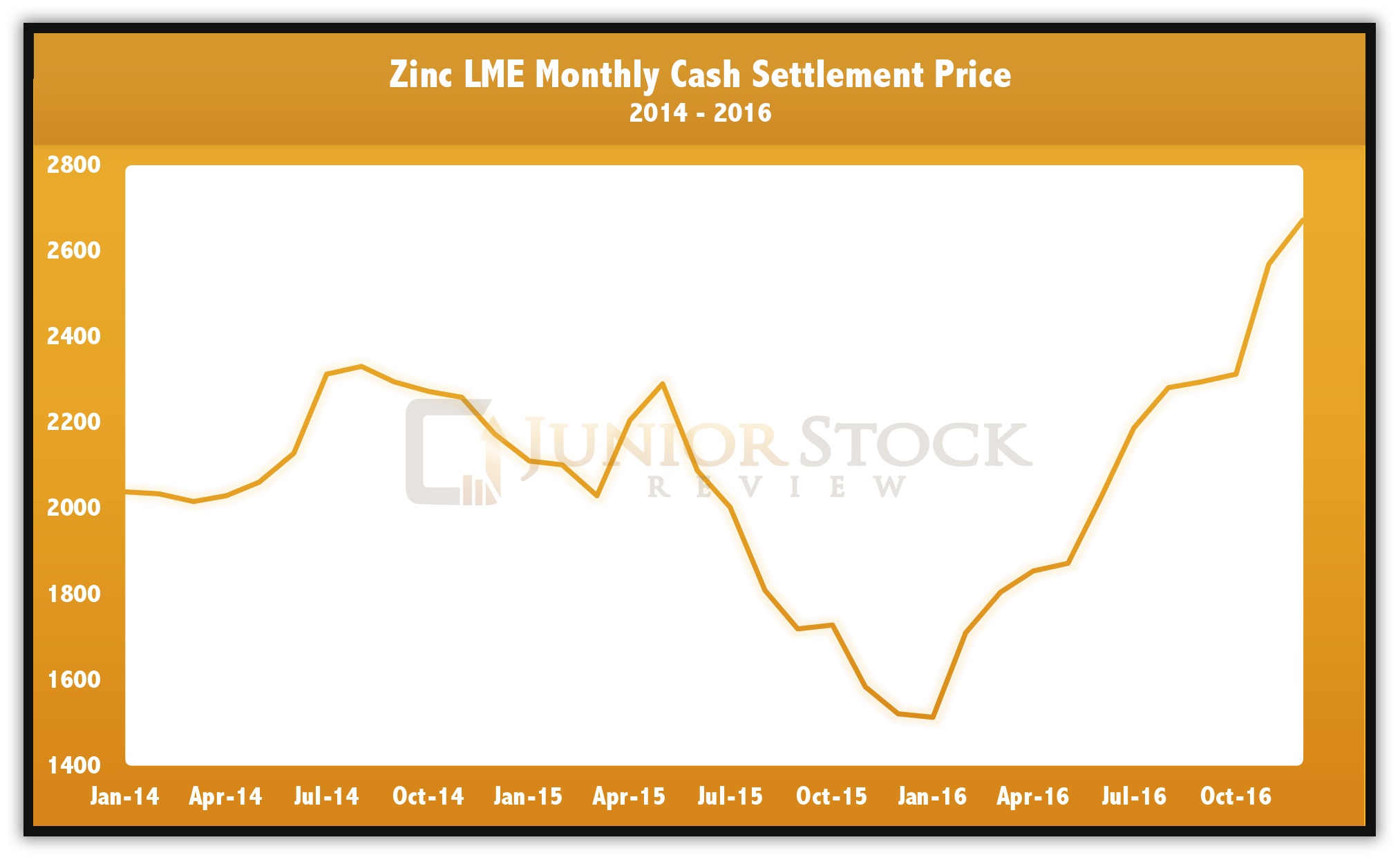

Zinc has exploded upward from its low in January of 2016 and it doesn’t appear to be coming down any time soon. Supply constraints caused by mine closures, mining issues and Glencore’s 500K tonne production cut have led the way to higher zinc prices in 2016.

Source: London Metals Exchange

To understand this bullish trend in zinc prices, I’ve put together a 2-part series examining the supply and demand fundamentals of the zinc industry.

Here, in Part 1, I’ll examine the supply side of the zinc market, including a few tidbits on the zinc mineralization and the ore bodies in which it’s found.

Enjoy!

Zinc Mining

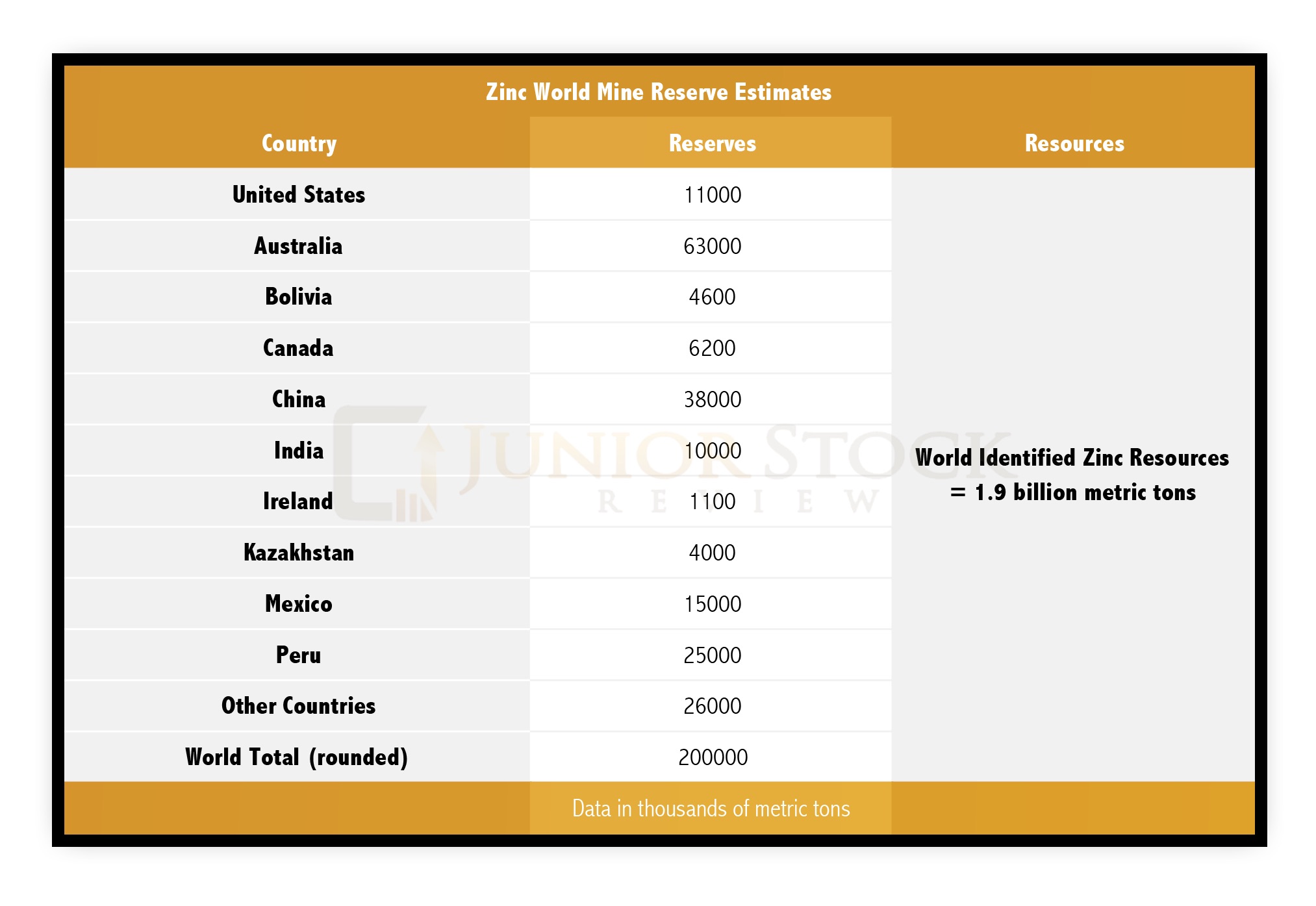

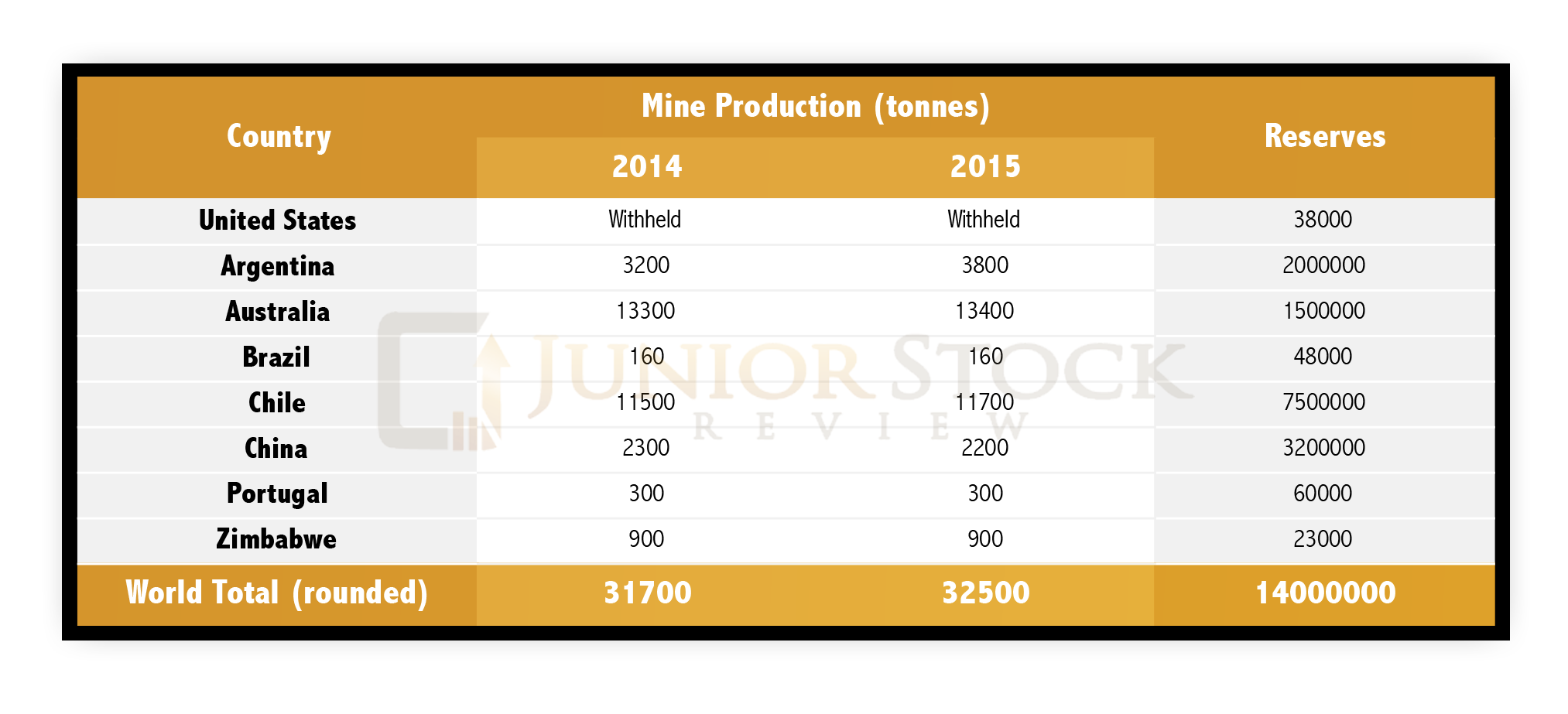

There’s an abundance of zinc in the earth’s crust, but like many metals, abundance doesn’t necessarily mean it can be extracted economically at the current price. Because of zinc’s relative abundance and important uses, zinc is mined in over 50 countries. Here’s a look at the current world zinc reserves:

Source: U.S. Geological Survey

Some commonly found mineral forms of zinc are:

- Sphalerite (zinc blende) – the most commonly mined zinc mineral in the world. The Sphalerite Mineral contains 67% zinc.

- Marmatite – a zinc-iron sulfide, which is commonly found but rarely mined

- Smithsonite (calamine) – zinc carbonate, typically found near surface

- Hemimorphite – hydrated silicate

- Willemitte

Zinc mineralization is commonly found in 4 types of ore bodies:

- Volcanic hosted Massive Sulfides (VMS)

- “[VMS] deposits are predominantly stratiform accumulations of sulfide minerals that precipitate from hydrothermal fluids at or below the sea floor, in a wide range of ancient and modern geological settings (Figs. 1, 2). They occur within volcanosedimentary stratigraphic successions, and are commonly coeval and coincident with volcanic rocks. As a class, they represent a significant source of the world’s Cu, Zn, Pb, Au, and Ag ores”~ Geo Science World

- Carbonate hosted Lead-Zinc (Mississippi Valley and Irish Types)

- “These ore bodies tend to be compact, fairly uniform plug-like or pipe-like replacements of their host carbonate sequences… Mississippi Valley Type or MVT ore deposits, after a number of such deposits along the Mississippi River in the United States… Irish-type carbonate lead-zinc ores, exemplified by Lisheen Mine in County Tipperary, are formed in similar ways.” ~Wikipedia

- Sediment hosted (SEDEX deposits)

- “SEDEX deposits form deep under the ocean where vents in the sea floor allow hydrothermal fluids to mix with seawater. These hot, saline fluids have percolated through several kilometers of sediments and crystalline rocks, picking up precious metals along the way. As the metal-rich hydrothermal fluids hit the cool sea water, they precipitate material onto the sea floor at and near the vents. Metal-rich minerals are deposited between layers of fine-grained mud, sand and silt.”~ Geology for Investors

- Intrusion related (high sulfidation, skarn, manto, vein)

- “These deposits are typically found in carbonate rocks in conjunction with magmatic-hydrothermal systems and are characterized by mineral association of calcium and magnesium. Typically the ore body contains more lead than zinc and is associated with silver.” ~International Zinc Association

Zinc is mined in the traditional manners: Underground, in an open pit, or a combination of the two. To note, underground zinc mining is the most common process, representing more than 60% of annual production.

NOTE: Zinc deposits aren’t unlike many other mineral deposits, in that they do have a number of issues that prevent projects from being economic. Here’s a brief list of some of the issues: Poor by-product grades, low grade zinc, remote deposit locations and high impurities such as manganese.

The zinc ore is drilled or blasted, the rough ore is then brought to the surface or to an area on the surface where it is crushed and finely ground. For efficiency and economics, the finely ground ore is then processed through a froth flotation circuit where the zinc concentration is increased anywhere from 3.5 to 15% to an average of around 50%.

The froth flotation process is as follows:

- Zinc ore, water and chemicals are mixed together in banks of flotation cells.

- Air is then constantly blown into the cell, providing constant agitation of the solution.

- The zinc sulphide particles stick to the air bubbles which rise to the top of the cell.

- The tailings or unwanted metals of the solution sink to the bottom of the cell, leaving the concentrated zinc sulphide on the surface.

- After a period of time, the zinc sulphide concentrate can be skimmed from the cell’s surface, dried and packaged for delivery to the smelter, where the concentrate will be further refined.

- Not all concentrates are created equal, as the residual elements such as the amount of iron make some concentrates more desirable than others due to their lower refinement costs.

- It should be highlighted that the transportation of the concentrate to the smelter is the mine’s responsibility and, therefore, in some cases, makes up a huge portion of their cost. Needless to say, it’s an advantage to have a smelter in close proximity to the zinc mine.

NOTE: In addition to the zinc concentrate, other base metal concentrates such as lead and copper concentrate are commonly created. Base and precious metal by-products can really add to the bottom line and, in some cases, they are the reason the deposit is economic. In turn, however, when these by-product metal prices fall, so do the economics of the mine which depends on them.

Zinc Mine Supply

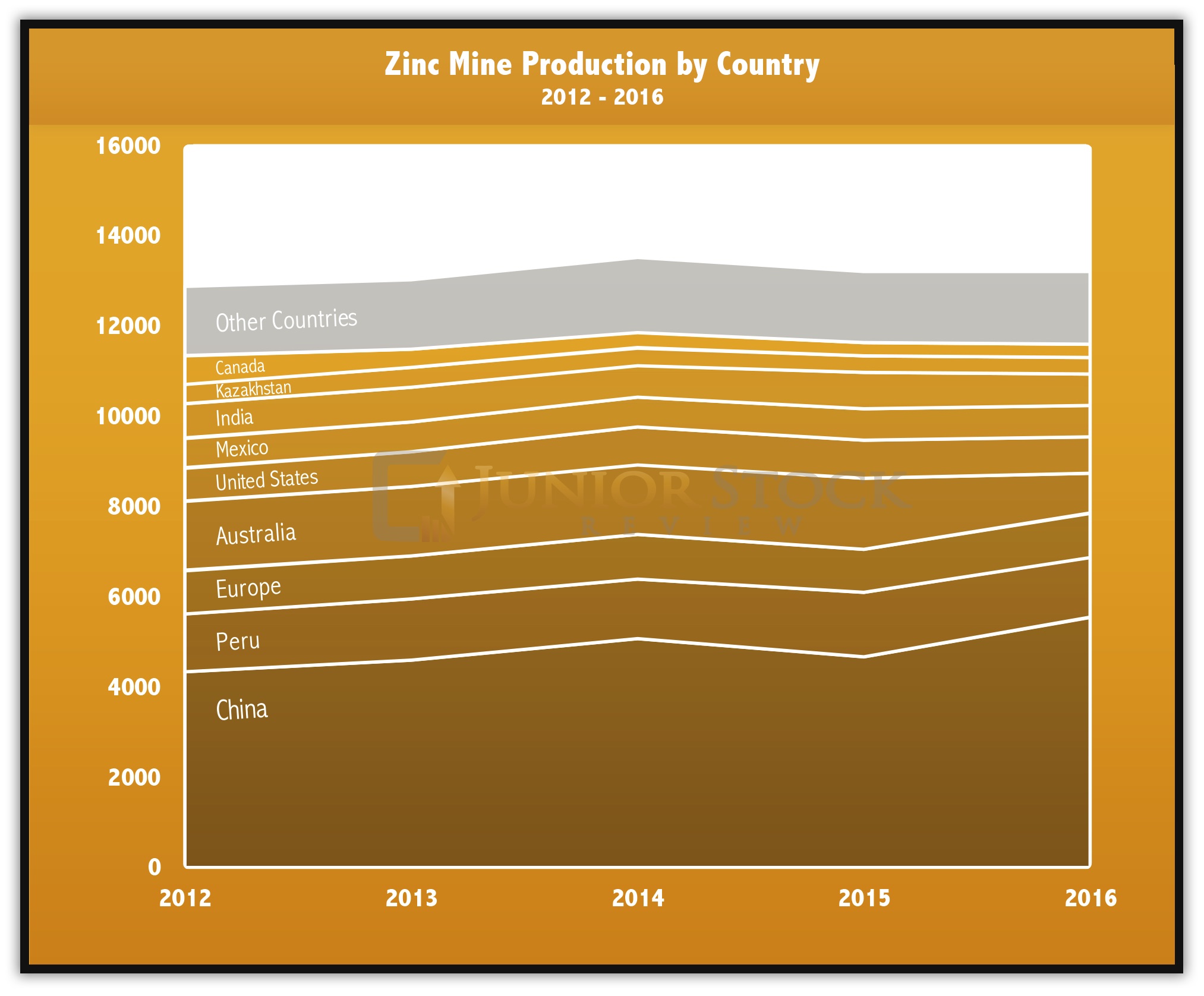

Source: International Lead and Zinc Study Group

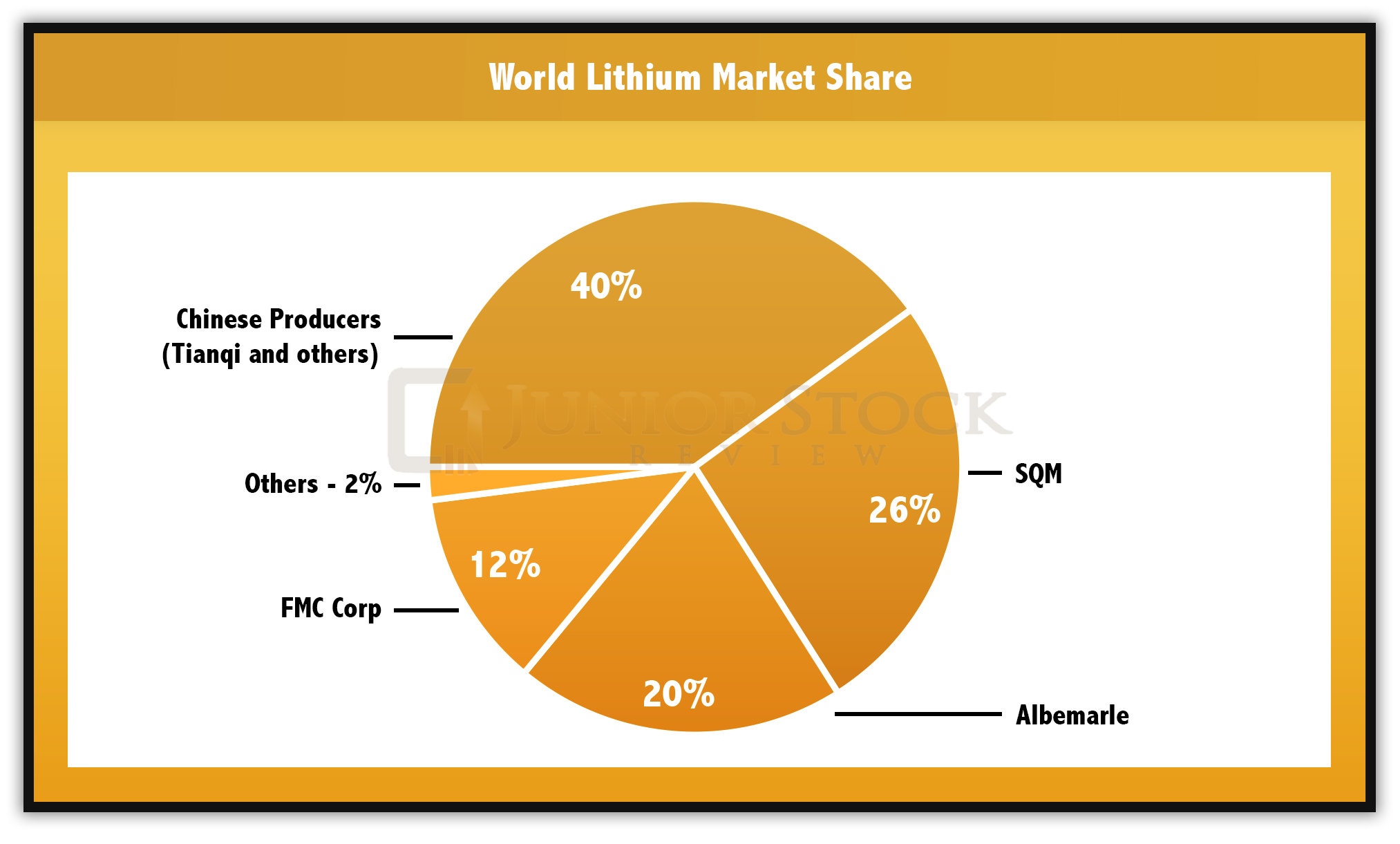

Zinc is mined all around the world, but a couple of spots in particular make up roughly half of the world’s mine production each year; China and Peru. In reality, China is the heavyweight when it comes to zinc production as its 5.5 million tonnes of zinc production is 4 times as much as the next largest producer, Peru, with 1.3 million tonnes. Australia is an honourable mention as before 2016, it held the position as the 2nd largest zinc producer in the world.

Over the last year, China has ramped up its production by almost 20%, however, this big leap in mine production was almost erased by the drop in production by the rest of the world. In total, 2016 ended with 22 more tonnes produced than 2015. The caveat to this analysis is that any data from China should be taken with caution as it may not be completely reliable.

The countries with the largest drops in zinc mine production since 2015 were Australia at -43.1% or 680K tonnes, India at -16.8% or 138K tonnes, Peru at -6.0% or 85 tonnes, and the United States at -2.3% or 19 tonnes.

Source: International Lead and Zinc Study Group

Australia

Australia’s production was drastically cut in 2016 due to the shutting down of MMG’s Century Mine. Century was Australia’s largest open cut zinc mine and was highly valued by smelters because its zinc concentrate had such low iron content, which helped minimize the smelter’s refinement costs. The Century Mine’s loss of production will have to be filled by an increase in production from other mills or new zinc mines coming into production, or a combination of the two.

Additionally, on October 9, 2015, Glencore announced a reduction in its mine production by 500K, or a third of their annual zinc metal production, across their operations in Australia, South America and Kazakhstan. The reason for the reduction? The company states that the low zinc and lead prices do not properly reflect the metals scarcity and, therefore, they’re moving ahead with the cut in production until prices rise. Glencore’s reduction affects its Australian mines by approximately 380K tonnes, and its Peruvian operations by 80K tonnes. As the zinc price rises, Glencore may decide to bring this production back online , which will not happen overnight, but will have an impact on the zinc market supply dynamics when it does.

India

Indian zinc is mined by Hindustan Zinc Limited (HZ) a subsidiary of Vedanta Limited. HZ’s production is led by their flagship operation, the Rampura Aqucha Mine (RAM), which has a zinc reserve of 51.1 mt at 14.0% Zn, and an ore capacity of 6.15 mtpa. Details can be found in HZ corporate presentation from last summer and the summer of 2015. In particular, look at the last slide of 2015’s presentation. The last slide details HZ’s mine reserves, highlighting the quickly declining open pit portion of the Rampura Aqucha mine. The open pit will be depleted by 2018, removing a significant source of zinc from the global market. The plan is to transition this into an underground mine, where there is still a substantial amount of zinc contained, however, they’ve experienced issues with the transition.

United States

American zinc mine production was impacted by Nyrstar’s placing of its Middle Tennessee Mines (MTN) on care and maintenance. The news release issued on December 7, 2015 outlines that the company’s decision to put the mining operation on care and maintenance was related to the current zinc price and, therefore, to minimize their cash consumption, they had to take action. MTN’s impact on the market is around 50K tonnes per annum.

On January 7, 2016 Nyrstar announced the formal launch of the sale process for all or the majority of its mining assets. Further, on September 27, 2016, Nyrstar announced that it would be restarting its MTN operations, given the rise in the zinc price and its expected sustainability in the future. The restart of MTN will cost USD $14 million, and it will take over a year until the mill is at full production. Given the current bullish outlook for zinc prices, I think that these assets will find a buyer.

Also, American production will be affected by zinc production declines from one of the world’s largest producing mines, Teck’s Red Dog, which is located in Alaska. In early 2016, Teck announced a forecasted reduction in its zinc production in the years ahead; see SEDAR for further information.

Future Mine Production (Restarts / New)

There are some new and existing mining projects that are scheduled to come online in the next few years, stretching out to 2021. Here’s a list of the biggest 4:

- India – HZ’s Underground Portion of RAM

- South Africa – Vendanta’s (Exxarco/Sterlite) Gamsberg mine

- Australia – MMG’s Dugald River mine

- Peru – BHP/ Mitsubishi / Glencore / Teck’s Antamina mine expansion

There are a more projects planned over the same time period, but each is much smaller in size than the 4 that I have listed here.

Mine Contractions and Closures

While there are a few big mines coming back online or starting up, there are a number of closures and contractions that will occur over the next 5 years. The production contraction is headlined by Teck’s Red Dog, Sumitomo’s San Cristobal and Glencore’s Mt Isa, which will all see a steady decline in their output. Mine closures are headlined by the HZ’s RAM open pit and Kayad, Sterlite’s Skorpion (Closure by 2021) and Glencore’s Bracemac-McL in Canada, which is on pace for closure in 2019.

There are more contractions and closures albeit they are much smaller than the ones listed. Cumulatively, however, there is roughly 1,000K tonnes being removed from the market. Unfortunately, we may be able to count on the loss of production with more confidence than the mine expansions and re-starts.

Zinc Stockpiles

Besides mine production, another source of zinc in world markets is from stockpiles. The International Lead and Zinc Study Group data shows that zinc stockpile inventories have been steadily dropping over the course of the last 4 years. Currently, world zinc inventories sit at 1.3 million tonnes, down 82K tonnes from last year. Currently, the largest stockpile holders are the producers and the London Metals Exchange, which both have inventories around 400k tonnes.

Concluding Remarks

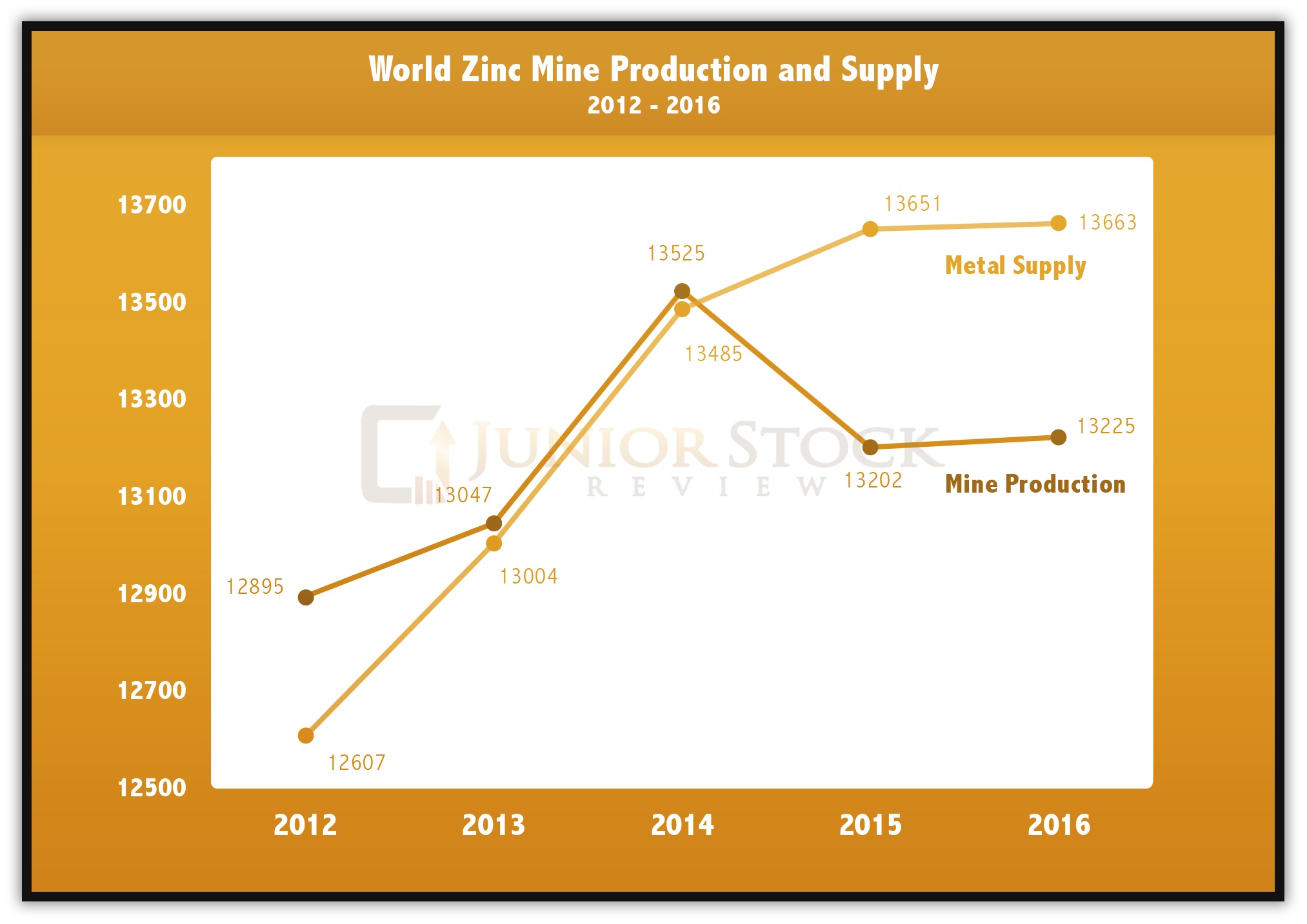

In all, zinc mine production has been relatively flat over the last 4 years, with an increase of only 330K tonnes since 2012. As discussed, MMG’s Century mine production is gone and will need to be filled with new production, if that deficit is to be filled. Glencore’s missing 500K tonnes of production will have an effect on the market when it returns, but that won’t happen overnight. Using Nyrstar’s Middle Tennesse Mine as a gauge for re-start, I think that you can expect it to take 6 to 12 months for Glencore to be back at full production. Finally, India’s giant zinc mine is making a big transition moving to underground mining; time will tell if they are able to maintain production levels from this prolific mine site. Mine production is falling faster than it’s being replaced, and the bottom line, in my mind anyway, is that until Glencore announces they are bringing their missing capacity back online, the diminishing zinc supply will lead to higher prices.

Disregarding China, the impact of new and re-starting mines will almost be nullified by the amount of mine production contractions and closures over the next 5 years. If new projects aren’t developed, we could be standing in much of the same position that we’re in today, as far as supply is concerned.

China will have an impact on the future of the zinc market – the size of this impact is what’s in question. What’s surprising is that China is paying closer attention to the environmental and safety impacts of mining and manufacturing. Inspections over the last year have resulted in production suspensions and closures of the smaller producers that couldn’t comply with the more stringent regulations. I think China will continue to lead in zinc production in comparison to the rest of the world, however, the current large difference in production levels may not be as significant in the future as it is today.

Zinc supply fundamentals are bullish, but don’t tell us the whole story. In Part 2 of this series on zinc, I will take a look at world zinc consumption, which should allow us to make some conclusions about where the zinc market is headed in the months and years ahead.

Don’t want to miss a new investment idea, interview or financial product review, become a Junior Stock Review VIP now – for FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Sources:

Australian Atlas of Minerals Resources, Mines & Processing Centres

International Zinc Association

Disclaimer: This is not an investment recommendation, it is an investment idea. I am not an investment professional, nor do I know you and your specific investment criteria. Please due your own due diligence. I have NOT been compensated to write this article and do NOT have a business relationship with any of the companies mentioned in this report. I do NOT own shares in any company mentioned.