A key component to Anaconda Mining’s story is exploration.

Like all producing companies, its mineral inventory is in constant need of replenishing.

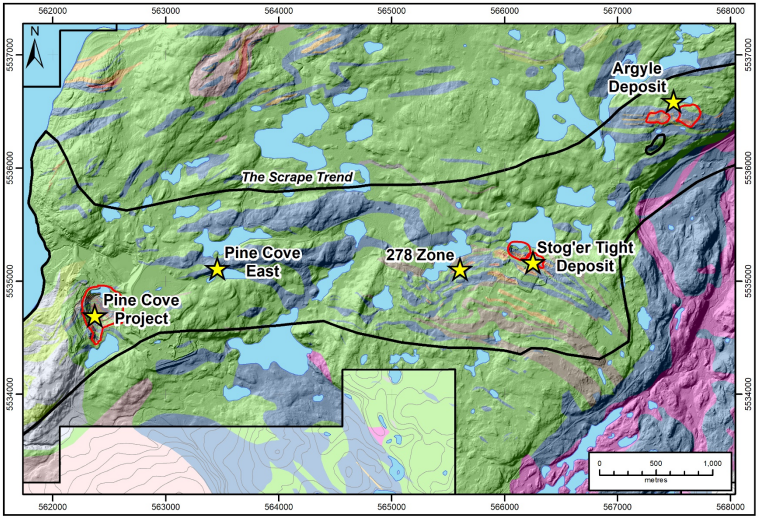

Over the last few months, Anaconda has enjoyed great success in unlocking more gold mineralization potential within the Scrape Trend, which is particularly important given its proximity to the Pine Cove Mill.

Thus far, my analysis of Anaconda has been purely based on what they have, not on any potential that could come through exploration.

In my conversation with Paul McNeill, Anaconda’s VP of Exploration, I wanted to understand how McNeill views the exploration process and, of course, get a better idea of the gold mineralization potential of Anaconda’s key projects.

In our conversation, we cover the aspects of a good exploration project, the high priority targets at the Tilt Cove project and much more.

Enjoy.

Brian: Before we get into the details of Anaconda’s 2020 Exploration program, could you please give us a little colour on your background?

Paul: Professional Geologist, exploration career focused on gold and uranium exploration and development. Expertise in structural controls on mineralization with a broad expertise and experience in greenfield to feasibility level exploration and development mining projects.

Brian: Mineral exploration is a risky business. The odds of discovering economic mineralization are low.

However, good management teams are able to identify good projects with high potential, which greatly increase the odds of success.

In your opinion, what are the hallmarks of a great exploration project? Please explain.

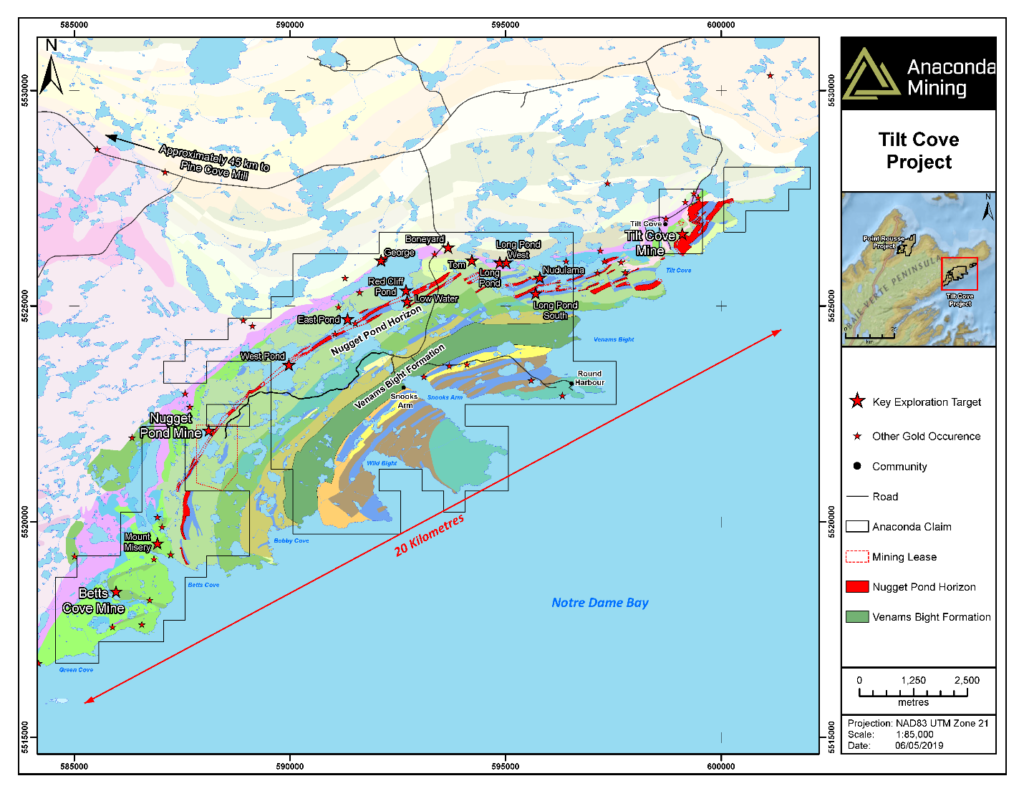

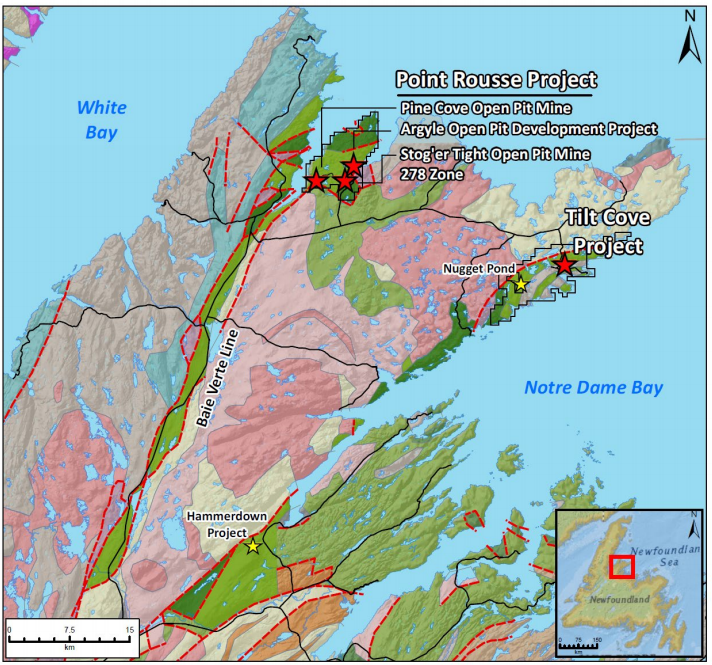

Paul: Great exploration projects are those that offer data rich environment and/or one that has a compressed pathway to development. All of our projects have both of these characteristics. Point Rousse, Tilt Cove and Goldboro has seen exploration activity since the 1980s that have resulted in the collection of large amounts of exploration data as well as significant gold discoveries. These previous results/work lay the foundation for the next stage of discovery and fast tracks the discovery process. In the case of Point Rousse and Tilt Cove, because we have an existing mill and tailings infrastructure, we generally have compressed timelines to permitting of projects once a discovery is made.

Brian: In the fall of 2017, I did a site visit to Anaconda’s Point Rousse project and was able to spend a day at Rambler Metals and Mining’s Nugget Pond Mill, which is located near the town of Tilt Cove.

While I was there, the mill manager gave me a history lesson on the town of Tilt Cove and the important role it played in Newfoundland’s mining history, going all the way back to 1864.

Before we get into the specifics on Anaconda interest in the area, can you share with readers some of Tilt Cove’s history and why this particular area is of geological interest?

Paul: There is a long history of mining in the Baie Verte Mining District – Gold, Copper and Asbestos. This makes the area particularly interesting geologically because, as an explorer, I know we are working in a metal rich environment. Both the early geological history, which enriched and fertilized these rocks during formation, and the later orogenic history, which provided the pathways and environments for gold deposits to form, make the Baie Verte Mining District an incredibly interesting place to work. With numerous mines and a long history of successful mining this history enables us to de-risk the opportunities available to us. For example, the numerous mines past and present mean that the environment is right for the formation of gold deposits. And the long history of mining means the communities and the people that live and work on the Baie Verte Peninsula have generational mining know-how.

Brian: At the end of July, Anaconda announced the initiation of a 35 line-kilometre geological survey and a 10,000m drill program at its Tilt Cove project.

Before getting into the priority targets, can you first give us a breakdown of what work you guys have completed on the Tilt Cove project to date and why you believe there is potential for discovery?

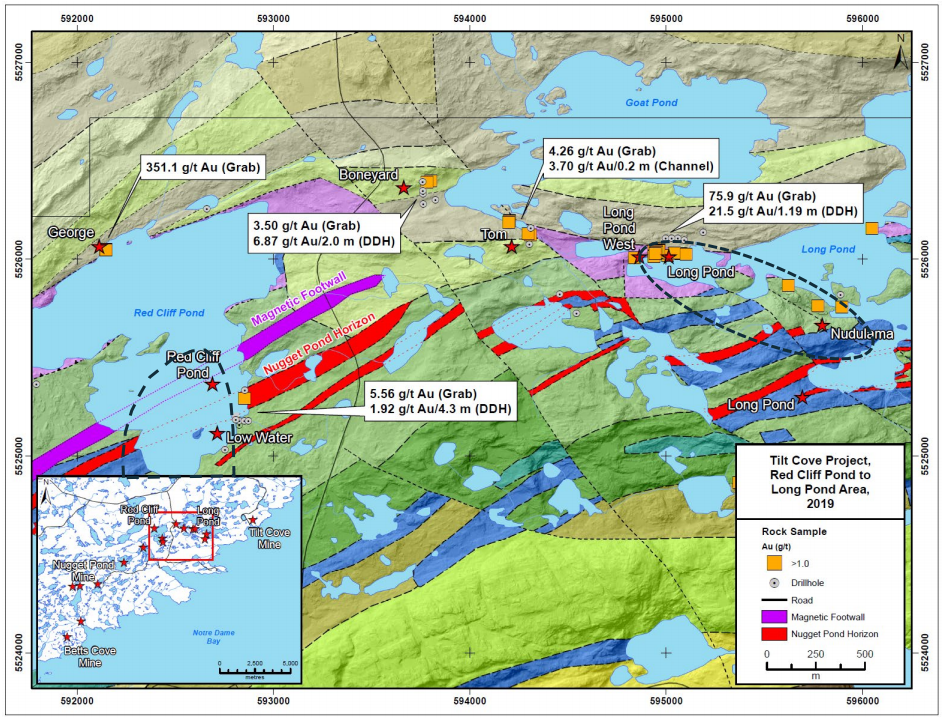

Paul: To date at Tilt Cove, we have compiled all historical geological, geochemical and geophysical data from historical exploration efforts, flown a drone bourne magnetic survey over the prospective Nugget Pond Horizon, conducted mapping and prospecting as well as an initial drill program. Within the past couple of months, we have been mapping at our top priority targets as well as conducting a ground IP survey at the Scarp zone, the Betts Cove area and the Growler area to supplement our other geological and geophysical data sets. With these data sets in hand, we are now ready to launch into a drill program to test our top priority targets.

The potential for discovery at Tilt Cove is based on the geological characteristics of the rocks and the history of discovery in the region. Geologically, the rocks at the Tilt Cove Project and at the Point Rousse Project are the same and have a very similar history. In particular, the early volcanic history at both sites created rocks that are rich in metals and include potentially reactive, iron-rich sediments, mafic volcanic and gabbroic units. Later, the deformation history of the area provided the faults that act as pathways for the interaction of gold-rich fluids with the reactive sediments, mafic volcanic and gabbroic rocks. These processes result in gold accumulation. There are numerous examples of where this phenomenon can be observed and interpreted and, in at least four locations, this geological environment/process produces economic gold deposits.

At Tilt Cove, we are looking for a high-grade gold deposit like the past producing Nugget Pond Mine, which had mill grades averaging 9.8 g/t gold. The fact that these high-grade gold deposits are known to form in the rocks at the Tilt Cove project means there is a very high potential for the process to be repeated nearby. We have a highly refined exploration model based on the discovery of the Nugget Pond Mine, as well as our work at Point Rousse, and believe this will lead us to the discovery of another Nugget Pond-like deposit.

Brian: Finally, can you summarize the top 5 targets for us and give us a rough timeline for the work to be completed?

Paul:The five key targets we are focused on include: West Pond, Betts Cove, Scarp, East Pond and Growler.

West Pond is underlain by the Nugget Pond horizon, which hosted the Nugget Pond Mine and has a gold-in-soil anomaly located down-ice that is very similar in position, dimension and quality to a gold-in-soil anomaly associated with the Nugget Pond deposit. Geophysically, the West Pond area is associated with patterns in the magnetic data expected to be associated with an alteration system commonly associated with these gold deposits. The target area is also located along a cross-cutting lineament that projects beneath the pond. Drilling in this area will focus on drilling targets beneath West Pond.

The Betts Cove area is adjacent to a past producing copper mine but includes numerous drill intercepts of gold nearby. The gold intersections indicate that a mineralized zone exists over a known strike of 250 metres and is otherwise open. Drilling in this area will focus on understanding the context of the known mineralization and testing the extents of gold mineralization.

The Scarp zone is in the northwesterly portion of the property and is associated with a gold-in-rocks anomaly that is more than a kilometre long and specifically focused on the Nugget Pond Horizon. Recent geophysical work has produced a number of anomalies that will also help focus our drilling expected to start in the next week.

East Pond is underlain by the Nugget Pond horizon, which hosted the Nugget Pond Mine and has a gold-in-soil anomaly located down-ice. Geophysically, the East Pond area is associated with patterns in the magnetic data expected to be associated with an alteration system coincident with these type of gold deposits and is coincident with a structural lineament. Drilling in this area will focus on drilling targets beneath East Pond.

Growler is new. We made some key findings at Growler that make this area interesting: Newly recognized Nugget Pond Horizon within a strong deformation corridor. These are two of the key ingredients. We also have surface mineralization and alteration within 800 metres of each other and none of this has every been tested before. We just finished a ground IP survey in the area and, with this data, will be ready to drill this target.

We have other targets at the Tilt Cove property, as well, but we are not focusing on these five priority targets.

Brian: From a mineral discovery perspective, the Scrape Trend has been very productive for Anaconda over the years. Most recently, Anaconda declared a mineral reserve at its Argyle deposit, adding another source of future ore for the Pine Cove mill.

The question I have is, in your opinion, is there more gold discovery potential to unlock within the Scrape Trend?

Paul: Yes. We recently drilled 5.40 g/t over 20 metres and another follow up hole of 4.37 g/t over 15 metres and several other intersections near the Stog’er Tight mine. These intersections were made on what we previously considered secondary targets. We have discovered the presence of significant gold mineralization. This work has rejuvenated our interest and we will be revisiting our exploration model in the Scape Trend and test more of these targets. The Scrape Trend continues to offer more gold and we have a 2500 metres drill program to test these targets.

Brian: Finally, we have the Goldboro project, on which you are very close to completing a Feasibility Study.

While getting Goldboro into production is clearly the focus, can you give us a breakdown of the deposit’s geology and its potential for expansion in the future?

Paul: The Goldboro Deposit is hosted in sedimentary rocks and is a particular class of deposit associated with the folding of these sediments. During folding, the rocks form a series of ridges and troughs with gold associated with the ridges, or anticlines. Gold is deposited during this deformation and is located within the fold hinges and, importantly at Goldboro, down the limbs of the fold. Broadly, there are end members of this deposit type in Nova Scotia: one that has high-grade gold forming only in the hinges of thin (2 metres or less) sedimentary units, and the other has a generally lower grade deposit that is more broadly distributed over thick (tens or hundreds of metres) sedimentary units. Uniquely, Goldboro contains both high grade while still having a broad distribution of gold in the hinges and down the limbs of the anticlines. For this reason, Goldboro can accumulate much more gold and this is why it is the largest single gold deposit in Nova Scotia.

Our work at Goldboro has demonstrated that the deposit can grow rapidly with drilling and that the deposit remains open in all directions. Currently, the deposit is just over 2 kilometers of strike and has been tested to a maximum depth of 550 vertical metres with the majority of drilling in only the top 250 metres. Based on mapping, historic drilling and geophysical surveys, we know that the structure hosting the Goldboro deposit extends for at least 3.5 kilometres at surface, and that gold has been intersected along this entire strike. The deepest holes at Goldboro – testing approximately 550 meters deep – ended in the same structure, alteration and mineralization seen throughout the deposit, meaning the deposit is open at depth for expansion. Significantly, the center portion of the Goldboro deposit, named the Boston Richardson system, contains the best grade-thickness intersections within the deposit. The Boston Richardson, like the rest of the deposit, plunges gently eastward at about 20 degrees and remains open for expansion at depth.

With continued drilling near surface for open pittable resources, as well as deeper drilling for high grade underground resources, the Goldboro deposit has very high potential for further growth.