Waking the Giant: A Look at Cameco in Today’s Uranium Market & Going Forward

Disclaimer: The following is not an investment recommendation, it is an investment idea. I have not been compensated to write this review, however, I do own shares in this company. Please perform your own due diligence to decide whether it is a company that’s best suited for your personal investment criteria. All Cameco Corporation analytics were taken from their website and press releases.

The uranium price continues to make new lows, and in the midst of this carnage, a slumbering giant is still making its shareholders money. Cameco’s 3rd quarter results, released last week, surprised many in the midst of such dismal prospects.

This report takes a look at the current Cameco story, specifically the people who manage this uranium company, the properties and the jurisdictions in which they’re located, and how Cameco is weathering a falling uranium price. This analysis also sheds light on the reasons I think Cameco will be the leader when this long uranium bear market comes to an end.

The People at the Helm of Cameco

Unlike junior companies which, for all intents and purposes, are only as strong as the people who manage them, the executive personnel in senior companies with producing assets aren’t always considered to be as vital to the company’s success. When a stalwart executive group is at the helm of a big company like Cameco, however, it can make all the difference in the world. Let us take a look at what I believe is a great mix of business and real world uranium mining experience.

Cameco’s management is headed by Chief Executive Officer (CEO), Tim Gitzel, who took the reins back in July of 2011. Gitzel has a law degree from the University of Saskatchewan and possesses 25 years of combined experience in senior management and legal experience. Before joining Cameco, Gitzel was the Executive Vice-President (VP) of AREVA’s mining business unit based in Paris, France, later becoming President and CEO of AREVA’s Canadian subsidiary. Gitzel’s working experience has set him up well for his current position at the top of the world’s 2nd largest uranium company.

Gitzel’s operational team is led by Chief Operating Officer (COO), Robert Steane, who worked his way up the corporate ladder from Assistant Mill Superintendent to his appointment as Senior VP and COO in May of 2010. Speaking from my own experience, having worked in the steel manufacturing industry for several years, the best operational management comes from those who have worked their way up from the ‘floor’ to the c-suite. Hands on ‘floor’ experience can never be replicated in a class room, and in Cameco’s case, they have chosen well, promoting Steane from within to lead their operations.

Rounding out the most important positions in Gitzel’s team is Chief Financial Officer (CFO), Grant Issac. Issac holds a BA and MA in economics from the University of Saskatchewan and a PhD from the London School of Economics. Before joining Cameco, Issac was a professor and Dean of the Edward School of Business at the University of Saskatchewan. Issac was appointed Senior VP and CFO of Cameco in July of 2011, where he oversees finance, tax, treasury, investor relations, strategy and risk, and marketing for Cameco Inc. and Nukem.

The Cameco team is built around experience in the industry, and in my opinion, it will be what powers them through what is currently a very tough uranium market.

Cameco’s Producing Properties

Cameco’s properties have a combined Proven and Probable Reserve total of 410 million pounds (Mlbs). Further, they have 377 Mlbs in Measured and Indicated resources and an Inferred total resource of 381 Mlbs. Cameco’s 3 largest producing mines are giants next to their peers. Let’s take a look:

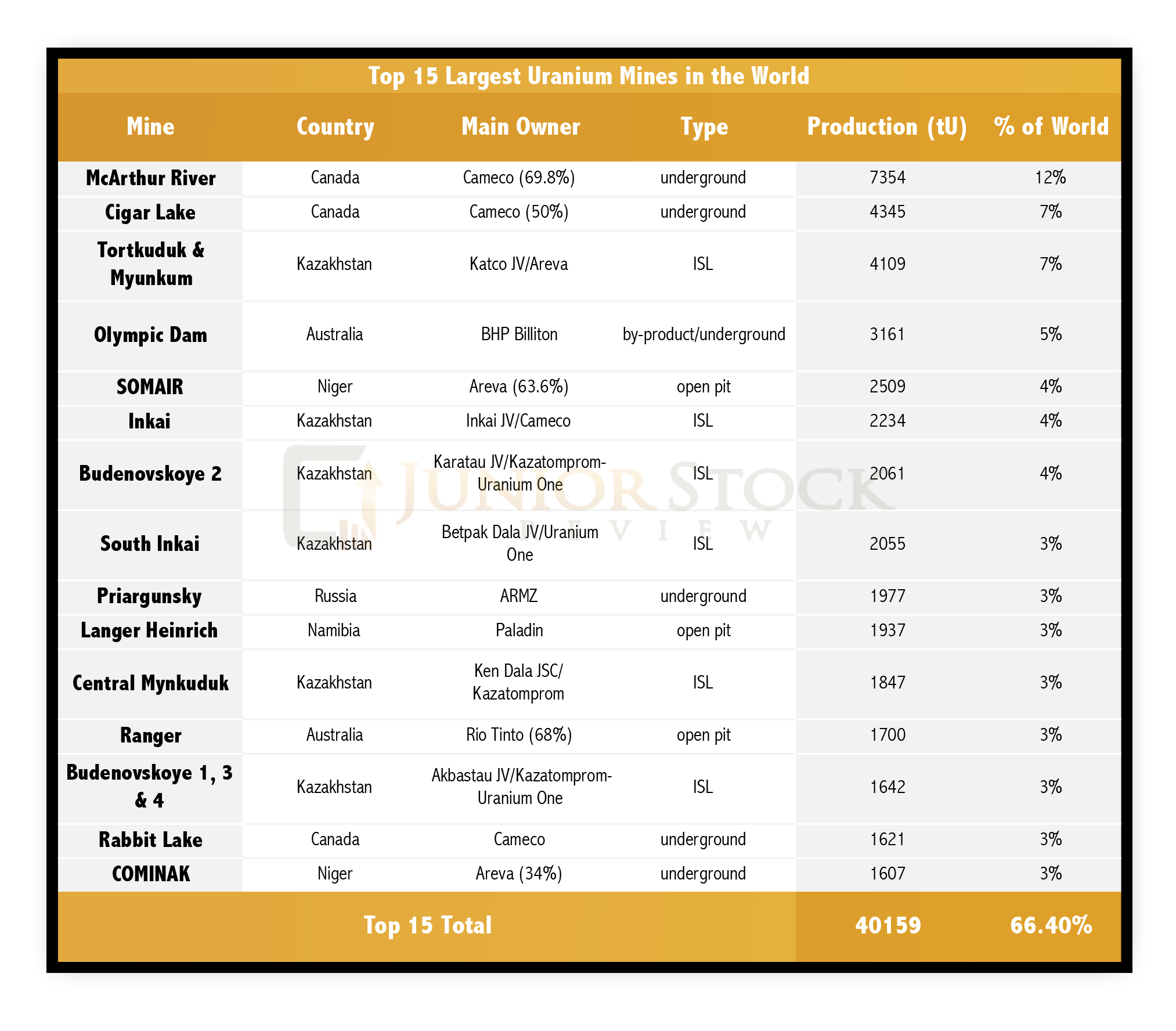

McArthur River and Cigar Lake are not only Cameco’s largest producing assets, but the largest producing mines in the world. McArthur River and Cigar Lake are a part of Saskatchewan’s Athabasca Basin, which is home to some of the highest grade uranium mines in the world.

By the numbers:

McArthur River

- Proven & Probable reserves of 234.9 Mlbs @ 10.94% (average grade U3O8) – more than 50% of Cameco’s reserves

- Underground mine

- 70% owned by Cameco

Cigar Lake

- Proven and Probable reserves of 110.9 Mlbs @ 16.7% (average grade U3O8)

- Underground mine

- 50% owned by Cameco

Cameco’s third largest producing asset is a joint venture located in Kazakhstan, named Inkai. While not a high grade uranium source, the uranium in the Inkai deposit is extracted using In-Situ Recovery, a very low cost form of mining.

Inkai

- Proven and Probable reserves – 43.1 Mlbs

- In-Situ Recovery

- 60% owned by Cameco

NOTE: On April 21, 2016, Cameco announced that it would be suspending production at its Rabbit Lake operation.

Prospective Properties

Cameco’s Millennium uranium project is a joint venture (Cameco owns 69.9%) with Areva and is located in the Athabasca Basin in northern Saskatchewan. It contains an Indicated resource of 53.0 Mlbs at an average grade of 2.39% U3O8 and an Inferred resource of 20.2 Mlbs, average grade of 3.19% U3O8.

As stated on the Cameco website, regarding work at Millennium,

“[N]o work is planned for 2016, as regulatory activity related to our final environmental impact statement continues to be on hold. Further progress towards a development decision is not expected until market conditions improve.” ~ Cameco

Given the current uranium market and the need to tie up regulatory requirements for the project, Millennium will wait for development until the market turns from bear to bull.

Cameco’s Kintyre uranium project is a joint venture (Cameco owns 70%) with Mitsubishi Development Pty Ltd. and is located in the Pibara region of Western Australia. It contains a Measured and Indicated (M&I) resource of 53.5 Mlbs U3O8.

The Kintyre project is advance-staged and has completed a prefeasibility study, community engagement and education program and signed an Indigenous Land Use Agreement with traditional owners, the Martu.

Although this project appears to be ready for construction, it may be a while before Cameco gives the green light, given the current uranium market.

Cameco’s Yeelirrie uranium project is 100% owned and located in Western Australia. It contains a M&I resource of 127.3 Mlbs, with an average grade of 0.16% U3O8. This past summer, Cameco had Western Australia’s Environmental Protection Agency (EPA) do an assessment of the Yeelirrie project. The EPA evaluated the property against 9 criteria. Cameco reports on the results of the assessment on the Cameco Australia website,

“The EPA has determined that eight of the nine key environmental factors at Yeelirrie can be managed to meet the EPA’s objectives. For one factor, subterranean fauna, the EPA was not satisfied with what was proposed.” ~ Cameco Australia

Cameco will have to find a way to effectively deal with the subterranean fauna before they will have any hope of constructing a mine here. What’s the likelihood that they will be able to deal with this set back? I’m not really sure, more research is needed, but given the uranium price, I don’t believe bringing this asset to production is a very high priority.

Although Cameco’s business is highlighted by the strength of its mining operations, they’re involved in and excel at each aspect of the nuclear fuel cycle, from conversion to fuel rod assembly. Their nuclear fuel facilities are exclusive to Canada, or more specifically, Ontario. For those familiar with the geography of Southern Ontario, 3 of the 4 nuclear fuel facilities are actually situated in the Port Hope/Cobourg region, which is about a 1.5 hour drive east of Toronto.

Also to note, Cameco does have a 24% interest in the experimental Global Laser Enrichment facility in the United States. They are partnered with GE and Hitachi in this endeavour.

Cameco is truly an international company, but does have the bulk of its operations in North America, and specifically Canada. From a jurisdictional perspective, Cameco’s risky assets are in Kazakhstan. In relative terms, however, the Inkai mine makes up 10.5% of Cameco’s uranium reserves, and while this would certainly impact the company if it were compromised, it’s a small part of the company’s business as a whole.

Why do I consider Kazakhstan to be risky? There are a couple of reasons; Firstly, Kazakhstan uranium is primarily mined by a state-owned company called, KazAtomProm. Any time an industry is controlled by a government, I’m concerned about the possibility that the resource (asset) will be nationalized at some point. Second, with Kazakhstan being a former Soviet state, I wonder where allegiances will lie if tensions rose between Russia and the rest of the world – I wrote about this in part 3B of the Uranium series.

NUKEM

If you have explored Cameco quarterly news releases, you may be wondering about NUKEM. Prior to being purchased by Cameco in 2012 for USD $136 million, NUKEM Energy group had been involved in the nuclear energy industry for more than 50 years. NUKEM acted as an intermediary in the commercial nuclear fuel market, concentrating primarily on the purchase and sale of uranium concentrates U3O8, UF6 and enriched uranium product (EUP). Cameco has kept the NUKEM offices in Germany and the United States.

Further information on NUKEM can be found in the report, here

A Look at How Cameco is Surviving the Bear Market

How is Cameco fairing in this uranium bear market? I had the chance to correspond with Senior Communications Specialist, Carey Hyndman, last month:

- Cameco’s uranium selling prices are protected to a certain degree with a price hedge, as outlined in the price sensitivity section of the 6Q. That said, when does the decision to cut production at these lower trending spot prices become a reality?

Hyndman: “The uranium price sensitivity table is based on our portfolio of contracts, where we have an average of 27M lbs in sales commitments over the 5-year period shown. It isn’t evenly distributed, but heavily committed through 2018 and declining in 2019 and 2020 to arrive at that average. We are cautiously preparing for a scenario where the market remains lower for longer and on that basis, our strategy is to profitably produce from only our tier-one assets, at a pace aligned with market signals, to increase long-term shareholder value. This means maintaining flexibility to increase or decrease production, but it depends on the market conditions.”

My Comments:

Commodity price hedging is fairly common for the largest producers in the resource sector, and it certainly protects against downside risk, but it also limits their upside potential in a raging bull market. In this case, I think Cameco has done a fine job protecting themselves from a massive slide in the uranium price, by hedging their sales portfolio.

Let us take a look at Cameco’s performance by the numbers in 2015:

- Produced – 28.4 Mlbs U3O8

- Average realized sale price per pound – $57.58 CDN

- Revenue – $2.8 billion

- Gross Profit – $697 million

- 2016 YTD – Quarter by Quarter – Taken from Cameco News Releases, please review reports for further details, this is only meant to be a high level look at the quarterly financials:

- 1st Quarter – 3 months ending March 31, 2016 – Revenue $408 million / Gross Profit $118 millon / Net Earning (loss) in $ per share (diluted) 0.20

- 2nd Quarter – 3 months ending June 30, 2016 – Revenue $466 million / Gross Profit $43 million / Net Earning (loss) in $ per share (diluted) (0.35)

- 3rd Quarter – 3 months ending Sept 30, 2016 – Revenue $670 million / Gross Profit $146 million / Net Earning (loss) in $ per share (diluted) 0.36

I believe this performance – in what is widely thought to be the 2 worst years of the uranium business in decades – to be proof that Cameco can survive and profit in the face of adversity.

- With an exploration budget greater than 2015, yet a lower 2016 trending uranium price, how is Cameco’s exploration work affected?

Hyndman: “You’ve seen our exploration program decline significantly, from a spend of $97 million in 2012, to under $50 million this year, so exploration has been significantly impacted. The budget process for 2017 is currently underway.”

- In a lower trending uranium price market, why does Cameco choose to invest in exploration rather than purchasing an outlined resource?

Hyndman: “You’ve seen our exploration program decline significantly, from a spend of $97 million in 2012, to under $50 million this year, so exploration has been significantly impacted. We continue to believe that our pipeline of advanced exploration projects including Millennium, Kintyre and Yeelirrie, as well as the other deposits where we have an interest, are best in class. On the M&A side, junior companies, including exploration plays and those that consider themselves developers, must compete against our internal suite of projects and mine expansion opportunities, and we have not seen anything that we think will add more value than what we already have.”

- Considering Russia’s decision to suspend their weapons grade plutonium down blending deal with the US (Oct.3/16 News Release), do you foresee this having a positive effect for Cameco’s primary uranium supply? If so, how?

Hyndman: “This was a headline in the context of political implications, not due to a potential impact on the uranium market. At the moment, only a very small quantity of MOX fuel (mixed oxide, where plutonium is recycled into reactor fuel) is produced globally, and the Russian proportion would only be a small piece of that. With a significant amount of oversupply in the market today, we would not anticipate much of an impact on the primary supply market.”

- In the 6Q uranium market update, you reference a few positives for uranium demand; Japanese reactor stress testing and new reactor construction. In the short term (1 to 2 years), does Cameco foresee any other catalysts for an increase in uranium demand? If so, please explain.

Hyndman: “Demand is fairly predictable: national energy policies are widely known, plans for reactors are published, and it’s generally reported when a reactor construction project begins and when reactors come online. The catalysts you listed are the ones we’re watching – Japanese reactors need to get on a sustained path for restarting (which would impact market sentiment), and we need to see continued construction of new reactors around the world, particularly in China, India and South Korea. As overall demand grows, and the excess inventory and oversupply that has built up over the past 5 years clears the market, we are then watching for a return to long-term contracting and more concern around security of supply. However, in the meantime, we’re keeping an eye on primary supply performance, as there has yet to be a significant supply reaction to the current oversupply situation.”

Issues with the CRA

Cameco has been in the news as of late, with their public battle with the Canadian Revenue Agency (CRA) over a potential $2.2 billion tax bill. The Financial Post reports in their October 3, 2016 article,

“At question is whether Saskatoon-based Cameco Corp. set up a subsidiary in low-tax Switzerland and sold it uranium at a low price simply to avoid tax, as the CRA contends. Cameco maintains it was a legal and sound business practice.” ~The Financial Post

In 1999, Cameco Europe Ltd. was established in Zug, Switzerland (Low Corporate Taxes). As reported by the Globe and Mail,

“Cameco then signed a 17-year deal to take the uranium it produces in Canada and sell it to Cameco Europe before it made its way to the end customer.” ~Globe and Mail

The CRA’s reassessment of Cameco taxes for 2003, 2005 and 2006 tax years are being appealed in tax court now, with the court’s decision to come early next year. On their websites, Cameco outlines that the worst case scenario for them is,

“[O]ver time we would be required to pay cash taxes and transfer pricing penalties of between $1.5 billion and $1.7 billion, plus interest and instalment penalties. These payments cover the period 2003 to 2015.” ~ Cameco

My take on this situation; In the end, I think Cameco will have to pay some percentage of the monies in question to the CRA. Interestingly, Cameco isn’t the only resource company that’s in the midst of a major tax dispute with the CRA; Silver Wheaton is also in a public battle.

I believe this tax dispute trend isn’t going away any time soon, as governments around the world continue to spend money that they don’t have. Their only option, besides raising taxes, is to hire more people to question the tax returns of their citizens and corporations.

No matter the outcome, Cameco is still the major player in the uranium sector, and in my opinion, has the balance sheet to deal with whatever the courts decide. With the down trodden uranium price and this negative press, Cameco’s share price seems like a tremendous buy.

PUSH: Next spring, when this tax dispute is finalized by the courts, I’m of the opinion that Cameco’s stock will be re-evaluated to the upside.

Cameco Comparables

CCO – TSX Listing

MCAP – CDN $4, 975, 112, 002 (at the time of writing)

Price to Book – 0.914

Yield – 3.26%

52-Week High – CDN $17.67

52-Week Low – CDN $9.88

It’s incredibly hard to try to compare Cameco to its peers; If you consider the top 10 uranium producers in the world, most are state-owned and controlled, and the others, specifically BHP Billiton and Rio Tinto, don’t have businesses that revolve solely around uranium.

AREVA is probably the closest comparison because it’s involved in each part of the nuclear fuel cycle, but the French state controls, directly or indirectly, 86.52% of AREVA, making it, as far as I’m concerned, an unfair comparison.

In reality, Cameco is the largest publicly traded uranium company in the world and really has no direct comparisons. Instead, I believe Cameco’s value is better evaluated on the assets that it possesses and the people in management.

- The top 2 producing uranium mines in the world (a 3rd in the top 10)

- Proven and well established executive leadership – Gitzel, Steane and Issac

- Cash generation in a down market – Hedged sales book protects against a falling uranium price

- Not just a miner, but involved in all aspects of the nuclear fuel cycle

- Good portfolio of undeveloped properties in great jurisdictions

- Dividend paid quarterly

PUSH: In my opinion, even at these low uranium prices, Cameco is under-valued at its current MCAP. The market, however, can remain irrational longer than most of us can remain solvent, meaning this push may take a little while. That said, when uranium is looked upon with a little more positivity, I believe Cameco will lead the way in gains.

To me, choosing to invest in Cameco now does come with the risk of further negative sentiment toward the uranium sector, via a falling uranium price. As stated earlier in the report, however, Cameco’s executives have done a great job of protecting against this downside risk.

If money is made on the delta between price and value, Cameco is a company which possesses great value at its current price. Invest opposite to the crowd and take a look at Cameco – the uranium industry’s GIANT!

Until next time,

Brian Leni P.Eng