Kenorland Minerals (KLD:TSXV)

Kenorland Minerals is my largest personal position and the #1 ranked company in the JSR Premium portfolio.

Therefore, I’m biased in my view of the company.

That said, looking back to my original recommendation I was right about what I saw – see bleow.

Today looking out to the future, I’m more bullish than ever on KLD’s future.

Original Recommendation Article – Published on Nov.27th, 2020

A big drop in the gold price to start the week gave us a great buying opportunity on a number of the Premium portfolio companies.

Since Monday’s drop, the gold price has stabilized and so have the share prices of most of the companies.

So is the correction over?

Unfortunately, I don’t think so.

As I said in previous weeks, the uncertainty in the market has gone on long enough to stretch into tax loss selling season.

For those new to investing and the stock market, the end of the year can be plagued with selling as investors lock in losses for tax saving purposes.

My guess is that tax loss selling plus a weak gold price have led some investors to decide to dump positions in which they were down.

While I don’t think the result of the U.S. election or Covid-19 lockdowns becomes any clearer in the next few weeks, it’s my guess that by mid December, we may see share prices begin to move upward.

It is, however, impossible to say for sure.

I continue to believe it’s advantageous to set stink bids at 15% to 20% below market and be patient.

With that said, today I have for you a new pick, one which won’t be free trading again until its RTO is complete in mid December – great timing.

The company is Kenorland Minerals (NTW:TSXV).

Let’s take a closer look.

Kenorland Mineral (NTW:TSXV)

MCAP – $47.5M

Shares – 47.5M

FD – 58.0M

Cash – roughly $12M

Strategic Ownership: Management & Directors – 41%, John Tognetti – 22%

Private Placement – $10M at $1.00/unit (no Warrant) closed on November 4th.

NOTE: Kenorland will RTO into Northway Resources, which is already a public company run by the same management team. The company will move forward as Kenorland Minerals and trade under the ticker NTW.

The People

The success of a junior resource company is always linked to the strength of its management team.

This maxim is never more apparent than with exploration companies.

The fact is exploration is both expensive and risky.

Investors must understand that grass roots exploration, more often than not, results in failure.

It is, therefore, absolutely necessary to align your investment dollars with the people who have the experience, technical acumen and access to cash to give you the highest probability of success.

Just as the risk to the downside is high, conversely, so is the risk to the upside.

The upside is especially pronounced if mixed with a bull market.

With this said, some of the most seasoned resource sector investors that I know will still only invest in exploration, if the companies are prospect generators.

For those who are unaware, prospector generators are junior companies that use their technical acumen to identify high potential projects, which are then joint ventured (JV) with larger, more senior mining companies.

Once a JV deal is struck, the senior mining company will pay for the exploration work on the project.

Typically, JV deals are set out over a number of years, with a minimum spend each year and a gradual increase in ownership as the exploration work progresses, milestones are met and money is spent.

Joint venture agreements reduce the downside risk to the junior companies, while still maintaining good exposure to the upside.

As you will learn, Kenorland is a hybrid prospect generator with projects with and without JV agreements.

As CEO Zach Flood explained to me, the prospect generator model was something that made a lot of sense for Kenorland when they first launched the company.

It allowed them to both reduce their risk and operate on a shoe string budget.

Today, after some exploration success and, of course, a good resource market, Kenorland is able to make the jump to the public realm and explore projects outside of the prospect generator model.

The Kenorland team is made up of 6 geologists, all with varying experience levels and specialities.

The team is led by CEO Zach Flood.

Flood is a geologist with over 15 years of experience in managing mineral exploration programs, primarily within the Ivanhoe Group.

Francis MacDonald is the Executive VP of Exploration.

Prior to Kenorland, MacDonald spent the majority of his career with Newmont managing exploration projects around the world.

MacDonald comes with expertise in orogenic gold systems and VMS deposits, which is particularly important to note considering Kenorland’s stable of projects.

Scott Smits is the Chief Geophysicist.

In my view, Smits plays a particularly important role with Kenorland considering the deposit types they are attempting to discover and the importance of target generation in controlling costs and risk.

Thomas Hawkins is VP Exploration and has a PhD in geology.

Hawkins has 18 years of exploration experience, having most recently worked for Santa Fe Metals as VP Exploration.

Finally, Janek Wozniewski is the Exploration Manager.

Kenorland Board of Directors includes Rick Trotman, Jamie Levy, Jay Sujir, Jessica van Den Akker and Peter Meredith.

Projects

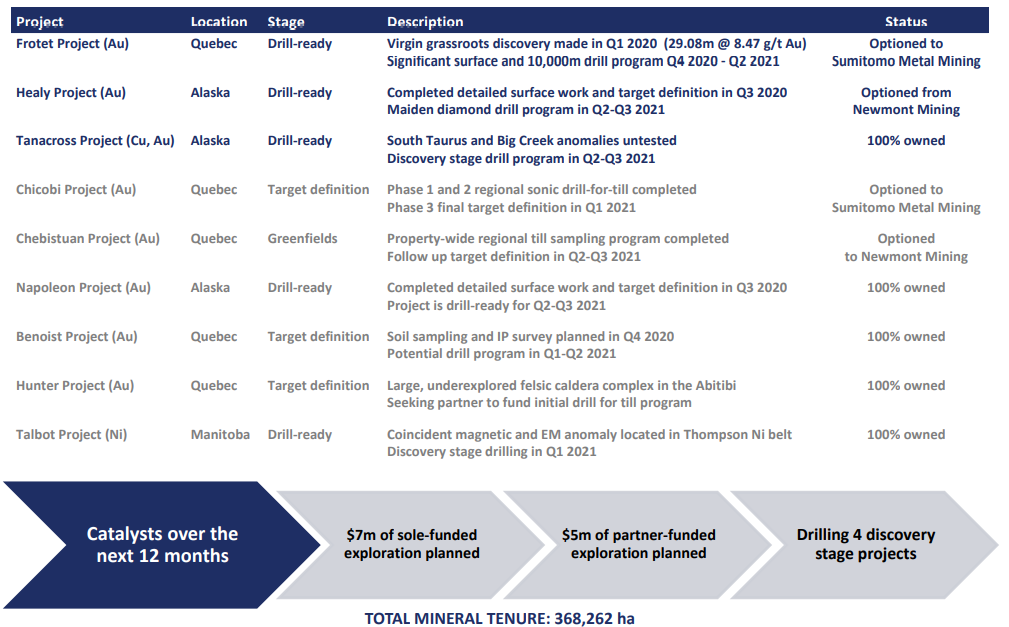

Frotet

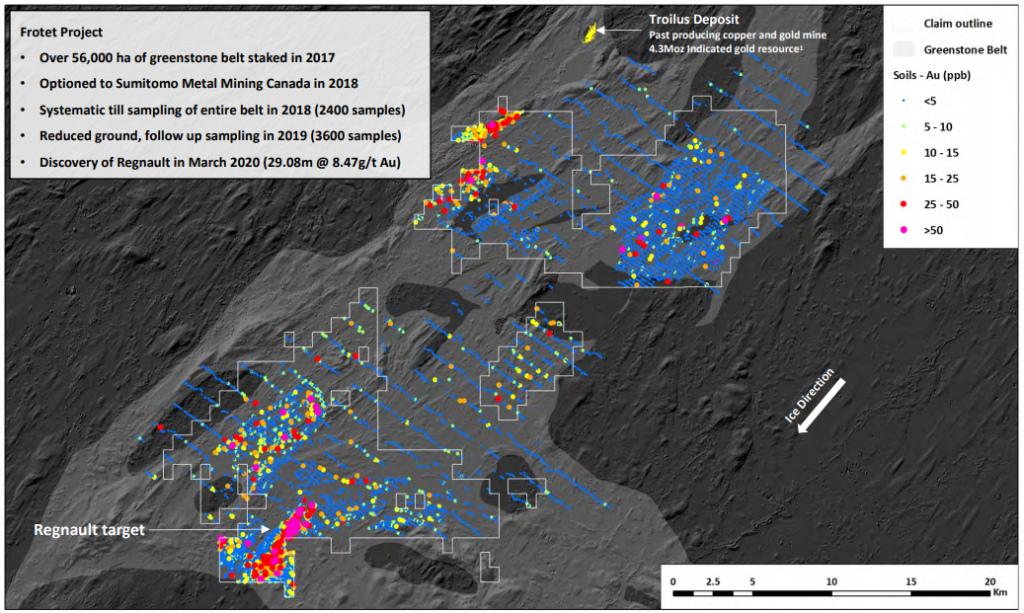

Kenorland has a number of interesting projects, but what first caught and held my attention was the blind discovery they made at their Frotet project in Quebec.

The future of mineral exploration, in my view, will be focused on blind discoveries as most of the outcropping deposits, at least in tier 1 jurisdictions, have mostly been found.

It goes without saying, therefore, that it’s vital for exploration teams to execute on the required baseline geological data acquisition – geological mapping, soil & till sampling / grab and chip sampling – geochemical, regional and target specific geophysics.

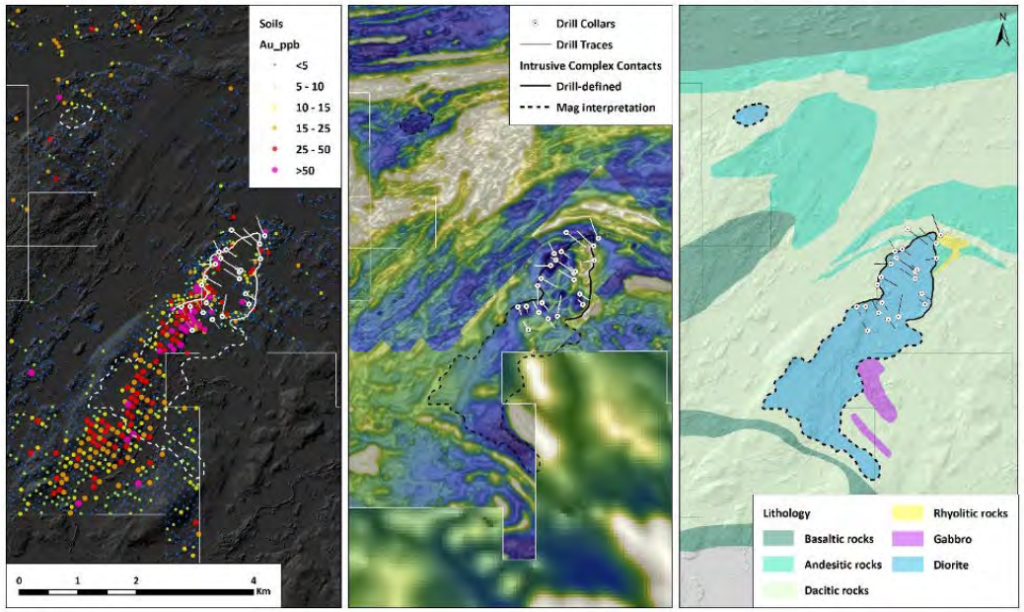

NOTE: As you can see from the regional soil data, there is a concentration of high grade samples around the Renault target. From here, the exploration team would have completed more detailed sampling in the area, plus complete a localized geophysical study. The combination of these localized data sets would then have allowed the team to define drill targets and, ultimately, make the discovery.

Kenorland acquired Frotet in 2017 and, over the next 3 years, completed all of the necessary baseline work to make the initial discovery in 2020.

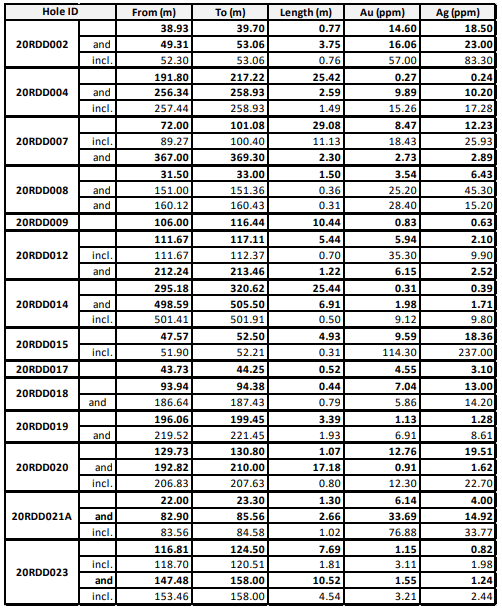

For those who aren’t familiar with the discovery, it was headlined by an excellent intercept of 29.08m of 8.47 g/t gold, including 11.13m of 18.43 g/t gold.

Overall, the drill program was very successful with 14 of 23 holes intercepting mineralization.

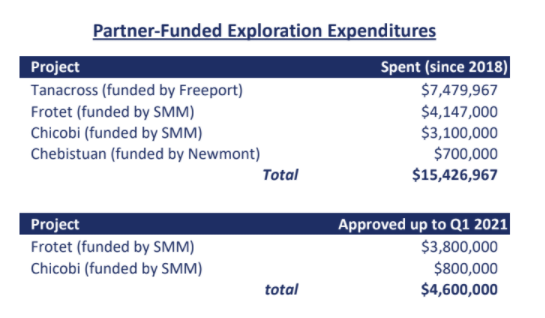

Sumitomo has committed to spending $3.8M in Q1 of 2021 to follow up on this initial drill program – which is great news.

To date, Sumitomo has spent $4.3M to earn a 65% interest in Frotet.

The Phase 2 earn-in will require them to spend $4M within 12 months to acquire up to 80% of the project.

I’m very keen to see the results from the follow-up drill program.

29.08m of 8.47 g/t gold is rare and could be the telltale sign of a big gold deposit.

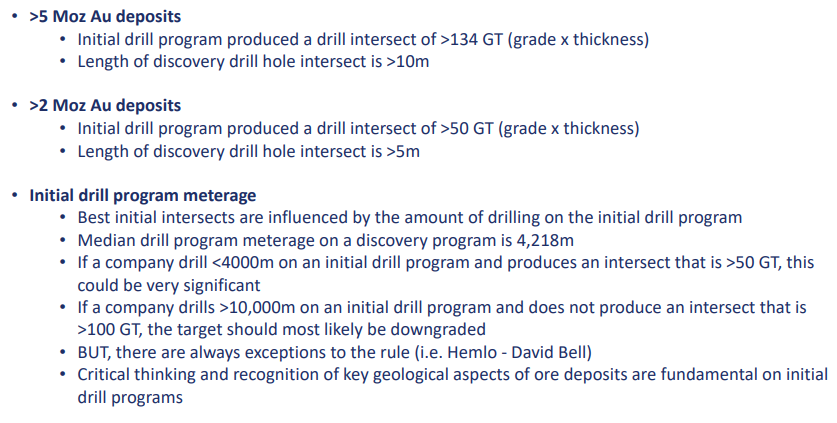

Food for thought – I highly suggest checking out Kenorland’s Discovery Study which is a copulation of drill data across Canada, specifically looking at the initial discovery drill programs.

Key takeaways:

As the study suggests, nothing is for sure, but having a 246.3 GT (29.08 x 8.47g/t) intersection in the initial drill program speaks volumes about Renault’s potential.

Chicobi

The Chicobi project has yet to have any drilling completed on it.

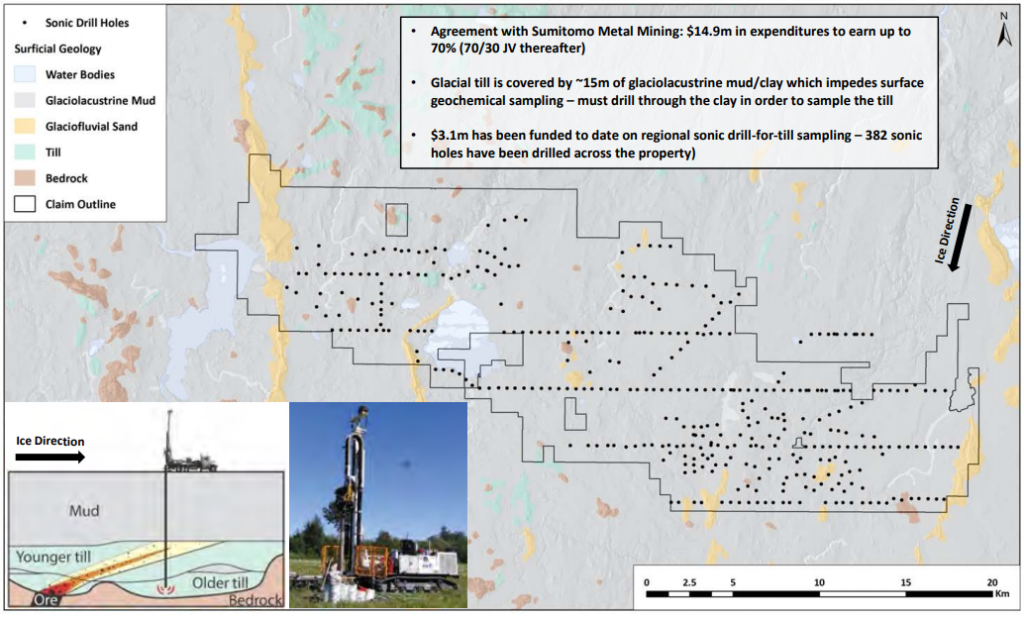

To date, much of the work is centered on till sampling, but not in the traditional sense.

The till at Chicobi is located under 15m of glaciolacustrine mud/clay.

They, therefore, had to drill to till sample.

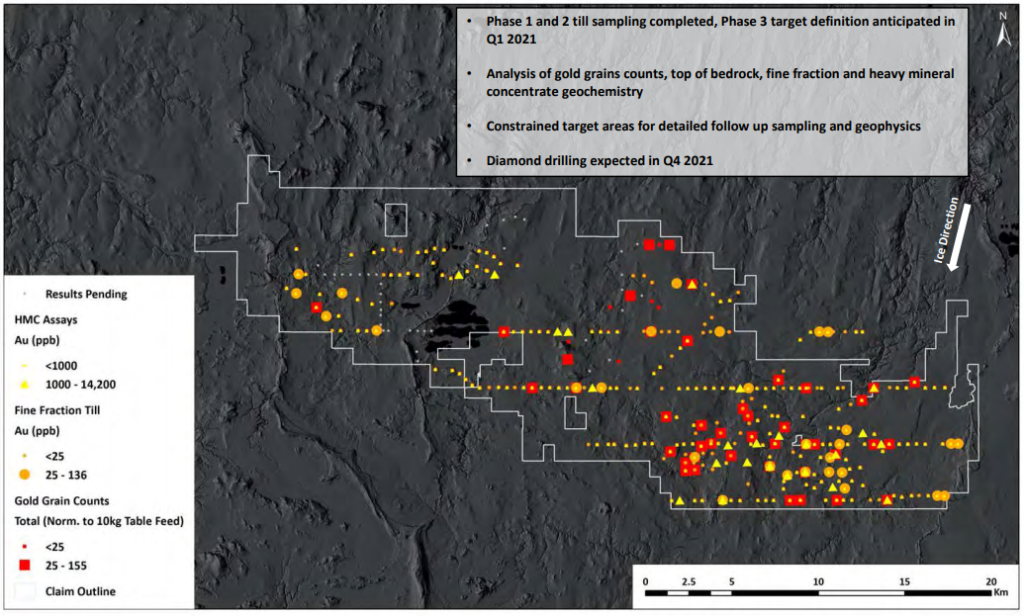

382 sonic drill holes have been completed with the results for gold grain counts, top of bedrock, fine fraction and heavy mineral concentrate geochemistry to come.

Following this data, the exploration team will be able to further focus their attention on the high potential areas.

As with Frotet, the high potential areas will be followed up on with localized geochemical and geophysical testing.

Drill target formation and drilling expected by Q4 2021.

Like Frotet, Chicobi is JVed with Sumitomo.

Sumitomo is required to spend $14.9M in expenditures to earn up to 70% of the project.

To date, Sumitomo has spent $3.1M and has committed to a further $800k in Q1 2021.

It’s my guess that further spending won’t be announced until results from the sonic drilling have been returned and analyzed.

The Chicobi project is large at 120,000 Ha, and is located in a favourable geological setting.

More data is obviously needed but the key take away at this point, in my view, is that there’s a gold system here.

Other Projects – Chebistuan, Tanacross, Healy, Benoist, Napoleon, Hunter, Talbot

I’m not going to go into the details of all the projects at this point, because there’s just too much information for one article.

Secondly, many of the other projects are in the initial stages of exploration and, therefore, while interesting, we won’t see any drilling for a while yet.

I will cover the other projects in more detail over the next year, as we receive new data.

I will, however, point out that the Healy and Tanacross projects are drill ready.

Healy

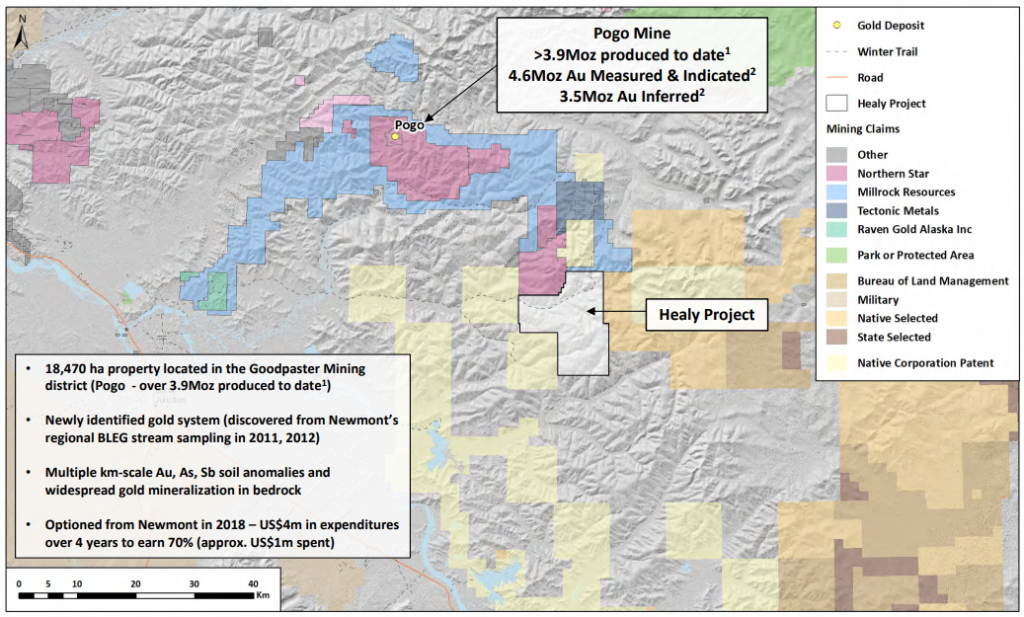

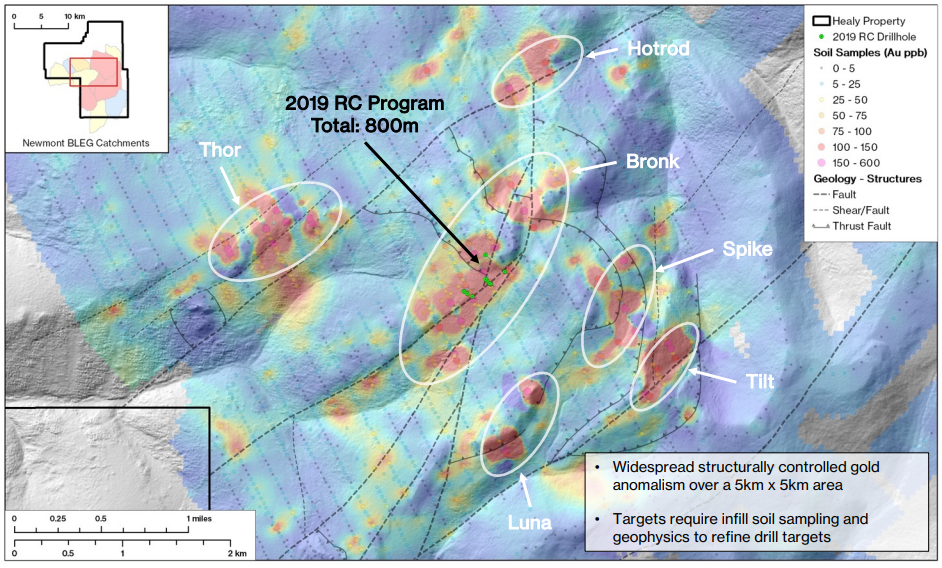

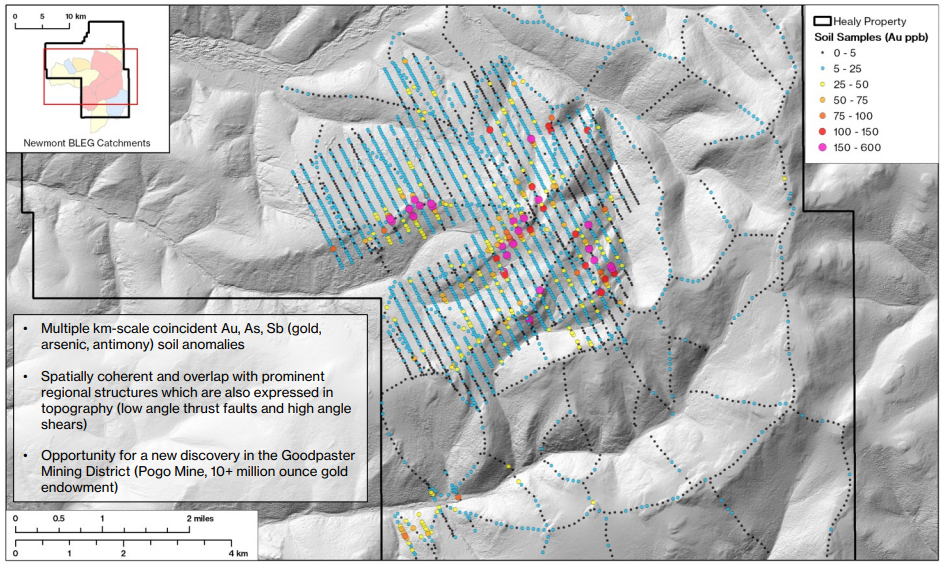

Healy is located in the Goodpaster Mining District, which, at the moment, is probably best known for the Pogo mine.

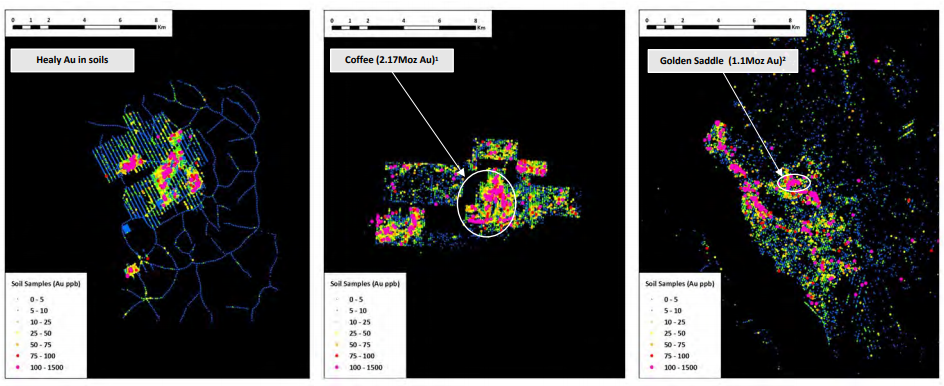

The above geochemical footprint comparison brings perspective on possible size of Healy when compared to the Yukon’s Coffee and Golden Saddle deposits.

Diamond core drilling is expected to commence in Q2 or Q3 of 2021.

Tanacross

Tanacross is a large district scale project, which is 100% owned and located in Alaska.

Exploration at Tanacross is concentrated on a cluster of highly prospective porphyry centers.

Historical drilling on the property is highlighted by 239m of 0.3% Copper, 0.23 g/t gold and 0.036% moly.

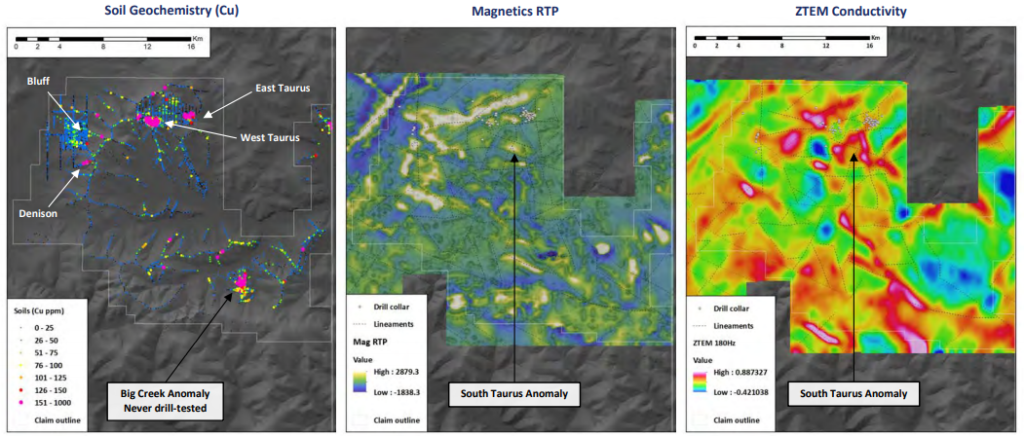

Property-wide soil sampling and airborne ZTEM and magnetics, completed in 2018, identified many geophysical and geochemical anomalies.

Specifically from the soil sampling, you can see high copper hits at Big Creek and East/West Taurus.

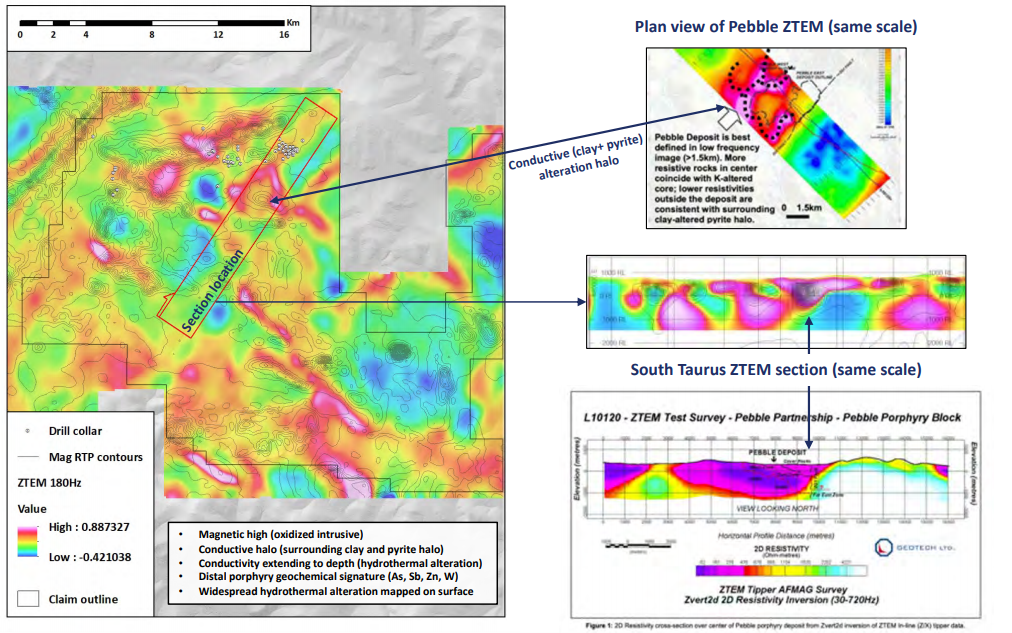

With that said, it’s the South Taurus anomaly which seems to have the most potential, as it clearly shows up in all three data sets – soils, magnetic and ZTEM.

Kenorland goes into more depth on the South Taurus anomaly with an interesting size and ZTEM comparison with the Pebble deposit.

For those who are unaware, Pebble is a massive deposit owned by Northern Dynasty, also located in Alaska.

Drilling is expected in Q2 or Q3 of 2021.

Risks to Investment

Gold Price

At the moment, the biggest risk to any junior gold company is arguably the gold price.

Uncertainty remains in the market with a contested U.S. election and Covid-19 lockdowns begin to re-appear.

Getting through tax loss selling season and into the new year with more certainty of who will be the U.S. President and when a stimulus bill can be passed, should go a long way toward changing the direction of the market.

Time will tell.

Covid-19

In Canada, Toronto and Peel Region (communities directly west of Toronto proper) are in lockdown until Dec. 20th.

Additionally, the provinces of Alberta, Saskatchewan and Manitoba have reported spikes in number of Covid cases.

It’s my guess that we may be on the precipice of a lockdown in these provinces, too.

Kenorland has projects in Quebec and Alaska.

At the moment, things appear to be OK in these jurisdictions, but Covid lockdowns can be instituted very quickly.

It’s my guess that the biggest risk associated with a lockdown would be related to the assay labs, which are already overrun with samples.

We will have to wait and see.

Exploration Risk

Exploration companies always come with a high amount of risk.

Companies using the prospect generator model, however, do have the advantage of reducing that downside potential by having senior companies pay for the exploration expenses.

Kenorland has a nice mix of JV deals and 100% owned projects, which all appear to have great potential.

Personally, I really like the balance of exploration in Kenorland and am particularly intrigued by the technical and data-rich approach the team takes to make their decisions.

Strong frameworks for decision making are integral to success.

In my view, while there is certainly risk here, it’s greatly reduced by the team’s technical acumen and overall approach.

Concluding Remarks

Exploration is a risky business, no matter how you slice it.

With that said, if investors are picky and are able to find the right people, the risk associated with exploration can be diminished.

In Kenorland’s case, I’m very confident that this team has the right people.

The framework that they use to make decisions appears to be very strong.

Examining Kenorland’s stable of projects and the data that they present as reasoning for their continued interest in the projects suggest to me that this company is headed toward immense success.

This thesis will be tested in the near future as the ground truthing mechanism – the drill will be turning at Frotet in Q1.

Drilling at Frotet will be followed by drilling at Tanacross and Healy in Q2 or Q3.

There’s a lot of news flow in 2021 as Kenorland makes its foray into the public realm.

I participated in the recent financing at $1.00/unit and will be looking to add to my position when the company RTOs into Northway in mid December.