Nevada Site Visits – Day 2 – U.S. Gold Corp.

Have we reached peak gold?

I have read this headline multiple times, but never really listened to the commentary. Now, this isn’t for any specific reason, it’s just that, generally speaking, I really don’t read or listen to much sector commentary.

To start, I think it’s really important to define what exactly peak gold is before discussing it.

Personally, when I think of peak gold, it is a scenario whereby global production and discovery never again reaches the highs of the past; essentially, it’s all downhill from here.

To start, does it matter if this is true?

In my mind, it’s debatable, as gold is very different from almost every other metal. Essentially, all the gold that has ever been mined still exists – it isn’t consumed in the traditional sense.

Bullishness on gold based on supply and demand, therefore, is hard for me to accept because supply is readily available to come into the market at any time.

My thought is that peak gold or, really, peak anything, is just a matter of price.

Price or economics is the ultimate motivator; as we have continually seen throughout history, it pushes innovation.

Oil is a great example.

During the years of +$US100 per barrel, much of the narrative focused on peak oil, which coincidently sounds a lot like what we are hearing about peak gold now.

We are finding less, we have to go deeper and explore in more remote jurisdictions or harsher environments, making it more expensive to extract – we have hit peak oil.

Wrong, high oil prices spurred the innovation of horizontal drilling and, of course, have broadened the discussion on other fuel sources.

Each metal is going to be different, I agree. However, generally speaking, my thought remains that scarcity leads to higher prices and higher prices lead to innovation and/or substitution.

In gold’s case, I think we’re going to see the industry innovate itself in exploration and mineral processing.

Firstly, with regards to exploration, I think it will be geophysics that sees a major revelation in the future.

Pre-drilling exploration work is becoming more and more important in identifying and prioritizing targets and I believe this is where we may see the bulk of innovation.

Second, there’s a large portion of known deposits with refractory gold. It’s my guess that money will be spent to optimize the mineral processing techniques that are needed to liberate this trapped gold.

As the gold price rises, more and more attention will be given to producing and discovering it – ergo a new renaissance will emerge and gold’s horizontal drilling equivalent will be born.

Or, maybe not. Time will tell!

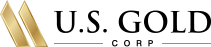

Today, I have for you my notes from the field from day 2 of my Nevada site visit tour. U.S. Gold Corp was the focus of the second half of the trip and took us to the northeastern portion of the state, near Elko.

Let’s take a look.

U.S. Gold Corp (USAU:NASDAQ)

MCAP – US$18.2 million (at the time of writing)

Shares – 23.6 million

FD – 29.9 million

Cash – roughly $2 million

NOTE: On June 20, 2019 U.S. Gold Corp closed a $2.5 million F Series convertible preferred stock in a non-brokered registered direct offering.

NOTE: U.S. Gold Corp was acquired by Dataram in mid-2016. At the time, U.S. Gold Corp. was in possession of a PEA level Copper King project located in Wyoming. Keystone project acquired after formation of the new company.

Keystone Project

U.S. Gold Corp.’s flagship Keystone project is located on the Cortez Trend, just south of Nevada Gold Mines’ Cortez Hill mine.

NOTE: Nevada Gold Mines was formed through the merger of Barrick Gold’s and Newmont Goldcorp’s Nevada assets.

Keystone, in its current form, represents the consolidation of what used to be a few different properties and, in total, encompasses 20 square miles or roughly 5200 hectares.

Past operators of these various claim blocks were Newmont, Chevron, USMX, Placer Dome and McEwen Mining Co.

Note: Dating back to the 1980s, a total of 240 shallow, less than 100m deep, drill holes have been drilled on the various portions of the property.

Geochemical and Geophysical Data

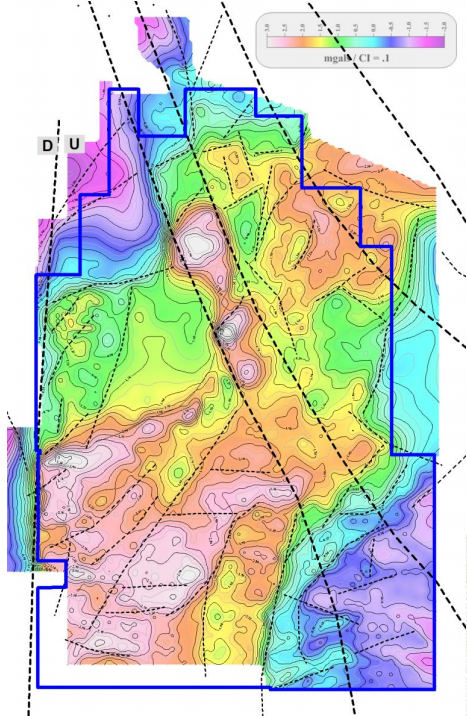

Keystone’s geochemical database consists of 7,372 soil samples, 3,414 rock samples, 666 fine-sediment stream samples and 661 altered stream cobble samples.

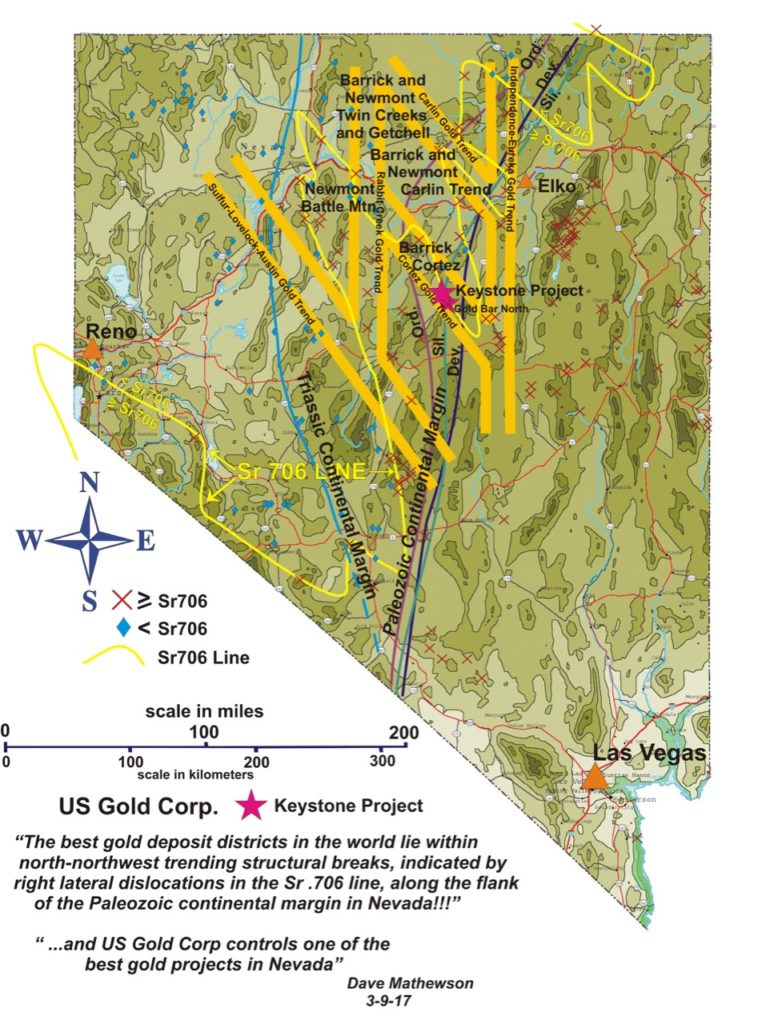

Along with the strong database of geochemical data, they have also completed regional magnetics on the project.

As the image demonstrates, the magnetics are interpreted to reveal a northwest striking structure. These structures have been confirmed by geological mapping and through geochemical testing.

For example, most of the soil sampling data reveals high concentrations of pathfinder metals within this northwest trend.

The arsenic samples in particular provide us with a clear visual concentration along the northwest trend, and also appear to follow a secondary structure to the southwest.

More data can be found within the Keystone specific page, too – geochemical testing, magnetic report, Keystone Master of Science Thesis, etc.

2019 Drill Program

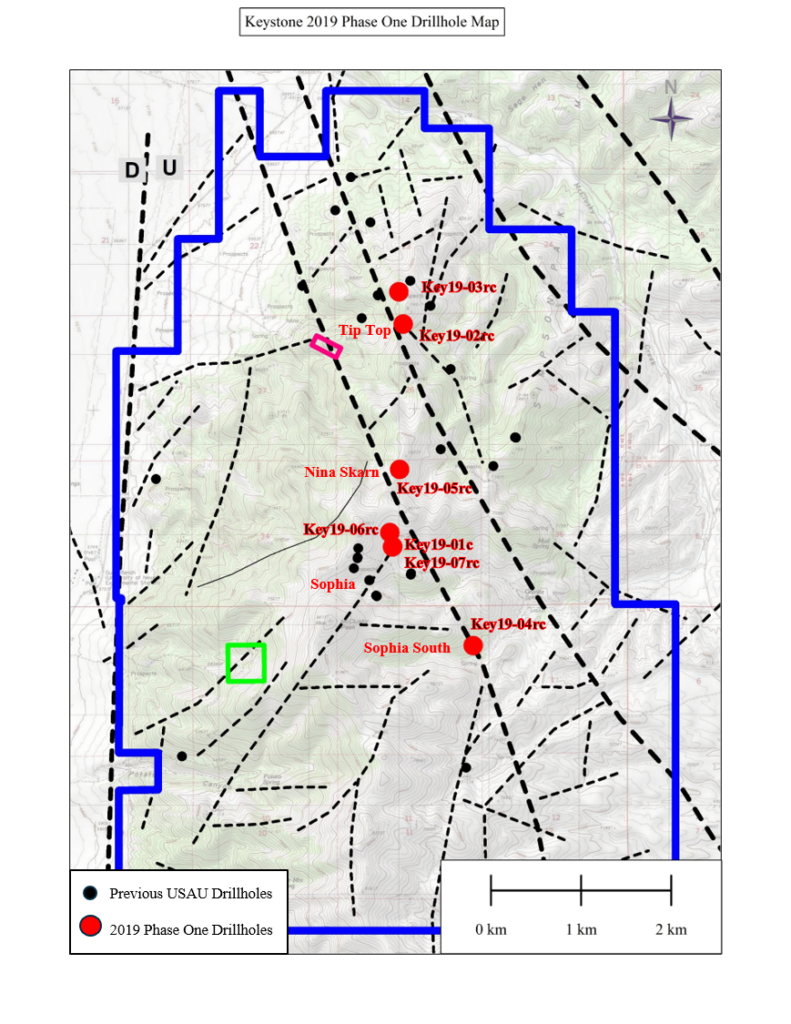

The 2019 drill program consisted of 7 holes, 6 RC and 1 diamond, totalling 4,000m. The first hole of the program was a follow up on hole 18-09rc, in Sophia Target Zone, from the 2018 program, which encountered over 350m of nearly continuous oxidized breccias, but was lost approximately 1600ft or 500m down hole, due to hitting a 20ft void.

CEO, Ed Karr, explained to me that they were very interested to follow up on this lost hole because of its possible similarities to Nevada Gold Mine’s Gold Rush deposit.

Gold Rush is a deep deposit, with voids or a Swiss cheese like matrix of rock above it. Hence, their excitement. Unfortunately, the follow up hole was a dud, returning mostly clay.

The 6 remaining holes, all RC, were drilled within the Tip Top, Sophia South and Nina Skarn Target Zones.

To date, U.S. Gold Corp. has really had no significant gold intercepts to list, but have shown many intersections with anomalous gold, which they define as greater than 10ppb gold over 50ft thick.

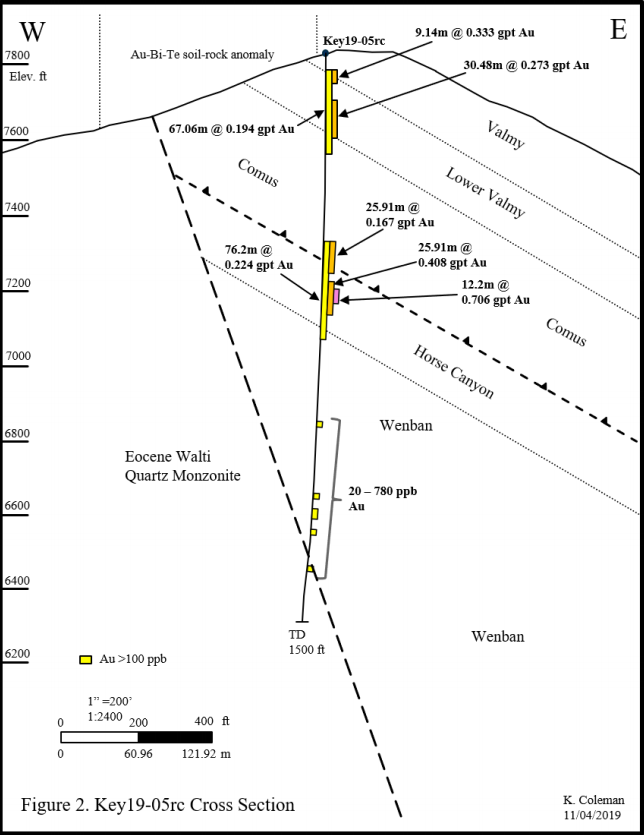

The 2019 drill program continued with similar results, mainly low grade gold over thin widths, except for hole 19-05rc which was drilled within the Nina Skarn Target Zone.

19-05rc intercepted 67.06m of 0.194 g/t gold, which includes intervals of 9.14m of 0.333 g/t gold and 30.48m of 0.273 g/t gold.

Additionally, further down hole, it intercepted 76.2m of 0.224 g/t gold, which includes 25.91m of 0.167 g/t and 25.91m of 0.408 g/t gold, which includes 12.2m of 0.706 g/t gold.

Now, these aren’t high grade hits by any means, but compared to historical results and the bigger geological picture, they may indicate the presence of a larger gold system.

Karr explained that they believe this mineralization is a part of a halo surrounding what could be a larger, higher grade gold deposit northeast of drill hole 19-05rc. U.S. Gold Corp.’s geologists believe that it’s an intrusion in this northeast area of the property which may have acted as the heat engine for the mineralization intercepted in this hole.

This area between hole 19-05rc and the northeast intrusion will be the main focus of the company’s next drill program, as they try to vector in on what they hope is a high grade gold deposit.

While they have narrowed their exploration focus on Keystone, in my opinion, it’s still akin to finding a needle in a haystack – 2020 drilling at Keystone should be interesting.

Winter is upon them in this mid portion of the Battle Mtn – Eureka / Cortez Trend, and given the mountainous terrain, they will not be able to get drills back into Keystone until next spring.

To add, with roughly $2 million in cash left, U.S. Gold Corp will have to raise more money before conducting next year’s program.

Copper King

The Copper King project is 100% owned by U.S. Gold Corp. and is located in southeastern Wyoming, approximately 32 km west of the city of Cheyenne.

An updated version of the PEA was completed for U.S. Gold Corp. in 2017 and can be found here.

In my discussion with Karr, he indicated that they are working on a PFS for the project and expect it to be complete by mid-year.

Personally, I’m interested in seeing the mineral processing results, as they will have to use a wider range of samples in their testing, as the PEA met work mainly used high grade material from the centre of the deposit.

Here are the high level highlights from the 2017 PEA:

Gold Price Assumption – US$1275

Copper Price Assumption – US$2.80

Pre-tax NPV@5% – $178.5 million

Pre-tax IRR – 33.1%

CAPEX – $113.66 million

Measured Resource – 13.7 Mt at 0.62 g/t Au (272K oz) and 0.198% Cu (60.1 mlbs)

Indicated Resource – 40.4 Mt at 0.48 g/t Au (654K oz) and 0.182% Cu (162.8 mlbs)

Inferred Resource – 14.1 Mt at 0.38 g/t Au (174K oz) and 0.2% Cu (62.5 mlbs)

Concluding Remarks

Currently, U.S. Gold Corp. has a MCAP of around $25 million CAD and, in my opinion, makes it fairly valued given their assets.

In my view, the bulk of U.S. Gold Corp.’s value is found within their PEA level Copper King project, where I’m happy to hear they are moving forward with PFS level development work.

On the other hand, while the Keystone project has the right address, the visual hallmarks of a prospective Carlin style gold project, it just hasn’t produced the results for me to give it much value.

In saying this, hole 19-05rc may end up being the key needed to discover Keystone’s yet to be found gold deposit. More time and money is going to be needed to move this forward and prove their current thesis.

As an investor in the junior resource sector, I have learned that it’s integral to protect my downside risk and, therefore, I’m always looking to put my money into companies that are selling for less than their intrinsic value.

As I said, I believe at its current MCAP, U.S. Gold Corp. is arguably selling for its intrinsic value and, therefore, makes it less appealing to me considering the money and upcoming catalysts needed for share price appreciation.

I’m not a buyer of U.S. Gold Corp., but will be adding it to my watchlist, as tax loss season is upon us and who knows where the market may be headed.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with any of the companies discussed in this article, however, U.S. Gold Corp. did pay for my site visit expenses. I do NOT own shares in U.S. Gold Corp.